Daily Macro Economy New on May,19th

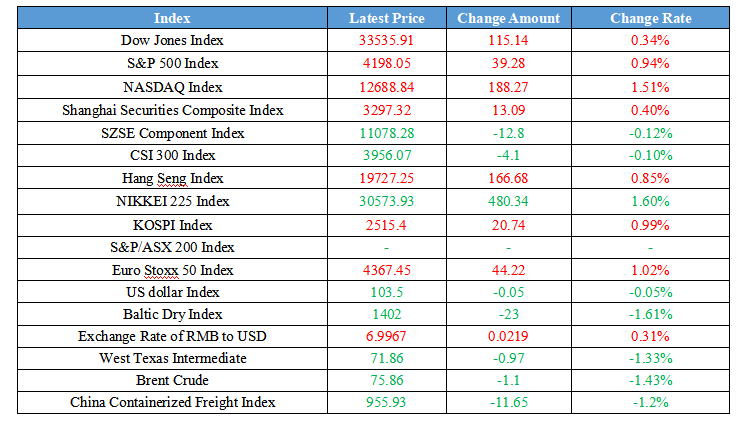

Latest Global Major Index

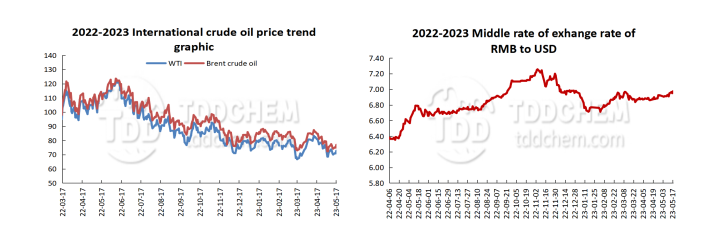

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1、Sinopec and Kazakhstan National Oil and Gas Corporation Signed a Key Terms Agreement on Polyethylene Project

2、Shenzhou XVI Manned Spacecraft Will Be Launched This Month

3、ZCE Issues Notice on Portfolio Margin Business for All Market Makers

4、Many Institutions Respond to the Lowering of Trading Commissions for Public Funds: It Is as Predicted

International News

1、ING: AUD/NZD Might Run Weak Further

2、BOE Deputy Governor Dave Ramsden: The Central Bank Quantitative Tightening Policies Are Likely to Accelerate

3、EU Approved A Memorandum of Cooperation Draft to Advance Financial Cooperation with the UK

4、ASB: Fiscal Budget Increases the Risk of 50 Basis Point Rate Hike by New Zealand Fed

Domestic News

1、Sinopec and Kazakhstan National Oil and Gas Corporation Signed a Key Terms Agreement on Polyethylene Project

On May 18, Sinopec and Kazakhstan National Oil and Gas Corporation signed a key terms agreement in Xi'an on the development of a polyethylene project in the Atyrau region of Kazakhstan. The signing of the agreement marks that Sinopec will participate in the development and implementation of the project as a partner. The polyethylene project is the largest natural gas chemical project in the region and the parties expect to make a final investment decision in 2024. When Sinopec officially joins the project in the future, the parties will sign an equity acquisition agreement and other relevant legally binding documents.

2、Shenzhou XVI Manned Spacecraft Will Be Launched This Month

The six-month Shenzhou XV space mission is coming to an end, and on the 10th of this month, the Tianzhou-6 cargo spacecraft has been launched and docked at the space station assembly. According to the basic situation of manned space missions in 2023 announced on the official website of China Manned Space, just in this month, Shenzhou XVI manned spacecraft will also be launched when the six astronauts of two crews of Shenzhou XV and Shenzhou XVI will meet at the space station, and it is also the second time of the two crews to dock in orbit at the Chinese space station.

3、ZCE Issues Notice on Portfolio Margin Business for All Market Makers

The Zhengzhou Commodity Exchange (ZCE) has decided to conduct a portfolio margin business for all market makers in accordance with the SPBM model under the current margin rate from May 19, 2023, in order to further improve the quality of market operation and promote the continuous activity of futures contracts and the function of options. The range of varieties includes futures and options varieties for which market-making business is carried out by the ZCE. In case of adjustment of market-making varieties in the future, the scope of applicable varieties will be dynamically adjusted simultaneously with the increase or decrease of market-making varieties.

4、Many Institutions Respond to the Lowering of Trading Commissions for Public Funds: It Is as Predicted

The rumors of a commission cut for public funds become prevalent for a long time, and recently the rumors have intensified. It is reported that the trading commission paid by public funds to brokers may drop from the current 0.0008% to 0.0004%, or even lower to 0.0003%. In this regard, the reporter verified that, combined with the market and regulatory requirements, the downward adjustment of transaction fees is within the expectation. Related research has also been conducted, but the proportion of downward adjustment is not yet clear, most of the rumors are saying down the level to 0.0004%, but currently, there is no landing schedule. An insider said, “If the transaction fee is reduced, it will have a relatively large impact on the income of the broker institutes. For fund investors, the trading commission is deducted from the fund assets, so the fee reduction will be somewhat helpful to the fund net value.”

International News

1、ING: AUD/NZD Might Run Weak Further

The Australian dollar could extend its losses against the New Zealand dollar as weak employment data from Australia on Thursday could complicate any plans for further interest rate hikes by the country's central bank, said Internationale Nederlanden Groep N.V. (ING). An analyst with ING, Francesco Pesole, wrote in a report that the AUD could reverse against the NZD, meaning a shift from a potentially bullish opportunity to a low point of 1.0600 (which is also an important support level), with an increasing possibility. In addition, he said, for the NZD, the improved economic outlook, expansionary fiscal policy and increased immigration will keep inflation high, putting pressure on the New Zealand Fed to raise interest rates.

2、BOE Deputy Governor Dave Ramsden: The Central Bank Quantitative Tightening Policies Are Likely to Accelerate

Bank of England (BOE) deputy governor Dave Ramsden said on Thursday that the withdrawal of the central bank from the quantitative easing plan may accelerate the reduction in Treasury bond holdings instead of slowing down. BOE is currently reducing its holdings of U.K. Treasury bonds at an amount of 80 billion pounds ($101 billion) per year to stimulate the economy, which was purchased between 2009 and 2021. The central bank’s quantitative tightening policies are likely to accelerate a little, given the experience of the first year of quantitative tightening, he believes the pace will not decline. The current way BOE adopts is reducing its holdings by selling Treasuries directly, rather than reinvesting the maturing U.K. Treasuries yields.

3、EU Approved A Memorandum of Cooperation Draft to Advance Financial Cooperation with the UK

The European Commission on May 17th approved a memorandum of cooperation draft allowing the financial regulators from the EU and UK to further develop post-Brexit financial cooperation. The draft still needs to be approved by the 27 EU member states. The member states may approve the draft at the EU finance ministers meeting in June. The European Commission also stressed that the memorandum does not address the access of the EU single market and the UK financial market to companies headquartered in the UK and the EU respectively.

4、ASB: Fiscal Budget Increases the Risk of 50 Basis Point Rate Hike by New Zealand Fed

New Zealand's fiscal budget shows that government spending is expected to fall as a share of GDP, but fiscal stimulus policies will reach nearly 2% of GDP between 2023 and 2024, said Mark Smith, senior economist at Auckland Savings Bank (ASB). New Zealand's government spending has risen sharply in recent years and has struggled to prove itself in fiscal prudence. Instead of posing an obstacle to the New Zealand official cash rate rising to higher levels shortly, fiscal policy has increased the risk of a 50 basis point rate hike in May.

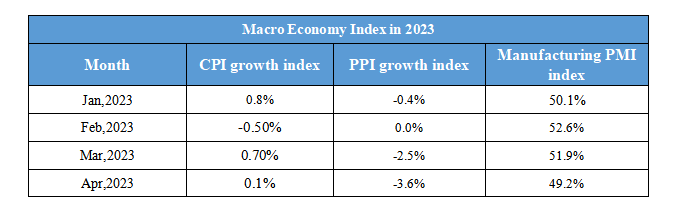

Domestic Macro Economy Index