July 3rd Macroeconomic Index: Central Bank to Conduct Treasury Bond Borrowing Operations, Auto Imports and Exports Rise

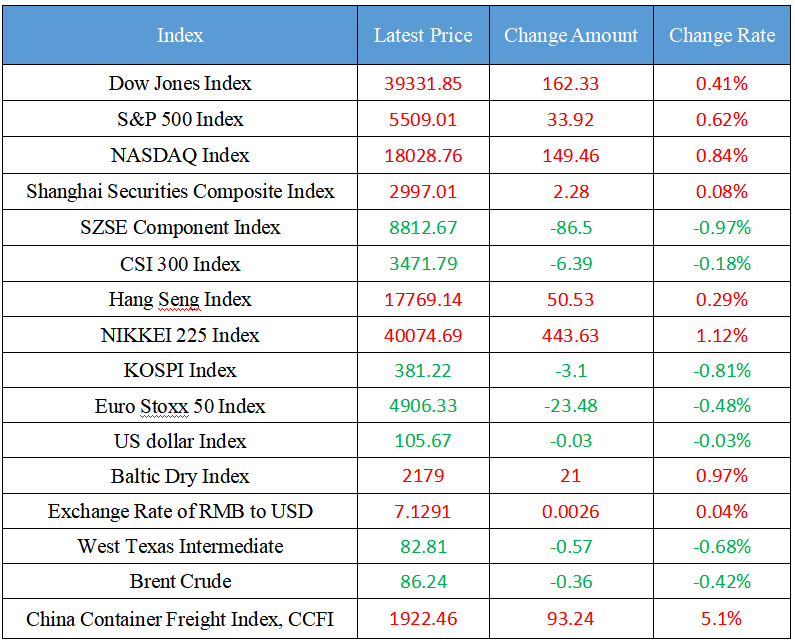

Latest Global Major Index

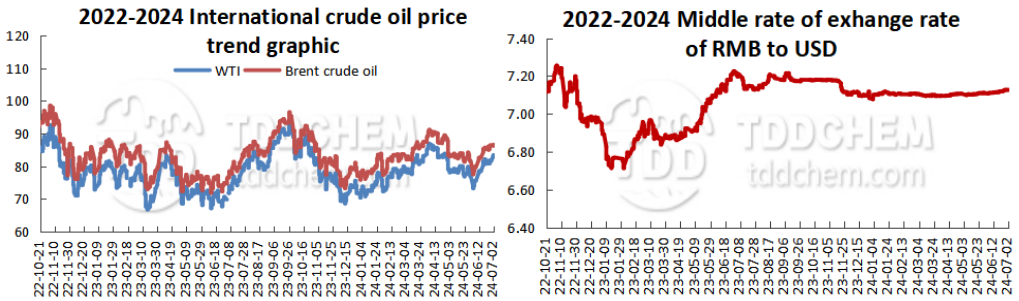

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Whether the downward trend of long-term bond interest rates in the second half of the year can be reversed depends on the next operation of the central bank

2. China Association of Automobile Manufacturers: The total import and export volume of automobile goods in May was 26.38 billion US dollars, an increase of 3.4% month-on-month

3. Ministry of Industry and Information Technology: It will continue to consolidate the construction of digital infrastructure and open up the main arteries of data circulation

4. Ministry of Finance: The "two pre-allocation" mechanism shall be implemented for the financial discount interest funds of equipment renewal loans

5. He Lifeng, Vice Premier of the State Council, presided over a symposium on foreign investment and pointed out that it is necessary to pay close attention to the implementation of various policies that have been introduced and further relax market access

International News

1. The number of coal ships queuing in Newcastle, Australia, hit a 23-month high

2. Inflation in the euro area eases and the euro continues to weaken

3. Saxo Bank: The US dollar may be affected by economic weakness in the third quarter, but the decline is limited

4. The two economists expect the Japanese economy to shrink in 2024

5. Affected by the situation in the Middle East and hurricanes, oil prices are close to a two-month high

Domestic News

1. Whether the downward trend of long-term bond interest rates in the second half of the year can be reversed depends on the next operation of the central bank

According to the central bank on July 1, in order to maintain the steady operation of the bond market, on the basis of careful observation and assessment of the current market situation, the central bank decided to carry out treasury bond borrowing operations for some primary dealers in the open market in the near future. This is the first time that the central bank has carried out such operations in the open market, and a number of market participants interviewed said that it has sent a clear signal that monetary policy will return to neutral, and that long-term interest rates will continue to decline in the short term, and phased adjustments are inevitable. In the long run, whether the downward trend of long-term bond interest rates in the second half of the year can be reversed depends on the next operation of the central bank, and will also be affected by the economic and price trends in the second half of the year, especially whether the real estate industry can achieve a soft landing in the second half of the year, which is the key to the current economic situation and market expectations. (Brokerage China)

2. China Association of Automobile Manufacturers: The total import and export volume of automobile goods in May was 26.38 billion US dollars, an increase of 3.4% month-on-month

According to the data of the General Administration of Customs compiled by the China Association of Automobile Manufacturers, as of May this year, the total import and export volume of automobile goods increased slightly year-on-year. In May 2024, the total import and export value of automotive goods was US$26.38 billion, up 3.4% month-on-month and 7.9% year-on-year. Among them, the import value was 6.07 billion US dollars, an increase of 11.5% month-on-month and a year-on-year increase of 2.2%; The export value was 20.31 billion US dollars, an increase of 1.3% month-on-month and a year-on-year increase of 9.8%.

3. Ministry of Industry and Information Technology: It will continue to consolidate the construction of digital infrastructure and open up the main arteries of data circulation

Zhao Zhiguo, chief engineer of the Ministry of Industry and Information Technology, introduced at the 2024 Global Digital Economy Conference that China's digital infrastructure continues to be stable. The deployment of "dual gigabit" networks has been steadily promoted, with the penetration rate of 5G users exceeding 60%, and the number of gigabit cities reaching 207, realizing "5G network connection among counties" and "Gigabit network among cities". There are more than 8.1 million standard racks of data centers in use across the country, with a total computility of 230 exascale floating point operations per second, and a total storage capacity of about 1,200 EB, which strongly supports the circulation and utilization of data. Zhao Zhiguo said that in the next step, we will continue to consolidate the construction of digital infrastructure and open up the main artery of data circulation; Consolidate and enhance the leading position and competitive advantage of the information and communication industry, appropriately advance the layout and construction of new information infrastructure such as 5G, data centers, and computing power, and accelerate the construction of intelligent and comprehensive digital infrastructure; In-depth implementation of the industrial Internet innovation and development project, to create a number of globally competitive industrial Internet platforms. (China Securities News)

4. Ministry of Finance: The "two pre-allocation" mechanism shall be implemented for the financial discount interest funds of equipment renewal loans

The relevant person in charge of the Ministry of Finance answered reporters' questions on the implementation of the financial discount policy for equipment renewal loans, and said that in order to further improve the sense of gain of business entities, the financial discount funds implement the "two pre-allocation" mechanism, and the Ministry of Finance issued a budget to the provincial financial departments in advance to pre-allocate the discount interest funds; The provincial finance department implements the interest discount policy through 21 commercial banks, regularly allocates interest discount funds to its provincial branches, and subsequently settles according to the actual loan situation. After receiving the subsidized funds allocated by the financial department, 21 commercial banks deducted the interest on the pre-allocated part when collecting interest from the business entities, effectively reducing financing costs and better boosting the confidence and enthusiasm of the business entities in equipment renewal and technological transformation. (Ministry of Finance)

5. He Lifeng, Vice Premier of the State Council, presided over a symposium on foreign investment and pointed out that it is necessary to pay close attention to the implementation of various policies that have been introduced and further relax market access

He Lifeng, Vice Premier of the State Council, presided over a symposium on foreign investment and pointed out that it is necessary to pay close attention to the implementation of various policies that have been introduced and further relax market access; We should give full play to the role of various open platforms such as pilot free trade zones, state-level economic and technological development zones, comprehensive bonded zones, and comprehensive pilot projects for the expansion and opening up of the national service industry, hold key investment exhibitions, and actively explore new ideas and new models for attracting investment that adapt to the new situation.

International News

1. The number of coal ships queuing in Newcastle, Australia, hit a 23-month high

According to foreign media, the number of ships queuing in Newcastle, Australia's key coal port, reached 31 on July 2, a 23-month high, as climate protests and storms disrupted operations. According to Port Waratah Coal Services (PWCS), the average vessel turnaround time at the two PWCS terminals in Newcastle increased to 7.61 days in June, up from 5.05 days in May. Shipments from PWCS terminals increased to 7.9 million mt in June from 7.4 million mt in May, but decreased from 8.53 million mt in June 2023. The railroad was briefly closed for maintenance on June 8-10, but the month was also disrupted by climate protests. No maintenance is planned for July.

2. Inflation in the euro area eases and the euro continues to weaken

Headline inflation in the eurozone slowed in June, with Reynolds, a macroeconomist at Capital Economics, saying in a note: "A rate cut by the ECB at its July meeting is already unlikely, and the June inflation data will reinforce the tendency of policymakers to be very cautious."

3. Saxo Bank: The US dollar may be affected by economic weakness in the third quarter, but the decline is limited

Saxo Bank said the dollar could fall in the third quarter if the weakness in the U.S. economy extended, but the decline should be limited. Chanana, a foreign exchange strategist at Saxo Bank, said in a note that the November presidential election could prompt the Federal Reserve to signal interest rate cuts when there are signs of economic weakness. However, the pressure on the USD should ease due to relatively high US Treasury yields and safe-haven demand. "The high yields on the US dollar remain a supporting factor, and unless the US economy faces a credit crisis, the rate cut cycle is expected to start slowly," she said. She said safe-haven dollar demand should persist ahead of the U.S. election.

4. The two economists expect the Japanese economy to shrink in 2024

The day after the first quarter GDP data was sharply revised downward, the two economists shifted their views on the Japanese economy, expecting a contraction in 2024, also highlighting the difficulties the Bank of Japan faces as it weighs the case for raising interest rates, with economists at BNP Paribas and Japan's SMBC Nikko Securities cutting their growth forecasts in 2024, according to a report on Tuesday, expecting 2024 to be Japan's first annual contraction since the pandemic began in 2020. BNP Paribas economist Ryutaro Kono expects GDP to shrink by 0.4%, while economists such as SMBC such as Yoshimasa Maruyama say the economy is expected to decline by 0.3%. Both economists had previously predicted a modest expansion in Japan's economy. The Japanese government released a report on Monday revising the contraction in the first quarter to 2.9% from 1.8% previously. The adjustment of economic expectations will be a factor for discussion among members of the Bank of Japan's policy committee at the end of this month. According to a survey conducted last week, one-third of economists surveyed expect the Bank of Japan to raise interest rates at the meeting.

5. Affected by the situation in the Middle East and hurricanes, oil prices are close to a two-month high

Oil prices hit near-two-month highs after breaking out of their recent trading range amid escalating tensions in the Middle East and fears of an upcoming Atlantic hurricane season. The Israeli military previously said 18 soldiers were wounded in drone strikes launched by Iranian-backed Allah, one seriously, which could bring the conflict closer to full-scale war. Meanwhile, Hurricane Beryl has intensified to Category 5, the highest level of hurricane scale, becoming the strongest storm to form in the Atlantic Ocean at this time of year. "The conflict between Israel and Hamas continues to escalate, increasing the risk of oil supply disruptions," ING analysts including Ewa Manthey wrote in a note. He also added that the hurricane has also raised concerns about the upcoming severe hurricane season.

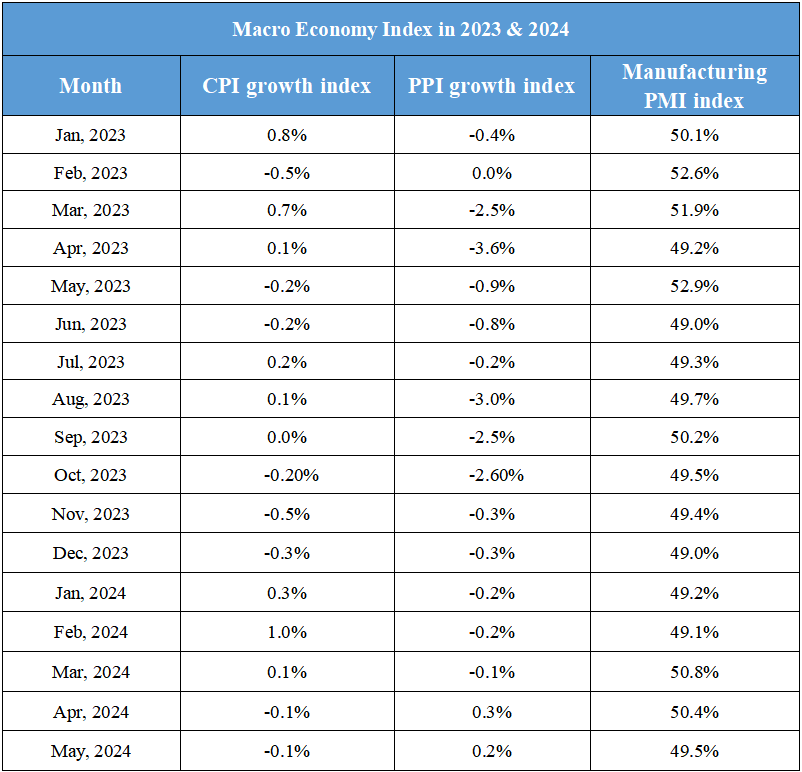

Domestic Macro Economy Index