June 7th Macroeconomic Index: Chongqing Encourages Foreign Capital in SOE Reform, CNOOC Makes Major Exploration Breakthrough

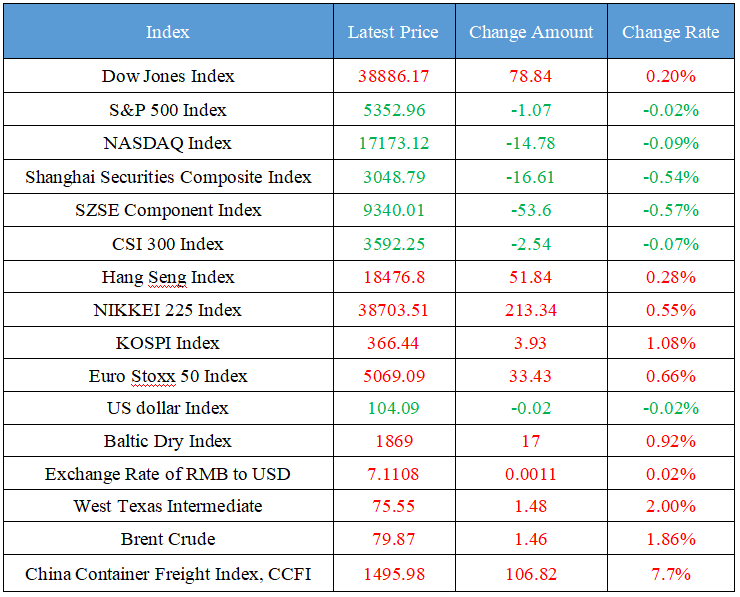

Latest Global Major Index

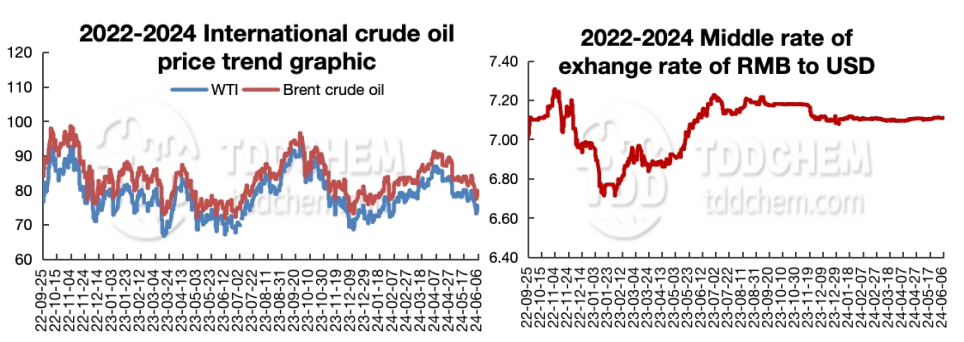

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Signing projects of more than 1 billion US dollars. Chongqing encourages foreign capital to participate in the reform of state-owned enterprises

2. ST Selen: signed a cooperation framework agreement with a subsidiary of Gree Group

3. Trust real estate business tracking: the scale has dropped to less than one trillion yuan for the first time, and the most difficult time has passed

4. Beijing-Tianjin-Hebei, Yangtze River Delta, and Northeast China have established a connection mechanism for CCC exemption work

5. CNOOC Limited has made a major exploration breakthrough in the western part of the South China Sea

International News

1. The European Central Bank fell for the first time in five years, and the price of Bitcoin rose slightly

2. The U.S. trade deficit widened in April

3. ING International: The ECB's interest rate cut cycle may have to be stopped shortly after it begins

4. Saudi Aramco's $12 billion share offering is said to have attracted strong overseas demand

5. The multilateral central bank digital currency bridge project has entered the stage of minimum viable products

Domestic News

1. Signing projects of more than 1 billion US dollars. Chongqing encourages foreign capital to participate in the reform of state-owned enterprises

The promotion meeting and signing event for foreign investors to participate in the high-quality development projects of Chongqing state-owned assets and state-owned enterprises was held in Chongqing on the 6th. More than 70 well-known foreign enterprises, foreign business associations and consular offices in Chongqing from 13 countries and regions attended the meeting and witnessed the on-site signing of 22 state-owned enterprises and foreign investment cooperation projects, involving an amount of more than US$1 billion. (China News Network)

2. ST Selen: signed a cooperation framework agreement with a subsidiary of Gree Group

ST Selen announced that it signed a "Cooperation Framework Agreement" with Zhuhai Gree Financial Investment Management Co., Ltd., a wholly-owned and important subsidiary of Gree Group, and the two sides will cooperate in industrial investment within the range of 35 million yuan to 50 million yuan, and fully promote projects such as high-performance materials, optoelectronic materials, precision manufacturing, R&D and sales centers for battery cells to settle in Zhuhai.

3. Trust real estate business tracking: the scale has dropped to less than one trillion yuan for the first time, and the most difficult time has passed

According to the 2023 industry data released by the Trust Industry Association, the scale of funds invested by trusts in the real estate sector has dropped below one trillion yuan for the first time since 2018. Zeng Gang, director of the Shanghai Finance and Development Laboratory, said bluntly that the era of traditional real estate trust business as the main business mode of trust has come to an end. At the micro level, the data shows that the scale and proportion of the vast majority of trust companies investing in the real estate industry are declining year by year, and in 2023, only one trust company will invest more than 100 billion yuan in trust assets, and 44 of the 57 trust companies will invest less than 10% of their trust assets in the real estate industry. A number of industry insiders told reporters that "the most difficult time has passed", and the stock of risk assets has been basically exposed, while some practitioners admitted that the current risk resolution situation is not optimistic.

4. Beijing-Tianjin-Hebei, Yangtze River Delta, and Northeast China have established a connection mechanism for CCC exemption work

It is learned from the State Administration for Market Regulation that recently, Beijing, Tianjin and Hebei Province in the Beijing-Tianjin-Hebei region, Shanghai, Jiangsu, Zhejiang and Anhui provinces in the Yangtze River Delta region, and Liaoning Province, Jilin Province, Heilongjiang Province and Inner Mongolia Autonomous Region Market Supervision Bureaus (departments and commissions) in the three northeastern provinces and one region have formulated and completed the "CCC Exemption Linkage Mechanism Work Plan, Work Item List" and other documents in their respective regions. In the future, the regional market supervision departments will give full play to the effectiveness of regional linkage in the CCC exemption work, strengthen cross-regional collaborative supervision, pilot cross-regional follow-up supervision of CCC-exempt products, and promote mutual recognition of follow-up supervision results in the region. (CCTV News)

5. CNOOC Limited has made a major exploration breakthrough in the western part of the South China Sea

CNOOC Corporation Limited announced a major breakthrough in the field of ultra-deepwater and ultra-shallow gas exploration in the South China Sea. The Lingshui 36-1 gas field is located in the western part of the South China Sea, with an average water depth of about 1,500 meters. The main gas-bearing strata are the Quaternary Ledong Formation reservoirs, with an average buried depth of 210 meters and an unobstructed natural gas flow of more than 10 million cubic meters per day.

International News

1. The European Central Bank fell for the first time in five years, and the price of Bitcoin rose slightly

Bitcoin edged up from below $71,000 to above $71,300 as the ECB cut interest rates for the first time in five years. The bank said it cut its benchmark interest rate by 0.25 percentage points. Keeping interest rates high for nine months in a row has helped bring down inflation. At present, it is appropriate to adjust monetary policy moderately. However, the ECB's statement did not mention weak growth or promise further rate cuts, but said it would depend on the data.

2. The U.S. trade deficit widened in April

The U.S. trade deficit widened in April as the increase in imports outpaced the modest increase in exports. The U.S. Commerce Department's Bureau of Economic Analysis said on Thursday that the trade deficit rose 8.7 percent to $74.6 billion. The March data narrowed slightly to $68.6 billion after revision. Imports rose 2.4% to $338.2 billion in April. Merchandise imports increased by $8.1 billion to $271.9 billion. Imports of capital goods such as automobiles and parts, computer accessories and telecommunications equipment, as well as industrial supplies and raw materials, including crude oil, increased. Exports edged up 0.8 percent to $263.6 billion. Merchandise exports increased by $2.2 billion to $172.7 billion. Exports of capital goods and consumer goods increased, while exports of industrial supplies and materials declined. Exports of services fell by $200 million to $172.7 billion.

3. ING International: The ECB's interest rate cut cycle may have to be stopped shortly after it begins

Carsten Brzeski, head of macroeconomics at ING Bank, said the ECB's rate cut on Thursday may have used up most of its room for maneuver. The move of the eurozone central bank to cut interest rates has received widespread attention and expectations, but it does show confidence to act before the Fed. The ECB does not seem to cut rates out of necessity, but simply because it can. The room for maneuver for this rate cut is shrinking as inflation across the monetary union becomes tricky, and the ECB itself has raised its expectations for higher consumer prices this year, which will limit the room for further rate cuts.

4. Saudi Aramco's $12 billion share offering is said to have attracted strong overseas demand

Foreign investors rushed to Saudi Aramco's $12 billion share offering, according to people familiar with the matter, marking a turnaround for the oil giant's 2019 listing. It's unclear exactly how much overseas demand will be, but the investors' bids are enough to cover the full cost of the offering, people familiar with the matter said. In addition to Western institutions, Asian investors are also in high demand for the offering, one of the people said. Saudi Aramco's dividend is one of the highest in the world, and investors would profit from an annual dividend of $124 billion if they were willing to ignore excessive valuations and a lack of buybacks. It is estimated that the company's dividend yield will reach 6.6%.

5. The multilateral central bank digital currency bridge project has entered the stage of minimum viable products

On June 5, the Multilateral Central Bank Digital Currency Bridge (CBDC) project, jointly built by the Bank for International Settlements (Hong Kong) Innovation Center, the Bank of Thailand (Bank of Thailand), the Central Bank of the United Arab Emirates, the Digital Currency Institute of the People's Bank of China and the Hong Kong Monetary Authority, announced that it had entered the minimum viable product (MVP) stage. MBridge Participants in the above jurisdictions may conduct live transactions in an orderly manner in accordance with the corresponding procedures. The MoneyBridge project is committed to creating a high-efficiency, low-cost, highly scalable and regulatory-compliant cross-border payment solution with central bank digital currency as the core, exploring the application of distributed ledger technology and central bank digital currency in cross-border payment by covering different jurisdictions and currencies, so as to achieve faster, lower cost and more secure cross-border payment and settlement.

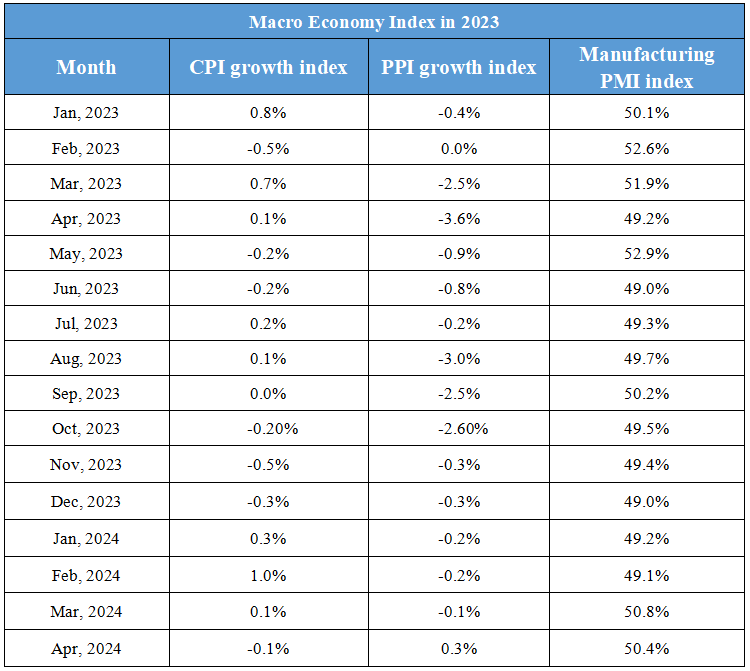

Domestic Macro Economy Index