July 2nd Macroeconomic Index: China's Rare Earth Regulations to Take Effect in October, Infrastructure Growth Expected to Rise

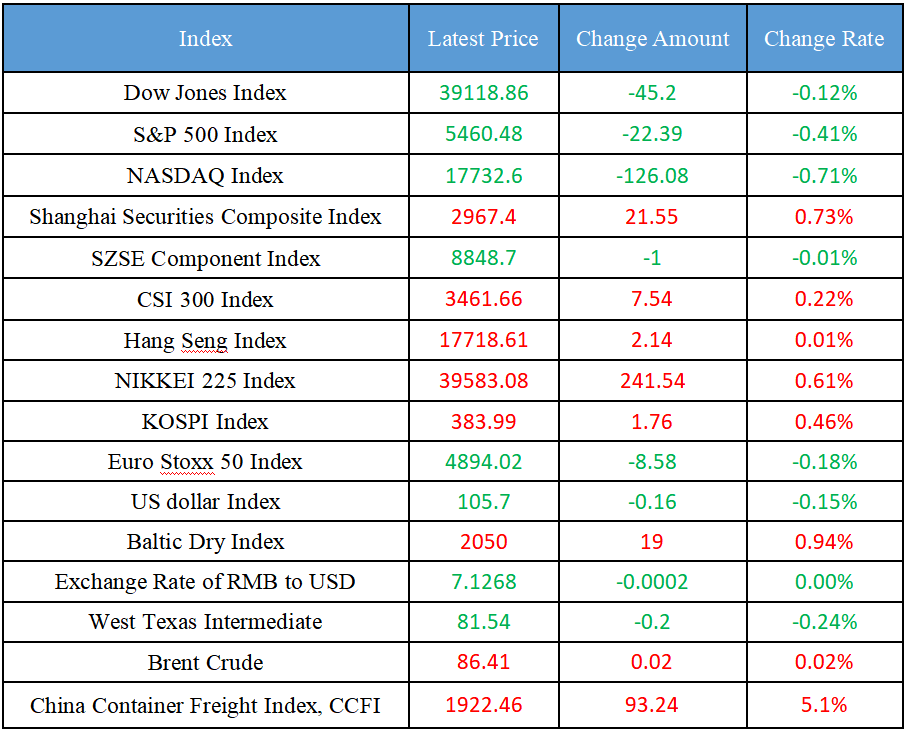

Latest Global Major Index

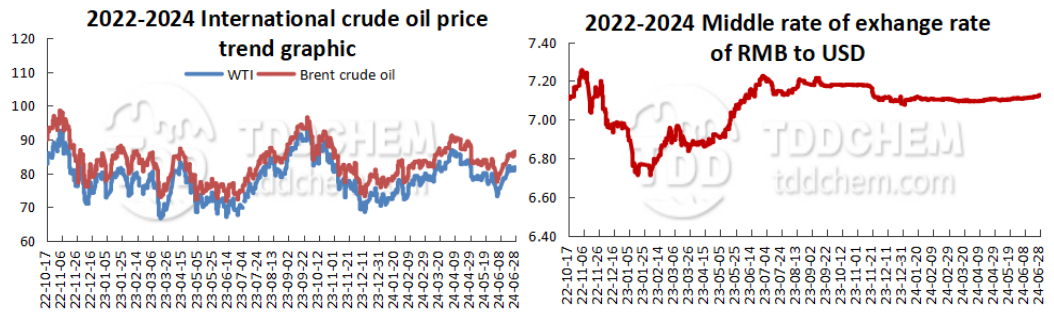

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The Premier of the State Council recently signed an order of the State Council promulgating the Regulations on the Administration of Rare Earths, which will come into force on October 1, 2024

2. China's cumulative imports from developing countries are expected to exceed 8 trillion US dollars

3. The Monetary Policy Committee of the Central Bank held a Q2 regular meeting of 2024

4. China Securities Co.: The issuance of special bonds accelerated in the third quarter, and the growth rate of infrastructure construction is expected to rise in the second half of the year

5. Beijing: It is planned to clarify that new, reconstructed and expanded roads, reserving space for intelligent roadside infrastructure

International News

1. Large U.S. banks announced interest rate hikes on June 28

2. Biden assured Democratic funders that he could still win the election

3. Egypt hopes to increase the proportion of renewable energy to 58% by 2040

4. Germany's arms exports have increased significantly due to the Russia-Ukraine conflict

5. Analysts: The Eurozone inflation report for June may not change the ECB's stance

Domestic News

1. The Premier of the State Council recently signed an order of the State Council promulgating the Regulations on the Administration of Rare Earths, which will come into force on October 1, 2024

The Premier of the State Council recently signed an order of the State Council promulgating the Regulations on the Administration of Rare Earths, which will come into force on October 1, 2024. There are 32 articles in the "Regulations", the main contents include: strengthening the protection of rare earth resources, making it clear that rare earth resources belong to the state, and no organization or individual may encroach on or destroy rare earth resources, and the state shall implement protective mining of rare earth resources; Improve the rare earth management system, and stipulate the responsibilities of the relevant departments of the State Council such as industry and information technology and natural resources in the management of rare earths; Promote the high-quality development of the rare earth industry, clarify the country's unified plan for the development of the rare earth industry, and encourage and support the research and development and application of new technologies, new processes, new products, new materials and new equipment in the rare earth industry; Improve the supervision system of the whole rare earth industry chain, stipulate the total regulation and control of rare earth mining and rare earth smelting and separation, and optimize dynamic management.

2. China's cumulative imports from developing countries are expected to exceed 8 trillion US dollars

China is planning and implementing major measures to further deepen reform in an all-round way, continue to expand institutional opening-up, and form a more market-oriented, law-based and international business environment. China will set up a Global South Research Center and provide 1,000 Scholarships for Excellence in the Five Principles of Peaceful Coexistence to countries in the Global South in the next five years. From now to 2030, China's cumulative imports from developing countries are expected to exceed US$8 trillion.

3. The Monetary Policy Committee of the Central Bank held a Q2 regular meeting of 2024

The meeting pointed out that it is necessary to intensify the implementation of the monetary policy that has been introduced. Maintain reasonable and abundant liquidity, guide the reasonable growth and balanced distribution of credit, and keep the scale of social financing and money supply in line with the expected targets of economic growth and price levels. Maintain the basic stability of the RMB exchange rate at a reasonable and balanced level, and resolutely guard against the risk of exchange rate overshoot. Effectively implement the existing structural monetary policy tools, increase financial support for large-scale equipment renewal and consumer goods trade-in, and guide financial institutions to increase medium and long-term loans for manufacturing industries with market demand; Increase financial support for the "market + security" housing supply system, and implement financial policy measures to promote the healthy development of the platform economy.

4. China Securities Co.: The issuance of special bonds accelerated in the third quarter, and the growth rate of infrastructure construction is expected to rise in the second half of the year

According to the China Securities Construction Investment Research Report, as of June 28, China issued 332.7 billion yuan of new special bonds in a single month, a decrease of 105.6 billion yuan from May, and the total issuance of 1,431.6 billion yuan for the whole year, with an issuance progress of 36.7%, which is still slow compared with previous years. Recently, many places announced the third quarter issuance plan, of which the new special bond plan to issue more than 1.6 trillion yuan, an increase of 859.3 billion yuan over the second quarter, is expected to be put into use with ultra-long-term treasury bonds, special bond projects continue to start in the third and fourth quarters, the second half of the infrastructure growth rate is expected to rise, it is recommended to pay attention to infrastructure-related central state-owned enterprises.

5. Beijing: It is planned to clarify that new, reconstructed and expanded roads, reserving space for intelligent roadside infrastructure

The Beijing Municipal Bureau of Economy and Information Technology has publicly solicited opinions on the "Beijing Autonomous Vehicle Regulations (Draft for Comments)", and has made comprehensive and systematic provisions on the integration of vehicles, roads and clouds such as traffic areas, intelligent roadside infrastructure construction, and service management platforms. It is proposed to make overall planning of traffic areas and roads, and support the opening of the whole region with complete intelligent roadside infrastructure; It is clarified that new, reconstructed and expanded roads reserve space for intelligent roadside infrastructure, and encourage the full use of existing facilities to transform and upgrade; Coordinate the construction of a unified autonomous vehicle safety monitoring platform and cloud control infrastructure platform for autonomous vehicles in the city; encourage the construction of low-latency and high-reliability communication networks; Support relevant entities to carry out pilot applications of autonomous driving maps, and give full play to the role of map support.

International News

1. Large U.S. banks announced interest rate hikes on June 28

Major U.S. banks announced dividend hikes on June 28, after easily passing the Federal Reserve's annual stress test, with JPMorgan Chase and Morgan Stanley also approving tens of billions of dollars in share buyback programs. The Fed asked banks to wait until after the market closes on June 28 to disclose updates to give each company and investors time to digest the results.

2. Biden assured Democratic funders that he could still win the election

US President Joe Biden assured Democratic patrons that he can still beat Trump to win the presidential election, according to the BBC, after his poor performance in the debate raised concerns about his candidacy. Biden, 81, took part in a series of fundraising activities in New York and New Jersey on Saturday and defended his performance in the CNN presidential debate. At one of the events, Biden said, "I don't have a big dream but neither does Trump, and I assure you that we will win this election." He said he understood concerns about his performance in Thursday's debate, but pledged to fight harder.

3. Egypt hopes to increase the proportion of renewable energy to 58% by 2040

Egypt's Minister of Electricity Mohammed Shakel said on the 29th that by 2040, it hopes to increase the proportion of renewable energy power generation to 58%, which is Egypt's latest strategic plan to expand green power supply. The previous target was to have renewables account for 42% of the country's electricity generation by 2030.

4. Germany's arms exports have increased significantly due to the Russia-Ukraine conflict

According to the latest data released by the German government, Germany's arms exports in the first half of this year increased by 30% compared with the same period last year, mainly due to the ongoing conflict between Russia and Ukraine. According to a report by the German Press Agency on the 30th, according to data released by the Ministry of Economy, as of the 18th of this month, the German government has approved at least 7.48 billion euros of arms exports this year, of which 4.88 billion euros’ worth of arms, or 65%, are exported to Ukraine. In 2023, the German government approved a record number of arms exports of 12.2 billion euros, mainly to Ukraine. The German Ministry of Economy published data on arms exports for the first half of this year at the request of parliamentarian Sevim Dadelen. Dadelen accused the government of "irresponsible" behavior by significantly increasing arms exports to conflict zones.

5. Analysts: The Eurozone inflation report for June may not change the ECB's stance

Analyst Giuseppe Dellamotta said that the Eurozone CPI is expected to be released next Tuesday at an annual rate of 2.5%, compared to 2.6% previously; Core CPI is expected to come in at 2.8% y/y versus 2.9% previously. The report is not expected to change any of the ECB's thinking, as they want to see data for the whole summer before the decision to cut rates in September. Still, if inflation slows faster over the summer, or if the economy experiences some rapid deterioration, the market should be pricing in more rate cuts before the end of the year. Currently, the market is pricing in a 46bp rate cut by the ECB by the end of the year, with a 61% chance of leaving it unchanged at the July meeting and an 83% chance of a rate cut at the September meeting.

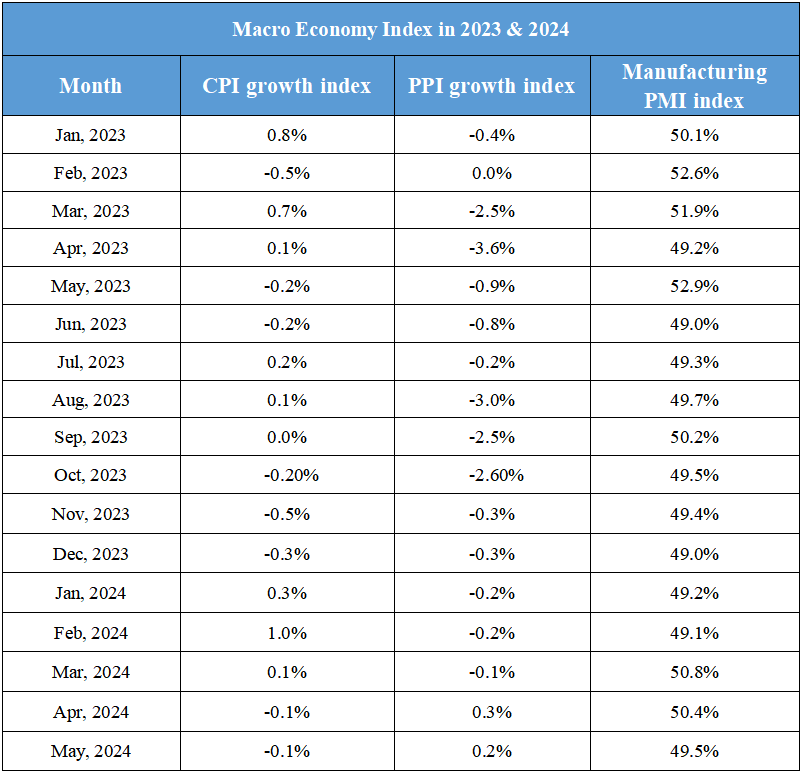

Domestic Macro Economy Index