June 20th Macroeconomic Index: US Industrial Output Surges, China Focuses on Cross-Border Financial Services

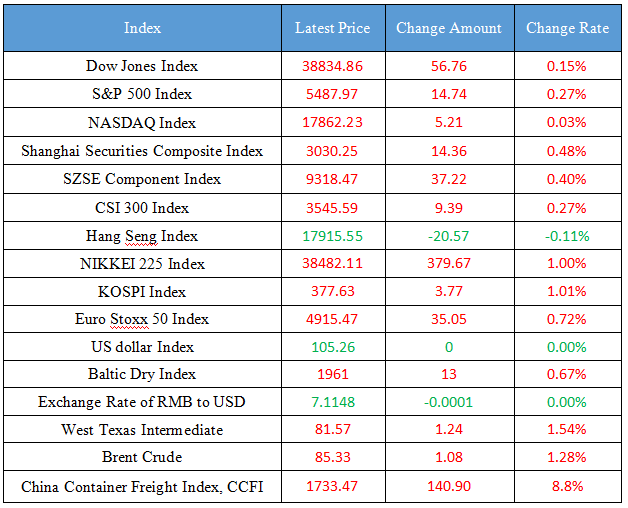

Latest Global Major Index

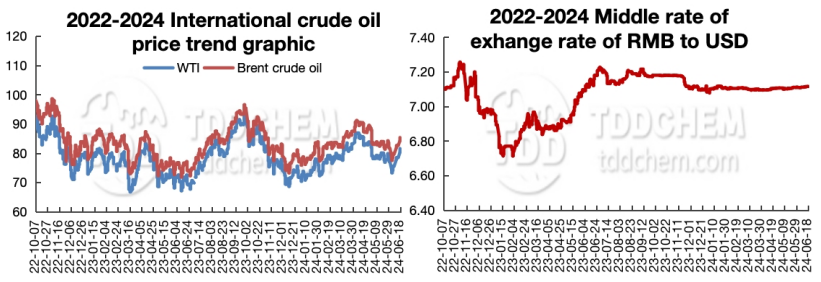

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Party Branch of the Research Bureau of the Central Bank: Study and introduce an action plan for the Shanghai International Financial Center to further improve the facilitation of cross-border financial services

2. Guangzhou held an economic situation analysis and scheduling meeting to vigorously promote the "three major projects" such as the transformation of urban villages

3. Li Qiang visited Tianqi Lithium Kuinana Lithium Hydroxide Company and Fortsk Metal Group Future Industry Center

4. GAC Group and Guangzhou Industrial Investment Co., Ltd. have comprehensively deepened their strategic cooperation

5. During the investigation in Guangdong and Shanghai, Zhang Guoqing emphasized that he should solidly promote the high-quality development of the manufacturing industry and accelerate the development of new quality productivity according to local conditions

International News

1. U.S. industrial output increased more than expected in May

2. Fed Williams: More data is needed to support interest rate cuts, and inflation will continue to fall

3. U.S. stocks are closed due to holidays

4. Bank of America survey: investors' pessimism about global economic growth has weakened, and most believe that the United States will avoid a recession

5. The new study said that quantitative easing has caused more than three times the loss of the Bank of England to the Federal Reserve

Domestic News

1. Party Branch of the Research Bureau of the Central Bank: Study and introduce an action plan for the Shanghai International Financial Center to further improve the facilitation of cross-border financial services

The Party Branch of the Research Bureau of the Central Bank published an article saying that the People's Bank of China will focus on new international trade and cross-border financial services, continue to increase facilitation policies and service supply, study and introduce an action plan for Shanghai International Financial Center to further improve the facilitation of cross-border financial services, and enhance the ability of finance to support the development of Shanghai's headquarters economy, especially multinational companies. Support Shanghai to build an international green finance hub, strengthen international cooperation in green finance and other fields, and promote the RMB as a green energy denominated currency. Strengthen communication and exchanges with other international financial organizations and international financial centers, continue to optimize the business environment, and attract more foreign financial institutions and long-term capital to develop their businesses.

2. Guangzhou held an economic situation analysis and scheduling meeting to vigorously promote the "three major projects" such as the transformation of urban villages

On June 17, Guangzhou held an economic situation analysis and scheduling meeting, Guo Yonghang, Secretary of the Municipal Party Committee, said that it is necessary to do everything possible to open up the market, implement policies such as large-scale equipment renewal and consumer goods trade-in, actively expand bulk consumption such as automobiles, housing, household appliances, etc., continue to carry out actions to promote consumption, vigorously support enterprises to explore overseas markets, and promote domestic and foreign trade to stabilize and improve. It is necessary to pay close attention to the construction of major projects, do a solid job in the planning and reserve of "two-fold" projects, promote the implementation of reserve projects as soon as possible, continue to consolidate the good momentum of industrial investment, speed up the implementation of the "Millions of Projects", and vigorously promote the "three major projects" such as the transformation of urban villages, so as to promote the acceleration and expansion of effective investment. It is necessary to accelerate industrial upgrading, develop and expand new quality productive forces, promote traditional industries to improve quality and create brands, continue to expand the new generation of information technology, new energy storage, low-altitude space economy and other strategic emerging industries, systematically plan the layout of future industries, accelerate the development of producer services, and cultivate new momentum for economic development.

3. Li Qiang visited Tianqi Lithium Kuinana Lithium Hydroxide Company and Fortsk Metal Group Future Industry Center

Premier Li Qiang, who is visiting Australia, visited Tianqi Lithium, Kwinana Lithium Hydroxide and Fortsk Metals Future Industry Center in Perth. At Tianqi Lithium Kwinana Lithium Hydroxide Company, Li Qiang, accompanied by Australian Minister of Resources Madeleine King and Governor Cook of Western Australia, listened to the company's person in charge introduce the company's relevant situation, and visited the lithium concentrate warehouse and product packaging workshop. Li Qiang said that China's new energy vehicles, lithium batteries and other industries have technology accumulation, Australia has rich resources in lithium and other critical minerals, the two sides can give full play to complementary advantages, tap their respective potential, and build a competitive industrial chain and supply chain in the field of new energy on the basis of mutual benefit, which not only serves the low-carbon development of the two countries, but also helps the global green transformation. It is hoped that Tianqi Lithium will continue to give back to the local society and benefit the local people's livelihood. It is also hoped that the Australian side will continue to provide a good business environment for Chinese enterprises to invest and operate.

4. GAC Group and Guangzhou Industrial Investment Co., Ltd. have comprehensively deepened their strategic cooperation

On June 18, the signing ceremony of the comprehensive deepening of strategic cooperation between GAC Group and Guangzhou Industrial Investment was held. Under the guidance of the Guangzhou State-owned Assets Supervision and Administration Commission, GAC Group and Guangzhou Industrial Investment will give full play to the advantages of both parties, deepen and expand the areas of cooperation, and further strengthen cooperation in the fields of talent training, industrial chain layout, scientific and technological innovation, and green and low-carbon transformation of the automobile industry in the future.

5. During the investigation in Guangdong and Shanghai, Zhang Guoqing emphasized that he should solidly promote the high-quality development of the manufacturing industry and accelerate the development of new quality productivity according to local conditions

Zhang Guoqing, Member of the Political Bureau of the CPC Central Committee and Vice Premier of the State Council, recently investigated the high-quality development of the manufacturing industry in Guangdong and Shanghai. From the 14th to the 18th, Zhang Guoqing went deep into electronic information, biomedicine, commercial aerospace, shipbuilding, artificial intelligence and other enterprises and scientific research institutions in Guangzhou, Shenzhen and Shanghai to learn about innovative research and development, manufacturing and industry development. He pointed out that to promote the high-quality development of the manufacturing industry, cultivate and develop new quality productivity, we must adhere to scientific and technological innovation to lead industrial innovation. It is necessary to continue to further promote the high-quality development of key industrial chains in the manufacturing industry, give full play to the leading role of chain owners and user enterprises, focus on overcoming a number of key core technologies, and effectively build a solid scientific and technological foundation for industrial development. It is necessary to strengthen the deep integration of scientific and technological innovation and industrial innovation, lay out and build a pilot platform for the needs of industrial development, and accelerate the transformation and industrial application of innovation achievements. It is necessary to strengthen the main position of enterprise innovation, encourage large and medium-sized enterprises, and the upstream and downstream of the industrial chain to integrate and innovate, especially to guide small and medium-sized enterprises to take the road of specialization, refinement, special and new development, to focus on casting expertise, supporting strong industries, and winning the market with innovation.

International News

1. U.S. industrial output increased more than expected in May

US industrial output rose in May, largely due to a broad-based pickup in factory output, which is a positive sign for the manufacturing sector, which has been struggling to find momentum. Data on Tuesday showed that industrial production rose 0.9% in May, beating market expectations. Manufacturing output also climbed 0.9 percent, led by the consumer goods sector, in stark contrast to other data that showed that the manufacturing sector struggled to build momentum amid rising input prices, volatile consumer demand and high borrowing costs. The latest report from the Institute for Supply Management (ISM) on factory activity has accelerated at a faster pace, and measures of output are close to stagnant; Retail sales also barely increased in May, and retail sales in previous months were also revised downward, suggesting greater pressure on the consumer economy. Commercial equipment output climbed for the first time in three months, while construction supplies also rose.

2. Fed Williams: More data is needed to support interest rate cuts, and inflation will continue to fall

Fed's Williams said the U.S. economy was "moving in the right direction," but he declined to say when interest rates would be cut. He stressed that any decision on the timing or extent of this year's rate cut will depend on new economic data; Recent inflation data is encouraging, and price pressures are expected to continue to weaken. Williams said in an interview on Tuesday: "There are very good signs that supply and demand are leveling off. I do see an ongoing anti-inflation process, and I expect inflation to continue to come down in the second half of this year and next year. He said the U.S. economy and labor market were strong, but also noted a slowdown in hiring.

3. U.S. stocks are closed due to holidays

Affected by the Juneteenth Day (June 19) holiday, the U.S. stock market will be closed tomorrow, and the trading of precious metals and U.S. crude oil futures contracts of CME Group (CME) will end at 02:30 Beijing time on the 20th, and the trading of stock index futures contracts will end at 01:00 Beijing time on the 20th. Trading in the Brent crude oil futures contract of the Intercontinental Exchange (ICE) will end at 01:30 Beijing time on the 20th, please note that so please note.

4. Bank of America survey: investors' pessimism about global economic growth has weakened, and most believe that the United States will avoid a recession

Bank of America's June fund manager survey showed that investor pessimism about global economic growth weakened slightly in June, with a net 6% of respondents expecting the economy to weaken, compared with 9% in May. Investors are optimistic about the ability of the U.S. to avoid a recession, with 53% of respondents expecting no recession in the next 18 months, according to the survey. Only 8% of investors surveyed expect a recession in the second half of 2024, while 30% predict a recession in 2025.

5. The new study said that quantitative easing has caused more than three times the loss of the Bank of England to the Federal Reserve

According to a new study, the Bank of England has suffered more than three times as much as the Fed in losses due to its quantitative easing (QE) program. Christopher Mahon, head of dynamic real returns at asset manager Columbia Threadneedle, said the Bank of England's portfolio of government bonds purchased between 2009 and 2021 incurred losses equivalent to 4.7% to 4.9% of GDP. This compares to 1.3%-1.5% for the Fed and 3.2%-3.4% for the ECB. QE caused losses to the Bank of England equivalent to about £130 billion ($165 billion), all of which are borne by taxpayers under a guarantee agreement reached in 2009. At its peak, the Bank of England held £895 billion in bonds. QE brought in £124 billion in profits for the Treasury, but the Treasury has already spent that money and now the losses are accumulating as the Bank of England cuts its holdings.

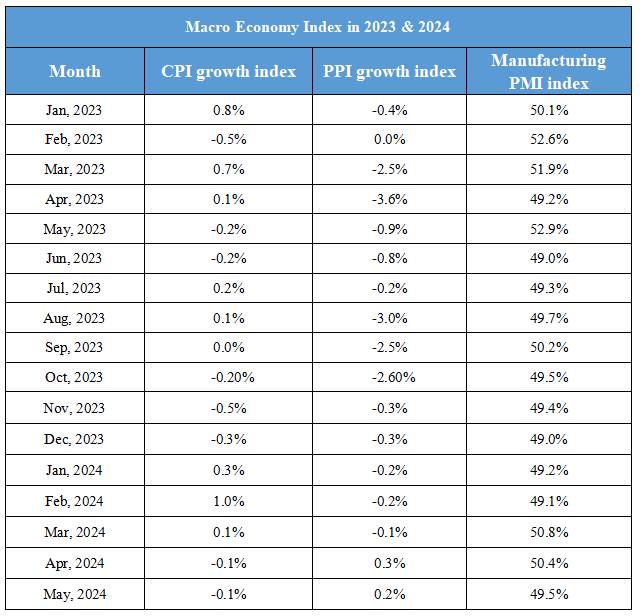

Domestic Macro Economy Index