Daily Macro Economy News on June 14

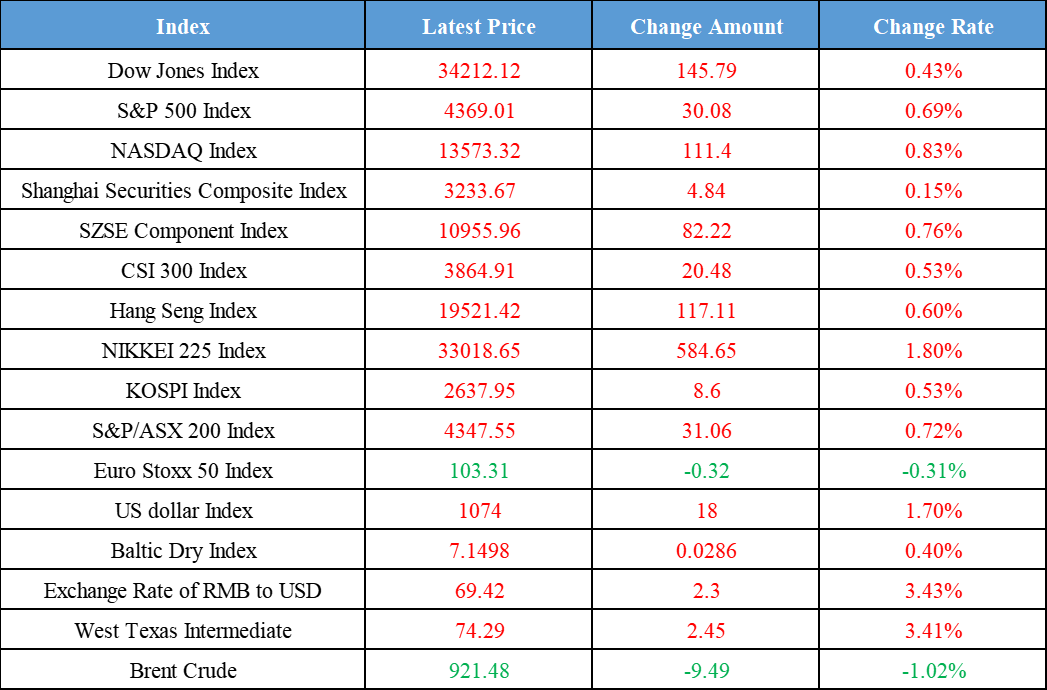

Latest Global Major Index

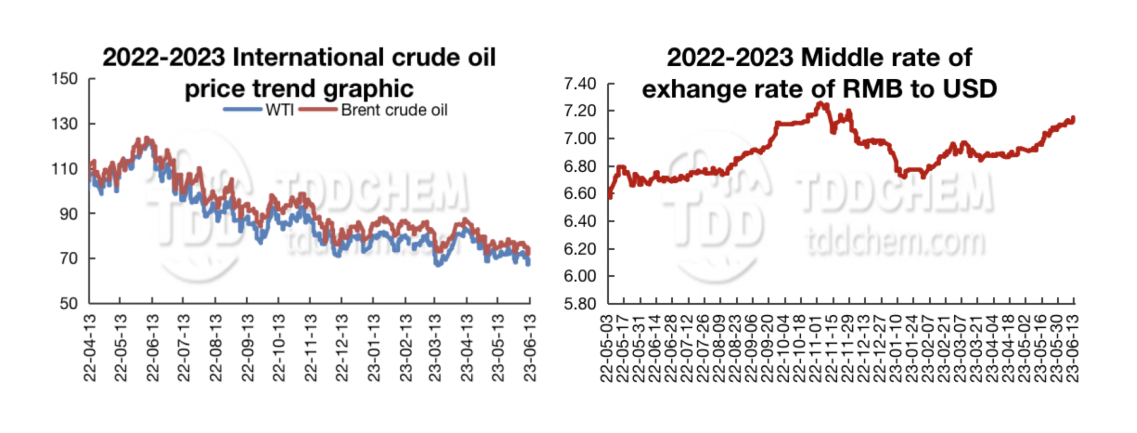

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Research and develop a package of policy measures around key areas such as supporting high-level scientific and technological self-reliance, serving the construction of a modern industrial system, reforming the investment side, and strengthening capital market supervision

2. PBC resumed 7-day reverse repo yesterday, injected 2 billion yuan, with a bidding winning rate of 1.90%, down 10 basis points from the previous day

3. By the end of 2023, small-scale taxpayers with monthly sales of less than 100,000 yuan will be exempted from VAT, and VAT will be levied at a reduced rate of 1% on taxable sales revenue for small-scale taxpayers applying the 3% levy rate

4. The General Administration of Customs launched 16 new initiatives to optimize the business environment and promote smooth import and export logistics and cross-border trade facilitation, including continuous improvement of cross-border logistics efficiency, support for the import of advanced technology equipment, and promotion of the import and export of important agricultural and food products

International News

1. US inflation fell more than expected in May, and the Fed is likely to pause rate hikes this week

2. Bank of England Governor Andrew Bailey said the UK job market is "very intense" and the available human resources are so low that employers have to stockpile labor. Still assume inflation will fall, but it will take much longer than expected

3. OPEC released its latest monthly report, expecting global oil demand to grow by 2.35 million barrels per day in 2023, a slight upward revision of 20,000 barrels from last month's estimate

4. US DOE: US will buy about 12 million barrels of oil in 2023 to increase the strategic petroleum reserve

Domestic News

1. Research and develop a package of policy measures around key areas such as supporting high-level scientific and technological self-reliance, serving the construction of a modern industrial system, reforming the investment side, and strengthening capital market supervision

Huiman Yi, chairman of the China Securities Supervision Commission (CSRC), stressed the need to strengthen the top-level design, to clarify the general idea of building a modern capital market with Chinese characteristics, important principles and task objectives, and strive to achieve the outline. Research and develop a package of policy measures around key areas such as supporting high-level scientific and technological self-reliance, serving the construction of a modern industrial system, reforming the investment side, strengthening capital market supervision and enhancing the system integration effect. We will also promote the implementation of tasks such as improving the quality of listed companies, regulating and guiding the healthy development of capital in accordance with the law, optimizing institutional supervision, developing the BSE with high quality, coordinating openness and security, and strengthening zero-tolerance law enforcement.

2. PBC resumed 7-day reverse repo yesterday, injected 2 billion yuan, with a bidding winning rate of 1.90%, down 10 basis points from the previous day

The People’s Bank of China (PBC) yesterday resumed 7-day reverse repo, injected 2 billion yuan, with a bidding winning rate of 1.90%, down 10 basis points from the previous day, the first adjustment since August 2022, and hit a record low. The central bank also simultaneously lowered the standing lending facility rate by 10 basis points, to 2.75%, 2.9%, and 3.25% for the overnight, 7-day and 1-month periods respectively. In addition, the central bank and four other departments to deploy the key work of cost reduction in 2023 proposed to create a favorable monetary and financial environment, promote a steady decline in lending rates, and guide the precise drip of financial resources. According to the analysis, the 7-day reverse repo rate cut implies the launch of a policy interest rate cut, and it is expected that the MLF rate this week and the LPR rate next week will probably be reduced accordingly.

3. By the end of 2023, small-scale taxpayers with monthly sales of less than 100,000 yuan will be exempted from VAT, and VAT will be levied at a reduced rate of 1% on taxable sales revenue for small-scale taxpayers applying the 3% levy rate

The National Development and Reform Commission (NDRC) and four other departments announced 22 key tasks to reduce costs this year. Among them, it is proposed to introduce targeted tax reduction policies in areas such as science and technology innovation and key industrial chains. By the end of 2023, small-scale taxpayers with monthly sales of less than 100,000 yuan will be exempt from VAT, and the taxable sales income of small-scale taxpayers subject to the 3% levy rate will be reduced by 1% for VAT. Renew the policy of phased reduction of unemployment insurance and work injury insurance rates, and extend the implementation period to the end of 2024. Continue to implement the zero tariff policy on coal imports, while strengthening domestic exploration and development of important energy and mineral resources and increasing reserves and production.

4. The General Administration of Customs launched 16 new initiatives to optimize the business environment and promote smooth import and export logistics and cross-border trade facilitation, including continuous improvement of cross-border logistics efficiency, support for the import of advanced technology equipment, and promotion of the import and export of important agricultural and food products

The General Administration of Customs launched 16 new initiatives to optimize the business environment and promote smooth import and export logistics and cross-border trade facilitation, including continuous improvement of cross-border logistics efficiency, support for the import of advanced technology equipment, and promotion of the import and export of important agricultural and food products.

International News

1. US inflation fell more than expected in May, and the Fed is likely to pause rate hikes this week

US inflation in May fell more than expected, the Federal Reserve is likely to suspend interest rate hikes this week. The US Bureau of Labor Statistics released data showing that the US CPI rose 4% in May, the 11th consecutive month of decline, the lowest since March 2021, expected to be 4.1%, the previous value of 4.9%. CPI rose 0.1% YoY, lower than the expected 0.2%, the previous value of 0.4%. May core CPI rose 5.3% YoY, 0.4% MoM, both in line with expectations. After the release of the data, the market is widely expected that the Fed will pause in this week's policy meeting to raise interest rates.

2. Bank of England Governor Andrew Bailey said the UK job market is "very intense" and the available human resources are so low that employers have to stockpile labor. Still assume inflation will fall, but it will take much longer than expected

Bank of England Governor Andrew Bailey said the UK job market is "very intense" and the available human resources are so low that employers have to stockpile labor. Still assume inflation will fall, but it will take much longer than expected

3. OPEC released its latest monthly report, expecting global oil demand to grow by 2.35 million barrels per day in 2023, a slight upward revision of 20,000 barrels from last month's estimate

The global oil market will see a supply gap of 2.7 million barrels per day in July due to unexpected Saudi Arabia production cuts. OPEC maintained its expectation of 2.6% global economic growth in 2023, continued to be optimistic about China's economic recovery, and raised its expectation of China's oil demand growth to 840,000 barrels per day this year.

4. US DOE: US will buy about 12 million barrels of oil in 2023 to increase the strategic petroleum reserve

US Department of Energy (DOE) indicated that the US will buy about 12 million barrels of oil in 2023 to increase the strategic oil reserves, and will continue to look for more purchases, those already announced for purchase in August and September are also included.

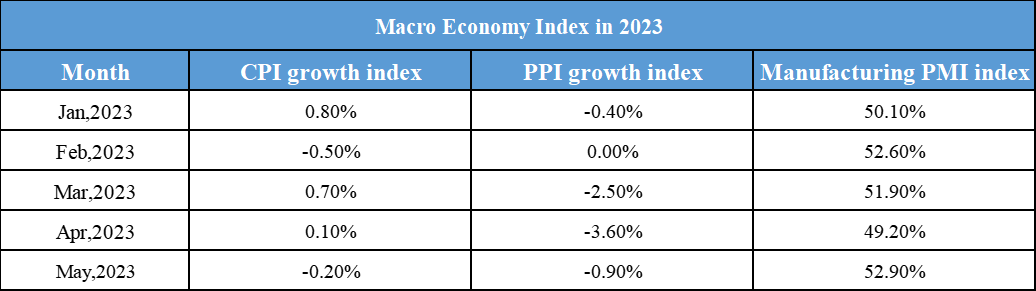

Domestic Macro Economy Index