Global Economic Highlights and Domestic Macro Trends on July 29th

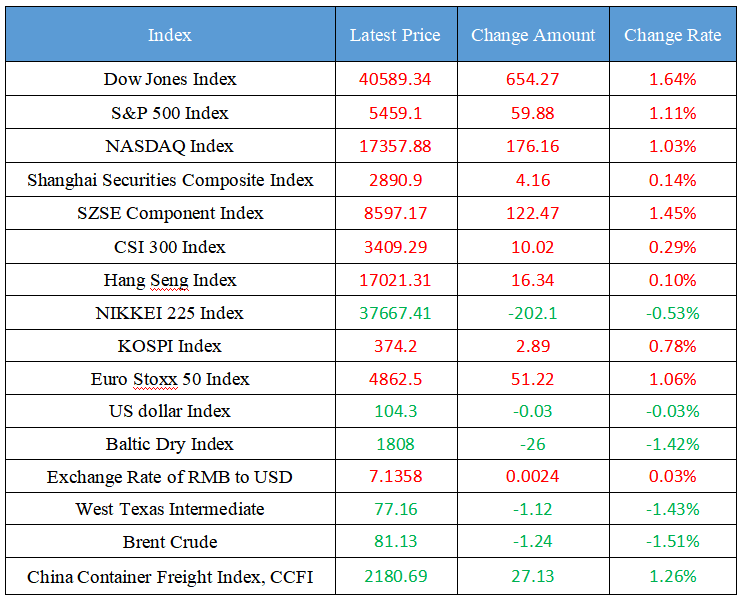

Latest Global Major Index

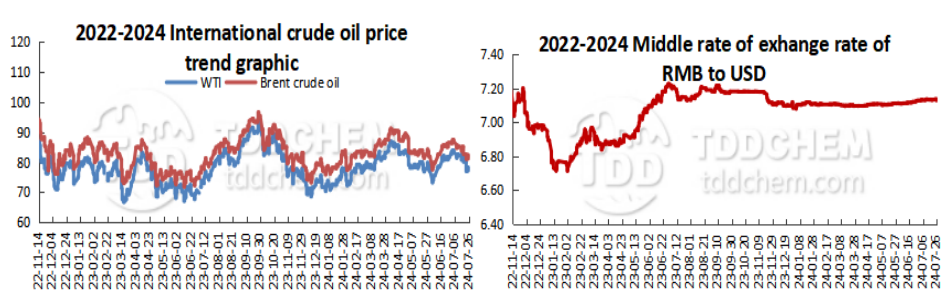

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. In the first half of the year, the profits of industrial enterprises above designated size reached 3,511.03 billion yuan, a year-on-year increase of 3.5%

2. China's declaration of "Beijing Central Axis - A Masterpiece of China's Ideal Capital City Order" was officially included in the "World Heritage List"

3. Datong is becoming an ideal place for building large-scale data centers and a data service city for transporting data and computility

4. In July, the transaction volume of second-hand houses in Beijing is about 12,000 units, and the transaction volume in July is expected to reach more than 15,000 units

5. Wang Wentao, Minister of Commerce, said that he would take the initiative to connect with international high-standard economic and trade rules and actively participate in the reform of the global economic governance system.

International News

1. United Kingdom Prime Minister's Office: The assessment results show that the United Kingdom is "bankrupt" and "fragmented"

2. Analysts: Inflation has not improved, and the United Kingdom Bank is very likely to keep interest rates stable

3. The Bank of Japan will hold a policy meeting on Tuesday and Wednesday, and analysts are divided on whether the central bank will further raise the policy rate

4. The two-day G20 Finance Ministers and Central Bank Governors meeting concluded in Rio de Janeiro, Brazil, on July 26

5. Private placement relies on hardware to monopolize Saudi ETF subscription? A number of quantitative private equity fund managers: there will not be monopolization transactions

Domestic News

1. In the first half of the year, the profits of industrial enterprises above designated size reached 3,511.03 billion yuan, a year-on-year increase of 3.5%

In the first half of the year, the profits of industrial enterprises above designated size reached 3,511.03 billion yuan, a year-on-year increase of 3.5%; The operating income was 64.86 trillion yuan, a year-on-year increase of 2.9%. At the end of June, the asset-liability ratio of industrial enterprises above designated size was 57.6 percent, down 0.1 percentage points year-on-year.

2. China's declaration of "Beijing Central Axis - A Masterpiece of China's Ideal Capital City Order" was officially included in the "World Heritage List"

On July 27, at the 46th session of the UNESCO World Heritage Conference held in New Delhi, the capital of India, China's declared "Beijing Central Axis - a masterpiece of China's ideal capital city order" was officially included in the "World Heritage List", and up to now, the number of world heritage sites in China has reached 59.

3. Datong is becoming an ideal place for building large-scale data centers and a data service city for transporting data and computility

As of the end of May, the city's data centers have completed a total investment of 19.24 billion yuan and put into operation 538,000 servers. The total planned investment of the city's data centers in use and under construction is 44.2 billion yuan, and the scale of servers exceeds 3.5 million, and the prototype of a computility center city is taking shape.

4. In July, the transaction volume of second-hand houses in Beijing is about 12,000 units, and the transaction volume in July is expected to reach more than 15,000 units

It has been a month since the introduction of the new policy on Beijing's property market. Guo Yi, chief analyst of Heshuo Institution, said that from July to now, the transaction volume of second-hand houses in Beijing is about 12,000 units, and the transaction volume in July is expected to reach more than 15,000 units. According to the statistics of the Centaline Real Estate Research Institute, from June 26 to July 25, the number of new residential buildings in Beijing was 4,501, an increase of 38.8% in the previous month. According to Beijing Lianjia data, the price trend of second-hand housing in Beijing has been generally stable since the second quarter, with a month-on-month increase of about 0.5% in June, and an average transaction price of 0.4% month-on-month as of July 24.

5. Wang Wentao, Minister of Commerce, said that he would take the initiative to connect with international high-standard economic and trade rules and actively participate in the reform of the global economic governance system.

We will implement the requirement of clearing the restrictions on foreign investment access in the manufacturing industry, and reasonably reduce the negative list for foreign investment access. We should make the cake of opening up bigger, extend the list of cooperation, fully participate in the WTO reform, expand the circle of friends in free trade, and promote the construction of an open world economy.

International News

1. United Kingdom Prime Minister's Office: The assessment results show that the United Kingdom is "bankrupt" and "fragmented"

On July 29, United Kingdom Chancellor of the Exchequer Reeves will announce the results of the fiscal review to Parliament. In the eyes of the Labor Party, which came to power through parliamentary elections earlier this month, the deficit of 20 billion pounds (about 186.415 billion yuan) is the responsibility of the former ruling Conservative Party. Reeves will set out the results of the fiscal review in a statement to Parliament, Reuters reported. The statement is expected to include a number of criticisms of the former Conservative government, accusing the Conservatives of "making unfunded spending commitments" "in order to win public support" during their 14 years in power. In response to the report, Prime Minister Starmer's office stated: "The results of the assessment will show that the United Kingdom has gone bankrupt and become 'broken and broken'."

2. Analysts: Inflation has not improved, and the United Kingdom Bank is very likely to keep interest rates stable

Giuseppe Dellamotta, analyst at Forexlive: The market believes that there is a 50% chance that the Bank of United Kingdom will cut interest rates by 25 basis points, reducing interest rates from the current 5.25% to 5.00%. Again, I think the expectations are wrong, as the likelihood of interest rates remaining stable should be high. Unless inflation data is very good, or employment data shows a very bad situation, the United Kingdom central bank is reluctant to cut interest rates for the first time in August. And the latest United Kingdom CPI is not good, as core data and services inflation remain unchanged. In terms of the labor market, the latest report was largely in line with expectations, with wage growth remaining at a high level. Therefore, I think the Bank of United Kingdom will probably stabilize the rate at 5.25%.

3. The Bank of Japan will hold a policy meeting on Tuesday and Wednesday, and analysts are divided on whether the central bank will further raise the policy rate

The Bank of Japan will hold a policy meeting next Tuesday and Wednesday, and analysts are divided on whether the central bank will raise its policy rate further. The recent strong yen has sparked speculation that the Bank of Japan may delay raising interest rates. However, some analysts noted that Japan politicians have called for further tightening of policy by the central bank to ease the yen's weakness.

4. The two-day G20 Finance Ministers and Central Bank Governors Meeting concluded in Rio de Janeiro, Brazil, on July 26

The two-day G20 meeting of finance ministers and central bank governors concluded July 26 in Rio de Janeiro, Brazil. The joint communiqué adopted after the meeting called for greater reform of the International Monetary Fund (IMF), strengthening the multilateral development banking system, and establishing a fairer, more stable, and more efficient international tax system.

5. Private placement relies on hardware to monopolize Saudi ETF subscription? A number of quantitative private equity fund managers: there will not be monopolization transactions

Recently, two Saudi ETFs ushered in a "violent" rise as soon as they were listed, and the turnover rate was as high as 700%. A market rumor showed that "private placement relies on hardware to improve the speed of filing, and then monopolizes Saudi ETF subscription". A number of quantitative private equity fund managers interviewed by the reporter said that although quantification does have advantages over other institutional investors and retail investors in terms of hardware and speed, it will not monopolize transactions. It is worth noting that a large number of retail investors who "do T" are important players in the two ETFs, and many investors frequently post orders, and some investors play "humanoid quantification", buying and selling more than 50 times a day. (China Securities News)

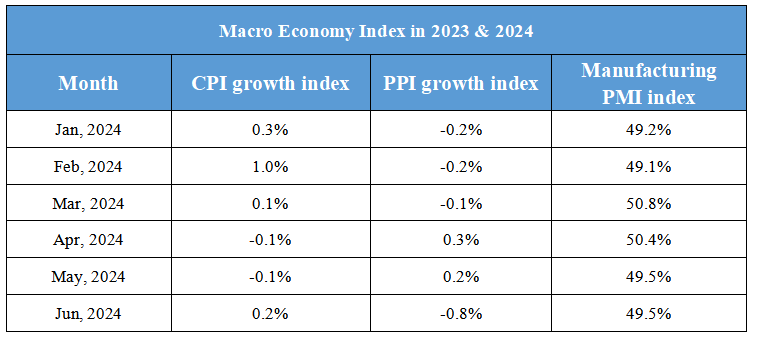

Domestic Macro Economy Index