Daily Macro Economy News on May,17

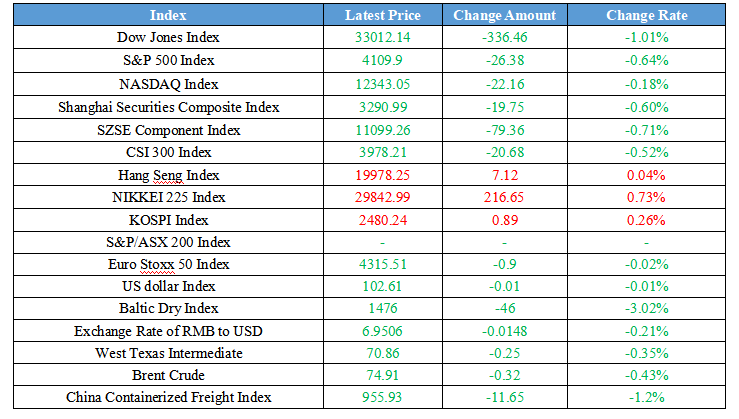

Latest Global Major Index

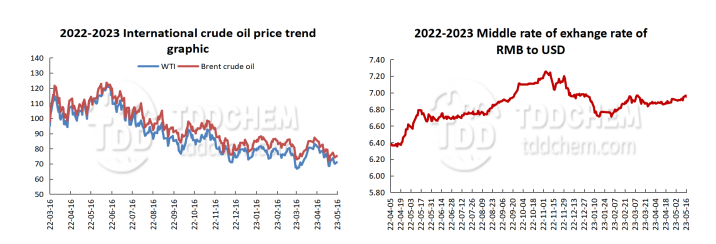

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1、NBS: Real estate development enterprise capital situation has improved

2、NBS: There are still several advantages to the continuous investment growth of the domestic manufacturing industry

3、The domestic retail prices of refined oil products may embrace the "biggest drop" of the year

4、NBS responds to controversy over the real estate-related data

International News

1、U.S. plans to repurchase 3 million barrels of oil to replenish strategic petroleum reserves

2、Canada's Inflation Rate Rises Slightly in April

3、EU countries approve the world's first comprehensive rules for crypto assets

4、ING: If no progress was made on the U.S. debt ceiling, it is favorable for the dollar and yen

Domestic News

1、NBS: Real estate development enterprise capital situation has improved

Fu Linghui, the spokesman with the National Bureau of Statistics (NBS), said that last year, the real estate market as a whole, showed a downward trend influenced by multiple factors, and some places have difficulties in the delivery of commercial housing. In order to protect people's livelihood and stabilize the real estate market, all localities and departments in accordance with the deployment of the Party Central Committee, adhere to the housing only for living and city-based policies, adjust and optimize housing, credit and other related policies to meet the reasonable financing needs of real estate enterprises and increase the efforts to ensure the delivery of buildings, until now the policies have gradually been effective. Since this year, the real estate market demand release faster, commodity housing sales have shown recovery, residential sales prices rose compared to last month, and the real estate development enterprise capital situation has improved.

2、NBS: There are still several advantages to the continuous investment growth of the domestic manufacturing industry

Fu Linghui, the spokesman with the National Bureau of Statistics (NBS), said that according to the next stage of the situation, There are still several advantages in the continuous investment growth of the domestic manufacturing industry. First, China is in the stage of rapid development of industrial upgrading, new technologies have been extensively penetrated, the pace of transformation and upgrading of traditional industries has accelerated, and the emerging industries have rapidly developed, which will boost the growth of manufacturing investment. At the same time, we see that the new energy industry and the digital economy-related manufacturing investment growth potential is still huge, providing strong support for the continued growth of manufacturing investment. Second, China's support for the development of manufacturing industry continues to increase. Manufacturing medium and long-term loans continue to maintain rapid growth, these policies are promoting the development of the the manufacturing industry and will continue to show the effect. Third, with the economic recovery, the manufacturing industry will have more development space, which is conducive to the stable growth of manufacturing investment.

3、The domestic retail prices of refined oil products may embrace the "biggest drop" of the year

At 24:00 on May 16, the domestic refined oil products will embrace the tenth round of price adjustment this year. Following the drop of the last round of refined oil prices, institutions expect that the current round of retail prices of refined oil products may continue to be lowered, and is expected to embrace the "biggest drop" of the year. According to Jinlianchuang's prediction, as of May 16, which is the tenth working day, the average price of reference crude oil varieties is $74.15/barrel, a decrease of 7.23%. The retail price of refined oil products will usher in a significant reduction, including a reduction of 380 yuan/ton of gasoline, and 365 yuan/ton of diesel, equivalent to the price adjustment of 0.3 yuan for 92 gasoline, 0.31 yuan for 95 gasoline, 0.31 yuan of 0 diesel. The largest reduction in domestic oil prices this year occurred on March 31, when domestic gasoline and diesel prices were cut by 335 yuan per ton and 320 yuan per ton respectively. This means that today's domestic retail price adjustment of refined oil products or a new record reduction in the year.

4、NBS responds to controversy over the real estate-related data

The National Bureau of Statistics (NBS) today released the macroeconomic data for the first four months of this year. Some readers found that, compared with the same period last year, the absolute amount of residential sales area fell from January to April this year while the year-on-year growth rate is positive growth, why is that? In response to the question, NBS explained that the growth rate of real estate development investment, the sales area of commercial properties and other indicators are calculated on a comparable basis. Reporting period data and the previous data published in the same period last year exist with incomparable factors, which can not be directly compared to calculate the growth rate. NBS said that the main reasons are, first, they have strengthened the management of projects in library management and revised the data of returned commercial properties which breaks the contract. Second, they have strengthened statistical law enforcement and corrected the problem data found in the statistical law enforcement inspection, in accordance with the relevant provisions. Third, have strengthened the management of data quality, and eliminated the sales data of non-real estate development nature project investment and with the nature of a mortgage.

International News

1、U.S. plans to repurchase 3 million barrels of oil to replenish strategic petroleum reserves

The United States is preparing to purchase 3 million barrels of sour crude oil to begin replenishing its depleting strategic petroleum reserves, according to insiders. In addition to directly buying crude oil, the Energy Department said part of its strategy to replenish the reserves includes returning oil from previous transactions and avoiding “unnecessary sales” unrelated to supply disruptions. The U.S. Energy Department previously canceled a congressionally mandated sale successfully of about 140 million barrels of oil.

2、Canada's Inflation Rate Rises Slightly in April

Canada's annual rate of inflation rose unexpectedly in April as consumers paid more for rent and mortgage interest costs. Data released today showed that Canada's CPI came in at an annual rate of 4.4% in April, compared to previous market expectations of 4.1%. Meanwhile, the revised average and weighted median underlying core inflation rate of interest to the Bank of Canada (BOC) averaged 4.2% in April, compared with 4.5% in the previous month.

3、EU countries approve the world's first comprehensive rules for crypto assets

On Tuesday, European Union countries finally approved the world's first comprehensive rules regulating crypto assets, putting head-on pressure on countries like the United Kingdom and the United States. The rules are expected to be implemented starting in 2024. The finance minister of the Swedish EU presidency said recent events confirm the urgent need for rules that will better protect Europeans who invest in these assets and prevent abuse of the crypto industry for money laundering and terrorist financing. The rules require companies that want to issue, trade and protect crypto assets, tokenized assets and stablecoins in the EU's 27 member states to obtain a license. Ministers agreed to a requirement that service providers obtain the names of originators and beneficiaries of crypto assets from January 2026, regardless of the amount transferred. The meeting also reached an agreement on revising rules on how member states can cooperate with each other on taxation to cover crypto asset transactions, as well as on exchanging information on advance tax rulings for the wealthiest individuals.

4、ING: If no progress was made on the U.S. debt ceiling, it is favorable for the dollar and yen

Internationale Nederlanden Groep NV (ING) economists point out that if U.S. President Joe Biden and U.S. House Speaker John McCarthy are unable to make tangible progress on top of a debt ceiling deal, we would certainly see the market increase expectations of a U.S. debt default. The potential negative impact on risk sentiment and currency markets means that the upside risk to the dollar and yen is quite high in this scenario.

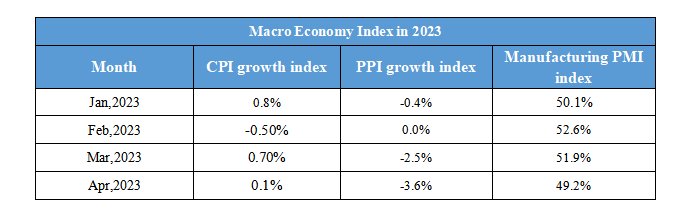

Domestic Macro Economy Index