Daily Macro Economy News on June 6

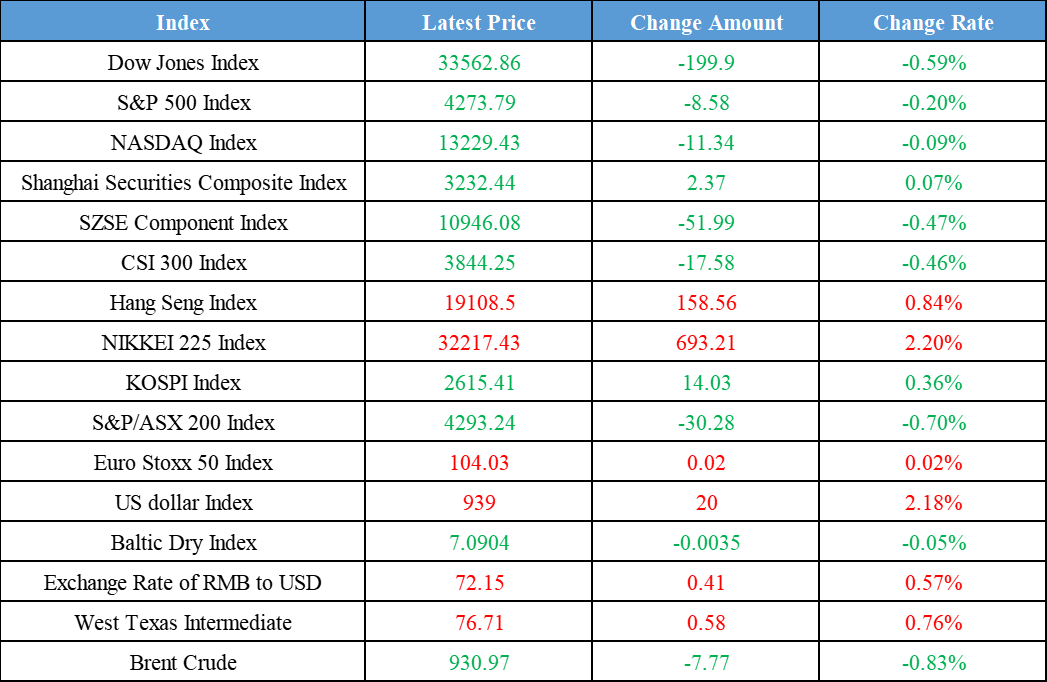

Latest Global Major Index

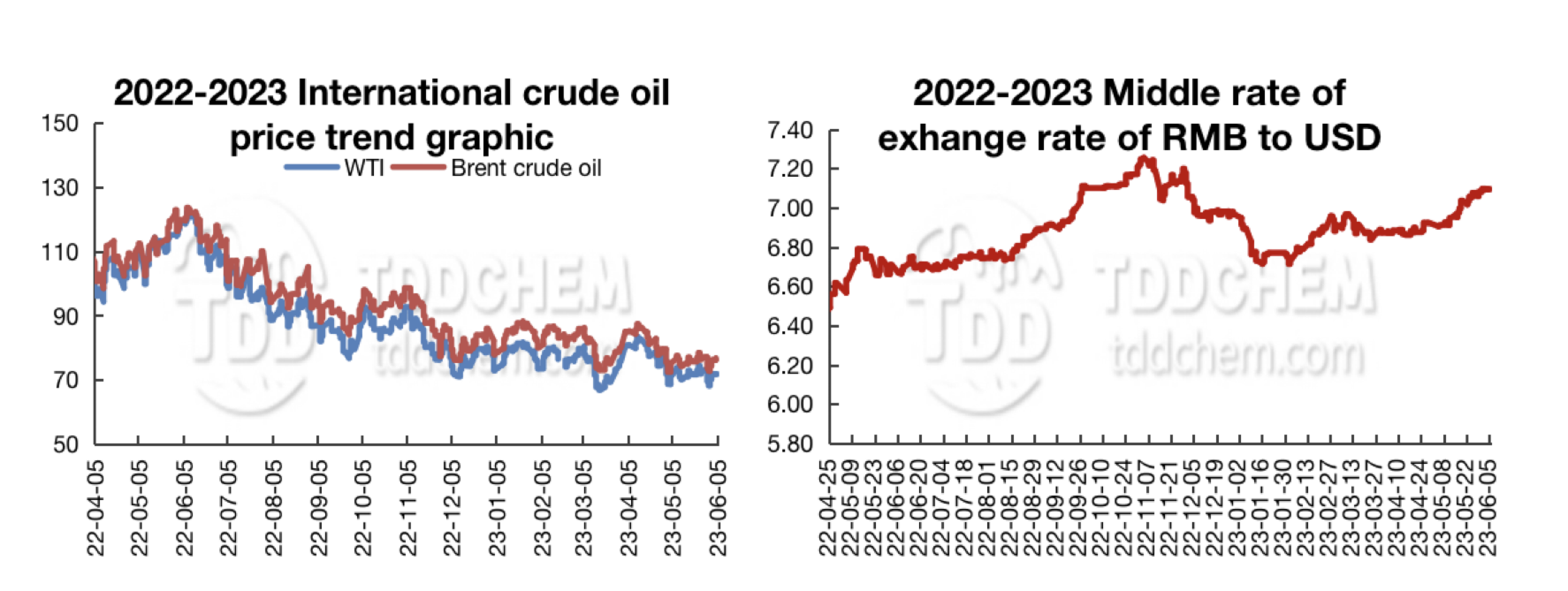

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. There is still room for further reduction in deposit rates in the future

2. Coal supply and demand overall may show a relatively loose situation, coal market prices may continue to go down

3. Caixin China report that services PMI rose to 57.1 in May, up 0.7 percent from April, and reaching the second highest since December 2020, just below March 2023

4. China will consolidate its position as a major driver of growth in the sector and will account for 55% of the increase in global renewable energy capacity in 2023 and 2024

International News

1. Necessary measures will be taken to achieve the 2% inflation target

2. US ISM non-manufacturing PMI at 50.3 in May, reached a 2023-year low

3. Bank of America: US Treasury expected to issue large amounts of bonds, posing a whole new challenge for the banking industry to retain deposits

4. Iranian embassy and consulate in Saudi Arabia will reopen on June 6 and 7 at local time

Domestic News

1. There is still room for further reduction in deposit rates in the future

In June, the replenishing deposit rates of small and medium-sized banks continued to decrease. Recently, a number of village banks in Sichuan Province, Jilin Province, Inner Mongolia, Shandong Province and other places have reduced the interest rates of time deposits for some terms since June, which is the third round of bank fixed deposit interest rates this year "interest rate cuts". The industry pointed out that although this year has experienced several rounds of bank interest rate cuts, the current bank net interest margin is still under pressure, and there is still room for further reductions in future deposit rates.

2. Coal supply and demand overall may show a relatively loose situation, coal market prices may continue to go down

China Coal Transportation and Distribution Association (CCTDA) expressed that the relevant departments and coal-producing provinces and regions will continue to promote coal production and supply, coal quality production capacity will continue to be released, all localities will work hard to achieve the coal production targets, China's coal production is expected to maintain growth trend. The overall coal supply and demand may show a relatively loose situation, coal market prices may continue to move downward.

3. Caixin China report that services PMI rose to 57.1 in May, up 0.7 percent from April, and reaching the second highest since December 2020, just below March 2023

The Caixin China Services PMI rose 0.7 percent to 57.1 in May from April, reached the second highest since December 2020 and just below March 2023. The Caixin China Composite PMI rose 2.0 percent to 55.6 in May, a record high since 2021, indicating accelerated expansion in Chinese business activity.

4. China will consolidate its position as a major driver of growth in the sector and will account for 55% of the increase in global renewable energy capacity in 2023 and 2024

International Energy Agency (IEA): the renewable energy capacity may grow at a record-high speed this year. Total global renewable energy capacity is expected to surge to 4,500 GW next year, equivalent to the combined generation capacity of China and the United States. China will consolidate its position as a major driver of growth in the sector, accounting for 55 percent of the global incremental renewable energy capacity in 2023 and 2024.

International News

1. Necessary measures will be taken to achieve the 2% inflation target

ECB President Christine Lagarde said that the impact of policy tightening on the economy is starting to be seen, but price pressures remain strong, and underlying inflationary pressures remain high. That means necessary measures will be taken to achieve the 2% inflation target.

2. US ISM non-manufacturing PMI at 50.3 in May, reached a 2023-year low

US ISM non-manufacturing PMI in May was 50.3, a new low in 2023, was expected to reach 52.3, and a previous value of 51.9. The inactive business activity and falling orders led to three-year low price payment indicators. US Markit services PMI reached a final value of 54.9 in May, and was expected to reach 55.1, the initial value is 55.1 and the final value of April is 53.6.

3. Bank of America: US Treasury expected to issue large amounts of bonds, posing a whole new challenge for the banking industry to retain deposits

On June 6, in spite of the challenge that the US banks have already been facing in maintaining deposits as customers choose higher-yielding alternative financial products, the suspension of the federal debt ceiling poses a whole new challenge. This will allow the US Treasury to replenish funding reserves by significantly increasing bond issuance, which in turn may further boost the rates that alternatives can offer, said Mark Cabana, director of interest rate strategy at Bank of America. US money market fund assets have risen to record highs as they move faster than banks in passing on rising interest rates to customers. "This is another unfavorable factor to the banking sector, we know the banking system has been under pressure. We also know that the use of Fed emergency loans by some banks is increasing, which will create another challenge for banks to retain deposits in the context of rising interest rates."

4. Iranian embassy and consulate in Saudi Arabia will reopen on June 6 and 7 at local time

Ministry of Foreign Affairs of Iran: Iranian embassy and consulate in Saudi Arabia will reopen on June 6 and 7 at local time. In March, China, Saudi Arabia and Iran issued a tripartite joint statement in Beijing, announcing that Saudi Arabia and Iran reached an agreement to restore diplomatic relations between the two sides.

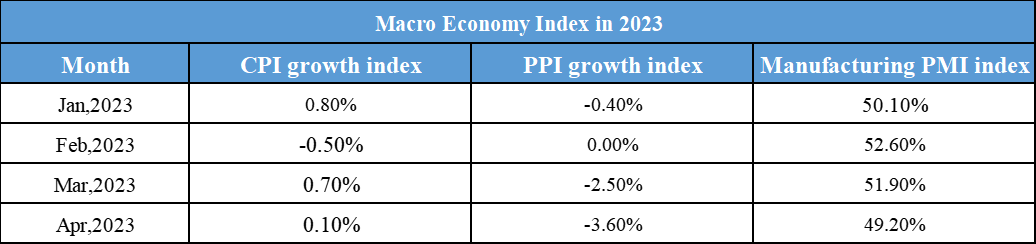

Domestic Macro Economy Index