July 26th Macroeconomic Index: China's Central Bank Cuts MLF Interest Rate, RMB Surges Against USD

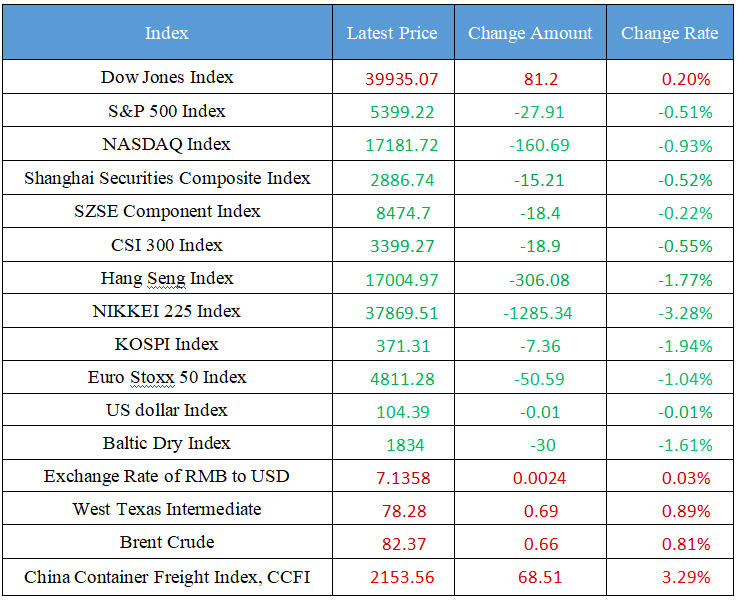

Latest Global Major Index

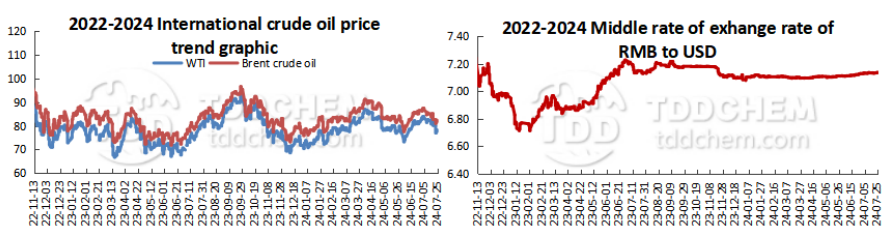

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The Central Bank opened MLF surprisingly at the end of the month, and the interest rate was lowered by 20 basis points

2. The RMB rose sharply against the US dollar yesterday, and the onshore and offshore RMB against the US dollar once approached the 7.2 mark, an increase of more than 600 basis points, and then fell back

3. EAST BUY announced yesterday evening that its well-known anchor Dong Yuhui will leave his post with immediate effect

4. The National Development and Reform Commission and the Ministry of Finance officially issued a document to arrange about 300 billion yuan of ultra-long-term special treasury bond funds to support large-scale equipment renewal and consumer goods trade-in

5. In the first half of the year, China's foreign non-financial direct investment was 72.62 billion US dollars, a year-on-year increase of 16.6%

International News

1. Bank of America: Inflation cooling may accelerate the Fed's interest rate cut and the depreciation of the dollar

2. Saudi Arabia rarely buys fuel oil from Kuwait to meet summer demand

3. Moody's: United States GDP is expected to reach 1.4% again in the second quarter

4. The probability that the Fed will keep interest rates unchanged in August is 93.3%

5. OpenAI will launch an online search tool "SearchGPT" to challenge Google

Domestic News

1. The Central Bank opened MLF surprisingly at the end of the month, and the interest rate was lowered by 20 basis points

On July 25, the Central Bank launched a 200 billion yuan MLF operation in the form of interest rate bidding, and the winning interest rate was 2.30%, which was 20 basis points lower than the previous time and the first reduction since August 2023. This is the second time that the Central Bank has carried out MLF operations in the month. At the same time, it carried out a reverse repurchase operation of 235.1 billion yuan. According to some people, the increase in MLF operation shows that the central bank maintains reasonable and abundant liquidity and consolidates the resolute attitude of economic recovery, and also shows that the reference role of MLF interest rates on LPR is gradually weakening. The MLF clearly adopts the interest rate bidding method, and the winning interest rate will better reflect the market interest rate. During the transition period of MLF operation point adjustment, financial institutions need to pay more attention to the liquidity situation in the middle of the month.

2. The RMB rose sharply against the US dollar yesterday, and the onshore and offshore RMB against the US dollar once approached the 7.2 mark, an increase of more than 600 basis points, and then fell back

Analysts believe that there are three main reasons for the sudden outbreak of RMB: First, the Central Bank has begun to cut interest rates continuously recently, and the external market may have begun to brew the expectation of a stronger domestic economy. Second, the yen has begun to strengthen one after another recently, and the linkage between the yen and the yuan has been relatively close in the past six months. Third, the US dollar has continued to weaken recently. Yesterday, the onshore RMB closed at 7.2203 against the US dollar at 16:30, up 557 basis points from the previous trading day, and closed at 7.2450 in the night; The central parity of the yuan against the US dollar was reported at 7.1321, up 37 basis points.

3. EAST BUY announced yesterday evening that its well-known anchor Dong Yuhui will leave his post with immediate effect

East Buy announced yesterday evening that its well-known anchor Dong Yuhui will leave his post with immediate effect. At the same time, its subsidiary Yuhui Tongxing were sold to Dong Yuhui for a price of 76.585 million yuan. Dong Yuhui and Yu Minhong then issued separate open letters, revealing more details. Yu Minhong said that Dong Yuhui's money to buy the company was arranged by him, and the company gave it to Dong Yuhui. In addition to paying Dong Yuhui in full the promised benefits and compensation, Yu Minhong has sought the approval of the Board to distribute all the remaining undistributed profits of Yuhui Tongxing to Dong Yuhui. According to the announcement of East Buy, from the establishment of the company to June 30 this year, the net profit of Yuhui Tongxing was 141 million yuan. East Buy also announced that it plans to repurchase no more than 500 million yuan of the company's shares in the future.

4. The National Development and Reform Commission and the Ministry of Finance officially issued a document to arrange about 300 billion yuan of ultra-long-term special treasury bond funds to support large-scale equipment renewal and consumer goods trade-in

The National Development and Reform Commission (NDRC) and the Ministry of Finance (MOF) officially issued a document to allocate about 300 billion yuan of ultra-long-term special treasury bond funds to support large-scale equipment renewal and trade-in of consumer goods. In terms of equipment renewal, the scope of support will be expanded to include energy and power, old elevators, and other fields. In terms of trade-in of consumer goods, the replacement and renewal of passenger cars and the decoration of old houses for individual consumers will be included in the scope of support.

5. In the first half of the year, China's foreign non-financial direct investment was 72.62 billion US dollars, a year-on-year increase of 16.6%

According to the Ministry of Commerce, in the first half of the year, China's foreign non-financial direct investment was 72.62 billion US dollars, a year-on-year increase of 16.6%. The turnover of foreign contracted projects was 72.25 billion US dollars, a year-on-year increase of 2.2%; The value of new contracts was 115.54 billion US dollars, a year-on-year increase of 22%.

International News

1. Bank of America: Inflation cooling may accelerate the Fed's interest rate cut and the depreciation of the dollar

Bank of United States stated the dollar could depreciate as the start of the Fed's rate-cutting cycle seems nearer. The continued disinflationary trend in the United States has triggered expectations that the Federal Reserve may accelerate interest rate cuts, signaling a shift in higher-than-expected inflation at the start of the year, which supported the case for delaying rate cuts and boosted the dollar, analysts said in a note. "As a result, we keep our expectations for a weaker US dollar, including our benchmark forecast for EUR/USD to reach 1.12 by the end of the year." Analysts say the dollar is also overvalued, which is reflected in the bank's long-term forecasts. Bank of United States expects it to rise to 1.20 from the current 1.0851 by September 2026.

2. Saudi Arabia rarely buys fuel oil from Kuwait to meet summer demand

In July, Saudi Arabia imported fuel oil from Kuwait for the first time in more than two years to help meet peak summer electricity demand, while discounted supplies from Russia fell, trade sources and shipping data showed. The country imported more than 180,000 mt (about 37,000 b/d) of high-sulfur fuel oil (HSFO) from Kuwait, the first time Saudi Arabia has bought fuel from Kuwait since May 2022, according to shipping analytics firm Kpler and Vortexa. Saudi’s demand kept more Kuwait oil supplies in the Middle East, and Singapore's benchmark oil prices were supported amid an overall decline in Middle East exports. Russia supplies still account for the large part of Saudi fuel oil imports, reaching about 441,000 mt in July, accounting for about 30% of total imports. However, it is down from nearly 750,000 tonnes in the same period last year. Emril Jamil, senior analyst at LSEGOilResearch, pointed out that bids from places like India for Russia's HSFO have prompted Saudi Arabia to turn to alternative suppliers such as Kuwait. In addition, maintenance at the SASREF refinery between April and June may also limit Saudi Arabia's ability to increase fuel oil inventories ahead of the summer.

3. Moody's: United States GDP is expected to reach 1.4% again in the second quarter

Estimates of United States' second-quarter GDP before Thursday did vary widely, as some recent economic data was weaker than expected, while other indicators such as retail sales and housing starts performed better. Moody's chief economist Zandi wrote that "United States economic growth has slowed this year compared to the surge in 2023." The Moody's Economics team predicts that GDP growth will reach 1.4% for the second consecutive quarter in the second consecutive quarter, but this in no way means that the economy is in free fall. Zandi said the recent slowdown was largely "deliberate." The Federal Reserve has kept the federal funds rate high to dampen demand, cool the overheated job market, and ease wage and price pressures.

4. The probability that the Fed will keep interest rates unchanged in August is 93.3%

According to CME's "Fed Watch": the probability that the Fed will keep interest rates unchanged in August is 93.3%, and the probability of cutting interest rates by 25 basis points is 6.7%. The probability that the Fed will keep interest rates unchanged until September is 0%, the probability of a cumulative 25 basis point rate cut is 88.6%, the probability of a cumulative rate cut of 50 basis points is 11%, and the probability of a cumulative rate cut of 75 basis points is 0.3%.

5. OpenAI will launch an online search tool "SearchGPT" to challenge Google

OpenAI is letting a small group of users test a new set of search features that will answer questions with more timely information and prominent source links, the company's most direct challenge to Google (G00G.0) to date. The new search tool, called SearchGPT, will be released as a prototype of a web browser and provide users with a standalone search experience that can later be added to ChatGPT. OpenAI declined to give a timeline for SearchGPT's launch, but said it would initially be open to users who signed up for the waitlist; And said it is working with creator and publisher partners to get feedback on the new tool and plans to integrate the most successful search functionality into ChatGPT.

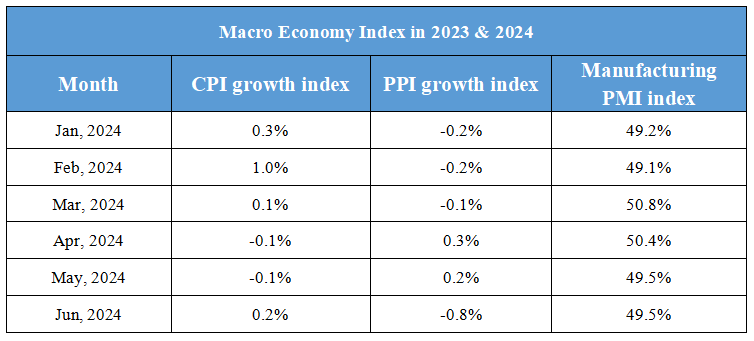

Domestic Macro Economy Index