Daily Macro Economy News on 20th,April

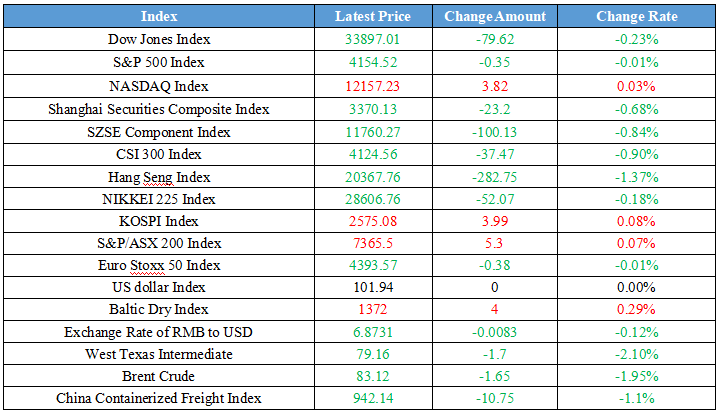

Latest Global Major Index

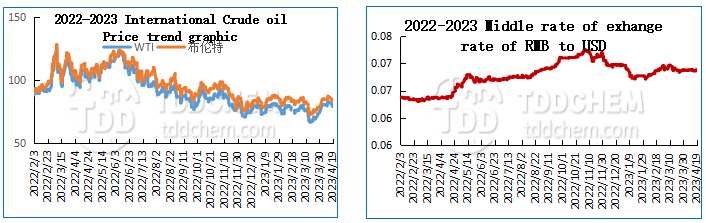

International Crude Price Trend and Exchange Rate of RMB to USD Trend

4.80 real estate companies saw a 43% increase in financing in March year-on-year.

International News

1.Central London house prices suffer the biggest drop since 2019

2.German cabinet approves bill to phase out oil and gas heating systems

3.Eurozone core inflation rises slightly in March, ECB may remain wary

4.EU Parliament backs EU up for dealing to include shipping in the carbon market

Domestic News

1. Natinal Mine Safety Administration Shanxi Bureau carries out Three Special Inspectionsâ on non-coal mines

Recently, the reporter learned from National Mine Safety Administration Shanxi Bureau, in

order to further curb accidents and prevent risks. To resolutely build solid non-coal mine production safety fundamentals, Shanxi Bureau in response to the current non-coal mine safety risks, decide to carry on a Three Special Inspections in Q2 based on the successful implementations of a comprehensive renovation of safety mine production, and special renovation of safety mine production of turning open-pit mining into underground mining production on metal and non-metallic mines according to the National Mine Safety Administration of the recent work arrangements. The âThree Special Inspections are as follows: Firstly, to carry out a special inspection of the roof. Secondly, to carry out a special inspection on turning open-pit mining into underground mining production in metal and non-metallic mines. Thirdly, to carry out a special inspection on pre-flood preparation.

Resource: CCTV

2.The Supplementary reduction in deposit interest rates of small and medium-sized banks collectively may face further downward in the future

Since April, many counties, including Guangdong, Hubei, Shaanxi, Henan, etc, has announced that they will reduce the interest rate of CNY deposit, which will make an impact on different adjustment on different period of maturities including demand deposit, time deposit, certificates of deposit and so on. Experts interviewed indicate that in the context of the overall downward market interest rates, large state-owned banks and some joint-stock banks have lowered deposit interest rates since last year. The new adjustment can be viewed as a âfollow-up â of those small and medium-sized banks and is a market-oriented pricing behavior to reduce the cost of debts. Experts also suggest that there is still room for downward movement of deposit rates in the future, and residents can diversify their asset allocation according to their personal needs to weigh the relationship between returns and risks.

Resource: Economic Information Daily

3.MIIT: Support Xiangyang City in Hubei Province, Deqing County in Zhejiang Province, and Liuzhou City in Guangxi Province, to host the Internet of Vehicles pilot area

According to the Ministry of Industry and Information Technology (MIIT) official news on April 19th, MIIT has replied to the People's Government of Hubei Province, Zhejiang Province, and Guangxi Zhuang Autonomous Region respectively, to support Xiangyang City in Hubei Province, Deqing County in Zhejiang Province, and Liuzhou City in Guangxi Province, to host the internet of vehicles pilot area. In recent years, Hubei province, Zhejiang province, and Guangxi province adhere to system planning on the transformation of vehicle networking functions, enhancement of core system capacity, cross-border integration development on "geographic information plus vehicle networking", and to develop vehicle networking scale deep application as the goal in key areas. Promote Integrated innovation and development of vehicle networking industry, actively cultivate the car networking industry ecology, has a better Industry development foundation.

4.80 real estate companies saw a 43% increase in financing in March year-on-year

Recently, listed real estate companies have been making frequent financing moves, with a stronger willingness to raise funds and more open financing channels. Data from CRIC Research Center shows that in March, the aggregate financing of 80 typical real estate enterprises reached 60.893 billion yuan, an increase of 43.4% year-on-year. In terms of financing structure, the domestic debt financing of real estate enterprises in March reached RMB 52.591 billion, up 36.1% year-on-year, while asset securitization financing reached 3.501 billion yuan, up 94% year-on-year. Only from the perspective of listed enterprises, more than 30 listed real estate enterprises have issued equity financing plans since the "Third Arrow" policy came into effect.

Resource: China Securities Journal

International News

1. Central London house prices suffer the biggest drop since 2019

According to the Financial Times, house prices in central London, England, fell nearly 5% from last March, the biggest annual drop in 3 and a half years. Last month, house prices in prime London fell to £1,261 per square foot from £1,326 compared to the price from a year ago, and reached the lowest level since mid-2021, according to data provider LonRes. "The market has lost momentum and the prices were a bit inflated last year," said LonRes managing director Anthony Payne. He also indicates that Property values in high-end areas of London tend to be less susceptible to the recent rise in mortgage costs, as the market relies on cash-rich foreign buyers. But buyers have become more cautious due to concerns about multiple factors, including the economic outlook and rising interest rates, fearing that prices could still fall further.

2.German cabinet approves bill to phase out oil and gas heating systems

According to the German economy minister, Germany's cabinet on Wednesday approved a bill to prohibit major new oil and gas heating systems from 2024. This policy aims at reducing greenhouse gas emissions but critics warn could be costly for poorer households. Berlin's ruling coalition agreed last month that nearly all new heating systems installed in Germany should use 65 percent renewable energy from 2024, both in old and new buildings. Germany's construction industry emitted 112 million tons of greenhouse gases last year, accounting for 15 percent of the country's emissions.

Eurostat announced on Wednesday that Eurozone inflation slowed last month, but underlying inflation remained at a high level, confirming the European Central Bank's (ECB) concerns about continued price pressures. The consumer price index (CPI) in the 20-nation eurozone fell to 6.9 percent from 8.5 percent, mainly due to rapidly falling energy costs. However, ECB policymakers are now beginning to worry that high energy costs have permeated through the broader economy and are affecting everything from services to wages, making inflation more difficult to control. Indeed, inflation excluding unprocessed food and fuel rose from 7.4% to 7.5%, while inflation excluding alcohol and tobacco rose from 5.6% to 5.7%, in line with preliminary data. Although the ECB has raised interest rates by a record 350 basis points since last July, the continued high core inflation data is precisely why most ECB policymakers have said they need to continue to raise rates. For now, the market tends to expect modest growth from ECB, but investors still believe that ECB has a one-third chance of hiking rates.

4.EU Parliament backs EU up for dealing to include shipping in the carbon market

The shipping emissions coverage is enlarged from 40 percent in 2024 to 100 percent in 2026. Reduce carbon market emissions by 62% from 2005 levels by 2030, which supporting put an end to the free allowances for industrial emissions of carbon dioxide by 2034.

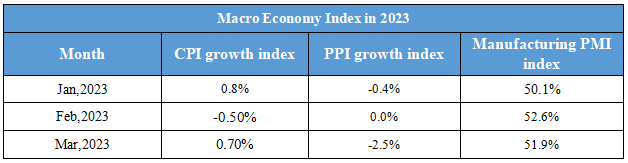

Domestic Macro Economy Index