June 28th Macroeconomic Index: China's Industrial Profits Rise, US Housing Contracts Fall to Record Low

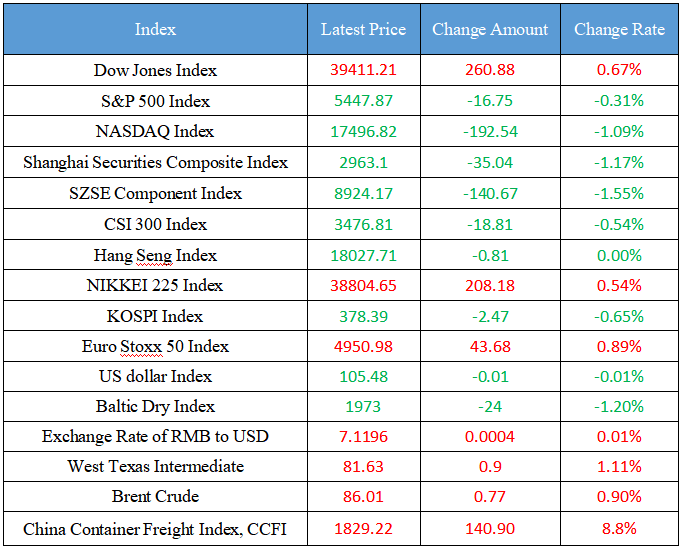

Latest Global Major Index

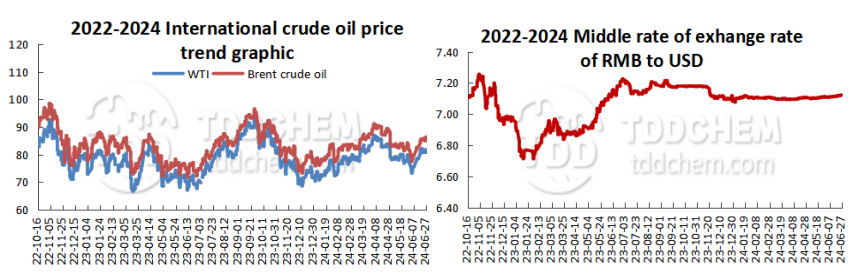

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Political Bureau of the CPC Central Committee: By 2035, a high-level socialist market economy system will be built in an all-round way

2. State-owned Assets Supervision and Administration Commission: It is actively promoting state-owned enterprises to accelerate the development of new quality productive forces

3. National Bureau of Statistics: From January to May, the profits of industrial enterprises above designated size increased by 3.4% year-on-year, continuing the growth trend since the beginning of the year

4. The coal market will run smoothly in the peak summer

5. China's first ultra-deep and extended-reach well project was fully put into operation

International News

1. The U.S. second-hand housing contract volume index unexpectedly fell to a record low due to factors such as high interest rates

2. The depreciation of the yen has triggered a wave of tourism in Japan, and the shortage of aviation fuel has become a "stumbling stone"

3. Switzerland and the United States reached an agreement on the exchange of financial account data with each other

4. The U.S. data was broadly in line with expectations, and the market turned to tomorrow's PCE data

5. Brazil's central bank raised its economic growth forecast for the country to 2.3% in 2024

Domestic News

1. Political Bureau of the CPC Central Committee: By 2035, a high-level socialist market economy system will be built in an all-round way

The Political Bureau of the CPC Central Committee held a meeting. The meeting stressed that the overall goal of further comprehensively deepening reform is to continue to improve and develop the socialist system with Chinese characteristics and promote the modernization of the national governance system and governance capacity. By 2035, we will build a high-level socialist market economy in an all-round way, further improve the socialist system with Chinese characteristics, basically modernize the national governance system and governance capacity, and basically realize socialist modernization, so as to lay a solid foundation for building China into a great modern socialist country in all respects by the middle of this century.

2. State-owned Assets Supervision and Administration Commission: It is actively promoting state-owned enterprises to accelerate the development of new quality productive forces

On June 25, 2024, Wang Hongzhi, Deputy Director of the State-owned Assets Supervision and Administration Commission of the State Council, was invited to attend the 15th Summer Davos Forum and met with Schwab, Founder and Executive Chairman of the World Economic Forum. Wang Hongzhi said that over the years, the State-owned Assets Supervision and Administration Commission of the State Council and the central enterprises have established close and friendly cooperative relations with the World Economic Forum. At present, the State-owned Assets Supervision and Administration Commission of the State Council is actively promoting state-owned enterprises to accelerate the development of new quality productive forces, and the theme and key topics of this year's forum are very consistent with the development direction of China's state-owned enterprises. The State-owned Assets Supervision and Administration Commission of the State Council is willing to continue to strengthen exchanges with the forum, support central enterprises to strengthen experience exchanges with other countries through participating in the forum, and hope that the two sides will continue to promote the researcher program and further deepen cooperation.

3. National Bureau of Statistics: From January to May, the profits of industrial enterprises above designated size increased by 3.4% year-on-year, continuing the growth trend since the beginning of the year

Yu Weining, a statistician from the Department of Industry of the National Bureau of Statistics, interprets the profit data of industrial enterprises. From January to May, the profits of industrial enterprises above designated size increased by 3.4% year-on-year, continuing the growth trend since the beginning of the year. Affected by short-term factors such as the decline in the growth rate of investment income, the profit growth rate of industrial enterprises above the designated size fell by 0.9 percentage points compared with that from January to April, but from the perspective of gross profit calculated by deducting operating income from operating costs, the growth rate of gross profit of enterprises from January to May was 0.8 percentage points faster than that from January to April, accelerating for two consecutive months, and the fundamentals of industrial enterprise efficiency continued to improve.

4. The coal market will run smoothly in the peak summer

Recently, extreme weather has occurred in many places across the country, and the overall situation is in a state of "drought in the north and flooding in the south", and the energy supply guarantee work in the peak summer has also ushered in a critical moment. The reporter learned from multiple interviews that the output of hydropower and other renewable energy will increase this year, coupled with the orderly supply of coal, the market is expected to maintain stable operation this summer, and the demand may increase in the second half of the year. At the same time, the pattern of coal producing areas is changing, and the whole industry is continuing to accelerate the green and intelligent transformation, bringing a new atmosphere to the development of the industry. (SSE News)

5. China's first ultra-deep and extended-reach well project was fully put into operation

CNOOC Limited announced that China's first ultra-deep extended reach well project, the Enping 21-4 oilfield, has been fully put into production, with a peak daily output of 740 tons of light crude oil. Enping 21-4 oilfield is located about 200 kilometers southwest of Shenzhen, with an average water depth of about 89 meters, and is a small sandstone marginal oilfield. CNOOC Limited has carried out technological and management model innovation, relying on the Enping 20-5 unmanned platform 8 kilometers away, to implement two ultra-deep and extended reach wells to develop oil and gas resources cost-effectively. (Xinhua News Agency)

International News

1. The U.S. second-hand housing contract volume index unexpectedly fell to a record low due to factors such as high interest rates

The U.S. second-hand home contract volume index unexpectedly fell to a record low in May, as rising mortgage rates and high home prices discouraged potential buyers. The National Association of Realtors (NAR) said Thursday that the index of second-hand home contracts fell 2.1 percent to 70.8, the lowest level since 2001. Economists surveyed by Bloomberg expected a median growth of 0.5%. NAR Chief Economist Lawrence Yun said in a statement that home inventory is rising while demand is falling, and the supply and demand trend suggests that the upward momentum in home prices will slow in the coming months, although as long as the economy continues to create jobs, the increase in inventory will inevitably lead to more home purchases, especially as mortgage rates fall.

2. The depreciation of the yen has triggered a wave of tourism in Japan, and the shortage of aviation fuel has become a "stumbling stone"

According to foreign media reports, the shortage of aviation fuel, which has been affecting the operation of domestic airports in Japan, has now expanded to Tokyo's Narita Airport, the largest airport in Japan. The airport said fuel shortages have affected the company's operations, with flight schedules currently affecting about 57 flights per week. Narita International Airport CEO Akibiko Tamura said, "We need to increase our fuel suppliers and ask governments and distributors to also receive fuel directly from overseas. "Narita Airport has also asked domestic dealers to ensure a stable supply, but it is currently unable to increase fuel sufficiently. The boom in international travel is reportedly driving global jet fuel consumption, with Asian flights expected to increase by 23% in 2024 compared to last year. The number of inbound tourists to Japan has increased dramatically due to the weakening yen, and the Japanese government aims to attract about 60 million international tourists annually by 2030.

3. Switzerland and the United States reached an agreement on the exchange of financial account data with each other

According to the statement, Switzerland and the United States signed a new Foreign Account Tax Compliance Act (FATCA) agreement on June 27 to establish a financial account data swap mechanism. Changes to the financial account data swap model are expected to apply from 2027. FATCA is currently implemented in Switzerland under "Model 2", where Swiss financial institutions disclose account details directly to the US tax authorities with the consent of the relevant US customers. If the U.S. customer does not agree, the U.S. must request the data through normal administrative assistance channels. Currently, the United States does not transfer account data to Switzerland. A spokesman for the Swiss Ministry of Finance said that after the adjustment, U.S. customers located in Switzerland will lose the possibility of refusing consent unless they can prove that the rules do not apply to them.

4. The U.S. data was broadly in line with expectations, and the market turned to tomorrow's PCE data

US jobless claims fell to 233,000 from 238,000 the previous week, while the final U.S. GDP for the first quarter was 1.4%, in line with market expectations. Meanwhile, core durable goods orders fell disappointingly by 0.6% in May, compared to expectations for a 0.1% rise. So, with no major surprises, the market will soon turn to tomorrow's core PCE data, which is expected to fall to 2.6% y/y from 2.8% in April (which would be the lowest since March 2021). USDJPY did not react materially to the data, holding around 160.50.

5. Brazil's central bank raised its economic growth forecast for the country to 2.3% in 2024

On June 27, local time, the second quarter inflation report released by the Central Bank of Brazil showed that the country's economic growth expectation in 2024 increased from 1.9% to 2.3%. According to the report, Brazil's economy grew by 0.8% in the first quarter of 2024 from the previous quarter, growing faster than expected. Although the floods that occurred in the southern Brazilian state of Rio Grande do Sul at the end of April this year had a negative impact on the local economy, the local economy is currently recovering, and the impact of the floods on Brazil's economic growth throughout the year will be less than expected. The report also said that inflation in Brazil is likely to rise in the second quarter of this year, and then it will start to show a downward trend; Inflation is expected to be 4% in 2024.

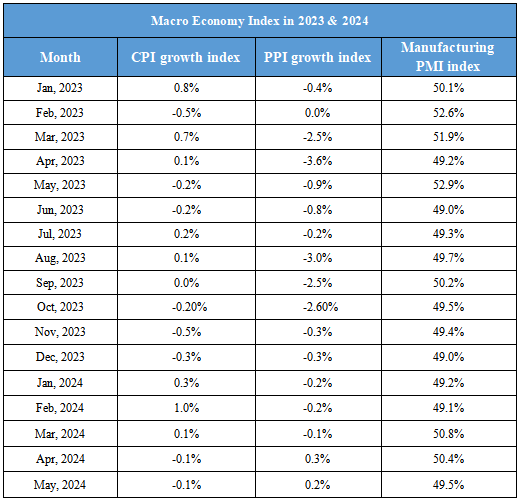

Domestic Macro Economy Index