On June 18th, Key Developments in Domestic and International Markets

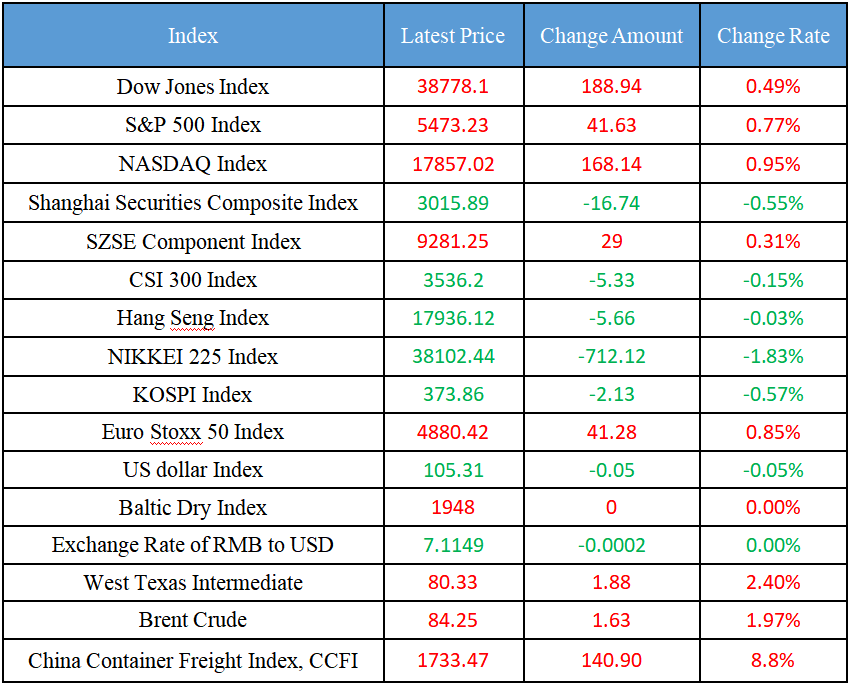

Latest Global Major Index

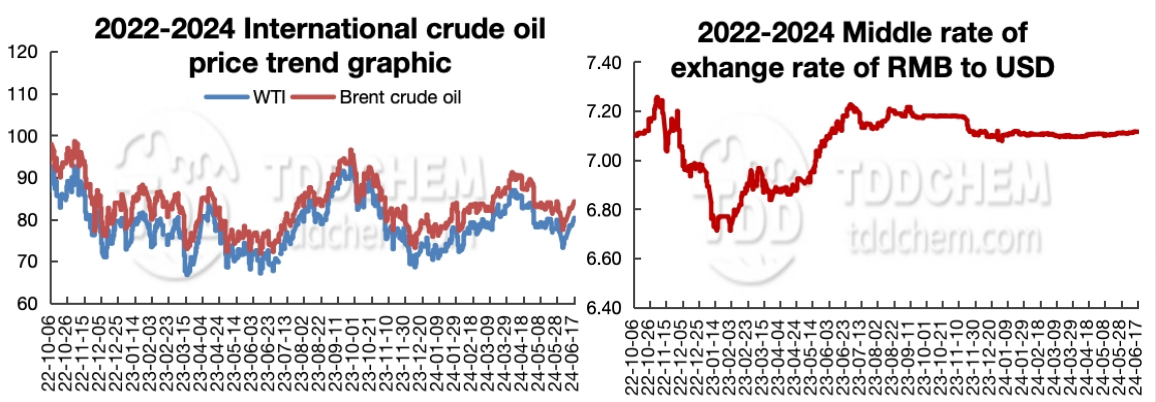

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Ministry of Industry and Information Technology: Make every effort to promote the steady growth of the raw material industry and accelerate the cultivation and expansion of the new material industry

2. Longbai Group: Invest 1.08 billion yuan to build a scandium and vanadium new material industrial park

3. The 10th Session of the Standing Committee of the 14th National People's Congress was held in Beijing from June 25 to 28

4. Seven departments in Shanghai: By the end of 2025, we will achieve full coverage of financial services for leading enterprises, "chain master" enterprises and important industrial chains and supply chains in Shanghai

5. Hong Kong's Hydrogen Energy Development Strategy was announced

International News

1. The Chinese government and the Australian government signed a memorandum of understanding on the China-Australia Strategic Economic Dialogue

2. ECB President Christine Lagarde said she was closely monitoring the market, while Lien believes that there is no disorder

3. Bank of America: If inventories continue to grow rapidly, oil prices will fall

4. New York Fed: New York State factory activity slows down and optimism rises

5. The peak season surcharge in the transpacific market appeared earlier and is at a higher level

Domestic News

1. Ministry of Industry and Information Technology: Make every effort to promote the steady growth of the raw material industry and accelerate the cultivation and expansion of the new material industry

On June 16, Wang Jiangping, Vice Minister of the Ministry of Industry and Information Technology, presided over the 2024 National Raw Material Industry Symposium in Chongqing. The meeting emphasized that it is necessary to fully implement the strategic deployment of new industrialization and systematically promote the key tasks of high-quality development of the raw material industry. It’s necessary to make every effort to promote the steady growth of the raw material industry, conscientiously implement the plan for the steady growth of key industries, accelerate the construction of major projects, in-depth implementation of equipment renewal and technological transformation projects, and strive to expand the demand of key industries to ensure the completion of the expected growth target. It is necessary to vigorously promote the transformation and upgrading of traditional industries, organize the implementation of the work plan for the digital transformation of the raw material industry and the implementation guidelines for key industries, thoroughly implement the implementation plan for carbon peaking in petrochemical, steel, non-ferrous metals, building materials and other industries, and improve the digital and green level of key industries. It is necessary to accelerate the cultivation and expansion of the new material industry, with the goal of ensuring major application needs and realizing the first material, systematically layout and build a new material big data center, promote the construction of a new material pilot platform, improve the first batch of material application and promotion policy system, and accelerate the process of making up for shortcoming, promoting advantages, and developing new advantages.

2. Longbai Group: Invest 1.08 billion yuan to build a scandium and vanadium new material industrial park

Longbai Group announced that the company's holding subsidiary, Hunan Dongsand or its subsidiaries, will invest 1.08 billion yuan to build a scandium and vanadium new material industrial park project. The project will be implemented in three phases, with the first phase building 2,500 tons/year of high-purity vanadium pentoxide, 20,000 cubic meters/year of vanadium electrolyte and 2,000 tons/year of aluminum balls; The second phase will build 50 tons/year of scandium fluoride, 1,200 tons/year of aluminum-based master alloy and 40,000 cubic meters/year of vanadium electrolyte; The third phase will build 20,000 tons/year of new scandium-containing high-performance aluminum alloy casting rods and 20,000 tons/year of new scandium-containing high-performance aluminum alloy profiles. The construction period of the project is 5 years, and the source of funds is self-owned and self-raised funds or other financing methods.

3. The 10th Session of the Standing Committee of the 14th National People's Congress was held in Beijing from June 25 to 28

The 26th meeting of the Chairmanship of the Standing Committee of the 14th National People's Congress was held at the Great Hall of the People in Beijing on the afternoon of 17 July. Chairman Zhao Leji presided over the meeting. The meeting decided that the 10th session of the 14th NPC Standing Committee will be held in Beijing from 25 to 28 June. The chairmanship meeting suggested that the 10th meeting of the Standing Committee of the 14th National People's Congress deliberate on the draft law on emergency response and management, the draft law on rural collective economic organizations, the draft revision of the border health and quarantine law, the draft amendment to the accounting law, the draft financial stability law, the draft law on preschool education, the draft revision of the law on public security administration punishments, the draft revision of the law on the protection of cultural relics, and the draft revision of the mineral resources law.

4. Seven departments in Shanghai: By the end of 2025, we will achieve full coverage of financial services for leading enterprises, "chain master" enterprises and important industrial chains and supply chains in Shanghai

Notice of the State Administration of Financial Supervision and Administration, Shanghai Supervision Bureau and other seven departments on the issuance of the "Action Plan for the Construction of a Supply Chain Finance Demonstration Zone in Shanghai's Banking and Insurance Industry". The notice pointed out that focusing on key areas such as integrated circuits, artificial intelligence, and biomedicine, as well as key industrial clusters in Shanghai, we will explore innovative service channels, provide comprehensive supply chain financial services, realize the integrated development of industry, science and technology and supply chain finance, comprehensively enhance the ability of the whole chain of the financial service industry, and explore a new model of linkage development of industrial chain, supply chain and capital chain. By the end of 2025, we will achieve full coverage of financial services for leading enterprises, "chain master" enterprises and important industrial chain and supply chains in Shanghai, enrich and improve movable assets and rights pledge financing, fully integrate the reasonable financing needs of upstream and downstream small and micro enterprises, significantly optimize the quality and efficiency of supply chain financial services, and significantly improve the level of risk control.

5. Hong Kong's Hydrogen Energy Development Strategy was announced

The Hong Kong Special Administrative Region (HKSAR) Government today (17th) announced the Hong Kong Hydrogen Development Strategy (Hydrogen Strategy). The Secretary for Environment and Ecology of the HKSAR Government, Mr Tse Chin-wan, said today that the country has a good foundation for the development of the hydrogen energy industry, and has clearly positioned hydrogen energy as an important part of the national energy system in the future. Seizing the opportunities of hydrogen energy development can help Hong Kong move towards carbon neutrality, develop new quality productivity and maintain international competitiveness. In accordance with the Hydrogen Strategy, the HKSAR Government will submit legislative amendments in the first half of 2025 to provide a legal basis for regulating the production, storage, transportation, supply and use of hydrogen used or intended to be used as fuel, and prepare a certification model that aligns with international hydrogen standards by 2027. (Voice of the Greater Bay Area)

International News

1. The Chinese government and the Australian government signed a memorandum of understanding on the China-Australia Strategic Economic Dialogue

On June 17, witnessed by the leaders of China and Australia, Liu Sushe, Deputy Director of the National Development and Reform Commission, and Chalmers, Minister of the Treasury of Australia, signed the Memorandum of Understanding between the Government of the People's Republic of China and the Government of Australia on the China-Australia Strategic Economic Dialogue on behalf of the two governments. The two sides agreed to resume the Strategic Economic Dialogue, focus on strategic and forward-looking economic topics, promote bilateral communication and exchanges, and promote pragmatic and effective economic cooperation. (National Development and Reform Commission)

2. ECB President Christine Lagarde said she was closely monitoring the market, while Lien believes that there is no disorder

ECB President Christine Lagarde said officials were "closely watching" financial market developments, while the bank's chief economist Lien had previously said he was not worried about the turmoil in France. Earlier, a week of turmoil caused the French stock market to wipe out $258 billion in market value, and the spread between French and German government bonds widened. "Price stability goes hand in hand with financial stability," Lagarde said on Monday, "and we are closely monitoring the good functioning of financial markets, and I think that at the moment, no matter what, we are continuing to pay close attention, but only that." "Earlier, when asked about the matter, Lien expressed optimism about the market turmoil over the past week." What we're seeing in the market is, of course, repricing," he said, "and it's not a dynamic and chaotic world." ”

3. Bank of America: If inventories continue to grow rapidly, oil prices will fall

Bank of America pointed out that crude oil and oil inventories have risen at an unseasonal pace since February, and if this trend continues, it could weigh on oil prices in the third quarter. Analysts such as Warren Russell wrote in the report that if inventories continue to increase rapidly, oil prices will fall. Global oil demand decelerated to 890,000 b/d year-on-year in the first quarter, with data suggesting that consumption growth could slow further in the quarter. U.S. economic indicators show some headwinds. Analysts say it's unclear whether the supply-demand balance in the third quarter of this year will be strong enough for the market to move from a clear and large oversupply to a supply deficit that can boost prices. Jet fuel is a "bright spot" on the demand side, and consumption should continue to rise.

4. New York Fed: New York State factory activity slows down and optimism rises

Manufacturing activity in New York State fell this month, albeit at a slower pace as manufacturing conditions continue to weaken, but hopes for a better outlook are held out. The New York Fed said on Monday that the manufacturing index climbed to -6 in June from -15.6 in the previous month and remained in contraction territory. Richard Deitz, an economic research adviser at the New York Fed, said: "Manufacturing conditions in New York State remained weak in June. Employment continues to shrink and capital expenditure plans are flat. "The survey showed that new orders were broadly flat, with a slight increase in the shipment volume component of the index. Optimism about the six-month outlook rose to its highest level in more than two years, with nearly half of respondents expecting an improvement in the economic situation.

5. The peak season surcharge in the transpacific market appeared earlier and is at a higher level

According to foreign media reports, transpacific container carriers are taking advantage of the momentum of the peak season earlier than expected, and are now imposing peak season surcharges (PSS) on trade with limited capacity and seeking to more than double the normal level. Ocean shipping companies began implementing peak season surcharges on June 1, about a month earlier than normal. Several carriers implemented a peak season surcharge of $600/FEU on June 1 and a peak season surcharge of $400/FEU on June 15. At least one liner company has announced that it has implemented a peak season surcharge of $1,000/FEU since July 1.

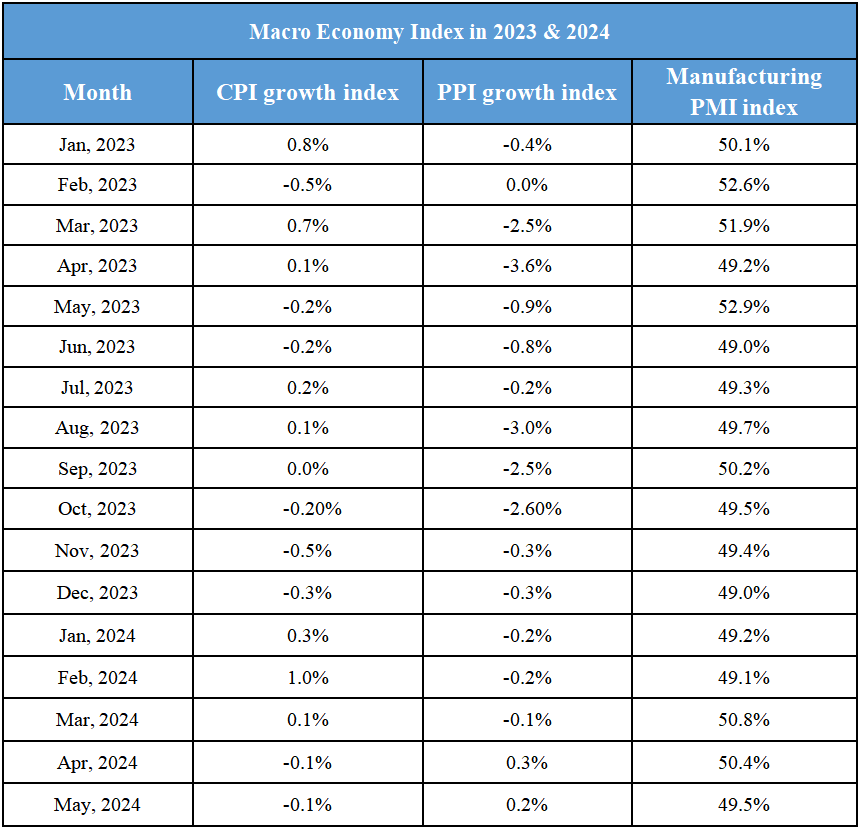

Domestic Macro Economy Index