June 21st Macroeconomic Index: China Issues Natural Gas Utilization Measures, Central Bank Stabilizes Exchange Rate

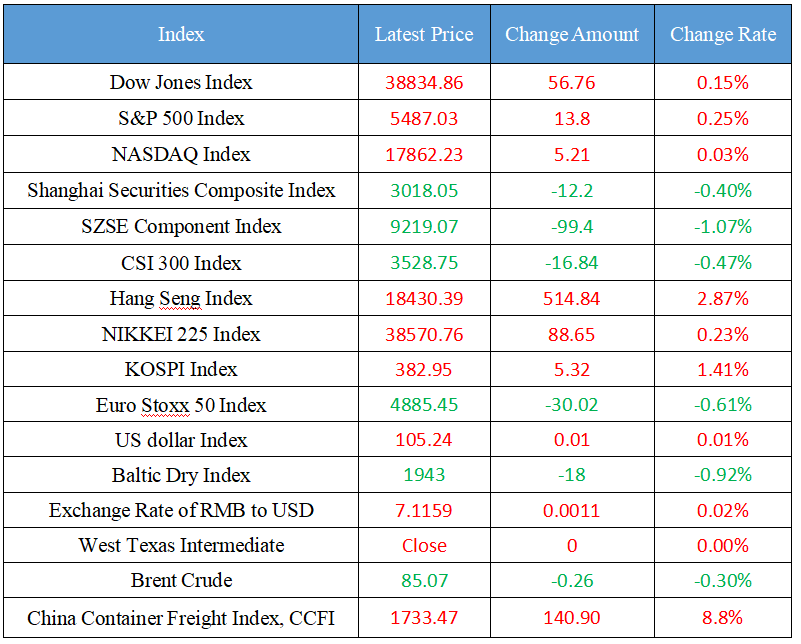

Latest Global Major Index

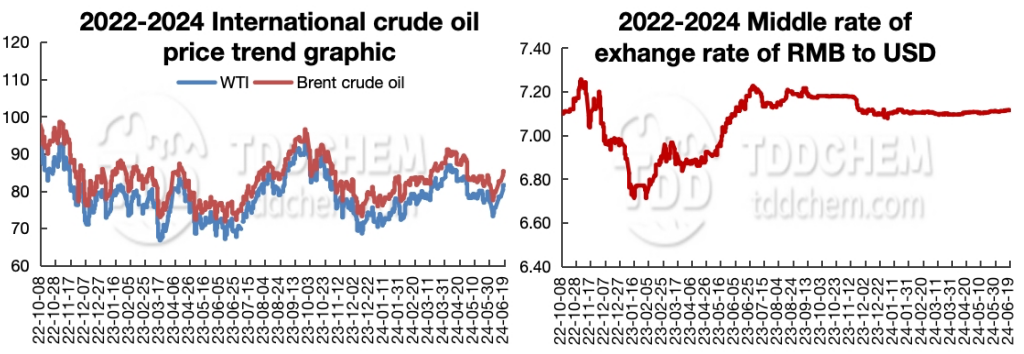

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The National Development and Reform Commission issued the Administrative Measures for Natural Gas Utilization to further guide the standardized and effective development of the natural gas market

2. The central bank's media commentator in charge: The central bank issued additional offshore central bills to release an important signal to stabilize the exchange rate

3. General Office of the State Council: Encourage industry backbone enterprises, scientific research institutions, innovation and entrepreneurship platform institutions to participate in venture capital, and focus on cultivating a number of outstanding venture capital institutions

4. Liu Jun, President of the Industrial and Commercial Bank of China: The Matthew effect of scientific and technological innovation has gradually strengthened the role of leading enterprises in industrial reshaping

5. Sinovel Precision: It plans to invest in the construction of a digital industrial park project for high-performance cemented carbide materials

International News

1. The Bank of England may cut interest rates in August and November

2. Indian government: India's coal power demand is at a record high

3. Nordea: The euro is expected to move lower against the dollar due to interest rate differentials

4. The release of EIA data has been postponed

5. US mortgage rates fell below 7% for the first time since March last week

Domestic News

1. The National Development and Reform Commission issued the Administrative Measures for Natural Gas Utilization to further guide the standardized and effective development of the natural gas market

The National Development and Reform Commission issued the "Measures for the Administration of Natural Gas Utilization". According to the relevant regulations, the general requirement is to guarantee the use of gas in the direction of priority natural gas utilization; No new construction or expansion of relevant production capacity will be made in the direction of restricted natural gas utilization; For the prohibition of natural gas utilization, upstream enterprises will no longer meet the gas demand. In addition to the priority, restricted and prohibited categories of these measures, and in line with the relevant national laws, regulations and policies, the direction of natural gas utilization is allowed, and for the projects in the direction of such utilization, the business entity is allowed to develop in an orderly manner under the conditions of implementing gas sources and economic sustainability and full market competition.

2. The central bank's media commentator in charge: The central bank issued additional offshore central bills to release an important signal to stabilize the exchange rate

In the past year, the central bank has issued offshore RMB central bills many times, and the balance of central bills of 6 months or more accounts for nearly 80%, releasing an important policy signal to strengthen the adjustment of offshore RMB liquidity and stabilize the RMB exchange rate, indicating the central bank's determination to resolutely stabilize the exchange rate, which is conducive to stabilizing foreign exchange market expectations. Looking ahead, China's foreign exchange market has the foundation and conditions to maintain steady operation, and the RMB exchange rate will remain basically stable at a reasonable and balanced level. On the one hand, China's economic fundamentals are more solid. On the other hand, in the medium and long term, with the effective improvement of the quality of the economy and the reasonable growth of the quantity, there is a solid foundation for the RMB exchange rate to remain basically stable at a reasonable and balanced level. (Financial Times)

3. General Office of the State Council: Encourage industry backbone enterprises, scientific research institutions, innovation and entrepreneurship platform institutions to participate in venture capital, and focus on cultivating a number of outstanding venture capital institutions

The General Office of the State Council issued the "Several Policies and Measures to Promote the High-quality Development of Venture Capital". Among them, it is proposed to accelerate the cultivation of high-quality venture capital institutions. Encourage industry backbone enterprises, scientific research institutions, innovation and entrepreneurship platform institutions to participate in venture capital, focus on cultivating a number of outstanding venture capital institutions, and support small and medium-sized venture capital institutions to improve their development level. Guide venture capital institutions to standardize their operations, and improve their comprehensive service capabilities such as equity investment, industry guidance, and strategic consulting. Where venture capital institutions carry out private investment fund business in accordance with provisions, they shall perform registration and filing formalities in accordance with laws and regulations. Entities that have not been registered and filed shall use their own funds to invest.

4. Liu Jun, President of the Industrial and Commercial Bank of China: The Matthew effect of scientific and technological innovation has gradually strengthened the role of leading enterprises in industrial reshaping

Liu Jun, President of the Industrial and Commercial Bank of China, said that the speed and dimension of scientific and technological innovation have changed differently. In the past, everyone has been talking about how long Moore's Law will continue in the process of high-speed innovation, and whether there will be attenuation, but from the current results, there is no attenuation. Moore's Law is still true, and to some extent it may develop faster, we see that from the development speed of artificial intelligence chips, we can see that the efficiency improved in eight years is a thousand times, this development speed tells everyone that the marginal effect of scientific and technological innovation may be decreasing, and the traditional laws of economics may be subverted in this field. He said that there is an enhanced version of the Matthew effect of scientific and technological innovation, where the winner takes all, and the head effect, the head enterprise, and the technology giant have become more and more powerful in reshaping the ecosystem and the industry.

5. Sinovel Precision: It plans to invest in the construction of a digital industrial park project for high-performance cemented carbide materials

Sinovel Precision announced that the company plans to set up a wholly-owned subsidiary, Sinovel New Materials, in Hetang High-tech Industrial Development Zone, Zhuzhou City, with a registered capital of 40 million yuan, and with the newly established subsidiary as the implementation body, Zhuzhou Hetang High-tech Industrial Development Zone will build Zhuzhou Sinovel High-performance Cemented Carbide Material Digital Industrial Park, with a total project investment of not less than 400 million yuan. In order to promote the implementation of the industrial park project, the company signed the "Admission Agreement" with the Management Committee of Hetang High-tech Industrial Development Zone in Zhuzhou on June 19.

International News

1. The Bank of England may cut interest rates in August and November

Gabriella Dickens, an economist at AXA Investment Management, said in the report that the Bank of England is likely to cut interest rates in August and November as UK inflation and labor market data continue to slow. Headline inflation in the UK is likely to remain around 2% in June before edging higher in July as the UK energy price cap is expected to fall less than a year ago, "In the second half of the year, headline inflation is likely not to be higher than around 2.5% as core goods CPI inflation remains negative and food CPI inflation declines further," AXA said. ”

2. Indian government: India's coal power demand is at a record high

India's coal power demand rose by 7.3 percent this fiscal year, a record high, the government said in a statement on Wednesday. Earlier this week, electricity demand peaked at a record high in India's hot, arid northern plains. The Indian Meteorological Department (IMD) expects above-normal temperatures in June in the northwestern and central regions of India, one of the longest heatwaves in India's history. As of June 16, India's cumulative coal production stood at 207.48 million tonnes, up 9.27 percent from the same period last year. In 2023, more than 75% of India's electricity generation came from coal, compared to about 2% of gas-fired power generation in recent years, mainly due to the higher cost of natural gas relative to coal.

3. Nordea: The euro is expected to move lower against the dollar due to interest rate differentials

Nordea analysts said in the report that as the ECB cuts interest rates further and US interest rates remain high for longer, the interest rate differential between the eurozone and the US will widen, and the EUR/USD pair will weaken against the US dollar in the coming months. The European Central Bank (ECB) has been cutting interest rates since June, Nordea is expected to cut rates every quarter, and the Fed is not expected to start cutting rates until December. According to the bank, it is becoming increasingly clear that the ECB is starting a different cycle of interest rate cuts from the Fed, and that the EUR/USD pair will fall to 1.04 in three months and 1.05 by the end of the year.

4. The release of EIA data has been postponed

Due to the Juneteenth holiday, the U.S. EIA crude oil inventory data will be postponed to 23:00 on June 20 (Thursday), and the API crude oil inventory data will remain unchanged at 04:30 on June 19 (Wednesday), so please pay attention.

5. US mortgage rates fell below 7% for the first time since March last week

Last week, U.S. mortgage rates fell below 7% for the first time since March, spurring a sequential increase in home purchase financing applications. The contract rate on a 30-year fixed mortgage fell 8 basis points to 6.94% in the week ended June 14, according to data released Wednesday by the Mortgage Bankers Association (MBA). The index of home mortgage applications rose 1.6% to its highest level since March. Treasury yields also fell significantly last week as government data showed broadly cooling inflationary pressures, prompting traders to ramp up bets that the Fed is in a better position to push forward with a rate cut, possibly as soon as September.

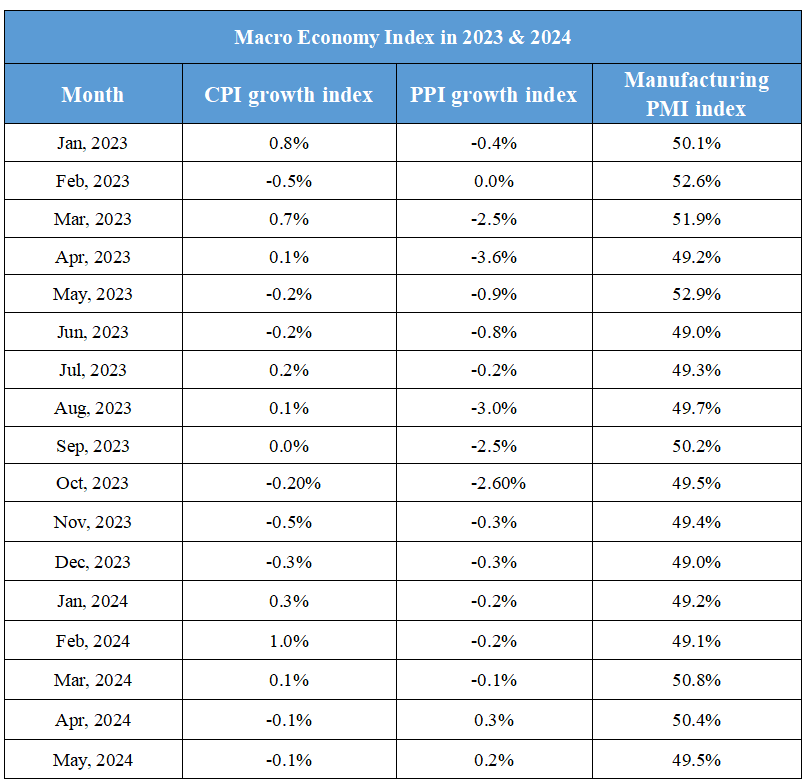

Domestic Macro Economy Index