Supply is limited, European EVA offers are high

May 29, 2024, 11:58 AM

TDD-global

6364

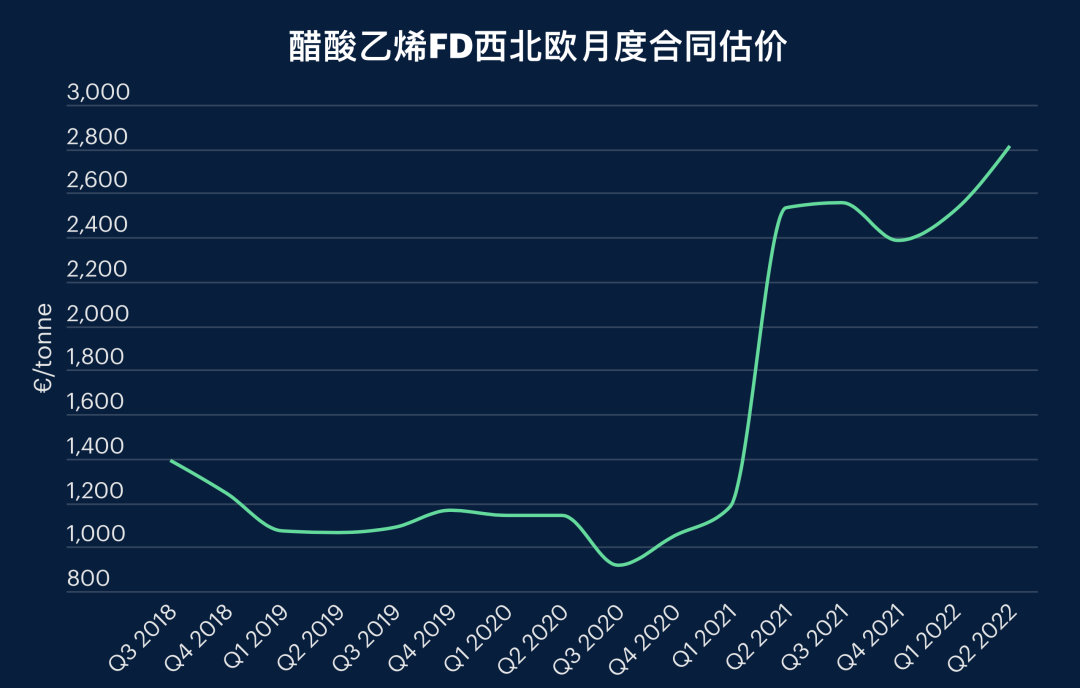

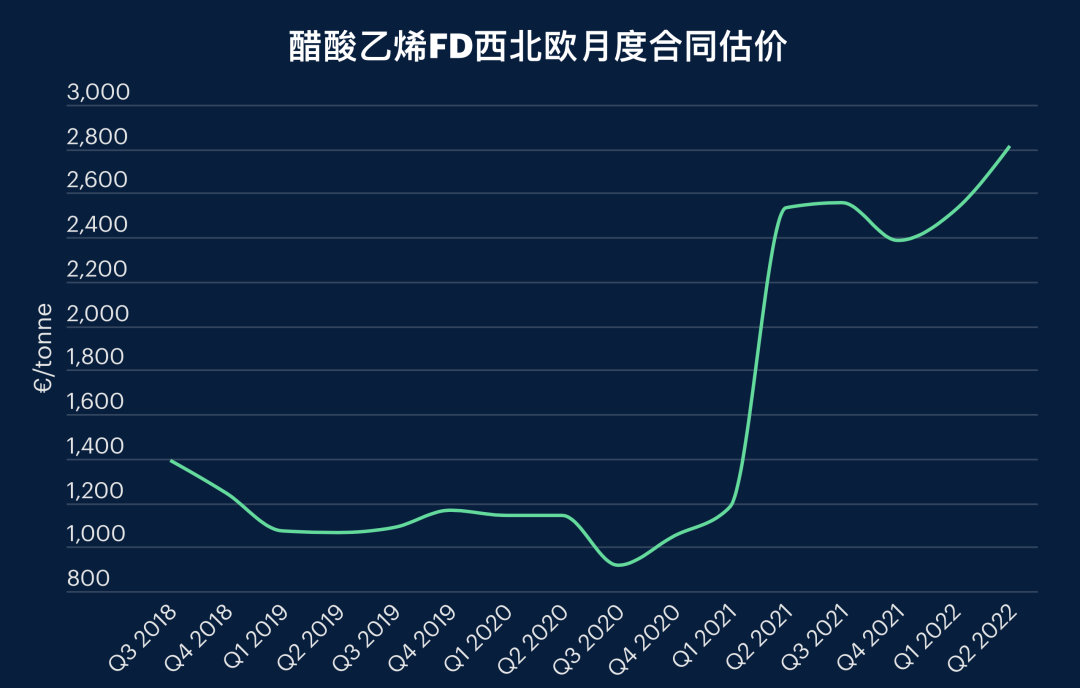

Although the contradiction between supply and demand in the polyethylene (PE) market has eased, the transaction price of ethylene-vinyl acetate copolymer (EVA) is still close to historical highs.

Although the contradiction between supply and demand in the polyethylene (PE) market has eased, the transaction price of ethylene-vinyl acetate copolymer (EVA) is still close to historical highs.

There is a serious shortage of upstream raw materials, and the superimposed cracker is planned to be shut down, resulting in a decline in domestic production in Europe. The European EVA market is basically self-sufficient, but the self-sufficiency rate of main raw materials is not high, resulting in limited EVA supply, high prices, and strong resistance from downstream users, but they often can only accept high-priced offers.

Some buyers said that despite the high price of EVA and the price difference with LDPE reaching a historical high, some sellers continued to raise their offers under the support of reduced supply, resulting in a sluggish purchase intention of buyers.

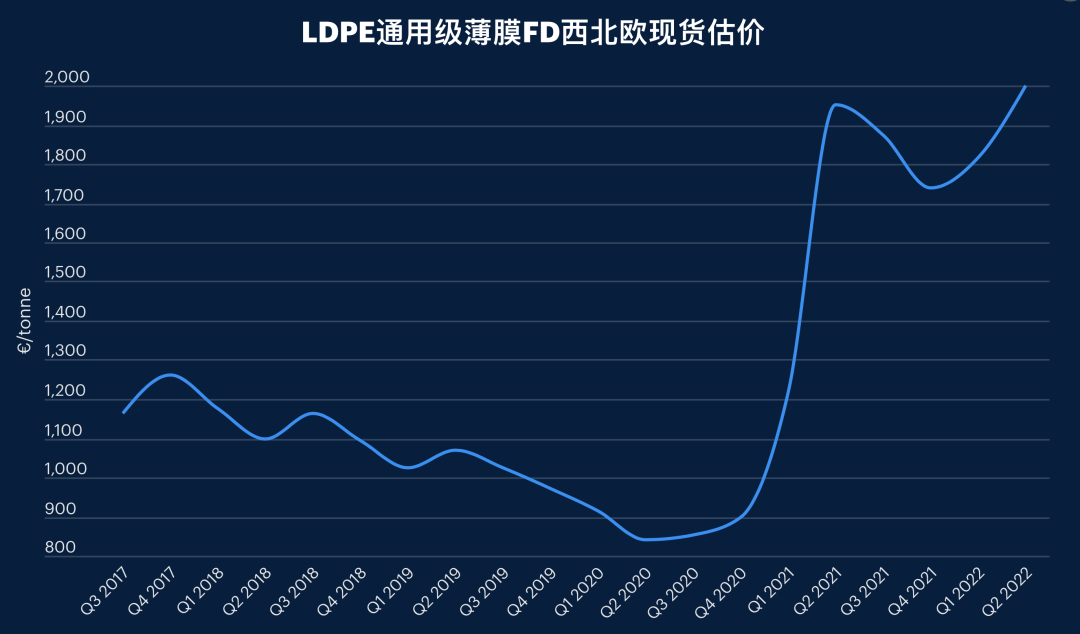

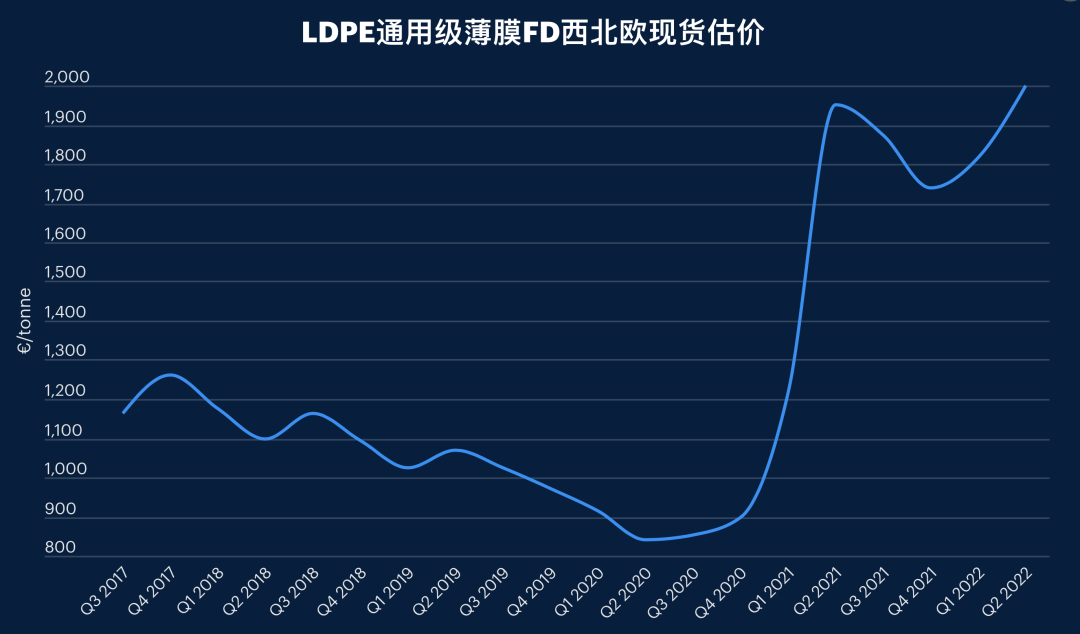

In 2021, the EVA market will perform strongly and profits will be better, so some manufacturers switch from LDPE to EVA production, resulting in a further tightening of the already tight supply of LDPE. The change of production by the manufacturer has kept the prices of both products at historically high levels, and buyers have a very weak voice in the market.

Market participants said that the current price difference between LDPE and EVA is at least 1,000 euros / ton, but the price difference of some offers far exceeds this level.

A market participant said: "The price difference is usually 400-500 euros / ton", and said that the current price difference does not represent the actual value of the product and cannot exist for a long time. Compared with LDPE, EVA is less affected by the commodity market, more professional in technology, has less output, and has a complex production process, which means that EVA has a higher premium.

Prices and spreads in many European markets have hit record highs as logistics and supply chain issues severely disrupt trade flows that will continue to plague industries around the world.

At present, due to the shortage of some raw materials, especially acetic acid, the supply of vinyl acetate (VA) is limited, thus inhibiting the production of EVA in Europe.

Several sets of acetic acid and vinyl acetate units have been declared force majeure in the United States, and Celanese has also declared force majeure on the production of these two products in Europe. A string of production problems has affected the supply of vinyl acetate to the European market, which is almost entirely dependent on imports.

Speaking of force majeure on Celanese's vinyl acetate and acetic acid production in the Americas, EMEA, an EVA buyer said: "We have been notified that EVA supply will remain tight in the coming weeks."

There is a serious shortage of upstream raw materials, and the superimposed cracker is planned to be shut down, resulting in a decline in domestic production in Europe. The European EVA market is basically self-sufficient, but the self-sufficiency rate of main raw materials is not high, resulting in limited EVA supply, high prices, and strong resistance from downstream users, but they often can only accept high-priced offers.

Some buyers said that despite the high price of EVA and the price difference with LDPE reaching a historical high, some sellers continued to raise their offers under the support of reduced supply, resulting in a sluggish purchase intention of buyers.

In 2021, the EVA market will perform strongly and profits will be better, so some manufacturers switch from LDPE to EVA production, resulting in a further tightening of the already tight supply of LDPE. The change of production by the manufacturer has kept the prices of both products at historically high levels, and buyers have a very weak voice in the market.

A market participant said: "The price difference is usually 400-500 euros / ton", and said that the current price difference does not represent the actual value of the product and cannot exist for a long time. Compared with LDPE, EVA is less affected by the commodity market, more professional in technology, has less output, and has a complex production process, which means that EVA has a higher premium.

Prices and spreads in many European markets have hit record highs as logistics and supply chain issues severely disrupt trade flows that will continue to plague industries around the world.

At present, due to the shortage of some raw materials, especially acetic acid, the supply of vinyl acetate (VA) is limited, thus inhibiting the production of EVA in Europe.

Several sets of acetic acid and vinyl acetate units have been declared force majeure in the United States, and Celanese has also declared force majeure on the production of these two products in Europe. A string of production problems has affected the supply of vinyl acetate to the European market, which is almost entirely dependent on imports.

Speaking of force majeure on Celanese's vinyl acetate and acetic acid production in the Americas, EMEA, an EVA buyer said: "We have been notified that EVA supply will remain tight in the coming weeks."

August 21, 2024, 2:42 PM

August 21, 2024, 2:28 PM

August 21, 2024, 2:20 PM

August 21, 2024, 3:01 PM