Daily Macro Economy News on June 7

Latest Global Major Index

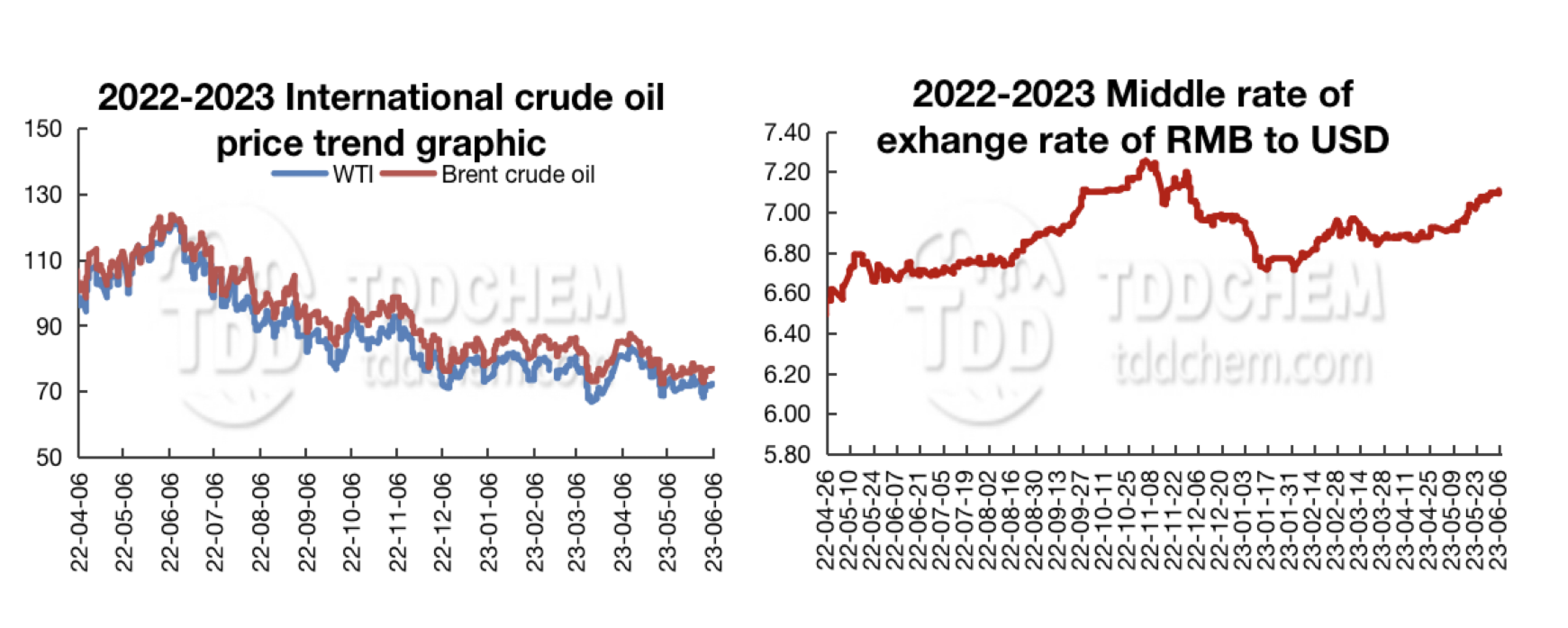

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The global economic growth forecast for 2023 was lifted to 2.1% from 1.7% in January, but lowered the economic growth forecast for 2024 to 2.4% from 2.7%

2. The most optimistic expectation at present is that the demand end is stable and the possibility of a substantial rebound is low

3. Stabilization in the real estate market still needs some patience

4. Balanced economic recovery momentum, signs are showing strong support for RMB exchange rate

International News

1. The Australian Fed unexpectedly raised interest rates by 25 basis points to 4.1%, reaching the highest level since April 2012

2. Goldman Sachs lowered the possibility of the US economy falling into recession in the next 12 months to 25% from the previous estimate of 35%, and expects the Fed to raise interest rates by 25 basis points in July

3. The global manufacturing PMI was 48.3% in May, down 0.3 percentage points from the previous month and down for the third consecutive month

4. Zelenskyy says he has confirmed that several countries will provide Ukraine with F-16 fighter jets

Domestic News

1. The global economic growth forecast for 2023 was lifted to 2.1% from 1.7% in January, but lowered the economic growth forecast for 2024 to 2.4% from 2.7%

In its newly-released Global Economic Prospects report, the World Bank said the outlook for global economic growth forecast for 2023 was raised to 2.1% from 1.7% in January but lowered its growth forecast for 2024 to 2.4% from 2.7%. The World Bank raised its forecast for China's economic growth in 2023 to 5.6 percent, a significant increase from 4.3 percent in January. The report also raised the US economic growth forecast to 1.1% this year, and the eurozone economic growth forecast was raised to 0.4% this year.

2. The most optimistic expectation at present is that the demand end is stable and the possibility of a substantial rebound is low

China Economic Times yesterday released an article titled Real estate restrictions in first-tier cities, should be optimized in due course, which caused massive discussion. Industry insiders believe that the most optimistic expectation is that the demand end is stable, and the probability of a substantial rebound is low. From the policy space of the first-tier cities, Beijing and Shanghai's general residential recognition criteria still need to be further relaxed, the previous "one district, one policy" method which has been tested, is expected to be further promoted.

3. Stabilization in the real estate market still needs some patience

There should be some patience for the policies that promote the stabilization and recovery of the real estate market to continue to come into effect. At present, we should continue to do everything possible to promote the delivery of buildings as scheduled, and to ensure the quality of housing delivery. By doing that, it will help restore the confidence of all parties in the real estate market. Support policies should be further explored to adjust and optimize the market, helping to stabilize and rebound it. Vigorously support the purchase of the first housings and reasonably support the purchase of the second housings. We should pay attention back to the house itself, providing better quality and better suited to the market demand of good houses will help promote housing consumption. In the long run, we should also continue to improve the housing security system, so that new citizens and young people can take root in the city through subsidized housing, and alleviate their worries about housing for their hard work. After they have some savings, they will gradually form new purchasing power.

4. Balanced economic recovery momentum, signs are showing strong support for RMB exchange rate

Exchange rate fluctuations are influenced by sentiment and expectations in the short term but still rely on fundamentals in the medium to long term. China's economy has shown a rebound and improvement out of the epidemic haze, plus, China still maintains a strong current account surplus, which will form a strong support for the overall stability of the RMB exchange rate. Even if some of the economic data is not enough to support the market to form optimistic expectations of trend appreciation of RMB exchange rate, the solidity of the macroeconomy, balance of payments and foreign exchange reserves also makes RMB exchange rate not possible to sustain depreciation. The increasingly mature spontaneous corrective forces and mechanisms in China's foreign exchange market will ensure that the RMB exchange rate remains basically stable at a reasonable equilibrium level.

International News

1. The Australian Fed unexpectedly raised interest rates by 25 basis points to 4.1%, reaching the highest level since April 2012

The Australian Federal Reserve unexpectedly raised interest rates by 25 basis points to 4.1%, reaching the highest level since April 2012, while the market was expected to keep rates unchanged. The Australian Fed said that inflation has peaked but is still too high and further tightening may be needed.

2.Goldman Sachs lowered the possibility of the US economy falling into recession in the next 12 months to 25% from the previous estimate of 35%, and expects the Fed to raise interest rates by 25 basis points in July

Goldman Sachs lowered the probability that the U.S. economy will fall into recession in the next 12 months to 25% from a previous estimate of 35%, and expects the Fed to raise rates by 25 basis points in July. UBS expects the Fed to raise rates by 25 basis points in July, bringing the terminal rate to 5.25%-5.50%.

3. The global manufacturing PMI was 48.3% in May, down 0.3 percentage points from the previous month and down for the third consecutive month

The China Federation of Logistics and Purchasing released data showing that the global manufacturing PMI was 48.3% in May, down 0.3 percent from a year earlier, declining for three consecutive months compared with a year earlier and below 50% for eight consecutive months, and hitting a new low since June 2020, with no change in the downward trend of global economic fluctuations.

4. Zelenskyy says he has confirmed that several countries will provide Ukraine with F-16 fighter jets

According to Ukrainian media reports, Ukrainian President Volodymyr Zelenskyy said at a briefing in Kiev on June 6 that at a very important meeting in Moldova. Ukraine held a closed-door meeting with a number of countries that have confirmed that they will provide Ukraine with F-16 fighter jets. In addition, he said, the number of F-16s provided to Ukraine will be a great amount, but he said he could not reveal more details. Zelenskyy also said that for this purpose, Ukraine needs to build the corresponding infrastructure, which is not yet available in Ukraine.

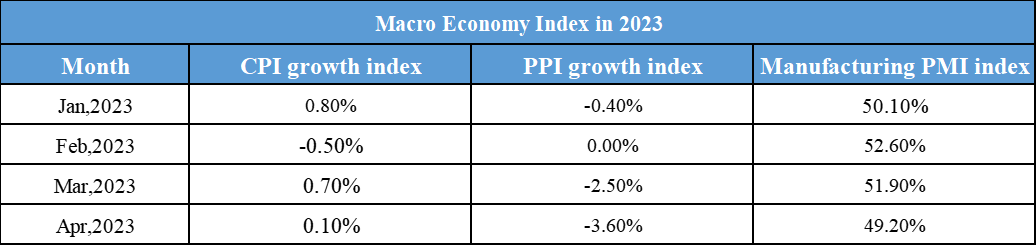

Domestic Macro Economy Index