July 25th Macroeconomic Index: New Batch of Central Enterprise ETFs Approved, Steel Production to Reduce by Over 900,000 Tons

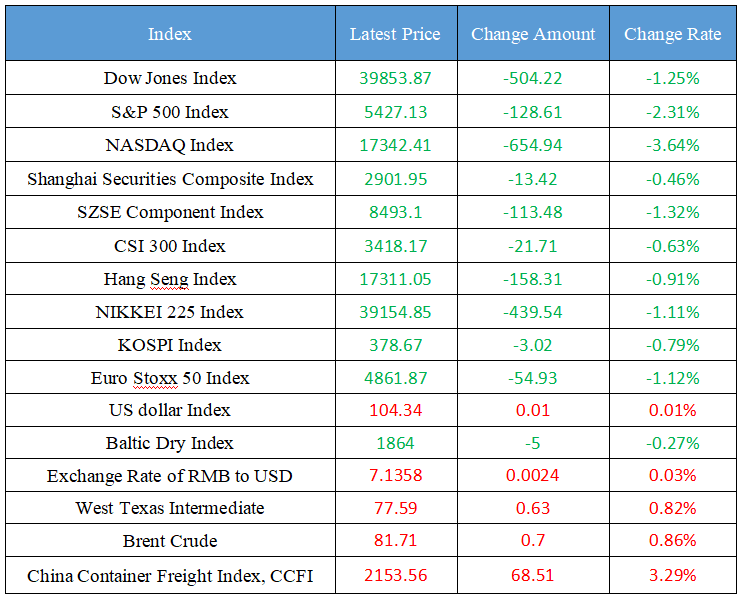

Latest Global Major Index

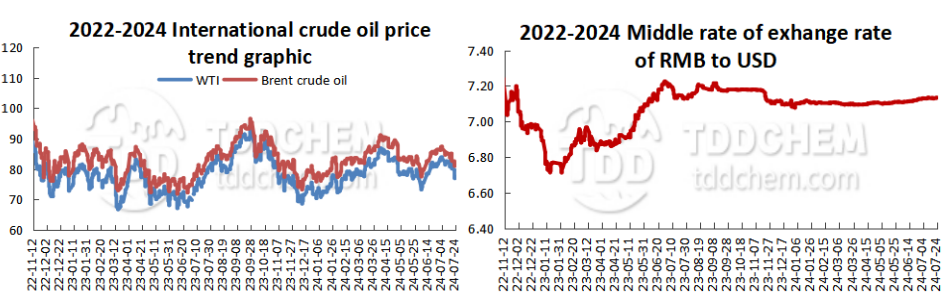

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. A new batch of Central enterprise index ETFs was approved

2. The switch of the new and old national standards for threads is imminent, and 9 steel companies across the country have the intention to control production and sales to reduce output by more than 900,000 tons!

3. Foreign Ministry: China’s Foreign Minister Wang Yi held talks with Ukraine Foreign Minister Kuleba in Guangzhou today

4. Hainan: Carry out special rectification of corruption in the pharmaceutical field and accept social reports

5. Liu Ruiming, professor of the National Institute of Development and Strategy of the Renmin University of China:Urban and rural integration will become an important development force in China In the future.

International News

1. Goldman Sachs: The job market in New Zealand and Australia has deteriorated significantly

2. Economist: The Paris Olympics are promoting economic activities in France

3. Global soybean meal production is expected to reach 269 million tons in 2024-2025

4. Netherlands International Bank: The Bank of Canada is expected to cut interest rates in July or further cut interest rates by 50BP within the year

5. Economists: The eurozone economy has experienced a calm summer, and there is still uncertainty about the European Central Bank's interest rate cut in September

Domestic News

1. A new batch of Central enterprise index ETFs was approved

Recently, a new batch of state-owned enterprise thematic index ETFs have been approved successively. It is reported that the batch of central enterprise theme index ETFs are Rongtong CSI Chengtong Central Enterprises Technology Innovation ETF, Rongtong CSI Chengtong Central Enterprises Dividend ETF, and Rongtong CSI Chengtong Central Enterprises ESG ETF. The indexes tracked by the three funds are all central enterprise thematic indices jointly compiled by China Securities Index Company and China Chengtong, a state-owned capital operation company. (CSI Taurus)

2. The switch of the new and old national standards for threads is imminent, and 9 steel companies across the country have the intention to control production and sales to reduce output by more than 900,000 tons!

The imminent implementation of the new version of the national standard GB 1499.2-2024 "Steel for Reinforced Concrete Part 2: Hot-rolled Ribbed Steel Bar" (scheduled for September 25, 2024) marks that the standard system of steel for reinforced concrete in China has entered a new stage. In order to ensure that the products meet the new national mandatory standards, and at the same time promote the digestion of the old national standards, a number of steel mills have adjusted their production lines and equipment maintenance in combination with their own and market conditions, and have successively introduced relevant production control and sales policies to adapt to the conversion of the old and new national standards. According to incomplete statistics, as of July 24, 9 steel mills have introduced relevant production and marketing control policies, and the preliminary estimate is to reduce output by more than 900,000 tons.

3. Foreign Ministry: China’s Foreign Minister Wang Yi held talks with Ukraine Foreign Minister Kuleba in Guangzhou today

Ning said that Foreign Minister Wang Yi said that the two countries established a strategic partnership more than ten years ago, respected each other, treated each other as equals, and continued to promote mutually beneficial cooperation. The two heads of state stressed the need to view and plan the relations between the two countries from a long-term perspective and push forward Sino-Ukrainian relations and bilateral cooperation. Mao Ning also said that the foreign ministers of the two countries exchanged views on the Ukraine crisis, and Wang Yi pointed out that the Ukraine crisis has entered its third year, and the conflict is still ongoing and there is a risk of escalation and spillover. China believes that the settlement of all conflicts must eventually return to the negotiating table, and that the resolution of all disputes must always be achieved through political means. Although the conditions are not yet mature, we support all efforts conducive to peace and are willing to continue to play a constructive role in the ceasefire and the resumption of peace talks. (Ministry of Foreign Affairs)

4. Hainan: Carry out special rectification of corruption in the pharmaceutical field and accept social reports

The Hainan Provincial Health Commission issued the "Announcement on the Special Rectification and Reporting of Unhealthy Practices and Corruption in the Pharmaceutical Field", and decided to carry out in-depth special rectification work on unhealthy practices and corruption in the pharmaceutical field. (surging)

5. Liu Ruiming, professor of the National Institute of Development and Strategy of the Renmin University of China:Urban and rural integration will become an important development force in China In the future.

Liu Ruiming, a professor at the National Institute of Development and Strategy at the Renmin University of China, said at the China Macroeconomic Forum (CMF) Symposium on Macroeconomic Hot Issues that in terms of balanced development, the future focus of development is actually on urban and rural areas. The decision of the Third Plenary Session of the 20th Central Committee of the Communist Party of China (CPC) focused on the aspect of urban-rural integration, which is very important in the unbalanced development of the region. We will support urban-rural integration through improving the institutional mechanism for promoting new urbanization, consolidating and improving the basic rural management system, improving the system of strengthening agriculture, benefiting farmers, and rich peasants, and deepening the reform of the land system. "In the future, urban-rural integration will become an important force in my country, and it is also an important support point for economic growth." Liu Ruiming said.

International News

1. Goldman Sachs: The job market in New Zealand and Australia has deteriorated significantly

Goldman Sachs said in a note to clients that a series of leading indicators of weakness in Australia and New Zealand's labor markets had deteriorated, suggesting that unemployment was continuing to rise. Goldman Sachs' future unemployment rate indicator shows that Australia's unemployment rate will rise to 4.6% by the end of 2024 from the current 4.1%. In New Zealand, the indicator shows that the unemployment rate will deteriorate further, climbing to 5.6% by mid-2025 from the current 4.3%. From a policy perspective, Goldman Sachs still expects the RBA to begin its easing cycle in February, but the New Zealand Fed is now on track to announce two rate cuts in 2024 and seven in 2025.

2. Economist: The Paris Olympics are promoting economic activities in France

Norman Liebke, an economist at Commerzbank Hamburg, said the Olympics in Paris from July 26 to August 11 were boosting France's economy. Business activity of France service providers increased for the first time in three months. According to anecdotal data, this is due in part to the Olympics. In addition, the company reported higher production as the end of the election period brought more certainty. In the second half of the year, the France economy appears to be on a recovery path led by the services sector, but as inflation accelerates, both input and output prices are a challenge for the France economy.

3. Global soybean meal production is expected to reach 269 million tons in 2024-2025

According to foreign media reports, analysts at Oil World raised their forecast for global soybean meal production in 2024/2025 by 1.7 million tons to a record high of 269 million tons. This is 10.8 million tonnes higher than in the previous season. Experts estimate that production has increased by 9% over the past two years. The processing of soybeans increased while the processing of rapeseed and sunflower seeds decreased. Therefore, despite the increase in soybean meal production in 2024/2025, the output of the other seven oilseed meal species will fall by at least 1.4 million tonnes per year. Earlier there were forecasts that EU countries would increase soybean meal production in 2024/2025 due to an increased soybean harvest, but would remain net importers of the product. In 2023/2024, EU soybean meal imports were the lowest in five years, almost 1 million tonnes less than in the previous season.

4. Netherlands International Bank: The Bank of Canada is expected to cut interest rates in July or further cut interest rates by 50BP within the year

As the unemployment rate continues to climb and inflation moves closer to target, the Bank of Canada is expected to choose to cut interest rates in a row in July. We expect a further 50bp rate cut this year. Given that financial markets are now pricing in a 22bp rate cut in July, it would be a surprise for the Bank of Canada not to cut rates. While we continue to believe that USD/CAD will depreciate modestly against the Canadian dollar later this year, offsetting factors such as the United States election may limit the pair's volatility range for longer.

5. Economists: The eurozone economy has experienced a calm summer, and there is still uncertainty about the European Central Bank's interest rate cut in September

Cyrus de la Rubia, chief economist at Commerzbank Hamburg, pointed out that the eurozone economy was little changed in July, according to the preliminary Eurozone PMI, which makes it feel a bit like a quiet period in summer. However, the situation in the manufacturing sector deteriorated significantly, offsetting modest growth in the services sector. However, according to our GDP Nowcast model, growth is still likely in the third quarter. If only economic growth is considered, there are good reasons for the ECB to cut interest rates in September. However, the price data did not offer any hope of relief. The pace of increase in input prices in the services sector accelerated, and the increase in selling prices was similar to that in the previous survey period. To make matters worse, input prices in the manufacturing sector fell for more than a year during March 2023 to May 2024, but have now risen for two consecutive months. Output prices fell only slightly, which could make it harder for headline inflation to make the necessary progress towards the 2% target. Our conclusion is that while a rate cut is likely in September, it will become more tricky in the months following unless the downturn turns into a deep recession.

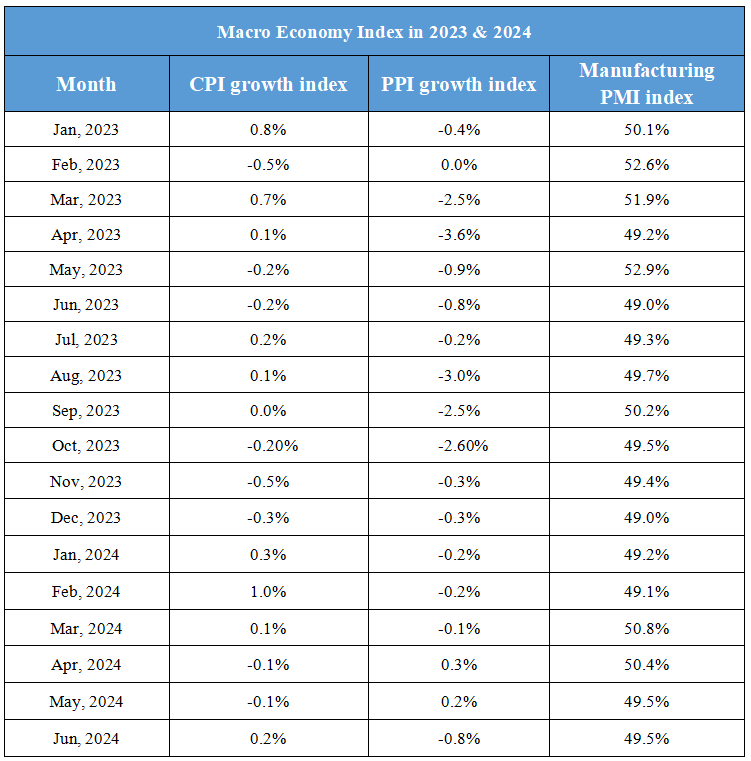

Domestic Macro Economy Index