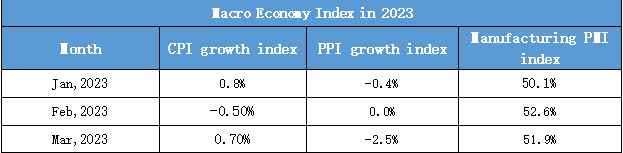

Daily Macro Economy News

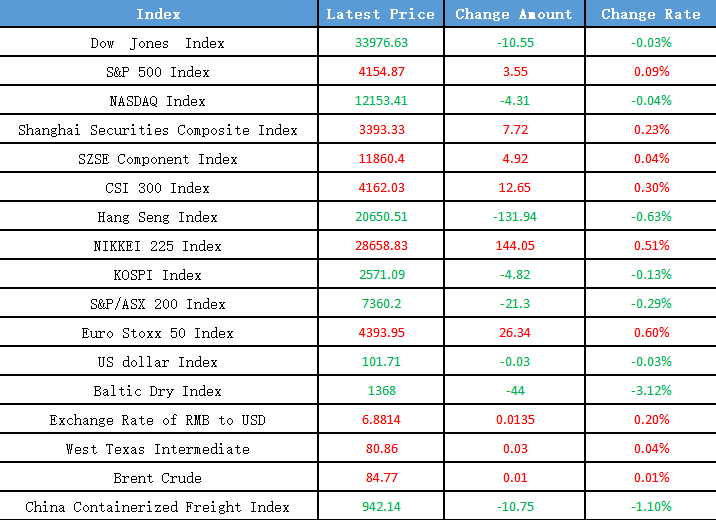

Latest Global Major Index

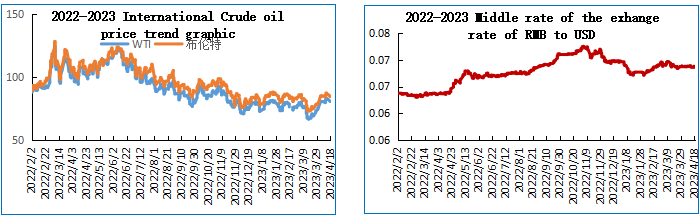

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1.National Bureau of Statistics: From January to March, the national real estate development investment of 2597.4 billion yuan, decreased by 5.8 percent year-on-year; among them, residential investment of 197.67 billion yuan, decreased by 4.1 percent.

2.National Bureau of Statistics: CPI rose moderately, while the price for industrial producers fell year-on-year.

3.National Bureau of Statistics: National industrial capacity utilization rate was 74.3 percent in Q1.

4.National Bureau of Statistics: Promoting a higher level of dynamic balance between supply and demand, and improving the healthy development of industry.

International News

1.Shale gas production in the USA may hit the record in May.

2.Global corporate defaults increase in March due to regional bank pressure.

3.The possibility of the FED raising interest rates by 25 basis points in May is 86.6 percent.

4.Egypt’s president calls on both sides of the Sudan conflict to start talks.

National Bureau of Statistics: From January to March, the national real estate development investment of 2597.4 billion yuan, which decreased by 5.8 percent year-on-year. Among them, residential investment reached 197.67 billion yuan, which decreased by 4.1 percent. From January to March, the sales area of commercial houses reached 299.46 million square meters, which decreased by 1.8 percent, while the residential sales area increased by 1.4 percent. Sales of commercial houses totaled 305.45 billion yuan, up by 4.1 percent, of which residential sales increased by 7.1 percent.

2.National Bureau of Statistics: CPI rose moderately, while the price for industrial producers fell year-on-year.

The national consumer prices (CPI) rose 1.3 percent year-on-year in Q1. Specifically, food, tobacco and alcohol prices rose 2.9 percent, clothing prices rose 0.7 percent, prices of household goods and services rose 1.2 percent, transportation and communication prices rose 0.1 percent, education, culture and entertainment prices rose 1.7 percent, health care prices rose 0.9 percent, prices of other supplies and services rose 2.7 percent respectively, while residential prices fell 0.2 percent. Among the prices of food, tobacco and alcohol category, fresh fruit prices rose 11.0 percent, pork prices rose 8.5 percent, grain prices rose 2.5 percent respectively, and fresh vegetable prices fell 2.9 percent. The core CPI, excluding food and energy prices, rose 0.8 percent year-on-year. In March, national consumer prices rose 0.7% percent year-on-year and fell 0.3 percent month-on-month.

3.National Bureau of Statistics: National industrial capacity utilization rate was 74.3 percent in Q1.

National Bureau of Statistics data show that, in Q1, the national industrial capacity utilization rate reached 74.3 percent, which decreased by 1.5 percent over the same period last year, which decreased by 1.4 percent over the previous quarter. Divided into three major categories, in the first quarter, the mining industry capacity utilization rate fell to 75.2 percent, which decreased by 1.8 percent year-on-year. The manufacturing capacity utilization rate fell to 74.5 percent, which decreased by 1.4 percent. Meanwhile, the electricity, heat, gas and water production and supply industry capacity utilization rate fell to 71.9 percent, which decreased by 1.9 percent.

4.National Bureau of Statistics: Promoting a higher level of dynamic balance between supply and demand, and improving the healthy development of industry.

Fu Linghui, the spokesman for the National Bureau of Statistics (NBS) and director general of the Department of Comprehensive Statistics at the NBS, indicates that the international environment is still complex and severe, there is uncertainty in the growth of external demand, and the domestic market demand constraints still remain insufficient, including the price of industrial products is still falling, meanwhile, the enterprise efficiency is still in depress. We will step up to the implementation of the policy to stabilize growth in the following stages, focus on expanding domestic demand, deepen the supply-side structural reform, vigorously transform and upgrade traditional industries, cultivate and support emerging industries, promote a higher level of dynamic balance between supply and demand, and improve the healthy development of the industry.

1.Shale gas production in the USA may hit the record in May

According to the report from Electronic Industries Alliance (EIA) on monthly drilling productivity, it shows that the natural gas production from the 7 major U.S. shale regions is expected to reach an all-time high of 9716.7 million cubic feet per day next month, up from 9683.5 million cubic feet per day this month. However, natural gas production continues to soar, while crude oil production in shale regions is showing signs of stabilization. The report shows that crude oil production in the shale regions will be 9.328 million barrels per day next month, up from 9.279 million barrels per day this month, but below the recent monthly report of 9.375 million barrels per day. Some analysts believe that oil and gas companies are finding a higher percentage of associated gas extracted underground as the oil-based wells are maturing and aging.

2.Global corporate defaults increased in March due to regional bank pressure

According to the Financial Times, last month, the number of global corporate in default reached its highest level since December 2020, with the collapse of Silicon Valley Bank and Signature Bank as the driving factors in defaults. Moody indicates that there are 15 companies rated by Moody’s rating defaulted on their debt in March, up from 12 in February and 6 in January. This resulted in the raise of the number of global defaulted companies to 33 in Q1, reaching the highest level since Q4 of 2020. S&P shows, "The stress experienced by some medium-sized regional banks in America is a reminder that the turning point in the interest rate period could increase other potential risks."

3.The possibility of the FED raising interest rates by 25 basis points in May is 86.6 percent

According to CME’s “Federal Reserve Observation”, the possibility of the FED keeping the interest rate maintained in May is 13.4 percent, and the possibility of raising rates by 25 basis points is 86.6 percent. Moreover, in June, the possibility of keeping the interest rate maintained at the current level is 9.7 percent, and the possibility of raising rates by 50 basis points cumulatively is 23.5%.

4.Egypt’s president calls on both sides of the Sudan conflict to start talks

Egyptian President Abdel-Fattah al-Sisi addresses they are communicating with both sides of Sudan conflict to stop the conflict and start negotiations to help Sudan rebuild stabilization.He also indicates that the current Egyptian forces in Sudan are deployed under the relevant agreements signed by the Egyptian and Sudan governments, the purpose of which is to exercise rather than intervene in the conflict. Meanwhile, Egypt is in contact with the Sudanese rapid support forces to ensure the release of some Egyptian soldiers who were captured in Sudan.