Biden launches the Indo-Pacific economic framework and expresses his stance on tariffs on China

May 29, 2024, 11:58 AM

TDD-global

6435

Biden made a big move yesterday!

On May 23, during his visit to Japan, U.S. President Biden announced the launch of the "Indo-Pacific Economic Framework" (IPEF), and 13 countries including Japan, South Korea and India will join this so-called new Asia-Pacific trade initiative.

Biden made a big move yesterday!

Picture Biden speaking at the launching ceremony of the "Indo-Pacific Economic Framework" on the 23rd

According to Reuters, Biden reiterated at a news conference during his visit to Japan that he was considering cutting tariffs on Chinese goods, "these tariffs were imposed by the previous administration and are currently under consideration."

Previously, Biden also publicly stated that he "considered cutting tariffs on China" and bluntly stated that "dealing with inflation is the top domestic task." According to an analysis by CNN, as the U.S. inflation rate soars, the business community is putting increasing pressure on the Biden administration to lift tariffs on China, thereby reducing some of the inflation faced by importers pressure.

A spokesperson for the Chinese Ministry of Foreign Affairs has previously stated that the essence of Sino-US economic and trade cooperation is mutual benefit and win-win results. There are no winners in trade wars and tariff wars. U.S. unilateral imposition of tariffs is not good for China, the United States, and the world.

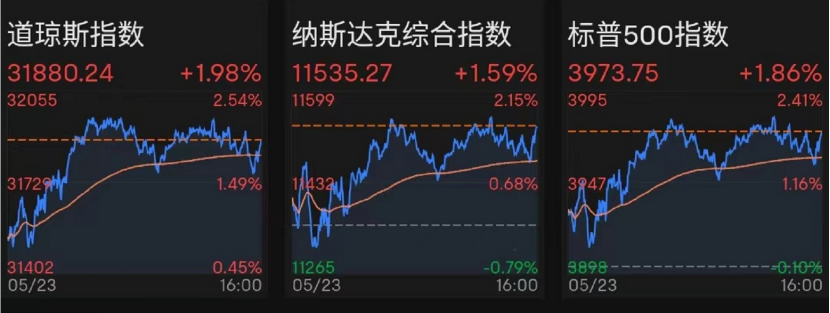

In terms of market conditions, U.S. stocks collectively opened higher last night. The S&P 500 and the Dow Jones Industrial Average continued to rise. The Dow once rose nearly 2.3%, while the S&P and Nasdaq rose nearly 2.1% and more than 1.7%, respectively. In the end, the three major U.S. stock indexes closed up collectively for the first time since May 17, all at the closing highs of the last four trading days. The Dow, which led the gains, closed up 1.98%, the Nasdaq closed up 1.59%, and the S&P closed up 1.86%.

Among commodities, U.S. natural gas futures rose nearly 9% in one day, approaching a nearly 14-year high. International crude oil rose for the third day in a row, with Brent oil closing at a one-week high, while U.S. oil futures were almost flat.

On May 23, during his visit to Japan, U.S. President Biden announced the launch of the "Indo-Pacific Economic Framework" (IPEF), and 13 countries including Japan, South Korea and India will join this so-called new Asia-Pacific trade initiative.

Picture Biden speaking at the launching ceremony of the "Indo-Pacific Economic Framework" on the 23rd

According to Reuters, Biden reiterated at a news conference during his visit to Japan that he was considering cutting tariffs on Chinese goods, "these tariffs were imposed by the previous administration and are currently under consideration."

Previously, Biden also publicly stated that he "considered cutting tariffs on China" and bluntly stated that "dealing with inflation is the top domestic task." According to an analysis by CNN, as the U.S. inflation rate soars, the business community is putting increasing pressure on the Biden administration to lift tariffs on China, thereby reducing some of the inflation faced by importers pressure.

A spokesperson for the Chinese Ministry of Foreign Affairs has previously stated that the essence of Sino-US economic and trade cooperation is mutual benefit and win-win results. There are no winners in trade wars and tariff wars. U.S. unilateral imposition of tariffs is not good for China, the United States, and the world.

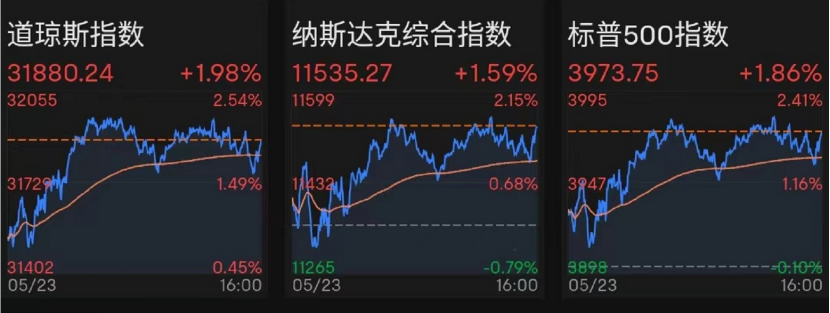

In terms of market conditions, U.S. stocks collectively opened higher last night. The S&P 500 and the Dow Jones Industrial Average continued to rise. The Dow once rose nearly 2.3%, while the S&P and Nasdaq rose nearly 2.1% and more than 1.7%, respectively. In the end, the three major U.S. stock indexes closed up collectively for the first time since May 17, all at the closing highs of the last four trading days. The Dow, which led the gains, closed up 1.98%, the Nasdaq closed up 1.59%, and the S&P closed up 1.86%.

Among commodities, U.S. natural gas futures rose nearly 9% in one day, approaching a nearly 14-year high. International crude oil rose for the third day in a row, with Brent oil closing at a one-week high, while U.S. oil futures were almost flat.

August 21, 2024, 2:42 PM

August 21, 2024, 2:28 PM

August 21, 2024, 2:20 PM

August 21, 2024, 3:01 PM