July 31st Macroeconomic Index: China Lifts Largest Ground-Sitting LNG Storage Tank, Focus on Boosting Consumption

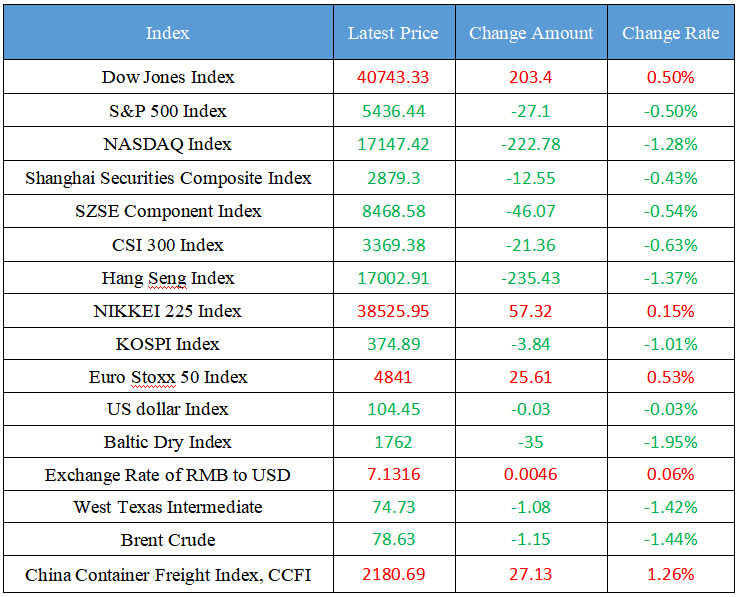

Latest Global Major Index

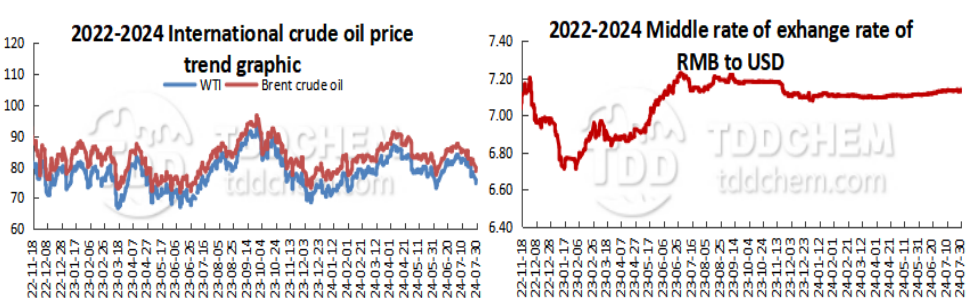

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. China's largest fully "sitting-on-ground" LNG storage tank has been lifted

2. Wang Wentao, Minister of Commerce: We will implement the requirements of the "zero" restrictive measures for foreign investment access in the manufacturing industry as soon as possible, and reasonably reduce the negative list for foreign investment access

3. It is necessary to focus on boosting consumption to expand domestic demand, and the focus of economic policies should be more shifted to benefiting people's livelihood and promoting consumption

4. National Development and Reform Commission: It is necessary to strengthen the analysis of the economic situation and policy research, accelerate the construction of the "two-focus", and strengthen the implementation of the "two new". Promote effective investment and vigorously boost consumption

5. In the first half of this year, the total amount of social logistics in the country was 167.4 trillion yuan, a year-on-year increase of 5.8%

International News

1. Institutions: The Fed's discussion of balance sheet reduction is likely to be as important as the outlook for interest rates

2. United States house prices remained unchanged in May, with the smallest annual increase in 10 months

3. US Treasury yields remained stable, and the market paid attention to the Fed's dovish signals

4. Prime Minister of Ukraine: The energy situation in Ukraine has stabilized

5. Bank of United States: Commodity prices fell due to sluggish demand

Domestic News

1. China's largest fully "sitting-on-ground" LNG storage tank has been lifted

CNOOC announced that with the lifting of the dome of the storage tank weighing about 1,200 tons, the three 270,000 cubic meter fully "sitting-on-ground" LNG storage tanks of the third phase of the Ningbo "Green Energy Port" project have all been lifted. This is currently the largest fully "ground-sitting" LNG storage tank in China, marking a new breakthrough in the independent design and construction capacity of China's ultra-large LNG storage tank. (Xinhua News Agency)

2. Wang Wentao, Minister of Commerce: We will implement the requirements of the "zero" restrictive measures for foreign investment access in the manufacturing industry as soon as possible, and reasonably reduce the negative list for foreign investment access

Wang Wentao, Secretary of the Party Leadership Group and Minister of the Ministry of Commerce, said that in the next stage, the reform of the foreign investment and foreign investment management system will be deepened. We will implement the "zero-clearing" requirement for foreign investment access in the manufacturing industry as soon as possible, reasonably reduce the negative list for foreign investment access, and promote the orderly expansion of opening-up in the fields of telecommunications, Internet, education, culture, and medical care. Improve the system and mechanism for promoting and guaranteeing foreign investment, improve the management service system, and promote international cooperation in industrial and supply chains; Create a market-oriented, law-based, and international first-class business environment, improve the roundtable system for foreign-funded enterprises, ensure the national treatment of foreign-funded enterprises in terms of factor acquisition, qualification licensing, standard setting, government procurement, etc., and protect the rights and interests of foreign investment in accordance with the law. In short, we will do a good job in the "subtraction" of the negative list and the "addition" of optimizing the business environment, so that foreign-funded enterprises can feel at ease, rest assured and confident, so that "the next 'China' is still China". (Xinhua News Agency)

3. It is necessary to focus on boosting consumption to expand domestic demand, and the focus of economic policies should be more shifted to benefiting people's livelihood and promoting consumption

It is necessary to focus on boosting consumption to expand domestic demand, and the focus of economic policies should be shifted more to benefiting the people's livelihood and promoting consumption, increasing residents' income through multiple channels, and enhancing the consumption ability and willingness of low- and middle-income groups. Strengthen the standardized management of government mobile internet applications, and rectify "formalism at the fingertips".

4. National Development and Reform Commission: It is necessary to strengthen the analysis of the economic situation and policy research, accelerate the construction of the "two-focus", and strengthen the implementation of the "two new". Promote effective investment and vigorously boost consumption

The National Development and Reform Commission (NDRC) has arranged the key work of development and reform in the second half of the year, emphasizing that it is necessary to strengthen the analysis of the economic situation and policy research, accelerate the construction of the "two-focus", and strengthen the implementation of the "two new". Promote effective investment and vigorously boost consumption. Actively attract and expand the use of foreign investment, and promote overseas investment in a steady and orderly manner. Accelerate the construction of a large country reserve system and effectively reduce the logistics cost of the whole society.

5. In the first half of this year, the total amount of social logistics in the country was 167.4 trillion yuan, a year-on-year increase of 5.8%

According to data released by the China Federation of Logistics and Purchasing, in the first half of this year, the total amount of social logistics in the country was 167.4 trillion yuan, a year-on-year increase of 5.8%, of which the volume in the first and second quarters increased by 5.9% and 5.7% respectively, continuing the rapid growth trend since the fourth quarter of last year.

International News

1. Institutions: The Fed's discussion of balance sheet reduction is likely to be as important as the outlook for interest rates

TS Lombard analyst Steven·Blitz said Fed officials' rhetoric about balance sheet reduction could be as important as the outlook for interest rates. In addition to keeping interest rates high, the Fed has been reducing its holdings of United States Treasuries. During the pandemic, the Fed has done the opposite. Now is the time for the Fed to start communicating a more specific strategy for reducing its balance sheet. This topic will likely be elaborated on in the minutes of this meeting.

2. United States house prices remained unchanged in May, with the smallest annual increase in 10 months

United States single-family home prices were flat in May, the smallest increase in 10 months on an annual basis, as rising mortgage rates dampened demand and increased home supply. The spike in mortgage rates in the spring dampened home sales, pushing existing home inventory to its highest level in nearly four years in June. The supply of new single-family homes jumped to its highest level since February 2008. The average rate on a 30-year fixed mortgage has eased from a six-month high of 7.22% in early May to an average of 6.78% last week, according to mortgage financier Freddie Mac. Residential investment, which includes home construction and sales, contracted in the second quarter, after double-digit growth in the previous quarter.

3. US Treasury yields remained stable, and the market paid attention to the Fed's dovish signals

Treasury yields were little changed ahead of the United States housing and jobs report, although the data is unlikely to change the Fed's outlook for keeping interest rates unchanged this week. Markets are watching the comments of the commissioners after the interest rate decision. John Velis, FX and macro strategist at BNY Mellon, said he would be watching the FOMC's statement for signs of a dovish Fed. Even if a rate adjustment is unlikely, the committee is likely to be dovish this time. CME data shows that there is a high probability that the Fed will cut interest rates in September. If the Fed fails to confirm this outlook, Treasury yields could rise.

4. Prime Minister of Ukraine: The energy situation in Ukraine has stabilized

On July 30, local time, Ukraine Prime Minister Shmygal said at a meeting of the Ukrainian government on the same day that the energy situation in Ukraine has stabilized due to factors such as the early completion of the maintenance work of the two nuclear power plants and the drop in temperature. At the same time, he stressed that at present, the energy system of Ukraine is undergoing preparations for autumn and winter.

5. Bank of United States: Commodity prices fell due to sluggish demand

The head of commodity research at Bank of United States said commodities are falling because of demand issues, or lack of demand. The performance of the global industrial economy is quite poor. Rising interest rates in the United States have exacerbated the blow to consumption, which has weighed on economies in other parts of the world. One commodity that goes against this trend is gold. Gold prices hit record highs earlier this month as Asian investors ramped up demand for physical gold bars in the over-the-counter market, and its rally was also buoyed by central bank buying.

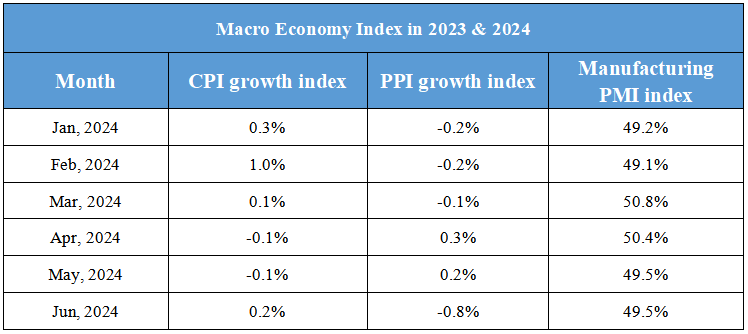

Domestic Macro Economy Index