Global Economic Highlights and Domestic Policy Updates on August 2nd

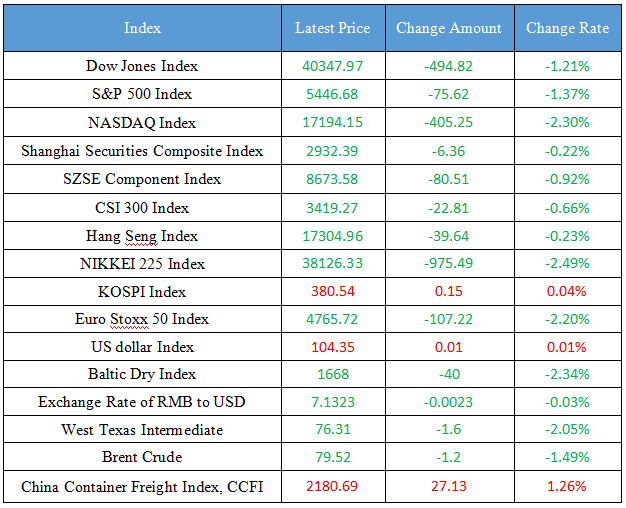

Latest Global Major Index

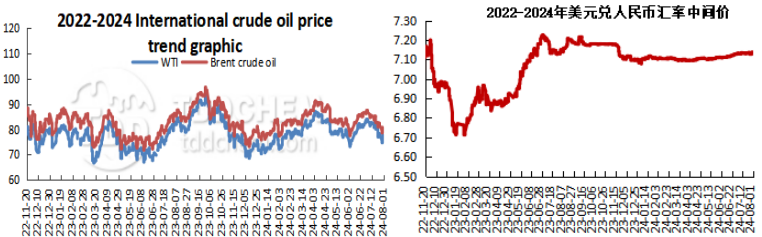

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. China's first long-term mechanism for basic medical insurance participation was officially announced

2. The National Development and Reform Commission held a press conference to introduce that there is still enough room for counter-cyclical policy adjustment

3. Ultra-long-term treasury bond ETFs have repeatedly hit new highs, and experts remind that we need to pay attention to risks

4. Private equity funds are receiving a steady stream of insurance capital "injection"

5. During the investigation and investigation in Henan, Liu Guozhong stressed the need to pay close attention to disaster prevention and mitigation and the restoration of agricultural production after the disaster, and resolutely seize a fruitful harvest of autumn grain

International News

1. The Bank of United Kingdom announced that it would cut the benchmark interest rate by 25 basis points to 5%, in line with market expectations and the first rate cut since early 2020

2. Amazon's performance guidance fell short of expectations, and its stock price fell 6% after hours

3. United States labor productivity has rebounded, and inflation risks have weakened

4. OPEC+ maintains its plan to resume oil production in the next quarter

5. Sales of South Korea's five major automakers fell by 2.2% year-on-year in July, marking the third consecutive month of year-on-year decline

Domestic News

1. China's first long-term mechanism for basic medical insurance participation was officially announced

There are incentives for continuous insurance, and for those who have participated in the resident medical insurance for 4 consecutive years, the maximum payment limit of serious illness insurance can be increased by at least 1,000 yuan for each additional year from the 5th year; There is an incentive for zero reimbursement of the fund, and for the insured people who do not use the medical insurance fund in the current year, the maximum payment limit of serious illness insurance can be increased by at least 1,000 yuan in the second year. The scope of the personal account of employees' medical insurance has been extended to close relatives, and at the same time, the scope has been gradually expanded.

2. The National Development and Reform Commission held a press conference to introduce that there is still enough room for counter-cyclical policy adjustment

At present, the list of the first two batches of "two-focus" construction projects this year has been issued, mainly focusing on accelerating the realization of high-level scientific and technological self-reliance and other fields; It is working with a number of departments to formulate a law on the promotion of the private economy; Opinions on improving the market access system will be promoted, and a new version of the negative list for market access will be issued.

3. Ultra-long-term treasury bond ETFs have repeatedly hit new highs, and experts remind that we need to pay attention to risks

As a relatively new instrumentalized product, ordinary investors still need to pay attention to rational investment when participating in ultra-long-term treasury bond ETF investment. Lou Feipeng, a researcher at the Postal Savings Bank of China, reminded investors that treasury bonds themselves are safe assets, but this does not mean that treasury bond transactions in the secondary market are absolutely safe, and it is a normal market phenomenon for treasury bond transactions in the secondary market to have price fluctuation. Ordinary investors still need to pay attention to risks when buying ultra-long-term treasury bond funds, and make rational investments according to their own risk tolerance and investment return expectations.

4. Private equity funds are receiving a steady stream of insurance capital "injection"

Recently, PICC Capital announced the successful establishment of a 10 billion yuan PICC modern industry fund, which means that there are at least 3 private equity funds with a scale of 10 billion yuan set up by insurance capital during the year. Previously, in January this year, Xinhua Insurance and PICC Capital jointly set up a 10 billion yuan fund; In May, Chinese Life initiated the establishment of a 10 billion yuan grey hair industry investment fund. The establishment of these funds means that the private equity investment market will usher in a large-scale "living water" of insurance funds.

5. During the investigation and investigation in Henan, Liu Guozhong stressed the need to pay close attention to disaster prevention and mitigation and the restoration of agricultural production after the disaster, and resolutely seize a fruitful harvest of autumn grain

Liu Guozhong, Member of the Political Bureau of the CPC Central Committee and Vice Premier of the State Council, went to Henan to investigate the restoration of agricultural production and autumn grain production after the disaster from July 31 to August 1. He stressed that it is necessary to thoroughly study and implement General Secretary Xi Jinping's important instructions on agricultural disaster prevention and mitigation and the spirit of the meeting of the Standing Committee of the Political Bureau of the CPC Central Committee, in accordance with the deployment of the Party Central Committee and the State Council, pay close attention to the recovery of agricultural production after the disaster, fully implement various measures for agricultural disaster prevention and mitigation, minimize agricultural losses, and strive to seize a bumper harvest of autumn grain.

International News

1. The Bank of United Kingdom announced that it would cut the benchmark interest rate by 25 basis points to 5%, in line with market expectations and the first rate cut since early 2020

Among the members of the Monetary Policy Committee, five voted for a rate cut and four voted for keeping rates unchanged. The United Kingdom Central Bank signaled that it will cut interest rates cautiously in the future, predicting that future inflation risks will maintain an upward trend. The analysis pointed out that the Bank of United Kingdom did not disclose the timing of its next action and did not commit to anything, which is a hawkish rate cut.

2. Amazon's performance guidance fell short of expectations, and its stock price fell 6% after hours

Amazon (AMZN. O) third-quarter net profit guidance fell short of analysts' expectations, indicating that the company was spending more than expected to meet demand for AI services, and the company's shares fell more than 6% in after-hours trading. Amazon expects third-quarter operating profit of $11.5 billion to $15 billion, compared to analysts' average estimate of $15.7 billion; Third-quarter sales are expected to reach $154 billion to $158.5 billion, an increase of 8% to 11%, compared to analysts' expectations of $158.4 billion. CEO Andy · Jassy has been cutting costs and focusing on the profitability of Amazon's main online retail business, while investing heavily in artificial intelligence services, which the company says are "multibillion-dollar revenue operations." Amazon's Web Services segment saw sales increase 19% to $26.3 billion, beating expectations and delivering the second consecutive quarter of sequential growth. But the strong cloud computing performance was offset by weakness in Amazon's main e-commerce business. Amazon's seller services and advertising revenue in the second quarter were lower than expected.

3. United States labor productivity has rebounded, and inflation risks have weakened

United States labor productivity rose more than expected in the second quarter, helping to moderate labor cost growth and providing further evidence that inflationary pressures are waning. Preliminary non-farm productivity of the United States recorded 2.3% in the second quarter, compared with only a slight increase in the first quarter of this year. The preliminary non-farm unit labor cost recorded 0.9% in the second quarter, and increased by 3.8% in the first quarter. Productivity figures tend to fluctuate significantly on a quarterly basis, but overall improvements over the past year suggest that companies are stepping up their efforts to mitigate the impact of rising operating costs. Despite high borrowing costs, business investment has remained strong, supporting long-term economic growth. The report provides further evidence for the Fed that the risk of another acceleration in inflation is waning.

4. OPEC+ maintains its plan to resume oil production in the next quarter

OPEC+ stressed at the meeting that there would be no change in oil supply and would stick to its initial plan to gradually liberate production starting next quarter. In June, OPEC+ agreed to gradually resume production that had been suspended at the end of 2022 to support oil prices, starting in October. Production will be added by about 540,000 b/d in the fourth quarter. While the recent drop in oil prices may be a relief for consumers and central banks, and it could have an impact on OPEC+ countries. Data from the International Energy Agency suggests that if OPEC+ continues to increase supply in the fourth quarter, a new supply surplus could emerge. Citi does not expect the group to begin resuming supply until mid-next year. Harry Tchilinguirian, head of oil research at Onyx Commodities, said OPEC+ still needs to see current policies play a role in falling inventories before considering a change.

5. Sales of South Korea's five major automakers fell by 2.2% year-on-year in July, marking the third consecutive month of year-on-year decline

Based on the sales performance released by South Korea's five largest automakers on August 1, the total domestic and overseas sales of Korean automobiles (including the assembly of all parts) in July decreased by 2.2% y/y to 658,297 units, marking the third consecutive month of decline. Specifically, due to the high sales base in the same period last year, the domestic sales of the five major automakers decreased for six consecutive months, falling by 4.1% to 110,152 units, while overseas sales fell by 1.8% year-on-year to 548,145 units. This was mainly due to factors such as the temporary stagnation in demand for electric vehicles in Europe and the Asia-Pacific region, which led to a decrease in export volumes.

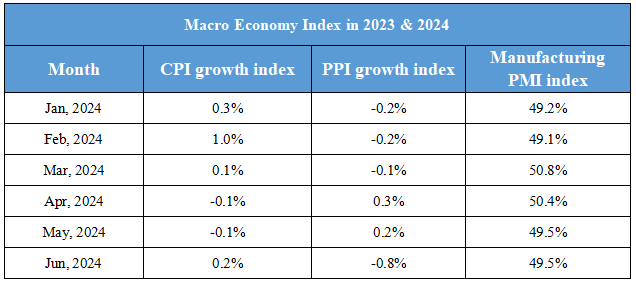

Domestic Macro Economy Index