On July 2nd, Global Economic Highlights and Domestic Policy Updates

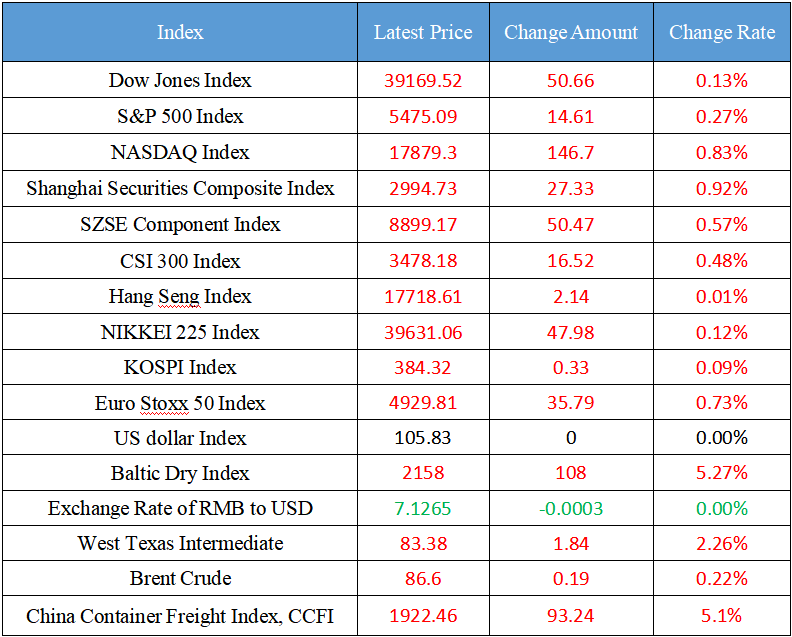

Latest Global Major Index

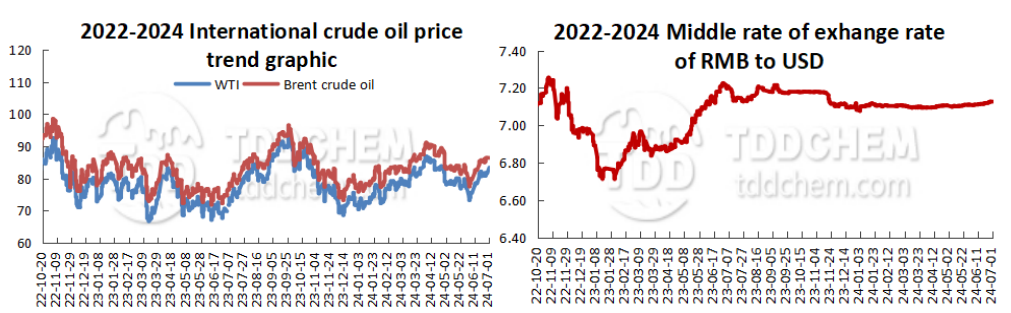

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The State Council: Clarify the transitional period arrangements for the adjustment of the subscription period of the existing companies

2. A number of manufacturers responded to the decline in production in the lithium battery industry: normal production scheduling and orders are growing

3. Wang Zhe: In June, the prosperity of the manufacturing industry remained good, and supply, domestic demand, and exports continued to expand

4. Beijing: Promote the construction of computility infrastructure and build a computility supply corridor in Beijing, Tianjin, Hebei and Mongolia

5. CITIC Securities: In the early stage, multiple policies have made efforts to increase the valuation of bank stocks with more fundamental support

International News

1. The demand gap for new energy vehicles in India's large and medium-sized cities has narrowed

2. The UK yield curve ended a more than year-long inversion

3. U.S. Treasury yields continued to rise, and the Fed's policy and employment data became the focus of attention

4. Capital Economics: Inflation in the German service sector is still worrying the ECB

5. The 2024/25 U.S. soybean harvest is still expected to be strong

Domestic News

1. The State Council: Clarify the transitional period arrangements for the adjustment of the subscription period of the existing companies

The Provisions clarify the transitional period arrangements for the adjustment of the subscription period of capital contributions by existing companies. If a company registered and established before June 30, 2024, and the remaining subscribed capital contribution period of a limited liability company exceeds 5 years from July 1, 2027, it shall adjust its remaining subscribed capital contribution period to 5 years before June 30, 2027 and record it in the articles of association, and the shareholders shall pay the subscribed capital contribution in full within the adjusted subscribed capital contribution period; The promoter of a company limited by shares shall pay the full amount of shares according to the shares subscribed by it before June 30, 2027.

2. A number of manufacturers responded to the decline in production in the lithium battery industry: normal production scheduling and orders are growing

On July 1, the lithium battery sector fell as a whole, of which CATL fell nearly 5% in early trading, and Xinwangda even fell more than 8%. Market analysts believe that this may be related to the "small composition" of "the industry's generally declined production data in July". The reporter then contacted a number of lithium battery manufacturers for verification. Among them, CATL responded that the company's operation is good, the global market share has increased steadily, the overall production schedule is round, and the recent and third quarter production schedule has shown a quarter-on-quarter growth trend. Guoxuan Hi-Tech told reporters that "production scheduling is normal, and orders are increasing instead of falling". In fact, a lithium industry business person is also more optimistic. He told reporters, "Generally speaking, the peak season of the downstream new energy vehicle market is concentrated in the third and fourth quarters, transmitted to the middle and upper reaches of the lithium battery market, and the peak season of stocking is concentrated in the second and third quarters." "The person expects that with the passage of time, the stocking tide of the lithium battery industry is coming." The lithium battery industry chain has been basically flat in the near future, and the prosperity will remain at a high level in the short term. (China Fund News)

3. Wang Zhe: In June, the prosperity of the manufacturing industry remained good, and supply, domestic demand, and exports continued to expand

Wang Zhe, a senior economist at Caixin Think Tank, said that the manufacturing industry continued to improve in June, with supply, domestic demand, and exports maintaining expansion, purchasing volumes and inventories rising, price levels rising slightly, and employment contraction improving, but the optimism of manufacturing entrepreneurs declined significantly. Lack of market confidence and effective demand remain the biggest challenges facing the economy today. Looking ahead, policy support for the economy still needs to be further strengthened, and policies such as the "three major projects" in the early stage, the optimization and adjustment of real estate regulation and control measures, large-scale equipment renewal and trade-in of consumer goods need to be further implemented. In addition, the promotion of fiscal and taxation reform and other related policies should pay special attention to cultivating the optimistic expectations of market operators. (Caixin)

4. Beijing: Promote the construction of computility infrastructure and build a computility supply corridor in Beijing, Tianjin, Hebei and Mongolia

The 2024 Global Digital Economy Conference Artificial Intelligence Forum was held at the Conference Center of Zhongguancun National Independent Innovation Demonstration Zone. Xu Xinchao, Deputy Secretary-General of the Beijing Municipal People's Government, said at the meeting that Beijing will continue to deepen regional coordination and cooperation, optimize industrial policy support, continue to promote the construction of computing infrastructure in the city, build a Beijing-Tianjin-Hebei-Beijing-Tianjin computility supply corridor with Inner Mongolia - Hebei - Beijing - Tianjin as the main axis, and accelerate the implementation of large model applications.

5. CITIC Securities: In the early stage, multiple policies have made efforts to increase the valuation of bank stocks with more fundamental support

According to the CITIC Securities research report, from the content of the second quarter regular meeting of the Monetary Policy Committee, the main expressions continue the direction of the first quarter cargo policy report and the first quarter regular meeting, and the current "supportive" monetary policy is in the stage of effect observation and camera selection. In the next stage, it is recommended to pay attention to the effect and effectiveness of real estate financial policy adjustment in the short term, and also pay attention to the optimization process of the monetary policy framework such as the intermediate variables of monetary policy, the policy interest rate control mechanism, and the way of base money delivery in the medium and long term. From the perspective of sector investment, the multi-party policy force in the early stage will help improve the risk expectations of banks, and the valuation of bank stocks will be more fundamentally supported, further consolidating the certainty of dividend income space.

International News

1. The demand gap for new energy vehicles in India's large and medium-sized cities has narrowed

The anomaly that has plagued the UK bond market for more than a year ended on Monday, with the UK 10-year yield rising above the 2-year yield. This suggests that the UK's bond market is back to normalcy and that investors are pricing in the end of an era of tighter monetary policy that distorts the interest rate market. UK 2-year yields have been higher than 10-year yields since May 2023. The inversion ended as the Bank of England rate cut approached. Traders expect the Bank of England to start easing policy as early as August, with a close 55% chance of a 25 basis point rate cut next month.

2. The UK yield curve ended a more than year-long inversion

According to the Financial Times, 27 EU leaders will gather in Brussels on Thursday to discuss appointments to the top positions in the EU's next commission. Ursula von der Leyen is expected to be re-elected President of the European Commission, former Portuguese Prime Minister Costa is expected to become the next President of the European Council, and Estonian Prime Minister Kallas is expected to be the next foreign affairs commissioner. In addition to the three top positions, France and Italy are expected to compete for the economic post of Commissioner for Trade, Competition and Industry, which has the power to control policies and fiscal levers to achieve industrial policy. Since Macron's rise to power, his relationship with Italian Prime Minister Meloni has been strained. Relations between the two countries have fallen to their lowest point in recent weeks. Personal grievances are expected to exacerbate this battle for economic jobs.

3. US Treasury yields continued to rise, and the Fed's policy and employment data became the focus of attention

US Treasury yields entered the third quarter, extending their recent gains, although they remained well below their April highs. Fed Chair Jerome Powell will hold a policy panel discussion in Portugal tomorrow at 9:30 p.m. Beijing time. Economists polled by The Wall Street Journal expect the June jobs report, due on Friday, to fall from 272,000 to 195,000 and the unemployment rate to hold steady at 4%. Hawkish Fed rhetoric or stronger-than-expected data could keep yields elevated. The yield on the 10-year Treasury note is 4.446%, and the yield on the 2-year Treasury note is 4.785%.

4. Capital Economics: Inflation in the German service sector is still worrying the ECB

Palmas, senior European economist at Capital Economics, said that although headline inflation in Germany fell more than expected, services inflation remained high, which would keep ECB policymakers cautious. Services inflation remained unchanged at 3.9% in June, unchanged from May, while core inflation fell to 2.9% from 3.0%. Palmas said the slow deflation in the core and services sectors is consistent with the view that the ECB will cut rates gradually, and he expects the ECB to pause in July before cutting rates two more later this year.

5. The 2024/25 U.S. soybean harvest is still expected to be strong

According to the National Grain and Oil Information Center, based on the latest acreage data, we estimate the U.S. soybean supply outlook based on two different yield scenarios. First, based on the USDA's latest estimate of 85.261 million acres of harvested area, using the USDA's current forecast of a record yield of 52 bushels/acre, U.S. soybean production will reach 4.434 billion bushels this year, 016 million bushels lower than the USDA's June supply and demand report production data, and 270 million bushels or 6.46% higher than the previous year's production. Second, the recent intensification of drought in the Midwest and the declining crop conditions on a week-by-week basis may make it difficult for U.S. soybean yields to meet USDA expectations, assuming yields fall to 51 bushels/acre, and this year's U.S. soybean production is estimated at 4.348 billion bushels, which is 100 million bushels lower than the USDA's June supply and demand report, but still 180 million bushels higher than in 2022/23.

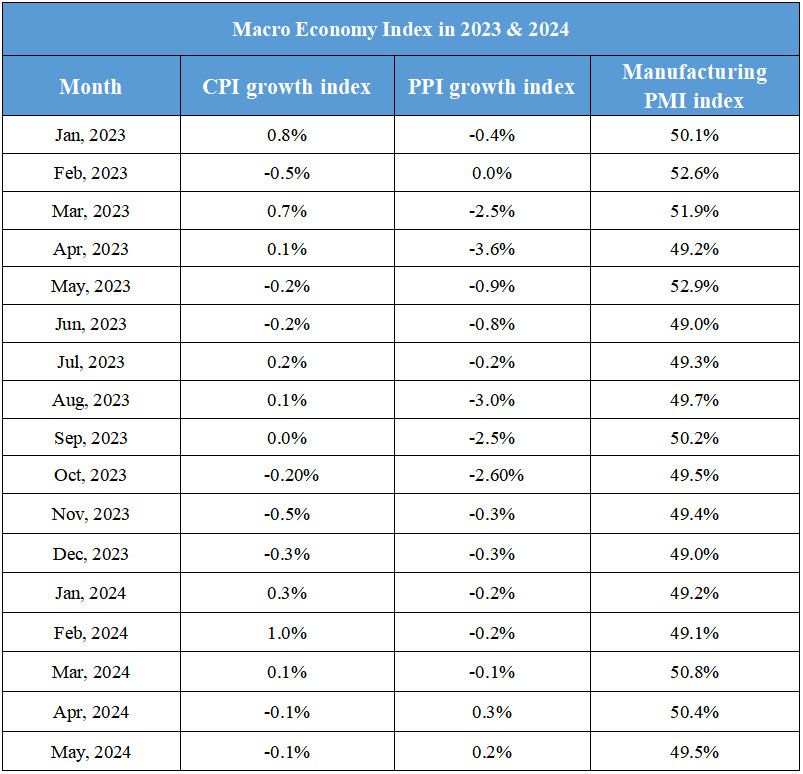

Domestic Macro Economy Index