Daily Macro Economy News on June 16

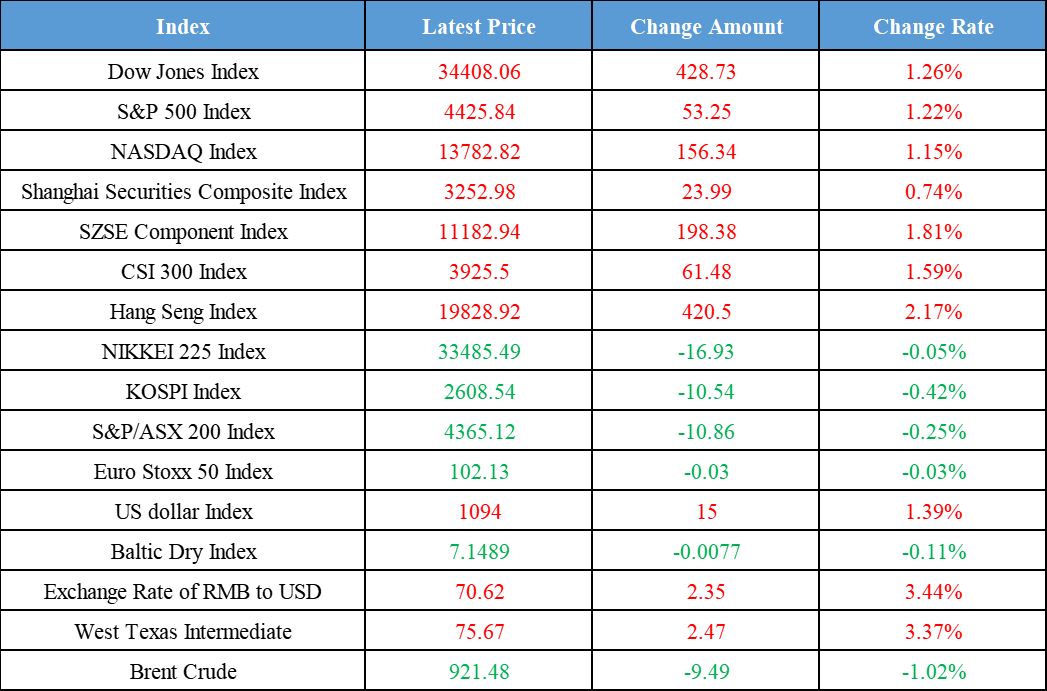

Latest Global Major Index

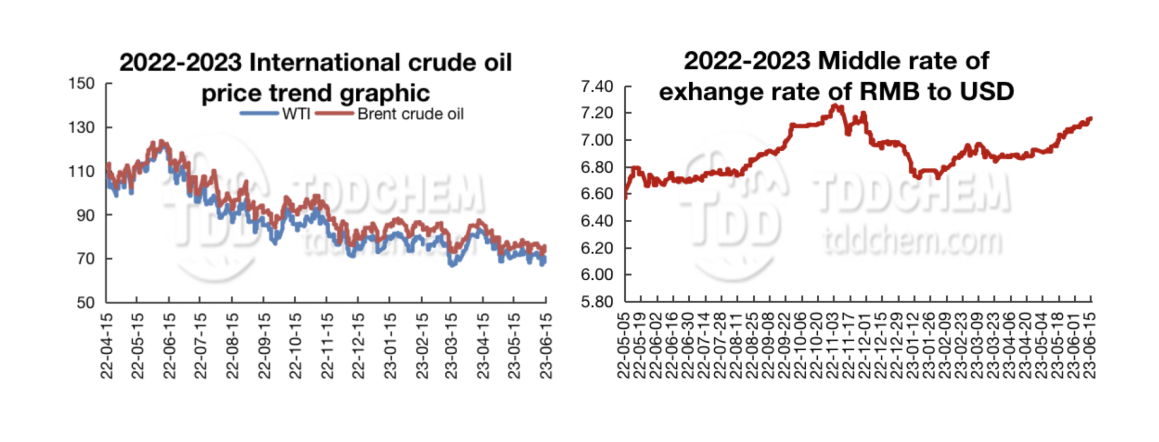

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. China's May economic performance was impacted by the higher basis point in the same period last year

2. Shanghai released a three-year action plan to promote the high-quality development of the manufacturing industry, proposing the implementation of six major actions and 22 key tasks

3. SASAC held a special meeting on improving the quality of listed companies’ M&A and restructuring of central enterprises

4. Industry insiders believe that with the MLF interest rate cut, the LPR to be announced on June 20th is expected to follow the reduction, 5 years and above LPR does not rule out a greater adjustment

International News

1. The European Central Bank announced an interest rate hike of 25 basis points as expected, raising rates to the highest level since 2001, and said it would stop reinvestment under the asset purchase program from July

2. The Dutch government will permanently shut down Groningen gas field in October

3. Economists on Wall Street are arguing over the forward guidance from the Fed of the June meeting

4. The SAFE released data showing that in May, the cross-border balance of the non-bank sectors, such as bank settlements and sales, enterprises and individuals, showed a surplus

Domestic News

1. China's May economic performance was impacted by the higher basis point in the same period last year

China's economic performance in May was impacted by a higher basis point in the same period last year, the growth rate of May production demand and other major macroeconomic indicators have fallen year-on-year, but the chain of growth has improved to various degrees, and the general economic operation continues to recover. According to the data, China's industrial value added of the enterprises above designated size in May increased by 3.5% year-on-year, and total retail sales of consumer goods increased by 12.7%. From January to May, the fixed asset investment increased by 4% year-on-year, and real estate development investment decreased by 7.2%. The national urban survey unemployment rate remained basically the same at 5.2% in May, of which the survey unemployment rate of the labor force aged 16-24 was 20.8%.

2. Shanghai released a three-year action plan to promote the high-quality development of the manufacturing industry, proposing the implementation of six major actions and 22 key tasks

Shanghai released a three-year action plan to promote the high-quality development of the manufacturing industry, proposing the implementation of six major actions and 22 key tasks. Among them, it is proposed to build a four trillion yuan industry cluster of electronic information, life and health, automobile and high-end equipment, and two 500 billion yuan industry clusters of advanced materials and fashion consumer goods.

3. SASAC held a special meeting on improving the quality of listed companies’ M&A and restructuring of central enterprises

State-owned Assets Supervision and Administration Commission (SASAC) held a special meeting on improving the quality of listed companies’ M&A and restructuring work of central enterprises. The meeting pointed out that central enterprises should take listed companies as the platform to carry out M&A and restructuring to help improve their core competitiveness and enhance their core functions while locking in key tasks to improve the quality of listed companies and taking more pragmatic and powerful actions to do better fundamentals and consolidate basic skills. The person in charge of the relevant departments of the Securities and Futures Commission from the perspective of capital market supervision of central enterprises holding listed companies to further enhance quality and efficiency through mergers and acquisitions and restructuring, to do better and stronger expectations and suggestions.

4. Industry insiders believe that with the MLF interest rate cut, the LPR to be announced on June 20th is expected to follow the reduction, 5 years and above LPR does not rule out a greater adjustment

MLF rate cuts finally "boots landing", LPR, or asymmetric downward adjustment. The central bank injected 237 billion MLF operations and 2 billion 7-day open market reverse repo operations on June 15, with winning rates of 2.65% and 1.90% respectively, of which the MLF rate was lowered by 10 basis points. On the same day, there are 2 billion yuan reverse repo and 200 billion yuan MLF come to maturity, to achieve a net investment of 37 billion yuan. Industry insiders believe that, with the MLF rate cut, the LPR to be announced on June 20th is expected to follow the reduction, 5 years and above LPR does not rule out a greater adjustment.

International News

1. The European Central Bank announced an interest rate hike of 25 basis points as expected, raising rates to the highest level since 2001, and said it would stop reinvestment under the asset purchase program from July

The European Central Bank announced an interest rate hike of 25 basis points as scheduled, raising rates to the highest level in 2001, and said it would stop reinvestment under the asset purchase program from July. At the same time, the ECB raised the CPI growth forecast for 2023-2025 and lowered the GDP growth forecast for this year and next year. ECB President Christine Lagarde said that no consideration was given to suspending interest rate hikes and that the battle to curb inflation was not over and that interest rate hikes were likely to continue in July.

2. The Dutch government will permanently shut down Groningen gas field in October

Sources say the Dutch government will permanently shut down the Groningen gas field in October, which is the largest in Europe. European natural gas futures prices jumped 30% on Thursday due to the news.

3. Economists on Wall Street are arguing over the forward guidance from the Fed of the June meeting

Economists on Wall Street are arguing over the forward guidance from the Fed of the June meeting. Some believe the pause in rate hikes is a "skip" sign and the rate hikes will continue, while others believe the Fed's plan to raise rates further is a "bluff".

4. The SAFE released data showing that in May, the cross-border balance of the non-bank sectors, such as bank settlements and sales, enterprises and individuals, showed a surplus

According to the data released by the State Administration of Foreign Exchange (SAFE), in May, the cross-border balance of bank settlement, enterprises and individuals in the non-bank sector showed a surplus of US$3.3 billion and US$1.9 billion respectively, and the supply and demand in the domestic foreign exchange market continued to be basically balanced. Foreign direct investment in China maintained a net inflow of capital, and foreign investment in the domestic bond market is further improved.

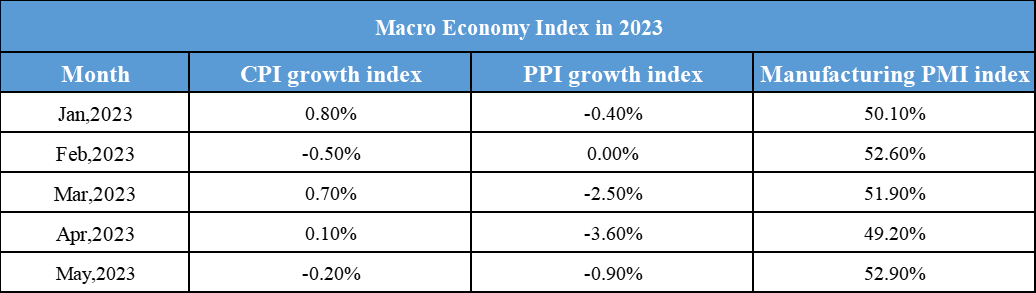

Domestic Macro Economy Index