On July 9th, Key Domestic and International Economic Updates

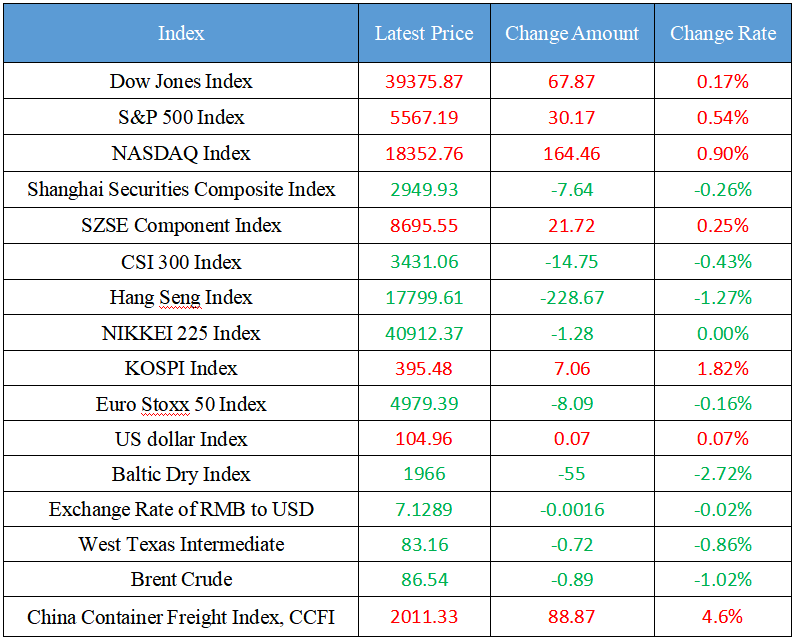

Latest Global Major Index

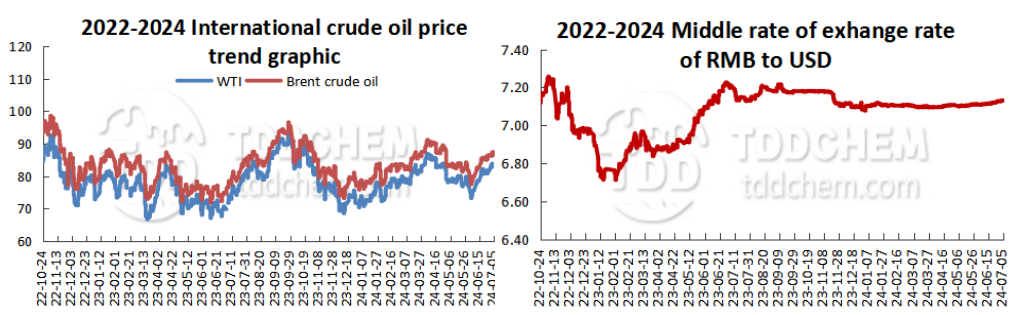

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The China Association of Automobile Manufacturers said that it was strongly dissatisfied with the temporary countervailing duty rate disclosed by the European Commission

2. The General Office of the State Council reposted the "Opinions on Further Improving the Comprehensive Punishment and Prevention of Financial Fraud in the Capital Market" formulated by the China Securities Regulatory Commission and other five departments

3. The China Securities Regulatory Commission will work closely with relevant departments to solidly promote the implementation of the Opinions

4. The State Council Information Office held a series of press conferences on the theme of "Promoting High-quality Development"

5. The current demand for building materials is weak, and the off-season characteristics are more obvious

International News

1. Russia extends temporary export restrictions on rice

2. Indonesia's official clarification of "200% import tariff": not for any specific country, let alone China

3. Huatai Securities: The Federal Reserve's start of the interest rate cut cycle in September may be a high probability event

4. Analysts: The risk of intervention in the yen seems to have eased

5. The Federal Reserve's semi-annual monetary policy report: inflation slows down and the job market is tight but not overheated

Domestic News

1. The China Association of Automobile Manufacturers said that it was strongly dissatisfied with the temporary countervailing duty rate disclosed by the European Commission

The China Association of Automobile Manufacturers said it was strongly dissatisfied with the temporary countervailing duty rate disclosed by the European Commission. It is hoped that the European Commission will not regard the current phased vehicle trade phenomenon that must be passed through for industrial development as a long-term threat, let alone politicize economic and trade issues, abuse trade remedy measures, and avoid damaging and distorting the global automotive industry chain and supply chain, including the EU, and maintain a fair, non-discriminatory and predictable market environment. It is hoped that the EU auto industry will think rationally and take positive actions to jointly maintain the current situation of reasonable competition and mutual benefit and win-win results between the two sides, and jointly promote the healthy and sustainable development of the global auto industry.

2. The General Office of the State Council reposted the "Opinions on Further Improving the Comprehensive Punishment and Prevention of Financial Fraud in the Capital Market" formulated by the China Securities Regulatory Commission and other five departments

The General Office of the State Council forwarded the "Opinions on Further Improving the Comprehensive Punishment and Prevention of Financial Fraud in the Capital Market" formulated by the China Securities Regulatory Commission and other six departments. The "Opinions" put forward 17 specific measures from five aspects: combating and curbing financial fraud in key areas, optimizing the system and mechanism of securities supervision and law enforcement, increasing all-round and three-dimensional accountability, strengthening inter-ministerial coordination and coordination between the central and local governments, and normalizing and long-term prevention and control of financial fraud.

3. The China Securities Regulatory Commission will work closely with relevant departments to solidly promote the implementation of the Opinions

The China Securities Regulatory Commission will work closely with relevant departments to solidly promote the implementation of the Opinions, focusing on the following tasks. The first is to strictly control the entrance to the capital market and strictly prevent entities with financial fraud from "breaking through with illness". The second is to strengthen penetrating supervision, play the role of "whistleblower", and identify and screen effective clues through multiple channels. Vigorously increase the intensity of administrative punishments, severely punish the "biggest bad buy" of counterfeiting, and improve the three-dimensional accountability system for administrative, criminal, and civil matters. The third is to increase the supply of basic systems, crack down on financial fraud and third-party cooperation fraud, and increase the cost of violations of laws and regulations. Fourth, strengthen cooperation with state-owned assets, financial and other regulatory departments, industry authorities, and local governments, and strengthen supervision and management and accountability. Fifth, strengthen the company's internal defense line construction to prevent financial fraud and prevent related parties from embezzling the assets of listed companies, and further consolidate the "gatekeeper" responsibility of intermediaries.

4. The State Council Information Office held a series of press conferences on the theme of "Promoting High-quality Development"

The State Council Information Office held a series of press conferences on the theme of "Promoting High-quality Development", which were attended by relevant persons in charge of the Ministry of Industry and Information Technology to introduce the high-quality development of industry and informatization. The key points of the conference include: (1) further expanding effective investment in the manufacturing industry, implementing the implementation plan for equipment renewal in the industrial field, and promoting advanced equipment renewal, digital transformation, green equipment promotion and intrinsic safety level improvement (2) Advancing the layout of future industries in six directions, especially focusing on humanoid robots, brain-computer interfaces, metaverse, next-generation Internet, 6G, quantum technology, atomic-level manufacturing, deep-sea & aerospace exploration and other fields (3) Coordinating the promotion of 5G-A evolution and 6G R&D and innovation, making the layout of ultra-high-speed optical fiber transmission and next-generation optical networks (4) Accelerate the development of green and low-carbon industries such as hydrogen energy, new energy storage, environmental protection equipment, green intelligent computing, and smart microgrids, and continue to create new advantages in industrial competition.

5. The current demand for building materials is weak, and the off-season characteristics are more obvious

Minsheng Securities weekly report shows that the output of liquid iron has fallen, and the resilience of plate consumption is still there. On the demand side, the apparent demand for rebar and hot coil fell. On the output side, except for hot rolling, the output of the rest of the steel fell month-on-month; In terms of inventory, threaded, hot-rolled, and cold-rolled warehouses were accumulated, and the remaining steel inventories fell month-on-month. The five major steel products as a whole maintain a state of accumulation. At present, the demand for building materials is weak, the off-season characteristics are more obvious, the demand for plates is still resilient, and the output of hot metal has begun to fall.

International News

1. Russia extends temporary export restrictions on rice

On July 6, local time, the Russian government issued a statement saying that in order to ensure the stability of the domestic grain market, Russia will extend the temporary restrictions on rice exports until December 31, 2024.

2. Indonesia's official clarification of "200% import tariff": not for any specific country, let alone China

Indonesia's Coordinating Minister for Maritime and Investment Affairs , Luhut, clarified the speculation of "200% import tariff" on the 5th. He said the move was not aimed at any specific country, let alone China. According to Luhut, on June 25, 2024, Indonesian President Joko Widodo chaired a coordination meeting and decided to protect the domestic industry in accordance with current regulations and applicable international trade norms. One of these measures was the imposition of safeguard tariffs on several textile products, but "the tariff has actually been implemented". Luhut said the measure applies to all imported goods, regardless of the specific country of origin.

3. Huatai Securities: The Federal Reserve's start of the interest rate cut cycle in September may be a high probability event

Huatai Securities released a research report saying that the non-agricultural data in June is in line with our previous judgment on the decline in the US economic slowdown and the resistance to interest rate cuts, and the probability of interest rate cuts in September has further increased. The recent weakening of the broad spectrum of US economic data, especially the CPI data in May and the non-agro payrolls data in June, has helped to strengthen the Fed's confidence that inflation is back to target. While the Fed's June FOMC dot plot indicates that there will only be one rate cut this year, as Powell said, the dot plot is just a projection based on data, and the actual path of rate cuts still depends on the data. If the economic data does not repeat sharply, especially the June CPI data released next Friday remains weak, the start of the interest rate cut cycle in September may now be a high probability event.

4. Analysts: The risk of intervention in the yen seems to have eased

According to foreign media reports, Australia has legislated to apply a comprehensive global minimum tax framework to large companies under an international tax agreement. Australian Treasurer Jim Chalmers said Australia's 15% global and domestic minimum tax rate would apply to all multinationals with annual revenues of at least $1.2 billion. The new domestic catch-up tax and income inclusion rules will be applied retroactively from January 1, 2024, to match the start date of similar laws adopted in other countries. The bills will be debated in the upcoming House session before being considered by the Senate.

5. The Federal Reserve's semi-annual monetary policy report: inflation slows down and the job market is tight but not overheated

The Fed said in its semi-annual monetary policy report that U.S. inflation is easing and that the job market has returned to a "tight but not overheated" situation before the pandemic plunged the U.S. economy into chaos. In the critical area of housing services, it may only be a matter of time before prices rise at pre-pandemic levels, the report said. At the same time, the job market "continued to rebalance in the first half of the year." Labor demand has eased due to fewer job vacancies in many sectors of the economy, while labor supply continues to increase, supported by strong growth in immigration. According to the report, the balance between labor demand and supply appears to be similar to what it was before the pandemic, when the labor market was relatively tight but not overheated. In addition, nominal wage growth is continuing to slow.

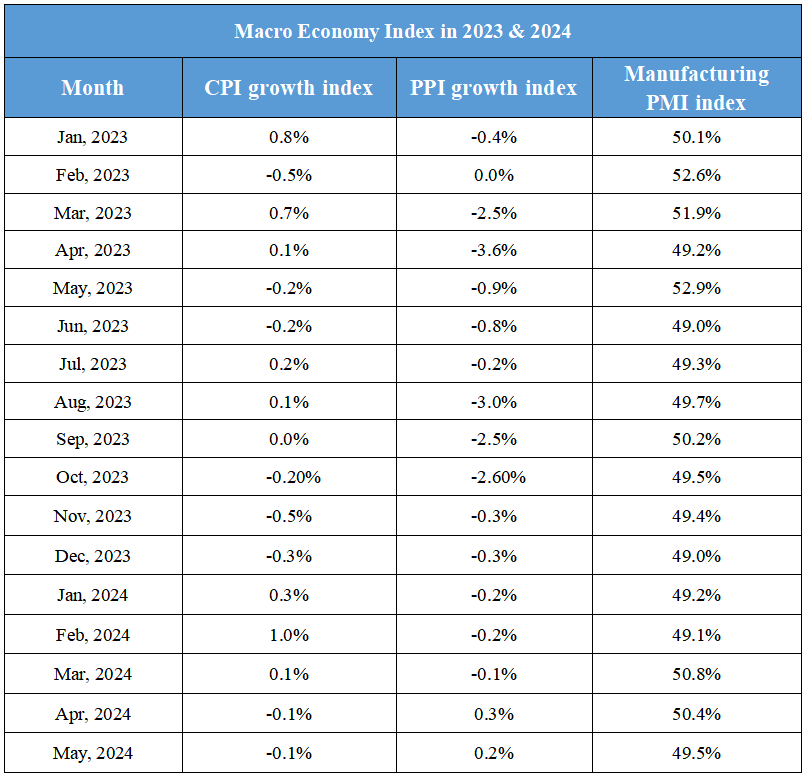

Domestic Macro Economy Index