Daily Macro Economy News on May,24th

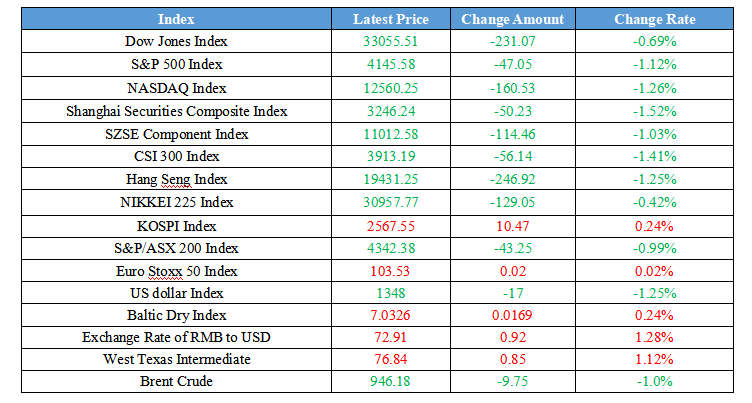

Latest Global Major Index

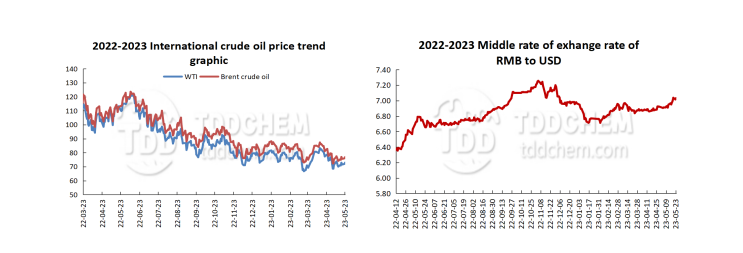

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1、CISA: Statement on the production and inventory of the key steel enterprises in mid-May 2023

2、The energy industry is rapidly entering a new era of digital energy

3、MIIT: Actively promote the coordinated development of Beijing, Tianjin and Hebei region focusing on the collaborative development of industry, which accelerates the promotion of eight key tasks

4、Donghai Securities: The development of the liquor industry in 2023 is expected to be characterized mainly by an increase in the concentration ratio

International News

1、Deutsche Bank: European luxury stocks plunge on the economic slowdown in the U.S.

2、Wheat and corn prices raise due to the Ukrainian exports slowing down

3、Fed may pause rate hikes in June but leaves the door open for future hikes

4、BOE Governor: "Significant Lessons" were learned from the UK inflation spike

Domestic News

1、CISA: Statement on the production and inventory of the key steel enterprises in mid-May 2023

China Iron and Steel Association (CISA) data show that in mid-May 2023, the key steel enterprises produced 22.4546 million tons of crude steel, 1995.30 million tons of pig iron, and 21.3969 million tons of steel. The daily production of crude steel reached 2,245,500 tons, down 0.24%. Daily production of pig iron of 1,995,300 tons, down 0.52%. Daily production of steel reached 2,139,700 tons, up 2.53%. In mid-May, the steel inventory of key steel enterprises reached 16,264,600 tons, 1,346,700 tons less than the previous ten-days, down 7.65%. Compare to the same ten-days last month, down 2,276,500 tons, which is down 12.28%. Compare to the end of last year, increased by 3,190,200 tons, an increase of 24.40%. Compare to the same period last year, a decrease of 3,712,900 tons, down 18.59%. Compare to the same period of the previous year, an increase of 1,625,000 tons, an increase of 11.10%.

2、The energy industry is rapidly entering a new era of digital energy

The opening ceremony of the 16th SNEC 2023 International Solar Photovoltaic and Smart Energy (Shanghai) Conference was held today. Jinlong Hou, the President of Huawei Digital Energy Technology Co.Ltd stated that the three-wheel that drives carbon neutrality, energy independence and commercial value is accelerating the process of energy transformation. “Under the impetus of technology, the digital world and the energy world are deeply integrated and developing, and the energy industry is rapidly entering a new era of digital energy, showing the main features of 'renewable energy-led, electricity-centric, and digital technology as the key enabler'.

3、MIIT: Actively promote the coordinated development of Beijing, Tianjin and Hebei region focusing on the collaborative development of industry, which accelerates the promotion of eight key tasks

The person in charge of the Ministry of Industry and Information Technology (MIIT) answered the reporters’ question that the next step will be to promote the coordinated development of Beijing, Tianjin and Hebei region focusing on the collaborative development of industry, which accelerate the promotion of eight key tasks. First, they will optimize the regional industrial division of labor and productivity layout. The second is to enhance the advanced level of the industrial base and modernization of the industry chain. Thirdly, we will enhance the overall effectiveness of the regional industrial innovation system. The fourth is to collaborate to create new advantages in the digital economy. The fifth is to accelerate the green and low-carbon transformation. The sixth is to promote the integration of quality, brand and standard construction. The seventh is to cultivate and grow high-quality enterprise groups. The eighth is to deepen the industry’s high-level open cooperation.

4、Donghai Securities: The development of the liquor industry in 2023 is expected to be characterized mainly by an increase in the concentration ratio

Donghai Securities pointed out that the well-known liquor companies have accomplished the destocking, while the new brand inventory remains higher, and the sub-high-end, sauce-flavor liquor and other categories this year will mainly focus on the destocking, which will further extend the gap between the new brand and the well-known liquor. In addition, after the epidemic, the well-known liquor has now gradually started the trend of full-price band layout with no discounts, from the moment of selling to attract investment, it will further interfere and influence the small and medium-sized brands, unlike local small brands, after the Spring Festival, well-known liquor inventory back to normal, Maotai, Wuliangye and other major famous wine prices gradually stabilize and rebound, the industry theme of the last two months of the small holiday, for non-famous liquor, well-known liquor may be the destocking and mid-autumn peak season price increase respectively, we expect the development of the liquor industry in 2023 is mainly characterized by increased concentration.

International News

1、Deutsche Bank: European luxury stocks plunge on the economic slowdown in the U.S.

European luxury stocks tumble on the economic slowdown in the U.S., Deutsche Bank says the investors may become more selective. European luxury stocks, which have risen strongly this year on the back of international demand, have taken a hit recently, with the sector evaporating more than $30 billion on Tuesday. Over the past year, booming luxury stocks have been to European equities what tech giants are to the U.S., which are dominant groups of luxury companies whose growth has remained steady even as the economy has had its ups and downs. However, Morgan Stanley analysts say this confidence has now taken a hit. At a luxury conference organized by Morgan Stanley in Paris, some participants said that the performance of the U.S. luxury market is "relatively weak". This reflects the weakness of wealthy consumers in the United States.

2、Wheat and corn prices raise due to the Ukrainian exports slowing down

CBOT wheat and corn futures were reportedly run higher in pre-market trading on the back of declining grain flows from Ukraine despite another extension of the Black Sea grain export agreement. The latest data from Ukraine showed that 118,300 tons of grain were exported through the agreement in the week by May 21st, down 78 percent from the previous week. Although the deal had been extended for two months, no incoming vessels cleared customs that week, leading to a significant drop in shipments, said the Dutch international group. However, those exports could recover in the coming weeks.

3、Fed may pause rate hikes in June but leaves the door open for future hikes

According to foreign media reports, the dollar has strengthened as investors are increasingly betting on longer U.S. interest rate hikes. The market generally expects the Fed to keep interest rates unchanged in June while leaving the door open for future rate hikes. Mark Chandler, chief market strategist at Bannockburn Global Forex LLC, said in a report that this seems increasingly like a hawkish fallback option, agreeing to suspend rate hikes in June but giving a promise of a low hike threshold for the next meeting.

4、BOE Governor: "Significant Lessons" were learned from the UK inflation spike

Bank of England (BOE) Governor Tony Blair said on Tuesday that BOE has learned "very important lessons" from the inflation spike since it still in double digits, and food prices is rising at the fastest pace since the 1970s. In a question-and-answer session in parliament, Andrew Bailey and other BOE’s top officials faced two hours of harsh criticism from lawmakers, accusing the central bank was failing to predict the scale of the inflation spike. Baldwin, chairman of the U.K. Parliament's finance committee, told Bailey, "There's something really wrong with your economic models and your information network." Bailey said the BOE's market contact was told in February that food inflation may have peaked, but that proved incorrect as weather events elsewhere in the world affected crops such as sugar. Food producers may also have locked in higher costs than BOE’s expectation, which the they should have noted, he said.

Domestic Macro Economy Index