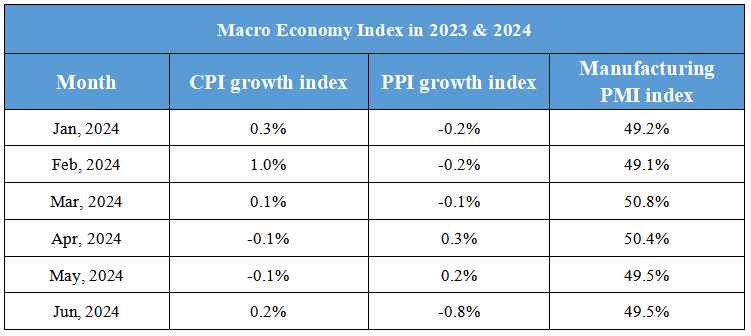

July 30th Macroeconomic Index: China's Financial Reforms Deepen, Major Banks Cut Deposit Rates

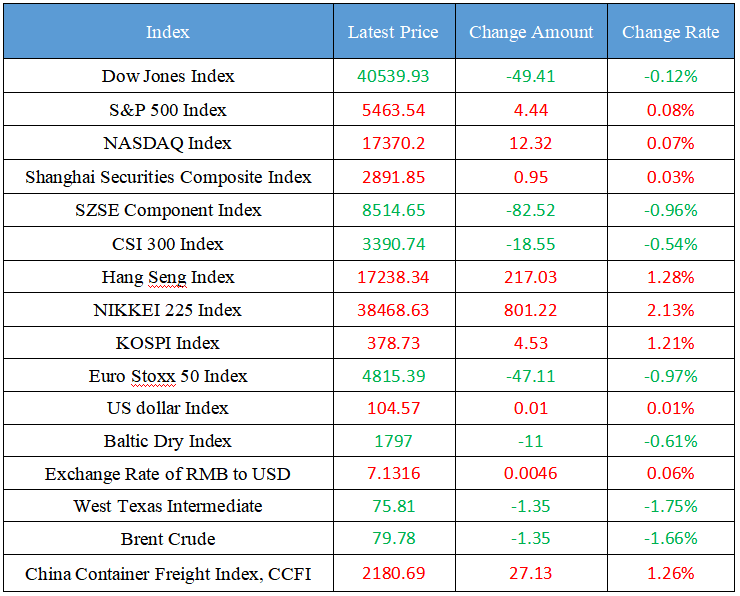

Latest Global Major Index

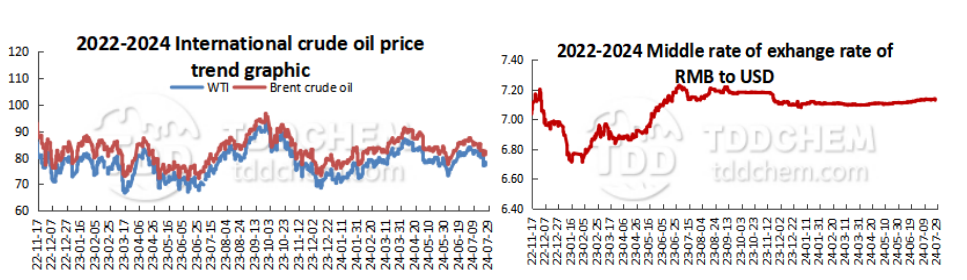

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Ministry of Finance: Strengthen the coordination of reform measures and enhance the consistency of reform direction

2. Ministry of Finance: Study the tax system that is compatible with the new business format

3. State Administration of Financial Regulation: Increase credit supply in the consumer sector and promote high-level financial opening-up

4. The China Securities Regulatory Commission held a mid-year work conference to study and implement the spirit of the Third Plenary Session of the 20th Central Committee

5. The six major state-owned banks and 12 national joint-stock banks completed the first round of RMB deposit interest rate cuts this year.

International News

1. Netherlands International: The oil market is closely watching the OPEC+ production policy change signal this week

2. US stocks closed: major stock indexes rose and fell, and Tesla rose more than 5%

3. Saudi Aramco's crude oil export prices to Europe are expected to remain stable in September

4. The probability that the Fed will keep interest rates unchanged this week is 95.9%

5. United Kingdom Chancellor of the Exchequer: The previous government left a fiscal deficit of 22 billion pounds

Domestic News

1. Ministry of Finance: Strengthen the coordination of reform measures and enhance the consistency of reform direction

The Ministry of Finance held a special meeting to study and implement the spirit of the Third Plenary Session of the 20th Central Committee of the Communist Party of China. The meeting required that organizational leadership should be strengthened and a precise and efficient reform work pattern of coordination between upper and lower levels and combination of sections and blocks should be built. It is necessary to persist in making joint efforts, pay attention to "opening the door to carry out reforms", and extensively listen to the opinions and suggestions of all quarters. It is necessary to adhere to the overall advancement, strengthen the coordination of reform measures, and enhance the consistency of reform orientation. Financial departments at all levels should think in one place and work hard in one place, and go all out to implement the various arrangements of the "Decision" of the plenary session. The meeting also made arrangements for key tasks such as intensifying the implementation of fiscal policies in the second half of the year.

2. Ministry of Finance: Study the tax system that is compatible with the new business format

The Ministry of Finance held a special meeting to study and implement the spirit of the Third Plenary Session of the 20th Central Committee of the Communist Party of China. The meeting called for improving the tax system, optimizing the tax structure, and promoting high-quality development, social fairness, and market unity. We will study the tax system that is compatible with the new business format, standardize the preferential tax policies, improve the support mechanism for key areas and key links, standardize the income tax collection policies for business income, capital income and property, implement the unified taxation collection mechanism labor income, improve the VAT refund policy and deduction chain, and deepen the reform of tax collection and management. Establish a central and local financial relationship with clear powers and responsibilities, financial coordination, and regional balance, increase local independent financial resources, and better mobilize the enthusiasm of the two.

3. State Administration of Financial Regulation: Increase credit supply in the consumer sector and promote high-level financial opening-up

On July 29, the State Administration of Financial Supervision held a mid-year work conference to study and implement the spirit of the Third Plenary Session of the 20th Central Committee of the Communist Party of China and the 2024 Mid-Year Work Conference. The meeting called for full support for economic and social development. We will further deepen the supply-side structural reform of the financial sector and do a solid job in the "five major articles". We will help develop new productive forces in accordance with local conditions, and accelerate the construction of a scientific and technological financial system that is compatible with scientific and technological innovation. Adhere to and implement the "two unswerving principles", and guide financial institutions to improve the financing support policies for private enterprises. Focus on people's livelihood fields such as pension and health, long-term care, accidental injury, disaster response, and agricultural production, and enrich the supply of inclusive insurance products. Pay close attention to the concerns of the people and protect the legitimate rights and interests of financial consumers. Strengthen the financing guarantee for effective investment, support the digital and intelligent transformation and green transformation of traditional enterprises, increase credit in the consumer sector, promote high-level financial opening-up, and promote the steady growth of foreign trade.

4. The China Securities Regulatory Commission held a mid-year work conference to study and implement the spirit of the Third Plenary Session of the 20th Central Committee

The meeting pointed out that in the next step, it is necessary to conscientiously implement the decisions and arrangements of the CPC Central Committee and the State Council on unswervingly achieving the annual economic and social development goals, and highlight the following tasks. Effectively maintain the smooth operation of the market. Strengthen the comprehensive research and response to market risks, improve the targeted and effective supervision of transactions, give full play to the market stabilization function of various business entities, and continuously improve the management of expectations. Greater efforts will be made to serve the recovery of the real economy. We will improve the counter-cyclical adjustment mechanism for the issuance of new shares, make good use of multi-level capital market tools such as bonds, futures, and regional equity markets, and promote the institutional opening of the capital market in a steady and orderly manner.

5. The six major state-owned banks and 12 national joint-stock banks completed the first round of RMB deposit interest rate cuts this year.

This round of deposit rate cuts is the fifth round of concentrated deposit rate cuts by major banks since the establishment of the market-based adjustment mechanism for deposit interest rates in April 2022. The long-term interest rate cut was even larger, and the two-year, three-year, and five-year time deposits were generally reduced by 0.2 percentage points.

International News

1. Netherlands International: The oil market is closely watching the OPEC+ production policy change signal this week

Netherlands international strategists Warren Patterson and Ewa Manthey said the oil market will be keeping a close eye on the OPEC+ meeting later this week in case there are any signals about changes in production policy, especially after the recent weakness in oil prices. If there are any surprises, it could come in the form of a postponement of the gradual easing of production cuts, which are currently planned from October.

2. US stocks closed: major stock indexes rose and fell, and Tesla rose more than 5%

U. S. stocks closed down 0.12% on Monday, the Dow initially closed down 0.12%, the S&P 500 rose 0.08%, and the Nasdaq rose 0.07%. Nvidia (NVDA. O) fell 1%, and Tesla (TSLA. O) rose 5.6%, and Google (GOOG. O) rose more than 1%. The Nasdaq China Golden Dragon Index fell 0.12%, while Alibaba (BABA. N) rose 2.7%, iQIYI (IQ. O) rose 3%, and New Oriental (EDU. N) fell 4%.

3. Saudi Aramco's crude oil export prices to Europe are expected to remain stable in September

According to Argus, an independent international energy and commodity price assessor, most market sources expect Saudi Aramco to keep the official price of its crude exports to Europe unchanged in September, which would mark a divergence after four consecutive months of gains. Traders said that the spread of rival Johan Sverdrup (JS) in Norway has fallen recently, and European demand is expected to cool after the summer holidays, which may prompt Saudi Aramco not to raise formula prices. But at the same time, the company is unlikely to implement price cuts in Europe, as it will at least guarantee some buying interest from refiners in the region, according to sources.

4. The probability that the Fed will keep interest rates unchanged this week is 95.9%

According to CME "Fed Watch": the probability that the Fed will keep interest rates unchanged this week is 95.9%, and the probability of cutting interest rates by 25 basis points is 4.1%. The probability that the Fed will keep interest rates unchanged until September is 0%, the probability of a cumulative 25 basis point rate cut is 89.6%, the probability of a cumulative rate cut of 50 basis points is 10.1%, and the probability of a cumulative rate cut of 75 basis points is 0.3%.

5. United Kingdom Chancellor of the Exchequer: The previous government left a fiscal deficit of 22 billion pounds

United Kingdom Chancellor of the Exchequer Rachel·Reeves said on July 29 that the previous Conservative government had concealed the true state of public finances, leaving a £22 billion fiscal deficit. Speaking in the House of Commons that afternoon, Reeves said the Treasury would take steps to reduce spending by £5.5 billion this year and more than £8 billion next year to make up for the fiscal deficit caused by the previous government. The Treasury will unveil Labour's first budget since taking office on 30 October, announcing new tax and spending plans. Former Chancellor of the Exchequer Jeremy·Hunt responded on the same day that the accusations about the previous government's huge fiscal deficit were false, and Reeves' speech tried to pave the way for future tax increase plans. The new United Kingdom Labour government has recently stressed United Kingdom's poor fiscal position. The United Kingdom Prime Minister's Office said on the 27th that the assessment showed that United Kingdom was in trouble.

Domestic Macro Economy Index