Global and Domestic Economic Highlights on July 11th

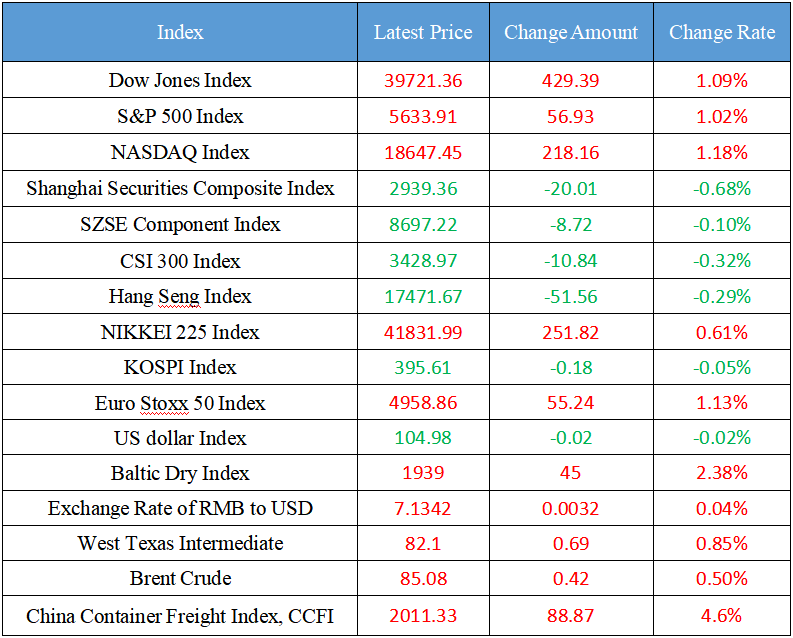

Latest Global Major Index

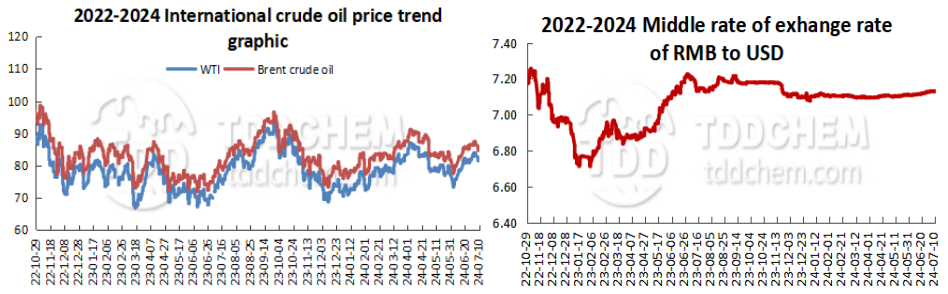

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Shanghai: Orderly opening up the application scope of intelligent networked vehicles in the new city to carry out large-scale applications of smart taxis, smart buses and other scenarios

2. The first plenary meeting of the Mediation Committee of the Asset Management Association of China in 2024 was held in Beijing

3. In the first half of the year, the sales volume of power batteries and other batteries in China was 402.6GWh, an increase of more than 4% year-on-year

4. Ministry of Transport: Accelerate the formulation of the "Rural Highway Regulations" and accelerate the formulation of the "15th Five-Year Plan for Highway Development"

5. Shanghai issued the "Shanghai Action Plan for Accelerating Automobile Renewal Consumption (2024-2027)"

International News

1. Source: The Bank of Japan may lower its growth forecast, expecting inflation to remain near the target

2. Fujairah refined oil inventories: The total refined oil inventories increased by 1.778 million barrels month-on-month

3. The market prepares for a rate cut, and the bets yield curve will gradually steepen

4. AI has led to a significant increase in the number of start-ups in Germany

5. Saudi Aramco launches its first bond offering since 2021

Domestic News

1. Shanghai: Orderly opening up the application scope of intelligent networked vehicles in the new city to carry out large-scale applications of smart taxis, smart buses and other scenarios

The finale of the 2024 "Tide of Pujiang" Investment in Shanghai Global Sharing Season - New Town Policy Release and City Promotion Event was held on July 10. Gu Jun, Director of the Shanghai Municipal Development and Reform Commission, introduced the recently released "Several Policy Measures to Deepen and Promote the High-quality Development of New Cities". Innovate the empowerment of Internet of Vehicles technology, promote the priority implementation of relevant platforms, functions and policies in Jiading, Nanhui and Fengxian New Town, orderly open the application scope of intelligent networked vehicles in the new city, and carry out large-scale applications in scenarios such as smart taxis and smart buses. In Qingpu, Nanhui and other conditional new cities, we need to promote the construction of low-altitude economy infrastructure. Accelerate the implementation of typical user-side energy storage scenarios such as new city industrial parks and data centers, and support the construction of a number of energy storage demonstration projects.

2. The first plenary meeting of the Mediation Committee of the Asset Management Association of China in 2024 was held in Beijing

Recently, the first plenary meeting of the Mediation Committee of the Asset Management Association of China in 2024 was held in Beijing. The meeting pointed out that the mediation of disputes in the fund industry is an important function entrusted to the Association by the Fund Law, and the Association resolutely implements the spirit of the important instructions of the General Secretary Xi Jinping to "insist on putting the non-litigation dispute resolution mechanism in the front", and highlights the background of serving the people in the dispute mediation work of the fund industry. Mediation work should adhere to and develop the "Fengqiao experience" in the new era. The Association actively promotes and improves the diversified resolution mechanism of fund disputes, continues to smooth the channels for complaints, appeals and mediation, further improves the professional level of dispute resolution, continuously optimizes the working mechanism and process of dispute mediation, and effectively enhances the standardization and transparency of work. (AMAC)

3. In the first half of the year, the sales volume of power batteries and other batteries in China was 402.6GWh, an increase of more than 4% year-on-year

The China Automotive Power Battery Industry Innovation Alliance released battery market data for June 2024 and the first half of 2024. In terms of output, in June, driven by the new energy vehicle market, the total output of power batteries and other batteries in China was 84.5GWh, an increase of 2.2% month-on-month and 28.7% year-on-year. From January to June, the cumulative output of power batteries and other batteries in China was 430.0GWh, a year-on-year increase of 36.9%. (SSE News)

4. Ministry of Transport: Accelerate the formulation of the "Rural Highway Regulations" and accelerate the formulation of the "15th Five-Year Plan for Highway Development"

Li Xiaopeng, Minister of Transport, said that we will further improve policies and regulations. We will speed up the formulation of the "Regulations on Rural Highways", speed up the preparation of the "Tenth Five-Year Plan for the Development of Highways", and continuously consolidate the "four beams and eight pillars" of the rural highway system. We will further enhance our governance capacity. Deepen the reform of the rural road management and maintenance system, improve the long-term operation mechanism of the "road chief system", and continuously stimulate the motivation and vitality of the high-quality development of the "four good rural roads". We will also implement a new round of rural road improvement actions, that is, the "eight major improvement actions" such as road network improvement action, safety improvement action, transportation improvement action, governance capacity improvement action, travel service improvement action, harmonious and beautiful rural improvement action, industry improvement action, and employment and income improvement action. (China.com)

5. Shanghai issued the "Shanghai Action Plan for Accelerating Automobile Renewal Consumption (2024-2027)"

The plan points out that by accelerating the elimination and renewal of vehicles, optimizing the structure of the automobile market, and accelerating the consumption of automobile renewal. The Action Plan clearly states that by 2027, the average age of used car transactions in Shanghai will be reduced by one year. The transaction volume of used cars reached 900,000 units, an increase of 50% compared to 2023; The export volume of used vehicles reached 15,000 units, doubling from 2023, and the number of scrapped vehicles recycled reached 50,000 units, doubling from 2023. (CCTV Finance)

International News

1. Source: The Bank of Japan may lower its growth forecast, expecting inflation to remain near the target

The Japan Bank of China may cut its economic growth forecast for this year in July, but expects inflation to remain near its 2% target in the coming years, keeping the possibility of a rate hike this month increases. Three business people familiar with Japan Central Bank's intention said that a rare surprise of a downward revision of historical GDP data by the Central Bank of Japan could lead to a small downward revision of the Japan Central Bank's economic growth forecast for the current fiscal year. But they said the Central Bank may not make significant adjustments to its GDP forecasts for fiscal 2025 and 2026 and stuck to the view that the economy will still recover modestly. "The downward revision of GDP is a thing of the past and will not have much impact on the Japan bank's economic assessment," one of the sources said, and another shared the view. "Overall, everything is on track." In addition, the Bank of Japan will also broadly maintain its forecast that inflation will remain around its 2% target by early 2027. "There isn't much data asking the Bank of Japan to change its view on the overall price trend," a third source said.

2. Fujairah refined oil inventories: The total refined oil inventories increased by 1.778 million barrels month-on-month

The latest data from the U.A.E. Fujairah Oil Industrial Zone showed that the total inventory of refined oil products at the U.A.E. port of Fujairah was 18.318 million barrels in the week ended July 8, up 1.778 million barrels from the previous week. Among them, light distillate inventories increased by 601,000 barrels to 5.741 million barrels, medium distillate inventories increased by 497,000 barrels to 3.156 million barrels, and heavy residual fuel oil inventories increased by 680,000 barrels to 9.421 million barrels.

3. The market prepares for a rate cut, and the bets yield curve will gradually steepen

Stocks rose as traders prepared for the Federal Reserve to cut interest rates. Euro Stoxx 600, S&P 500 and Nasdaq 100 futures edged higher, with swap traders continuing to predict two rate cuts in 2024. The two-year United States yield is near a three-month low, sparking widespread bets that the United States yield curve will normalize in a steeper direction. The idea behind this trade is that real rate cuts will push down yields on short-term bonds, while concerns about fiscal spending will push up yields on long-term bonds. Nicola Mai, Pimco sovereign credit analyst, said: "We are ready for a steepening curve. This year or early next year, we should see a reversal of the curve. ”

4. AI has led to a significant increase in the number of start-ups in Germany

The Germany Startup Association reported a 15 percent surge in the number of startups in Germany in the first half of this year compared to last year. The software industry is particularly prominent, with an unprecedented number of start-ups, accounting for one-fifth of the total, which is supported by the increasing use of digitalization and AI.

5. Saudi Aramco launches its first bond offering since 2021

Saudi Aramco has begun selling dollar-denominated bonds to bring cash to the oil-rich kingdom to help finance projects, a move that has continued the country's debt spree, according to foreign media reports. It was the world's largest oil exporter selling bonds for the first time since 2021. The bonds come in maturities of 10, 30 and 40 years, according to people familiar with the matter. Previously, it was reported that Saudi Aramco is seeking to raise at least $3 billion and may increase the size according to investor demand. The Saudi government and its affiliates have borrowed huge amounts of debt this year, making it the largest international debt issuer in emerging markets. The government now needs funds to help bridge the expected budget shortfall caused by an ambitious economic diversification plan, with the government selling more than half of the total debt of Saudi entities this year.

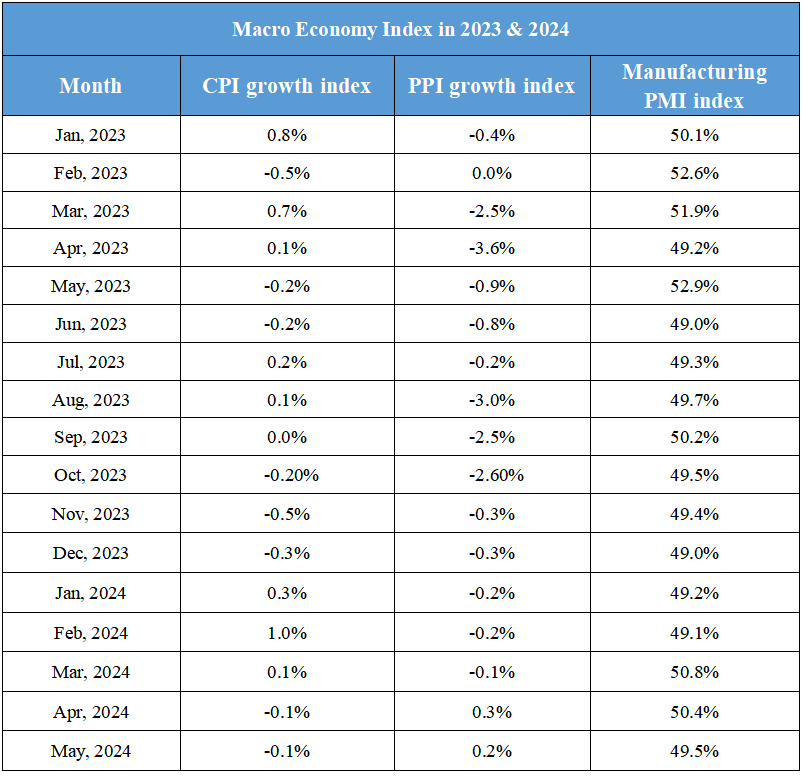

Domestic Macro Economy Index