May,9th Daily Macro Economy News

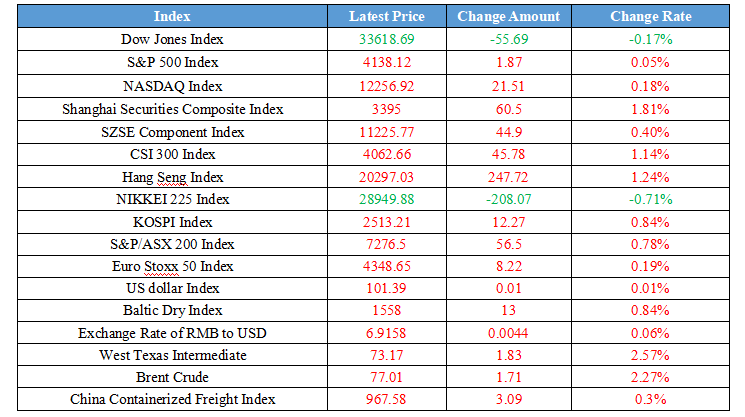

Latest Global Major Index

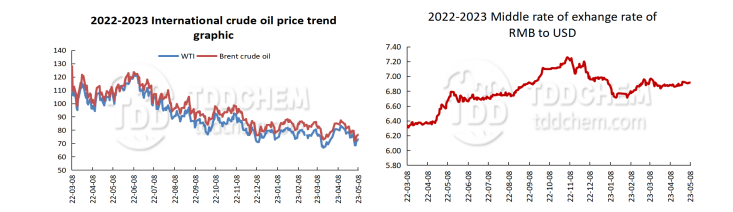

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1、MARA: We will step up launching the construction planning and guidance on protected agriculture and make solid improvements to the modernization of the protected agriculture

2、MARA deploys arrangements for flood and drought control to make sure the harvest of the summer and annual grain

3、ANZ Bank: Oil prices are likely to remain under pressure in the short term

4、Economic Daily: Accelerate the establishment of a new model for the development of the real estate industry

International News

1、EURUSD exchange rate may rebound to above 1.10 but may be limited for now

2、Dollar weakens while gold advances on eve of U.S. inflation data release

3、The EURUSD exchange rate may up moderately higher

4、Commerzbank: German manufacturing is expected to decline further after the weak March

Domestic News

1、MARA: We will step up launching the construction planning and guidance on protected agriculture and make solid improvements to the modernization of the protected agriculture

Tang Renjian, the minister of the Ministry of Agriculture and Rural Affair (MARA), convened a meeting, stressing the need to accelerate the development of a program to gradually build all permanent basic farmland to high standard farmland, mobilize local enthusiasm to improve the level of input, study separately and develop construction standards for different regions, and improve mechanisms and methods to ensure the quality of construction. Accelerate the scientific and technological research with emphasis on the seed industry, plan to promote the joint research on breeding of the popular varieties, study and develop mechanisms and methods in line with the characteristics of agricultural research, and play a good role in the innovation and research of the seed industry formation enterprises. Efforts will be made to enhance the level of modern agricultural facilities and equipment, the urgent development of the introduction of facilities and agricultural construction planning and guidance, step up launching the construction planning and guidance on protected agriculture and make solid improvements to the modernization of the protected agriculture, strongly promote the action on agricultural equipment to improve the weak links.

2、MARA deploys arrangements for flood and drought control to make sure the harvest of the summer and annual grain

Ministry of Agriculture and Rural Affairs (MARA) website on May 8 news, the country has entered the main flood season, the recent rounds of heavy rainfall weather in the south, some areas of flooding, flood control and drought into a critical period. According to the China Meteorological Administration, this year's flood season in China's climate conditions in general deviations, with a high possibility of drought and flooding, regional and staged drought and flooding disasters are obvious, more extreme weather and climate events are likely to happen, precipitation in the north and south are of two rain bands, more precipitation in the north are likely to occur heavy floods. The precipitation in the middle reaches of the Yangtze River is significantly less and may occur in high-temperature drought. Typhoons mainly affect South China and East China Coast area, with a high possibility of going north. In order to scientifically and effectively respond to unfavorable weather conditions, recently, the Ministry of Agriculture and Rural Affairs (MARA) issued a notice, requiring early agricultural flood control and drought work, efforts will be made to reduce the impact of disasters and losses, and make every effort to make sure the harvest of the summer and annual grain.

3、ANZ Bank: Oil prices are likely to remain under pressure in the short term

Oil prices are likely to remain under pressure due to the very much uncertain macro environment and the lack of strong signals in the oil spot market, said ANZ strategists. The bank lowered its short-term (0-3 months) price target for Brent crude to $82 per barrel. However, growing Chinese oil demand will offset weaker demand in developed markets. With OPEC+ production cuts and a gradual reduction in production from other major producers, we expect a tight oil market in the third quarter, which should allow oil prices to rebound in the second half of the year. ANZ bank maintains its year-end target price of $100 per barrel for Brent crude.

4、Economic Daily: Accelerate the establishment of a new model for the development of the real estate industry

The real estate market maintains a stable and healthy development, the fundamental solution is to promote the transformation, that is, to promote the establishment of a new model of real estate industry development. Several industry insiders said that the sale of existing houses may become mainstream, which will help reduce the leverage of the real estate industry and thus reduce the risk. At present, the market is in a transitional phase, must seize the key of "guarantee delivery of buildings" and can not let the buyers suffer from interest losses. To promote the establishment of a new model of development, we must move from solving the problem of "whether we have" to "whether is good". The Minister of Housing and Urban-Rural Development, Ni Hong, previously said that improving the quality of housing, so that people can live in a better house, is an inevitable requirement for the high-quality development of the real estate market. The next step will be made to increase the supply of affordable housing and the construction of a long-term rental housing market so that new citizens and young people can be better settled down.

International News

1、EURUSD exchange rate may rebound to above 1.10 but may be limited for now

Analysts at UBS said in a report that the EURUSD is likely to maintain a narrow range of oscillation for now, as the EURUSD is currently well above the key psychological level of 1.10, but traders are still reluctant to push the EURUSD above the yearly high of about $1.1095. "EURUSD is likely to continue its horizontal price movement in the near term, it may occur a rebound again afterward." Analysts said Friday's stronger-than-expected U.S. jobs data failed to temper expectations of a U.S. interest rate cut, producing only a "limited and short-lived" boost to the dollar.

2、Dollar weakens while gold advances on eve of U.S. inflation data release

As the dollar weakened, gold prices edged higher, recovered a little from Friday. On Friday, traders' bets on the Federal Reserve which they will cut interest rates later this year were reduced. This week, investors will pay close attention to U.S. CPI data for further clues about the Fed's monetary policy. Strong jobs data released on Friday eased fears of a U.S. recession as investors who considered the possibility that the Fed could keep interest rates high for longer, causing U.S. Treasury yields to spike and potentially step up for an 11th consecutive rate hike in June.

3、The EURUSD exchange rate may up moderately higher

Economists at Nordea Bank believe the Fed is in or near a pause in rate hikes and the ECB still plans to raise rates, meaning the euro will move higher against the dollar. However, given market expectations of a Fed rate cut after the summer, it is far from certain that the euro will move significantly higher against the dollar. If the market is disappointed, the negative bets on the dollar may decrease. As a result, the euro is expected a horizontal movement against the dollar next year. The likelihood of a global recession in the next few years is extremely high and is uncertain for the dollar's movement, but a recession could be beneficial to the dollar.

4、Commerzbank: German manufacturing is expected to decline further after the weak March

Weak demand suggests that German industrial output is expected to fall further in the coming months after an unexpectedly sharp 3.4 percent decrease in March, Commerzbank senior economist Ralph Solveen said in a report. He said the industrial sector is increasingly feeling the negative impact of sharp interest rate hikes by global central banks, adding that the construction sector has been in this situation for some time. However, he said that based on the sharp decline in March in Germany's indicators, which in some cases may have a special impact, it would not be surprising if April reported another increase. But in general, he added, this suggests that a mild recession is more likely in the second half of the year instead of any recovery.

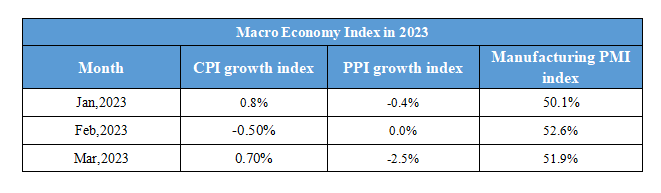

Domestic Macro Economy Index