On July 15th, Key Domestic and International Economic Updates

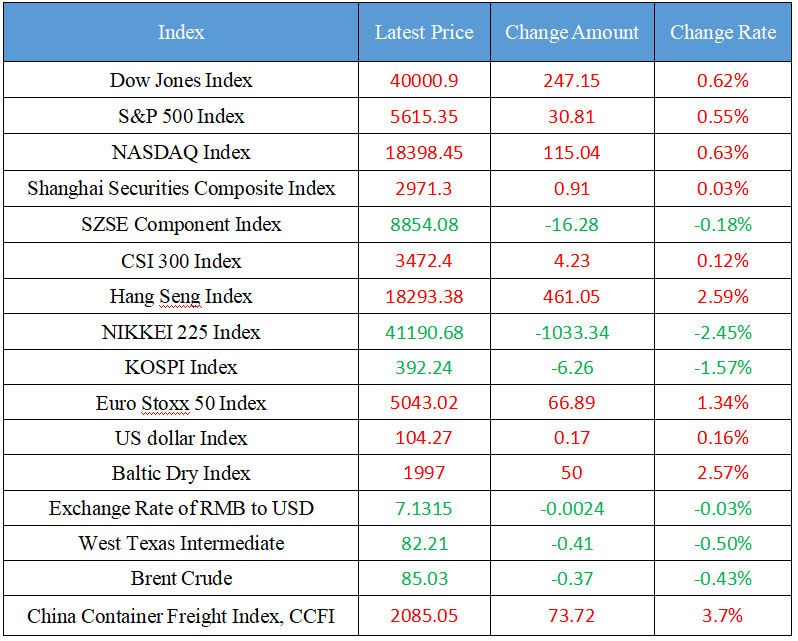

Latest Global Major Index

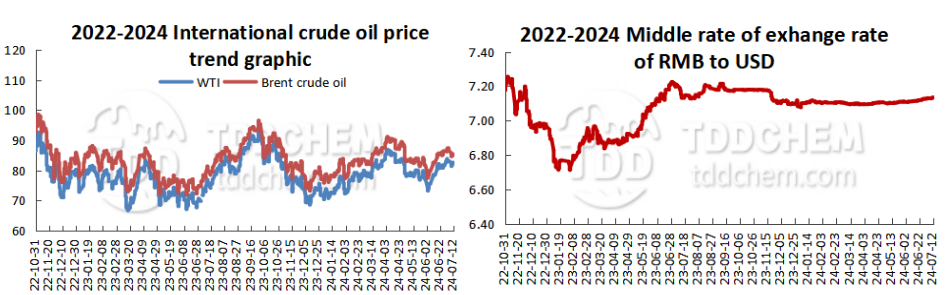

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Mortgage interest rates continue to bottom out, and some people in the industry hold the view that: mortgage interest rates are expected to continue to fall

2. The Central Bank will release a new loan prime rate (LPR) on July 22, and the LPR may improve

3. The Ministry of Commerce, the People's Bank of China, the State Administration of Financial Supervision and the State Administration of Foreign Exchange jointly issued the Opinions on Strengthening Commercial and Financial Coordination to Support the High-quality Development of Cross-border Trade and Investment

4. The China Securities Association plans to issue the "Guidelines for Initial Public Offering and Listing Guidance", and is soliciting opinions from the industry in the near future

5. The Shanghai Stock Exchange will release two indexes, including the SSE Science and Technology Innovation Board Chip Design Theme Index

International News

1. Russia relaxes the mandatory settlement requirements for exporters

2. In the first half of the year, the unit price of Korea's automobile exports exceeded 25,000 US dollars, a record high for the same period in history

3. Market participants: Asian investors will flock to safe havens and bet on Trump's victory

4. Market analysis: gold prices may consolidate in the short term, but the market sentiment is positive

5. Iraq: Compensatory production cuts will be made until the end of September 2025

Domestic News

1. Mortgage interest rates continue to bottom out, and some people in the industry hold the view that: mortgage interest rates are expected to continue to fall

"According to the latest housing loan policy of our bank, the loan interest rate for the first house in Guangzhou can be as low as 3.05%, and the loan amount must be more than 6 million yuan; If the loan amount is between 3 million yuan to 6 million yuan, the loan interest rate is 3.1%; The loan amount is less than 3 million yuan, and the loan interest rate is 3.15%. On July 13, HSBC staff said. Since the release of the new property market policy, mortgage interest rates have continued to bottom out. The removal of the lower limit of the mortgage interest rate policy has caused the mortgage interest rates of different banks to vary in some regions. According to the survey, the minimum mortgage interest rate in most regions has fallen to 3.5% and below. Industry insiders said that mortgage interest rates may still fall in the third quarter of this year. (China Securities News)

2. The Central Bank will release a new loan prime rate (LPR) on July 22, and the LPR may improve

The Central Bank will release a new loan prime rate (LPR) on July 22, and the LPR may improve. Industry experts pointed out that there is a certain deviation between the current LPR quotation and the loan interest rate of the best quality customers, and it is necessary to strengthen the evaluation of the quotation quality in the future to reduce the deviation.

3. The Ministry of Commerce, the People's Bank of China, the State Administration of Financial Supervision and the State Administration of Foreign Exchange jointly issued the Opinions on Strengthening Commercial and Financial Coordination to Support the High-quality Development of Cross-border Trade and Investment

The Ministry of Commerce, the People's Bank of China, the State Administration of Financial Supervision and the State Administration of Foreign Exchange jointly issued the Opinions on Strengthening Commercial and Financial Coordination to Support the High-quality Development of Cross-border Trade and Investment. The "Opinions" put forward 11 policy measures in 5 aspects around key areas such as stabilizing foreign trade, stabilizing foreign investment, deepening economic and trade cooperation and foreign investment cooperation along the "Belt and Road" and key links such as promoting financing, preventing risks and providing excellent services. The first is to promote the quality and quantity of foreign trade, and optimize the comprehensive financial services of foreign trade. The second is to promote the stable quantity and quality of foreign investment, and strengthen the guarantee of foreign financial services. The third is to deepen the economic and trade cooperation and foreign investment cooperation of the "Belt and Road", and improve diversified investment and financing services. Fourth, facilitate the development of cross-border trade and investment, and optimize the payment and settlement environment. Fifth, we should do a good job in the prevention and control of cross-border trade, investment and financial risks, and keep the bottom line of safety.

4. The China Securities Association plans to issue the "Guidelines for Initial Public Offering and Listing Guidance", and is soliciting opinions from the industry in the near future

The China Securities Association plans to issue the "Guidelines for Initial Public Offering and Listing Guidance", and is soliciting opinions from the industry in the near future. The "Guidelines for Counseling Work" clarifies and refines the organizational form and personnel requirements, work content and focus of each stage, work implementation process, working papers and other aspects of listing counseling work. Among them, the more important requirements include, but are not limited to: the sponsor representative should participate in the counseling work; focus on the "critical minority" word-of-mouth reputation; Clarify the relevant requirements such as changing the plate; The manuscript covers all stages of counseling.

5. The Shanghai Stock Exchange will release two indexes, including the SSE Science and Technology Innovation Board Chip Design Theme Index

Shanghai Stock Exchange Announcement: On July 26, the SSE Chip Design Theme Index and the SSE Sci-Tech Innovation Board Semiconductor Materials and Equipment Theme Index will be officially released to provide the market with more investment targets for the semiconductor industry on the SSE Science and Technology Innovation Board.

International News

1. Russia relaxes the mandatory settlement requirements for exporters

The Russia government announced on July 13 that it would reduce the mandatory foreign exchange settlement quota for exporters' foreign exchange earnings to 40%. According to the announcement, this decision was made based on the stability of the exchange rate of the national currency and the sufficient level of foreign exchange liquidity. Russia President Vladimir Putin issued an order in October 2023 calling for mandatory foreign exchange settlement by April 30, 2025 for exporters in the fuel and energy, ferrous and non-ferrous metallurgy, chemicals, wood and grain growing industries.

2. In the first half of the year, the unit price of Korea's automobile exports exceeded 25,000 US dollars, a record high for the same period in history

The Korea Automotive Mobility Industry Association (KAMA) said on the 14th that the export unit price of Korea automobiles in the first half of this year was 25,224 US dollars, a record high for the same period in history. The average export price of automobiles is on an upward trend. In the first half of the year, it was only $16,685 in 2018, and it exceeded the $20,000 mark for the first time in 2020, with an average annual growth rate of 2.8% in the following three years. Due to the increase in export unit price and export volume, the export value of automobiles has maintained a growth momentum for four consecutive years. In 2021, it was $19.553 billion, which increased to $37.009 billion this year.

3. Market participants: Asian investors will flock to safe havens and bet on Trump's victory

After the unsuccessful Trump assassination attempt, traders will initially flock to safe-haven assets and reevaluate the trades most relevant to their election when markets open, market watchers said. "There is no doubt that Asian markets will flow to protective or safe-haven assets in early trading," said Nick Twidale, chief market analyst at ATFX Global Markets, "I think gold may hit new highs, we will see the yen and dollar be bought, and money flowing into United States Treasuries." "However, early market views suggest that the shooting will improve Trump's chances of winning the election, which will shift the focus to the securities most affected by his policies and could ultimately negatively impact United States Treasuries." Assets linked to the so-called "Trump deal" range from dollars to United States Treasuries, but also stocks in private prisons, credit card companies and health insurance companies.

4. Market analysis: gold prices may consolidate in the short term, but the market sentiment is positive

Marc Chandler, managing director of Bannockburn Globa, said that the trend for gold is still upward. "Gold rose for the third week in a row, helped by lower interest rates in United States and a weaker dollar," he wrote. "Gold surged to nearly $2,425 following the release of weak CPI data, and speculation that the Fed could cut rates more than twice this year, with a 40% chance of three cuts. Gold prices are likely to see some consolidation in the short term, but the market sentiment is positive. "Separately, we note that while China's Central Bank may not have bought gold last month, other central banks in Asia and Europe are reportedly buying gold, and UBS's survey of 40 central banks found that the biggest concerns were geopolitical tensions and the weaponization of reserves," he added. ”

5. Iraq: Compensatory production cuts will be made until the end of September 2025

Iraq will stick to its production quota of 4 million barrels per day in July and in the coming months, and will compensate for excess oil production since the beginning of 2024 until the end of September 2025, the Iraq Oil Ministry statement said.

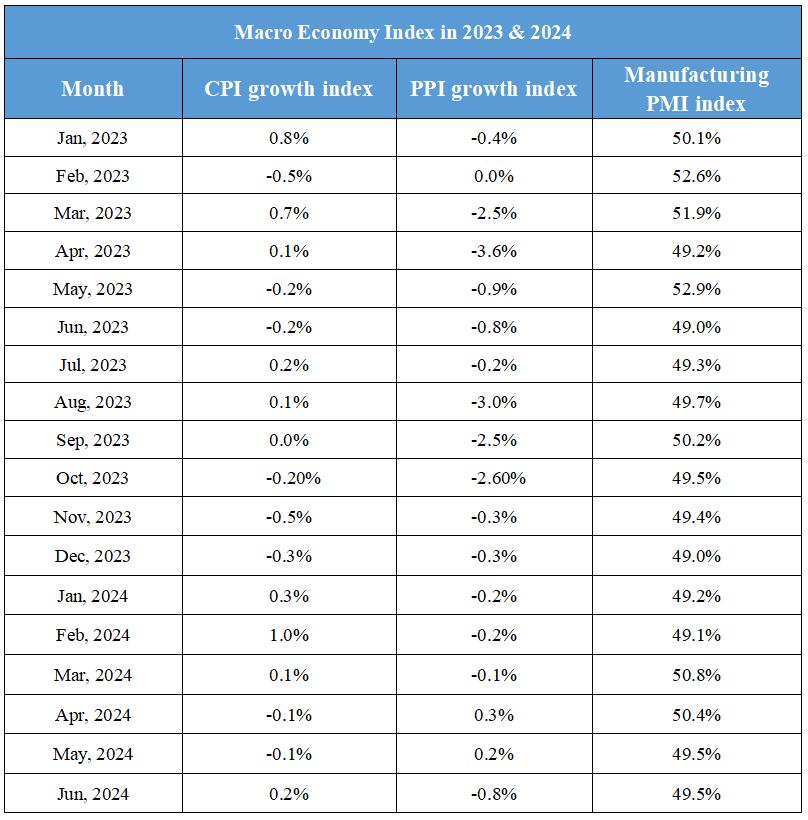

Domestic Macro Economy Index