On July 18th, Domestic and International Economic Policies and Trends Update

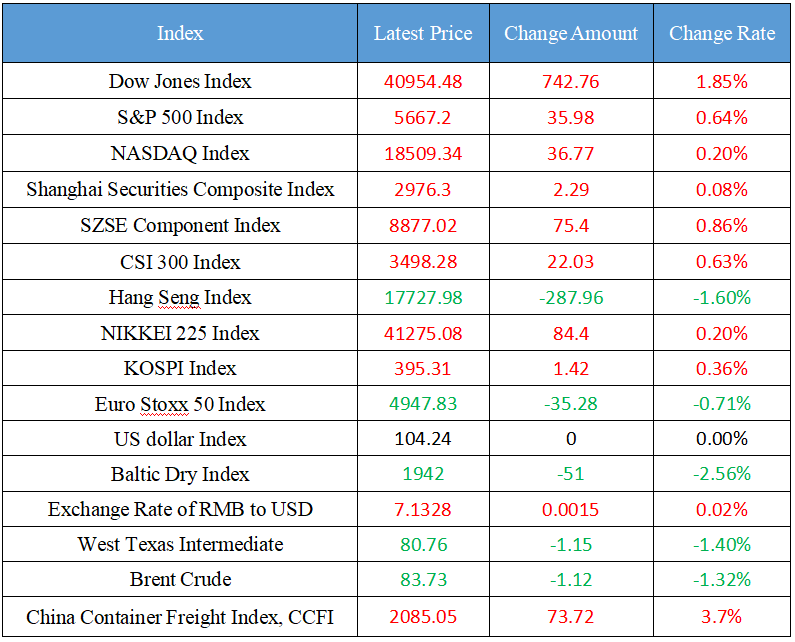

Latest Global Major Index

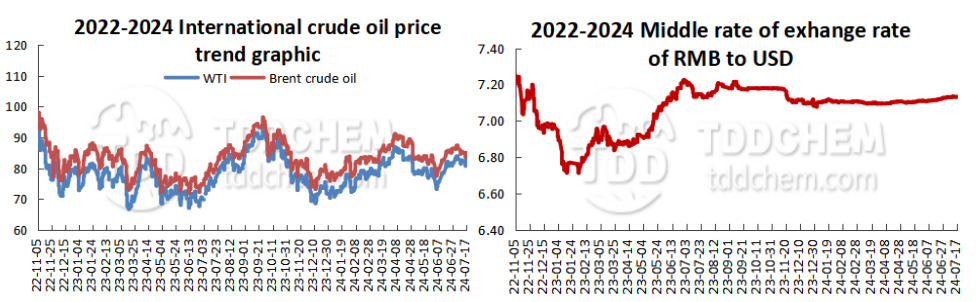

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The Ministry of Commerce held a roundtable meeting on the interpretation of large-scale equipment renewal and consumer goods trade-in policies

2. The China Securities Association plans to improve the publicity mechanism for the negative evaluation of insurance agents, and add category D (suspension of business)

3. Hu Rongbo, Ministry of Natural Resources: Actively promote the transfer of lithium blocks and increase the supply of lithium ore sources

4. In the first half of the year, Beijing's new energy vehicle production increased by 3.5 times year-on-year

5. The 2024 ultra-long-term special treasury bonds (Phase IV) will be issued soon

International News

1. Investment banks: It is expected that the European Central Bank will not take any actions, emphasizing data dependence

2. Japan's top foreign exchange official warned of intervention without limits

3. Economists: The United Kingdom Bank cut interest rates in August requires a slowdown in wage data

4. Commerzbank: The bond market continues to continue its summer recovery momentum

5. Russia's energy ministry is reportedly seeking to extend the ban on gasoline exports until September and October

Domestic News

1. The Ministry of Commerce held a roundtable meeting on the interpretation of large-scale equipment renewal and consumer goods trade-in policies

On July 17, Ling Ji, Vice Minister of Commerce and Deputy Representative of International Trade Negotiations, presided over a roundtable meeting on the interpretation of large-scale equipment renewal and consumer goods trade-in policies for foreign-funded enterprises. Representatives of foreign-funded enterprises such as Albemarle, Bole Life Medicine, Eni, Ford, GE Healthcare, Philips, Siemens Healthineers, and representatives of foreign business associations in China, such as the United States Chamber of Commerce in China, the European Union Chamber of Commerce in China, the Korea Chamber of Commerce in China, and the Japan Chamber of Commerce in China, attended the meeting and delivered speeches. Ling Ji said that China will unswervingly promote high-level opening-up, optimize the business environment, and support domestic and foreign-funded enterprises to participate in large-scale equipment renewal and consumer goods trade-in, as well as related government procurement and project investment. It is hoped that foreign-funded enterprises will seize the opportunity, deepen the Chinese market and increase investment in China. (Ministry of Commerce)

2. The China Securities Association plans to improve the publicity mechanism for the negative evaluation of insurance agents, and add category D (suspension of business)

The reporter learned from the brokerage that the Securities Association of China recently solicited opinions from sponsors on the revision of the "Rules for the Sponsorship Business of Securities Companies" and asked for feedback before July 29. According to the revision, the China Securities Association plans to improve the publicity mechanism for the negative evaluation of sponsor representatives, adjust the Classified List A of Sponsor Representatives (comprehensive business practice information), and add information on the withdrawal of sponsor representatives to the original list. At the same time, the China Securities Association has added a new classified list of sponsor representatives D (suspended business) to announce the list of sponsor representatives who have received administrative penalties from the CSRC in the past three years, as well as those who have been identified by the CSRC as unsuitable persons or temporarily refused to accept documents related to administrative licensing, and who have been determined by industry self-regulatory organizations to be unsuitable for engaging in relevant business or temporarily do not accept signed documents or temporarily do not accept relevant business documents issued and other disciplinary actions and are in the enforcement period. (Bond China Agency)

3. Hu Rongbo, Ministry of Natural Resources: Actively promote the transfer of lithium blocks and increase the supply of lithium ore sources

Hu Rongbo, Deputy Director of the Mining Office of the Information Center of the Ministry of Natural Resources, said in the "2024 China Lithium Industry Conference. The 2nd Lithium Battery New Energy Development Conference" said that in order to fully promote a new round of strategic actions for prospecting breakthroughs, promote the exploration and development of lithium resources and increase reserves and production, and promote the high-quality development of the lithium battery new energy industry, the Ministry of Natural Resources actively promotes the transfer of lithium ore blocks and increases the supply of lithium ore sources. Hu Rongbo said that in recent years, China's lithium ore and other rare metal prospecting work has achieved major breakthroughs in western Sichuan, Kunlun, Altun, Mufu Mountain, Himalayan and other metallogenic belts, and good progress has been made in increasing lithium reserves. (SSE News)

4. In the first half of the year, Beijing's new energy vehicle production increased by 3.5 times year-on-year

Data released by the Beijing Municipal Bureau of Statistics on July 17 showed that in the first half of the year, the added value of Beijing's digital economy increased by 7.8% year-on-year, of which core industries increased by 10.5% (calculated at current prices). In addition, in the first half of the year, the added value of Beijing's high-tech manufacturing industry above designated size and strategic emerging industries (the two are intersecting) increased by 9% and 12.9% respectively, contributing more than 40% and 70% to the growth of industrial enterprises above designated size. The output of new energy vehicles, smart TVs, 5G smartphones, and industrial robots increased by 350%, 87%, 16.9%, and 12.4% year-on-year, respectively. (SSE News)

5. The 2024 ultra-long-term special treasury bonds (Phase IV) will be issued soon

According to the Ministry of Finance of the People's Republic of China, the Ministry of Finance will issue 30-year fixed-rate interest-bearing bonds with a total amount of 55 billion yuan on July 24, 2024. The coupon rate of the treasury bonds was determined through competitive bidding, and the bidding time was from 10:35 a.m. to 11:35 a.m. on July 24. The members of the winning underwriting syndicate are required to pay the issuance fee before July 25, and the treasury bonds will be listed and traded on July 29.

International News

1. Investment banks: It is expected that the European Central Bank will not take any actions, emphasizing data dependence

The ECB is expected to keep interest rates unchanged in July, waiting for confirmation that inflation continues to move closer to target, according to Nordic Bank's analysis. Governor Lagarde is expected to re-emphasize that the ECB will rely on data and follow a meeting-by-meeting approach to decision-making, without pre-committing to a specific path of interest rates. Preliminary June data showed a further decline in headline inflation, while core HICP (harmonized CPI) was flat. Wage growth remains volatile, despite job postings showing a marked decline in wage pressures. Analysts believe that the ECB will wait until September to cut interest rates again, and the message from the July meeting is expected to support this.

2. Japan's top foreign exchange official warned of intervention without limits

Japan's top foreign exchange diplomat said on Wednesday that Japan did not rule out the possibility of intervening in the market if the yen fell too much under the leadership of speculators, Japan reported. He also said that Japan has no restrictions on market intervention. In recent days, speculation has increased that Japan's official buying of the yen will push the yen higher against the dollar.

3. Economists: The United Kingdom Bank cut interest rates in August requires a slowdown in wage data

Luke Bartholomew, senior economist at investment firm Abrdn, said in a note that the United Kingdom's August interest rate decision looks like a major challenge after the release of June inflation data. He said the United Kingdom Bank will almost certainly focus on dynamic factors such as the strength of hotel price growth, but the continued high level of services inflation will make the United Kingdom worry about how long inflation will remain above its 2% target once the favourable base effect has passed and domestic price pressures start to push headline inflation up again. ABRDN still expects a rate cut in August, but that would require Thursday's employment data to show a slowdown in wage growth.

4. Commerzbank: The bond market continues to continue its summer recovery momentum

Michael Leister, head of interest rate strategy at Commerzbank Research, said in the report that the eurozone bond market continued its summer recovery and shrugged off better-than-expected United States economic data. "The recovery is expected to continue, and markets are now almost fully pricing in a 25bp rate cut at the ECB's meetings with economic expectations in September, December and March next year. For the Fed, the probability of a 65 basis point rate cut by the end of the year has been priced in, despite the positive retail sales data. ”

5. Russia's energy ministry is reportedly seeking to extend the ban on gasoline exports until September and October

Russia's energy ministry has proposed to extend the ban on gasoline exports until September and October, the Russia business news agency reported, citing a letter from the Russia deputy energy minister. Russia initially partially banned gasoline exports for six months from March 1 to August 31 last year to preemptively address fuel shortages and stem fuel prices after Ukraine drone strikes on refineries and technological disruptions. These restrictions were suspended in May until June 30 and then further extended until the end of July. Russia's Deputy Prime Minister Alexander Novak said on Monday that the government could decide to reinstate a ban on gasoline exports from August if there is a supply shortage in the domestic fuel market.

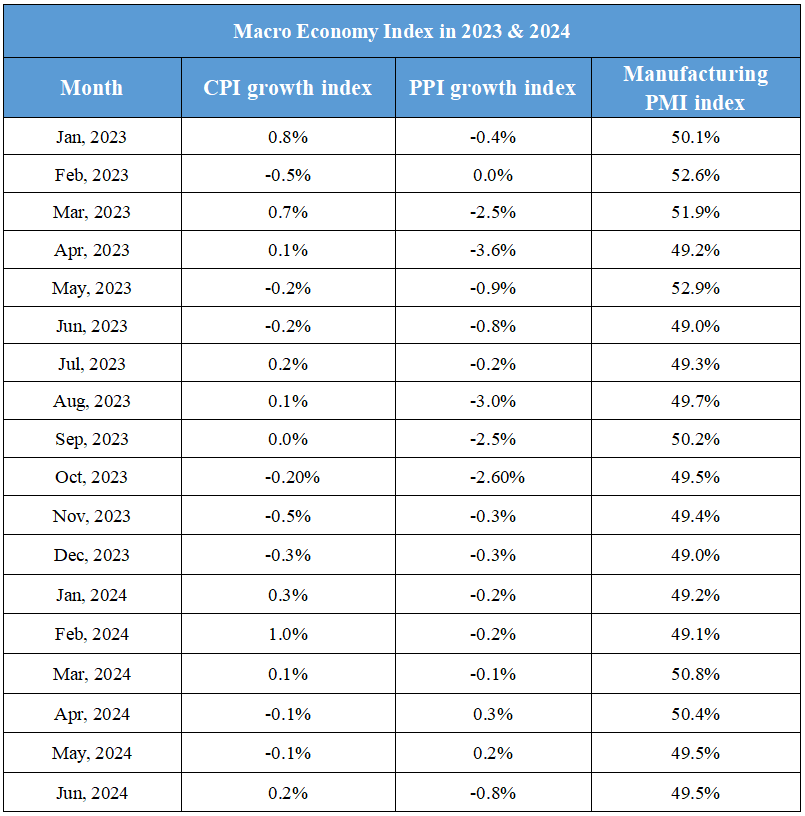

Domestic Macro Economy Index