Daily Macro Economy News on 27th,April

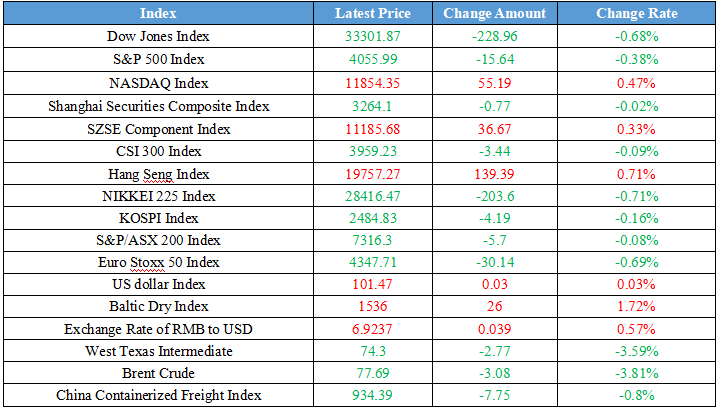

Latest Global Major Index

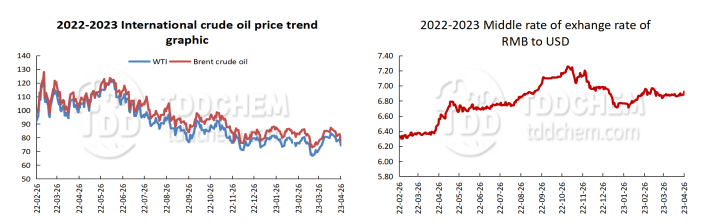

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1.Fu Bingfeng, the vice president of CAAM standing committee said lithium carbonate and other power battery raw materials price ups and downs dramatically is not a normal phenomenon

2.CME Group: reset the price limit for CBOT grains and oilseed futures since May 1st

3.Xin Guobin, the Vice Minister of MIIT, said that they will seriously study the development and timely launch of effective policies to stabilize and expand vehicle consumption

4.IEA expects an increase of another 35% in global electric vehicle sales in 2023

International News

1.Vujcic from the ECB Governing Council: the central bank "has no choice" but to raise interest rates further

2ãBOJ may hold firmly on its policy amid concerns about growth

3.EU agrees to push for sustainable fuels in the aviation section

4.The U.S. banking crisis may reverse the Federal Reserve's monetary policy, the end of the Fed's rate hike cycle is around the corner and may start a new round of interest rate cut cycle in the second half of the year

Domestic News

1.Fu Bingfeng, the vice president of CAAM standing committee said lithium carbonate and other power battery raw materials price ups and downs dramatically is not a normal phenomenon

At the 2023 annual general meeting of the China Automotive Power Battery Industry Innovation Alliance held on April 26, the vice president of China Association of Automobile Manufacturer (CAAM) standing committee Fu Bingfeng, pointed out that there still remains some problems in China's power battery industry, including the distribution of labor in the battery industry chain and the value chain. "Appropriate price increases for raw materials are normal, but big ups and downs are not normal." Fu Bingfeng said, lithium carbonate prices recently fell again, the new energy vehicles is China's strategic emerging industries, sustainable and healthy development is the core, raw materials sharply declined in a short-term is also not a normal phenomenon. The industry should take the previous sharp price increases as a example to ensure a reasonable distribution of the value chain, avoiding the impact of large ups and downs.

2.CME Group: reset the price limit for CBOT grains and oilseed futures since May 1st

The Chicago Mercantile Exchange Holdings Inc (CME Group) has announced that it will reset the price limit for CBOT grains and oilseed futures. This is the first time since 2023 that the price limit has been adjusted. Typically, the CME Group will reset the daily price limit for grains and oilseeds in May and November each year, according to the trading rules of each commodity. The new price limits for major agricultural futures contracts will take effect on May 1, 2023, and will be valid until the first trading day of November 2023.

3.Xin Guobin, the Vice Minister of MIIT, said that they will seriously study the development and timely launch of effective policies to stabilize and expand vehicle consumption

Xin Guobin, the Vice Minister of the Ministry of Industry and Information Technology (MIIT) said that they will seriously study the development and timely launch of effective policies to stabilize and expand vehicle consumption and establish the inter-ministerial coordination system for the development of the new energy vehicle industry. Promote research and as soon as possible to clarify the policy of car purchase tax reduction after 2023, develop accelerated charging and replacement construction, launch the promotion and application of new energy vehicles in the public sector and other support policies.

4.IEA expects an increase of another 35% in global electric vehicle sales in 2023

On the 26th of this month, the International Energy Agency (IEA) released a report on the Global Electric Vehicle Outlook 2023, in which it said that global electric vehicle sales exceeded 10 million units in 2022, and their sales are expected to increase by another 35% to 14 million units in 2023. Global sales of electric vehicles are currently concentrated in three markets: China, Europe and the United States. China is leading the top, with 60% of global electric vehicle sales in 2022, and more than half of the world's electric vehicle are now in China.

International News

1.Vujcic from the ECB Governing Council: the central bank "has no choice" but to raise interest rates further

April 26, Vujcic from the European Central Bank Governing Council said on Wednesday that the inflation is falling, but core inflation remains at a high level, so the European Central Bank (ECB) "has no choice" but to continue to raise interest rates until the condition has changed. He said that fighting against inflation usually requires costs, such as raising interest rates. Yet if they act decisively now, and make inflation less entrenched than expectations, then the price to be paid may be gentler. The ECB will hold a policy meeting soon, which will discuss raising interest rates of 25 or 50 basis points depending on the upcoming inflation and bank loan performance.

2.BOJ may hold firmly on its policy amid concerns about growth

The Bank of Japan (BOJ) appears to be sticking to its ultra-loose monetary policy amid concerns about economic growth and the forecasts that inflation will be at a low level. The BOJ Governor Kazuo Ueta has repeatedly made clear in recent Congress speeches that he has no intention of adjusting the central bank's current accommodative policy. He did, indeed, raise the possibility of future policy adjustments, which many market participants believe could happen this year. But only the BOJâs forecast of a downward in inflation, will the policy likely to change. Economic growth seems to be a bigger concern for the BOJ at the moment, with forecasts of a possible recession in the U.S. and other economies (such as the eurozone, etc.), coupled with geopolitical risks, which could face damage to international trade and supply chains. And within Japan, the outlook for businesses remains gloomy. In light of the above, the BOJ remains the high possibility of maintaining the current monetary policy unchanged this week and this year.

3.EU agrees to push for sustainable fuels in the aviation section

The European Union (EU) has agreed that they will require airlines to use green aviation fuels starting in 2025, according to the Financial Times. The EU is currently stepping up plans to reduce emissions from aviation, which is one of the most polluting sectors in the EU. Regulations require all aircraft fuel at EU airports to be blended with sustainable aviation fuels, with a minimum percentage of 2 percent starting in 2025, increasing every five years to 70 percent by 2050. These regulations are intended to boost the production of sustainable fuel for European aviation, which is currently in very small quantities. In addition, aircraft departing from EU airports will only be allowed to replenish the fuel needed to complete the flight to prevent attempts to circumvent sustainability requirements.

4.The U.S. banking crisis may reverse the Federal Reserve's monetary policy, the end of the Fed's rate hike cycle is around the corner and may start a new round of interest rate cut cycle in the second half of the year

The interest rate reduction process will lead to a decline in actual interest rates in the US, driving gold prices into a new bull market. Looking at the five interest rate cycles of the Fed since 1990, during the period from the end of this round of interest rate hikes to the beginning of the next round of interest rate cuts, the yield of gold has improved significantly. At present, with the increasingly certain timing of the end of the Fed's interest rate hikes and the increasing concern about the economic recession in the United States, the expectation of interest rate cuts is enhanced, and gold is likely to usher in a new bull market and strategic investment opportunities. In the long term, the US dollar index may enter a downturn, which is favorable for the medium- to long-term rise in gold prices.

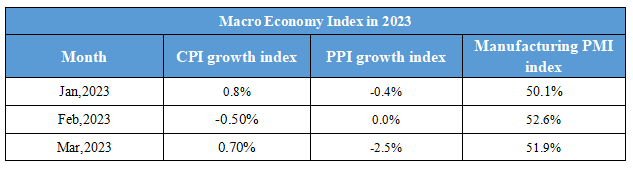

Domestic Macro Economy Index