May,8th Daily Macro Economy News

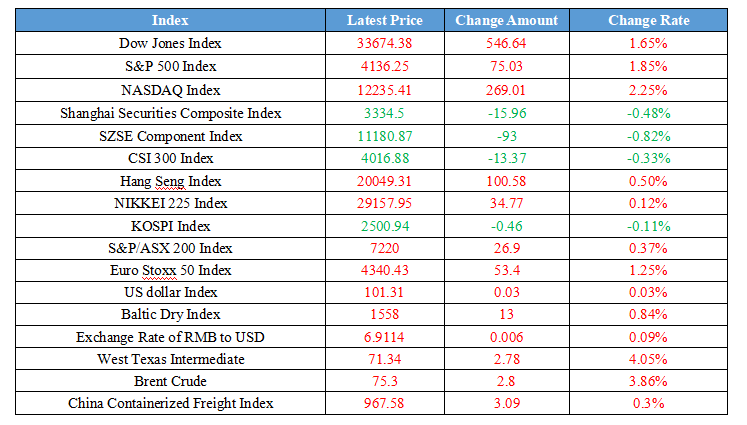

Latest Global Major Index

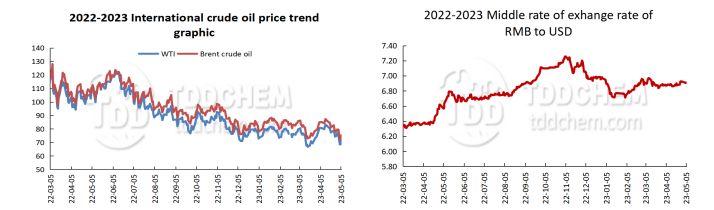

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1、NDRC indicates that will make steady headway on advancing the construction of the Chinese path to modernization with high-quality development

2、Monetary tightening policy marginal slowdown, precious metals are expected to usher in sectoral investment opportunities

3、The SASAC issued the Management Rules of Bond Issuance by Central Enterprises

4、Central Financial and Economic Affairs Commission: to improve the industrial policy of the new development stage, take the maintenance of industrial safety as the top priority.

International News

1、FDIC: Considering Loss-Sharing Agreements for private equity firms and other non-bank institutions acquiring portions of failed banks

2、Macro fundamentals and policies in the second quarter are difficult to exceed expectations, and incremental funds still need to wait

3、Haitong Futures: Oil prices are expected to continue to take the recovery in the market next week

4、Treasurer of Australia urges parliament to support petroleum tax reform

Domestic News

1、NDRC indicates that will make steady headway on advancing the construction of the Chinese path to modernization with high-quality development

NDRC indicates they will accelerate the realization of a high level of scientific and technological self-reliance and self-improvement, and actively expand domestic effective demand. Meanwhile, give priority to restoring and expanding consumption, increase the income of urban and rural residents through multiple channels, strive to improve consumption conditions and innovate consumption scenarios, which can fully unleash consumption potential. Promote the quality and upgrade of consumption, support the consumption of new energy vehicles, elderly services, education medical, cultural and sports services, and cultivate and grow new types of consumption.

2、Monetary tightening policy marginal slowdown, precious metals are expected to usher in sectoral investment opportunities

Haitong Securities issued a research report that said the May interest rate hike may be the last Fed rate hike, precious metals are expected to usher in sectoral investment opportunities in the context of a marginal slowdown in monetary tightening policy. However, it should be noted that the U.S. labor market is still resilient, and it is still early to discuss the process of Fed rate cuts. In addition, the bank expects the central bank of gold purchasing demand may continuously play a highlighted role in the "de-globalization" process, investment demand is expected a steady growth with the arrival of the gold cycle, and the strong demand may support the gold price to maintain high levels.

3、The SASAC issued the Management Rules of Bond Issuance by Central Enterprises

The State-owned Assets Supervision and Administration Commission of the State Council (SASAC) indicates that efforts to improve the management system of bond issuance will be made, expanding the scope of management to corporate credit bonds issued by enterprises in various bond markets, achieving full coverage of various types of bonds. Efforts will be made to prevent the risk of bond defaults, and systematic requirements will be put forward for risk prevention in all aspects of the work.

4、Central Financial and Economic Affairs Commission: to improve the industrial policy of the new development stage, take the maintenance of industrial safety as the top priority

Central Financial and Economic Affairs Commission: We should improve the industrial policy in the new development stage, make the maintenance of industrial security a top priority, strengthen the top-level design of strategic areas and enhance the synergy of industrial policies. We should pay more attention to hiding food in technology and break through the restrictions of arable land and other natural conditions on agricultural production. We should vigorously build world-class enterprises, cherish outstanding entrepreneurs and vigorously train great craftsmen.

International News

1、FDIC: Considering Loss-Sharing Agreements for private equity firms and other non-bank institutions acquiring portions of failed banks

The U.S. Federal Deposit Insurance Corp. is considering offering loss-sharing agreements to private equity firms and other non-bank institutions that acquire portions of failed banks. The regulator previously had to hold a large number of loans from the signature bank after it collapsed. This move is expected to attract such firms to buy loans and assets from failed institutions as interest rate hikes collapse more regional banks.

2、Macro fundamentals and policies in the second quarter are difficult to exceed expectations, and incremental funds still need to wait

As the liquidity risk of the U.S. banking sector gradually eases, more political resources may be put into geopolitical competition, the space for de-escalation of international relations may be compressed, and if the external environment changes, the market risk appetite may cool down. At the micro level, residents' expectations of significant income improvement are not strong, the willingness to invest from deposits has not yet been awakened, and the micro liquidity of the market is not ideal. In the second quarter, the macro fundamentals and policies are difficult to exceed expectations, incremental funds still need to wait, the market stock game to the extreme, and the market sentiment is reasonably running weak. The TMT sector, which was the strongest in the previous period, has entered an extremely high interval range, and the short-term profit/loss ratio has dropped significantly, the funds with low-risk appetite have gradually started to withdraw. If the market risk appetite can not continue to improve, the low valuation high dividend defense sector may continue to be favored.

3、Haitong Futures: Oil prices are expected to continue to take the recovery in the market next week

Oil prices rebounded sharply on Friday night to show that the previous macro shock has temporarily receded, but macro factors such as the banking crisis in Europe and the United States and the risk of recession will still be important factors affecting oil prices during the year. Although the OPEC+ countries stressed that the purpose of the production cut action is not to push up oil prices, the role of production cuts on oil prices is obvious. It is expected that there will still be a game between macro bearishness and supply-side stabilization. The overall performance of oil prices over the past year is under pressure oscillating downward, although OPEC + countries made efforts to reduce production to make oil prices rely on a strong bottom, but no healthy economic development as support, relying only on production cuts oil prices are difficult to have sustained strong performance, in light of the complex impact factors, oil prices are likely to maintain high volatility, which is expected to continue to take the recovery in the market next week, the height of the rebound remains to be observed and need to pay special attention.

4、Treasurer of Australia urges parliament to support petroleum tax reform

Jim Chalmers, the Treasurer of Australia, urged small political parties to support proposed changes to the Petroleum Resources Rent Tax (PRRT) paid by the offshore liquefied natural gas industry, which was welcomed by the industry's lobby group. The Australian government estimates that the changes would increase tax revenue for the industry by AUS$ 2.4 billion ($ 1.6 billion) over the next four financial years.

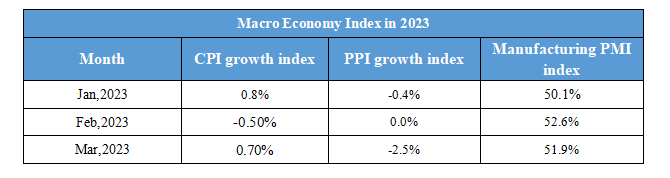

Domestic Macro Economy Index