June 26th Macroeconomic Index: China's Balance of Payments Expected to Remain Stable, Product Competitiveness in Passenger Car Market Declines

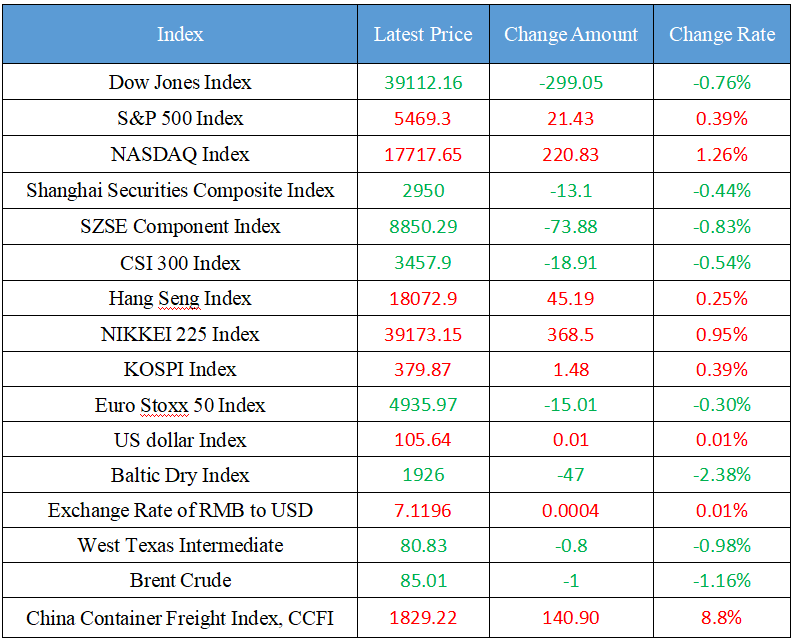

Latest Global Major Index

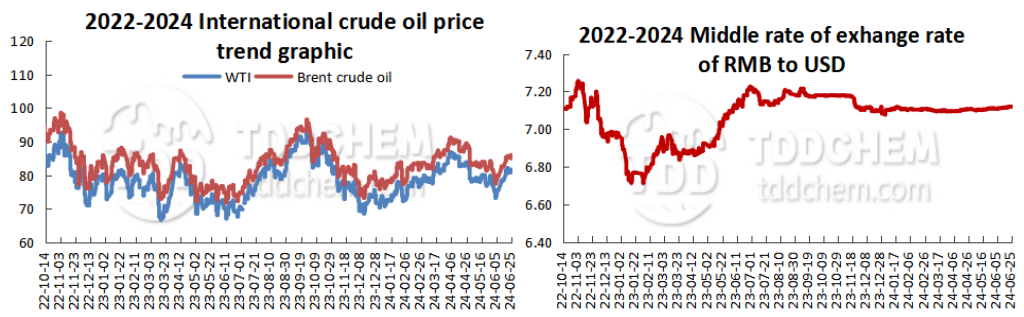

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Foreign Exchange Bureau: In the medium and long term, China's balance of payments has the conditions and foundation to continue to run smoothly

2. Passenger Federation Branch: The product competitiveness index of the passenger car market in May was 86.7, down 4.6 points from the previous month

3. The Ministry of Foreign Affairs responded to Canada's consideration of imposing import tariffs on Chinese EV

4. Two departments: it is necessary to consolidate the responsibilities of local governments, real estate enterprises, and financial institutions and strengthen the review and control of the "white list".

5. The General Administration of Customs and the Ministry of Agriculture and Rural Affairs: Lift the ban on the highly pathogenic avian influenza epidemic in Poland

International News

1. Assistant to the President of Russia: The conflict in Ukraine cannot be resolved without the participation of Russia

2. Mitsubishi UFJ: Japan may still face pressure to boost the yen

3. Traders are boldly betting that the Fed will cut interest rates 12 times by March next year

4. JPMorgan Chase: The liquidity of the U.S. Treasury market is better than traders’ expectation

5. Société Générale: As the Fed nears an interest rate cut, the S&P 500 index will maintain a "buying on weakness mode"

Domestic News

1. Foreign Exchange Bureau: In the medium and long term, China's balance of payments has the conditions and foundation to continue to run smoothly

The Party Branch of the Balance of Payments Department of the State Administration of Foreign Exchange issued a document saying that in the medium and long term, China's balance of payments has the conditions and foundation to continue to operate smoothly. On the one hand, there is a solid foundation for maintaining a reasonable and balanced current account surplus. China's savings rate is at a relatively high level in the world, and domestic investment will pay more attention to efficiency in the future, and the savings rate and investment rate are expected to maintain a positive gap of reasonable scale, supporting the current account surplus to maintain a reasonable level. At the same time, China's industrial chain is complete, skilled workers are sufficient and other relative advantages are obvious, and the transformation and upgrading of the manufacturing industry is steadily advancing, which will help optimize the export structure and cultivate new trade growth points. On the other hand, cross-border investment and financing is expected to maintain a balanced and orderly development trend. With the steady progress of the two-way opening up of the financial market and the continuous improvement of cross-border investment and financing facilitation, the potential of the consumer market and the improvement of the business environment will continue to attract long-term capital to invest in China.

2. Passenger Federation Branch: The product competitiveness index of the passenger car market in May was 86.7, down 4.6 points from the previous month

The Passenger Car Market Information Joint Branch of the China Automobile Dealers Association and Shanghai Fulan Automotive Technology Co., Ltd. jointly released the "Product Competitiveness Index", with January 2019 as the base period, the overall market product competitiveness index in May 2024 was 86.7, down 4.6 points from the previous month. And from the perspective of the three major segment markets, the sedan and MPV markets increased by 0.6 and 0.8 points month-on-month, respectively, while the SUV market fell by 5.7 points month-on-month.

3. The Ministry of Foreign Affairs responded to Canada's consideration of imposing import tariffs on Chinese EV

At a press conference of the Ministry of Foreign Affairs on June 25, a reporter asked that Canada is considering imposing import tariffs on Chinese electric vehicles due to the problem of "overcapacity". Do you have any response to this? Chinese Foreign Ministry spokesperson Mao Ning said that we have always believed that politicizing economic and trade issues and artificially erecting trade barriers will only undermine the normal economic and trade cooperation between China and Canada or the world, and will undermine the stability of international production and supply chains and global efforts to combat climate change, which is not in the interests of any party.

4. Two departments: it is necessary to consolidate the responsibilities of local governments, real estate enterprises, and financial institutions and strengthen the review and control of the "white list".

The Ministry of Housing and Urban-Rural Development and the State Administration of Financial Supervision jointly held a video conference on the training of the housing delivery policy. The meeting pointed out that in order to further play the role of the urban real estate financing coordination mechanism and better meet the reasonable financing needs of urban real estate projects, it is necessary to consolidate the responsibilities of local governments, real estate enterprises and financial institutions; Improve the composition of the mechanism, improve the management of project push feedback, and increase the intensity of project restoration; strengthen the review and control of the "white list"; guide banks to do a good job in financing support; Do a good job of summarizing and promoting experience.

5. The General Administration of Customs and the Ministry of Agriculture and Rural Affairs: Lift the ban on the highly pathogenic avian influenza epidemic in Poland

According to the website of the General Administration of Customs, the General Administration of Customs and the Ministry of Agriculture and Rural Affairs issued an announcement on lifting the ban on the highly pathogenic avian influenza epidemic in Poland. Based on the results of risk analysis, the ban on the outbreak of highly pathogenic avian influenza in Poland has been lifted as of the date of this announcement. The General Administration of Customs and the Ministry of Agriculture and Rural Affairs Joint Announcement No. 11 [2020] shall be abolished at the same time.

International News

1. Assistant to the President of Russia: The conflict in Ukraine cannot be resolved without the participation of Russia

On June 25, local time, Russian presidential assistant Ushakov said that Russian President Putin's peace proposal provides the possibility of ending the conflict in Ukraine immediately. There is a growing recognition that the conflict in Ukraine cannot be resolved without Russia's involvement. Russian President Vladimir Putin previously said that Russia's peace proposal offers a real possibility of resolving the conflict in Ukraine through diplomatic channels, but many politicians in the West are reluctant to understand the essence of the proposal.

2. Mitsubishi UFJ: Japan may still face pressure to boost the yen

Mitsubishi UFJ Financial Group said Japanese officials may will continue to be under pressure to intervene further to boost the yen, given the lack of fundamental factors that prompted the yen to reverse its downward trend in the near future. Lee Hardman, an analyst at the group, said in a note: "As we have seen over the past month, the yen continues to weaken, although yield spreads between Japan and other countries have been narrowing. "The latest international money market report shows that leveraged funds have been rebuilding short yen positions in recent weeks, which have risen to their highest levels since 2017.

3. Traders are boldly betting that the Fed will cut interest rates 12 times by March next year

Traders in the U.S. interest rate options market are embracing an emerging bet on the Fed's interest rate trajectory: up to 300 basis points of rate cuts over the next nine months (12 at the usual 25bp range). Over the past three sessions, positioning in the options market linked to the guaranteed overnight funding rate has shown that those bets will benefit if the Fed cuts rates to a low of 2.25% in the first quarter of 2025. Unless the U.S. economy suddenly falls into recession, such an outcome seems unlikely. This is an aggressive bet considering the market expects the Fed to cut rates by about 75 basis points during this period. Fed officials recently forecast a rate cut of just 25 basis points by the end of the year, for a total of 125 basis points by the end of 2025. Now, some are also starting to ramp up their bets to hedge against the consequences of tail risks, such as rapid and extreme rate cuts.

4. JPMorgan Chase: The liquidity of the U.S. Treasury market is better than traders’ expectation

For investors watching signs of turmoil in U.S. Treasuries, JPMorgan Chase & Co. has some advice: Don't worry, liquidity in the world's largest bond market is improving. JPMorgan interest rate strategists such as Jay Barry said the improvement trend in broad liquidity indicators continued into 2024 thanks to lower volatility. Strategists said that JPMorgan's preferred indicator, "Depth of Market," has "been steadily improving" over the past year. However, the strategists added that the "depth of the market" is still about 50% below the 10-year average, as Treasury market liquidity remains highly sensitive to uncertainty. After the Fed ended its rate hike in July 2023, market expectations for a rate cut this year increased sharply.

5. Société Générale: As the Fed nears an interest rate cut, the S&P 500 index will maintain a "buying on weakness mode"

Société Générale believes that as the Fed gradually moves closer to cutting interest rates, investors may continue to pour in when there are signs of a correction in U.S. stocks, and expects the Fed's easing cycle to start in early 2025. Strategists such as Manish Kabra, head of U.S. equity strategy at Société Générale, expect the S&P 500 to "remain in buying on weakness mode, with the next rally close to the Fed's rate-cutting cycle," despite the S&P 500's 15% year-to-date gain. ”

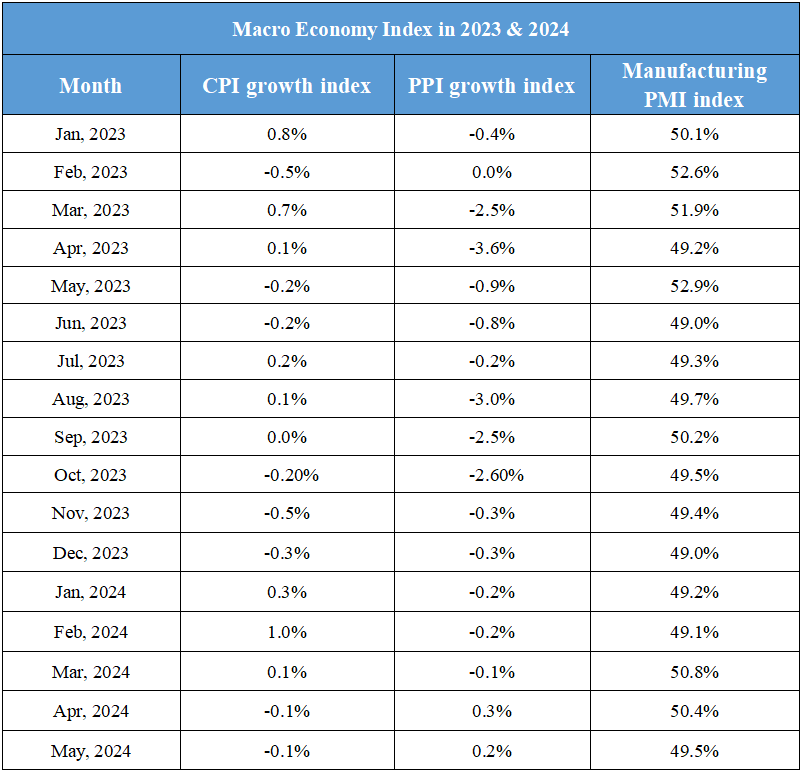

Domestic Macro Economy Index