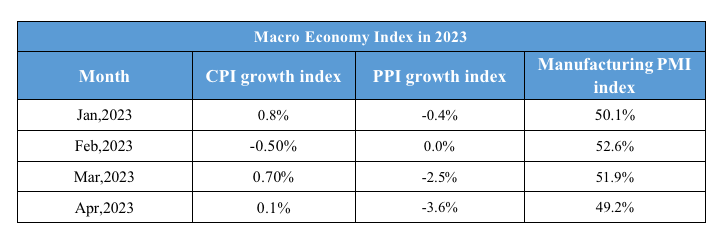

525 Daily Macro Economy News

Daily Macro Economy News

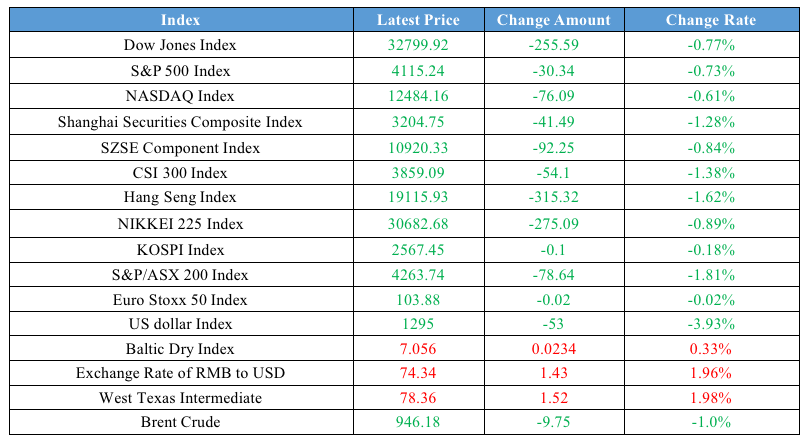

Latest Global Major Index

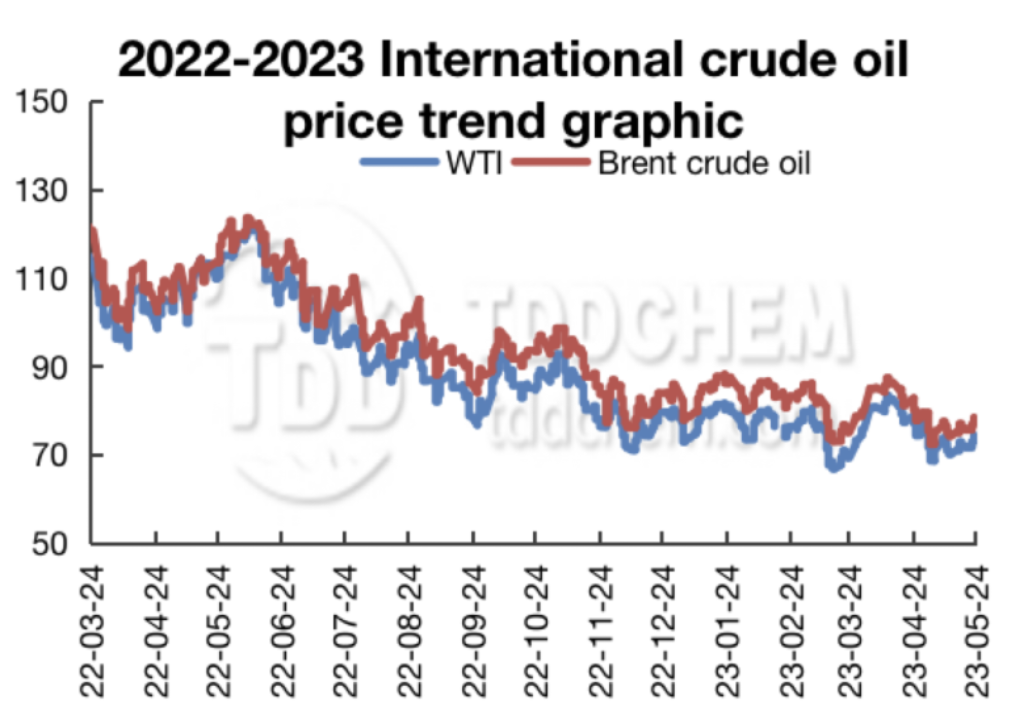

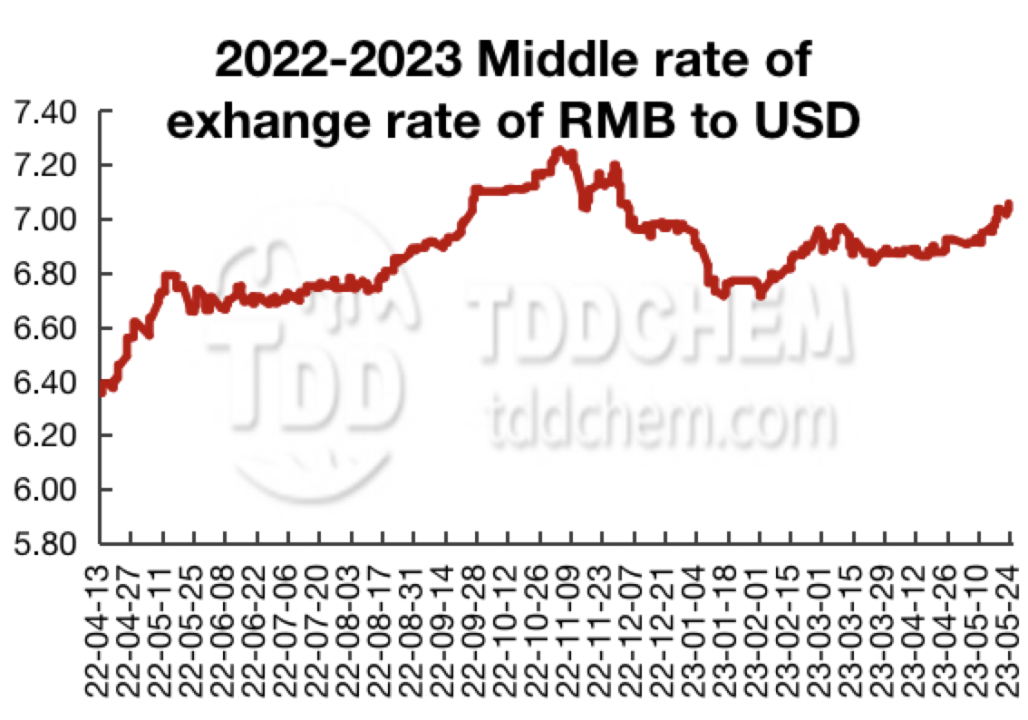

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1、Focus on building 5 to 10 new think tanks in central enterprises with powerful decision-making influence, social influence and international influence

2、Both sides of Sino-Russian should continue to dig deeper into the potential and give higher attention to the cooperation of economic, trade and investment

3、Domestic lithium production capacity is in contraction, driving lithium prices to a rebound tendency

4、Kunming SASAC issued a statement saying that the online rumor of "Kunming banking expert roadshow main points" and "Kunming city investment experts meeting minutes" information are untrue

International News

1、Fed officials agree that inflation is too high and falling slower than expected, but disagree on whether to pause rate hikes in June, stressing that action depends on data and is unlikely to cut rates

2、New Zealand Fed raises rates by 25 bps to 5.5% as expected, reaching the highest level since October 2008

3、ECB President Christine Lagarde: For the ECB, the immediate priority is to bring inflation down to the 2% medium-term target in a timely manner

4、There is every reason to expect that the Yuan will replace the US dollar in the next decade

Domestic News

1、Focus on building 5 to 10 new think tanks in central enterprises with powerful decision-making influence, social influence and international influence

The State-owned Assets Supervision and Administration Commission of the State Council recently issued the Opinions on the construction of new think tanks of central enterprises, pointing out that by 2025, focus on building 5 to 10 new think tanks of central enterprises with powerful decision-making influence, social influence and international influence.

2、Both sides of Sino-Russian should continue to dig deeper into the potential and give higher attention to the cooperation of economic, trade and investment

During his meeting with Russian Prime Minister Mikhail Mishustin, the state leader stressed that both sides should continue to dig deeper into the potential, give higher attention to the cooperation of economic, trade and investment, improve the institutional mechanism of bilateral cooperation, consolidate and expand the basic situation of cooperation in energy and interconnection, and create more new growth points.

3、Domestic lithium production capacity is in contraction, driving lithium prices to a rebound tendency

Lithium prices rose in the first quarter year-on-year, driving South American salt lake lithium extraction companies to maintain growth in operating performance. South American salt lake lithium producers reduce sales to China, remain optimistic about lithium prices in 2023 Chilean policy on lithium intensifies market concerns about lithium supply, and salt lake lithium resources development progress may be less than expected. Domestic lithium production capacity is in contraction, promoting the lithium price to a rebound tendency, which is expected to be at the bottom of the historical valuation of the lithium sector and will embrace a rebounding market. As lithium prices stabilize and rebound, the waiting game seems about to stop. The installed demand is stimulated, the economics of energy storage installations are highlighted, recovering prospect of the industry has shown, to remain optimistic about the increasing demand for energy storage installation.

4、Kunming SASAC issued a statement saying that the online rumor of "Kunming banking expert roadshow main points" and "Kunming city investment experts meeting minutes" information are untrue

Kunming SASAC issued a statement saying that the online rumor of "Kunming banking expert roadshow main points" and "Kunming city investment experts meeting minutes" information are untrue, and has taken legal measures to protect its legitimate rights and interests. Minsheng Bank Kunming Branch issued a statement saying that the minutes of the meeting were issued in the name of individual employees and that participation in the event was not approved and authorized, and would be handled seriously. Haitong Securities also clarified that the relevant minutes are the remarks of external participants and do not represent the views and positions of Haitong Securities.

International News

1、Fed officials agree that inflation is too high and falling slower than expected, but disagree on whether to pause rate hikes in June, stressing that action depends on data and is unlikely to cut rates

Fed minutes show that Fed officials agreed that inflation is too high and falling slower than expected, but there are differences of opinion on whether to suspend interest rate hikes in June, stressing that action depends on the data and is unlikely to cut interest rates. The minutes indicated Fed officials believe that the debt ceiling must be raised in a timely manner, otherwise, it could cause serious damage to the financial system and lead to a tightening of the financial environment, thereby weakening economic growth.

2、New Zealand Fed raises rates by 25 bps to 5.5% as expected, reaching the highest level since October 2008

The New Zealand Federal Reserve raised interest rates by 25 basis points to 5.5% as expected, the highest level since October 2008. The New Zealand Fed expects the official cash rate (OCR) rate to peak at 5.5% and begin to decline in the third quarter of 2024.

3、ECB President Christine Lagarde: For the ECB, the immediate priority is to bring inflation down to the 2% medium-term target in a timely manner

European Central Bank (ECB) President Christine Lagarde indicated that for the ECB, the immediate priority is to bring inflation down to its medium-term target of 2% in a timely manner, and that is what ECB is trying to do in the near future. ECB will face additional challenges to address the changing geopolitics, digital transformation, and the threat of climate change. ECB must continue to provide stability in a fundamentally unstable world.

4、There is every reason to expect that the Yuan will replace the US dollar in the next decade

The governor of the Russian Foreign Trade Bank indicated that there is every reason to expect that the Yuan will replace the US dollar as the world's main reserve currency within the next 10 years. More than 70% of trade settlements between Russia and China use the yuan and rubles, and some other countries are ready to use the yuan for settlements with Russia, but this requires approval from the Chinese side, which is the Russian side has been doing plenty of research on it.

Domestic Macro Economy Index