On July 17th, Domestic Macro Economic Trends and Key Policy Updates

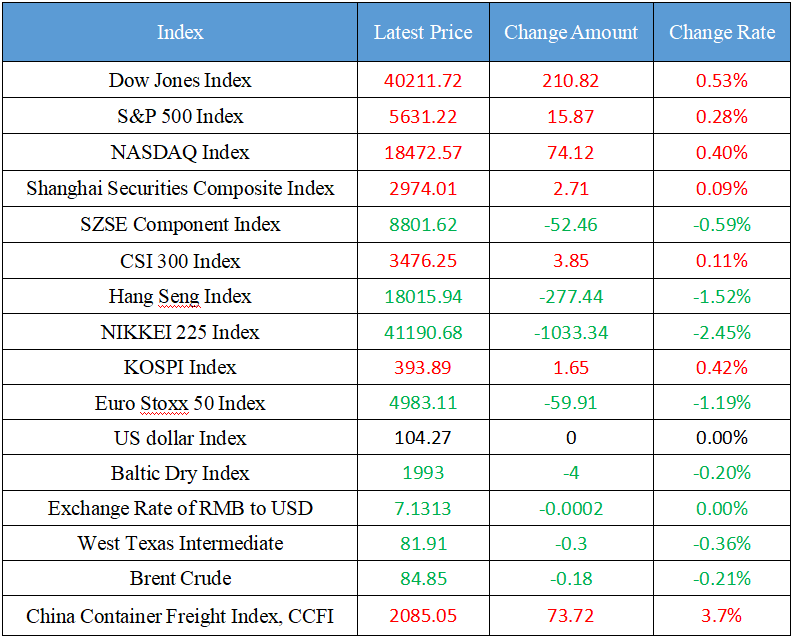

Latest Global Major Index

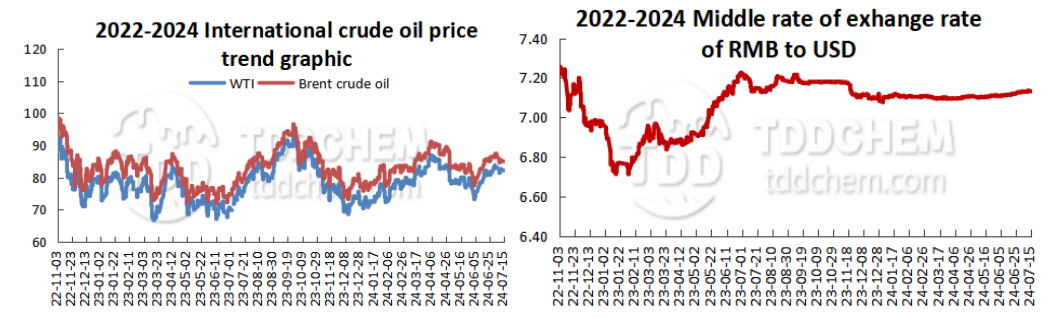

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The Central Bank shrink the Medium-term Lending Facility again, LPR quotations in July or may be cut separately

2. Positive change! The month-on-month decline in housing prices generally narrowed, and Shanghai led the trend

3. The people's sharp view: understand the preciousness of 5.0%, China's economy is still the main engine and ballast stone of world economic growth

4. Two departments: By 2025, the first batch of coal-fired power low-carbon transformation and construction projects will all start

5. CFFEX issued a notice on increasing the deliverable treasury bonds of 5-year national treasury bond futures contracts

International News

1. Economists: Even if inflation is high, the RBA will remain unchanged in August

2. USDA monthly report comments: the impact is limited, and the global soybean fruitful harvest is expected to remain unchanged

3. Pressure on European retailers has risen to the highest level since the pandemic

4. Statistics: The number of business closure registrations in Korea last year was nearly one million, a record high

5. A new Sino-Australian spodumene offtake agreement has emerged

Domestic News

1. The Central Bank shrink the Medium-term Lending Facility again, LPR quotations in July or may be cut separately

Analysts stressed that the central bank's reduction of MLF was mainly due to the abundant liquidity of the current banking system, not the release of a signal of quantitative contraction, considering the current economic operation and price level, the possibility of a separate cut in the loan market prime rate in July has risen. Wen Bin, chief economist of China Minsheng Bank, pointed out that at present, under the influence of factors such as the slowdown in credit expansion, abundant non-bank funds, and relatively stable local bond issuance, the capital situation remains stable and loose. The MLF interest rate of 2.5% was too high for commercial banks, and it can be replaced by NCD and financial bonds. "The low demand for MLF from financial institutions also makes it unnecessary for (Central Banks) to increase the amount." Wen Bin said.

2. Positive change! The month-on-month decline in housing prices generally narrowed, and Shanghai led the trend

On July 15, the housing price data of 70 cities of the National Bureau of Statistics was released. Judging from the data, in June, among the 70 large and medium-sized cities, the month-on-month decline in housing prices in all tiers of cities generally narrowed, the number of cities with declining housing prices decreased, and the number of cities with month-on-month declines in new and second-hand housing prices decreased by 4 compared with the previous month. It is worth noting that the month-on-month increase in the price of new houses in Shanghai has ranked first in the country for four consecutive months, and the prices of second-hand houses in Beijing and Shanghai have risen for the first time this year, and the second-hand housing prices in Shanghai have also led the country. Industry people believe that with the implementation of a series of real estate policies issued by multiple departments on May 17, the policy effect has appeared, and the property market in Beijing, Shanghai and other places has stabilized and warmed up in June, and it is expected that more hot city housing prices will stabilize in July. (Securities Times)

3. The people's sharp view: understand the preciousness of 5.0%, China's economy is still the main engine and ballast stone of world economic growth

The People's Daily pointed out in a commentary that the National Bureau of Statistics released data this morning that China's GDP in the first half of the year was 61.7 trillion yuan, a year-on-year increase of 5.0%. For the world's second-largest economy, it is rare to be able to achieve economic growth of about 5%. Observed in the global coordinates, China's economic growth rate in the first quarter was faster than that of major economies such as United States, the euro area, and Japan, and it is expected that China's economic growth rate will remain leading in the first half of the year. Not long ago, the World Bank also raised China's GDP growth forecast for 2024 by 0.3 percentage points from its December 2023 forecast. It can be seen that this 5 percent is a growth that has withstood the major test of high winds and waves, and is a growth that is basically in line with market expectations, and China's economy is still the main engine and ballast stone of world economic growth.

4. Two departments: By 2025, the first batch of coal-fired power low-carbon transformation and construction projects will all start

The National Development and Reform Commission (NDRC) and the National Energy Administration (NEA) jointly issued a notice on the Action Plan for Low-Carbon Transformation and Construction of Coal-fired Power (2024-2027). The goal is that by 2025, the first batch of low-carbon transformation and construction projects of coal-fired power will be started, and a number of low-carbon power generation technologies will be transformed and applied; The carbon emissions of the relevant projects are about 20% lower than the average carbon emission level of similar coal-fired power units in 2023, and significantly lower than the carbon emission level of the current advanced coal-fired power units, exploring useful experience for the clean and low-carbon transformation of coal-fired power plants.

5. CFFEX issued a notice on increasing the deliverable treasury bonds of 5-year national treasury bond futures contracts

The 2024 book-entry interest-bearing (14) treasury bonds have been tendered for issuance. According to the Detailed Rules for the Delivery of Treasury Bond Futures Contracts of the China Financial Futures Exchange and related regulations, the treasury bonds meet the conditions for deliverable treasury bonds of TF2409, TF2412 and TF2503 contracts, with conversion factors of 0.9516, 0.9539 and 0.9563, respectively. The treasury bonds are included in the scope of deliverable treasury bonds of TF2409, TF2412 and TF2503 from the next trading day after the listing trading date, and can be used for declaration of intention to deliver.

International News

1. Economists: Even if inflation is high, the RBA will remain unchanged in August

David Bassanese, chief economist at Betashares, said the RBA is likely to hold off on rate hikes in August as signs of easing inflationary pressures in the United States continue to mount and the Fed may return to the agenda. He added that the RBA could hold off on raising interest rates even if Australia's Q2 CPI was "slightly higher" than expected. Another indicator for investors to watch is the Australia jobs report for June released on Thursday, which Bassanese believes will increase pressure on the RBA if the unemployment rate soars to 4.2% or higher this week, "even if inflation continues to be high recently, the RBA will hold its ground next month".

2. USDA monthly report comments: the impact is limited, and the global soybean fruitful harvest is expected to remain unchanged

On the international front, the fine-tuning of the expected U.S. agricultural supply and demand report in July has limited impact on the market, and the global soybean fruitful harvest is expected to remain unchanged. Dominated by weak supply and demand and short-selling funds, U.S. bean prices continued to be weak. However, the current price is much lower than the cost of the new work, and it is necessary to be wary of the price rebound caused by the profit closing of short orders. In the domestic market, soybean imports in June increased more than expected, and imports from July to September are expected to be seasonally lower than the previous month and increase year-on-year. Soybean meal from oil mills is still on a seasonal upward trend, and inventory pressure continues. Downstream demand performance in general, although the profit of pig breeding rose month-on-month, and the pig inventory stopped falling and rebounded, but the soybean meal inventory of feed enterprises rebounded to a limited extent, and the overall maintenance was mainly based on the use of purchase, and there were not many long-term contract transactions. Overall, the near-end pressure on the soybean meal market is still high. The basis passively rebounded due to the sharp decline in the market. (CITIC Futures)

3. Pressure on European retailers has risen to the highest level since the pandemic

After the unsuccessful Trump assassination attempt, traders will initially flock to safe-haven assets and reevaluate the trades most relevant to their election when markets open, market observers said. "There is no doubt that Asian markets will flow to protective or safe-haven assets in early trading," said Nick Twidale, chief market analyst at ATFX Global Markets, "I think gold may test new highs, we will see the yen and dollar bought, and money flowing into United States Treasuries." "However, early market views suggest that the shooting will improve Trump's chances of winning the election, which will shift the focus to the securities most affected by his policies and could ultimately negatively impact United States Treasuries." Assets linked to the so-called "Trump deal" range from dollars to United States Treasuries, but also stocks in private prisons, credit card companies and health insurance companies.

4. Statistics: The number of business closure registrations in Korea last year was nearly one million, a record high

Pressure on European retail and consumer goods companies rose to its highest level since April 2020, weighed down by weakening spending power and ongoing supply chain disruptions, a study released on Monday showed. This trend is in stark contrast to other industries, where stress levels have generally eased. Overall, the pressure on European businesses eased in the second quarter compared to previous months, as economic growth in the region exceeded expectations and inflation continued to slow. According to the study, real estate remains the worst sector, with healthcare being the second most stressed sector, followed by retail. By country, Germany remains the most difficult among advanced economies, followed by United Kingdom.

5. A new Sino-Australian spodumene offtake agreement has emerged

According to foreign media reports, Australian miner Liontown Resources announced today, claiming that the company has reached an offtake agreement with Sinomine Resources for short-term spodumene concentrate. According to the announcement, the company will start providing spodumene concentrate to Sinomine Resources by September 30. The offtake agreement is for a period of 10 months and will supply a total of 100,000 dry metric tonnes of spodumene, which will be priced based on the market price of battery-grade lithium carbonate.

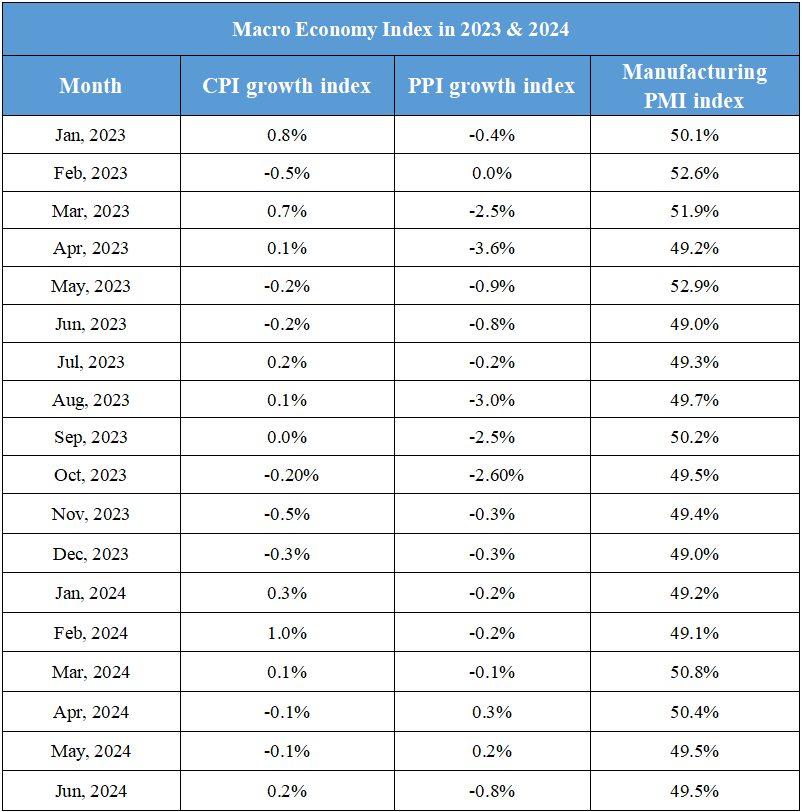

Domestic Macro Economy Index