Daily Macro Economy News on 28th,April

Daily Macro Economy News

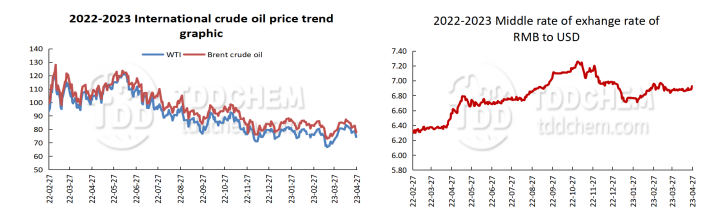

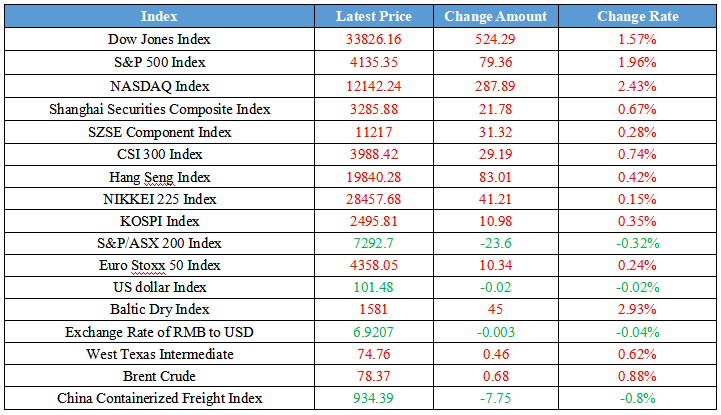

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1.MOC: Stabilize the scale of exports and actively expand imports

2.NEA: In the first two months of this year, the key projects in the national energy sector have completed the investment amount, increased by 24.9% year-on-year

3.NEA: since March, the national inventory of coal in the power plant remain at a high level

4.NEA: natural gas and refined oil consumption growth rate has significantly upward from February

International News

1.U.S. economic growth slows to 1.1% as business investment slumps

2.Novak: OPEC+ sees no need for further oil output cuts

3.The Deputy Chairman of the Board of Directors of the Russian Foreign Trade Bank predicts that investors will abandon the dollar and the euro by the end of 2025

4.U.S. economic growth may cool down in the first quarter along with the Fed's pace of rate hikes

Domestic News

1.MOC Stabilize the scale of exports and actively expand imports

Shu JueTing, the spokeswoman of the Ministry of Commerce (MOC), said at a regular press conference. The MOC will stabilize exports, expand imports, and promote innovation, keep increasing efforts to stabilize the scale of foreign trading, and perfect structure. First, we will pay close attention to policy implementation. Second, we will stabilize the scale of exports. The MOC will actively optimize the trade environment, and unclog the blocks in market channels expanding to stabilize orders of enterprises. Make efforts in smoothing visa application procedures with other countries for domestic business personnel, and support foreign trade enterprises to use APEC business travel cards to relevant economies to carry out supply and procurement docking. Third, we will actively expand imports. Support the import of advanced technology, important equipment, key components, and promote industrial structure adjustment, optimization and upgrading. To ensure the stable operation of all aspects of bulk commodity imports, increase the supply of energy resources products and agricultural imports. Fourth, to promote innovation and development.

2.NEA: In the first two months of this year, the key projects in the national energy sector have completed the investment amount, increased by 24.9% year-on-year

Dong Wancheng, deputy director of the Development Planning Department of the National Energy Administration (NEA), introduced at a press conference today, in the first quarter, accelerated the structure and stabilized the growth of major projects. The Hua-long Pressurized Reactor (HPR1000) demonstration project Fangcheng Port Unit 3 was officially put into operation in March. Sanmen Nuclear Power Unit 4, Jinshang - Hubei ultra-high voltage DC project, Hubei Tongshan pumped storage and other projects to start construction. Accelerate the construction of the second batch of large-scale wind power photovoltaic base projects in the Gobi desert areas, and the third list of projects has just been determined. According to monitoring, in the first two months of this year, the key projects in the national energy sector have completed the investment amount, increased by 24.9% year-on-year.

3.NEA: since March, the national inventory of coal in the power plant remain at a high level

On April 27, the National Energy Administration (NEA) held a press conference to release the energy situation and renewable energy development in the first quarter of 2023. Dong Wancheng, the Deputy Director of the Development Planning Department of NEA, said at the meeting that the energy supply security capacity continues to enhance. We will strengthen safety production in the key coal-producing provinces and enterprises, and make every effort to the exploration and development of oil and gas resources and increase storage on production. In the first quarter, coal, crude oil and natural gas production increased by 5.5%, 2.0% and 4.5% respectively. Fully play the role on the coal, electricity medium and long-term contracts to ensure the supply of stable prices of the "stabilizer", which makes sure of local and corporate energy supply responsibility. Since March, the national inventory of coal in the power plant remain at a high level.

4.NEA: natural gas and refined oil consumption growth rate has significantly upward from February

April 27th, Dong Wancheng, deputy director of the Development Planning Department of the National Energy Administration (NEA), introduced at a press conference, that energy consumption continued to grow up. Due to the impact of the epidemic in some areas last year, which led to a low base of social electricity consumption, social electricity consumption in March this year increased by 5.9% year-on-year, significantly higher than the growth rate of 2.3% in the previous two months. In the first quarter, social electricity consumption increased by 3.6% year-on-year, of which industrial electricity consumption increased by 4.4% year-on-year, contributing 78% to the increase in electricity consumption. the year-on-year growth rate of natural gas and refined oil consumption grew significantly from February. the increase in industrial energy demand drove the steady growth of coal consumption.

International News

1.U.S. economic growth slows to 1.1% as business investment slumps

U.S. economic growth slowed more than expected in the first quarter due to lukewarm business investment and a pullback in inventories that dampened a pickup in consumer spending. Preliminary data released by the US Ministry of Commerce on Thursday showed that U.S. real GDP recorded a preliminary annualized quarterly rate of 1.1 percent in the first quarter and a preliminary quarterly rate of 3.7 percent for real personal consumption expenditures, supported by the strongest consumer spending in nearly two years, compared with median estimates of 2 percent and 4 percent respectively.

2.Novak: OPEC+ sees no need for further oil output cuts

Russia's Deputy Prime Minister Novak said on Thursday that OPEC+ major oil producers do not see the need for further production cuts, although the organization can adjust its policy if necessary. Novak said OPEC+ does not expect oil shortages in global oil markets after the cuts, although the International Energy Agency (IEA) previously said the cuts could exacerbate supply shortages and expected it will happen in the second half of this year. Russia has maintained its oil production and exports by increasing sales of its energy products outside Europe after western countries imposed tough sanctions on the Russia-Ukraine conflict. Novak said Russia will shift 140 million tons of oil and oil products that would have been shipped to Europe to Asia this year.

3.The Deputy Chairman of the Board of Directors of the Russian Foreign Trade Bank predicts that investors will abandon the dollar and the euro by the end of 2025

Anatoly Pechatnikov, the Deputy Chairman of the Board of Directors of the Foreign Trade Bank of the Russian Federation, believes that the percentage of bank depositors using the dollar and the euro will drop from 10% to 7% in 2023, and by the end of 2025 this percentage may fall to zero. Pechatnikov said, "According to our estimates, by the end of 2025, citizens will stop saving foreign currency, at least in our banks." He also noted that currently, savers are increasingly saving in yuan. By the end of 2023, the amount of yuan savings could nearly double.

4.U.S. economic growth may cool down in the first quarter along with the Fed's pace of rate hikes

The U.S. economy is expected to grow moderately in the first quarter of 2023 as the Federal Reserve vigorously pursues its monetary tightening actions. The market expects U.S. real GDP to grow at an annualized quarterly rate of 2.0% in the first quarter, slowing from the 2.6% growth rate in the fourth quarter of last year. The underlying data shows that the U.S. economy continues to show some signs of strength, despite weakening growth momentum. Economists expect strong consumption growth in the first quarter to offset the drag from net exports and inventories.

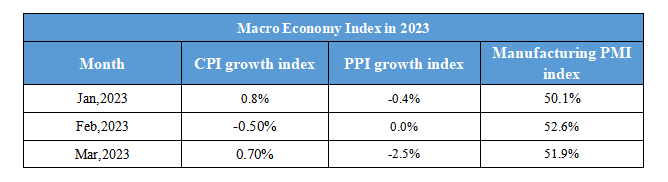

Domestic Macro Economy Index