June 4th Macroeconomic Index: China Offers Near 12 Billion Yuan in Trade-In Subsidies, Boosting New Energy Vehicles

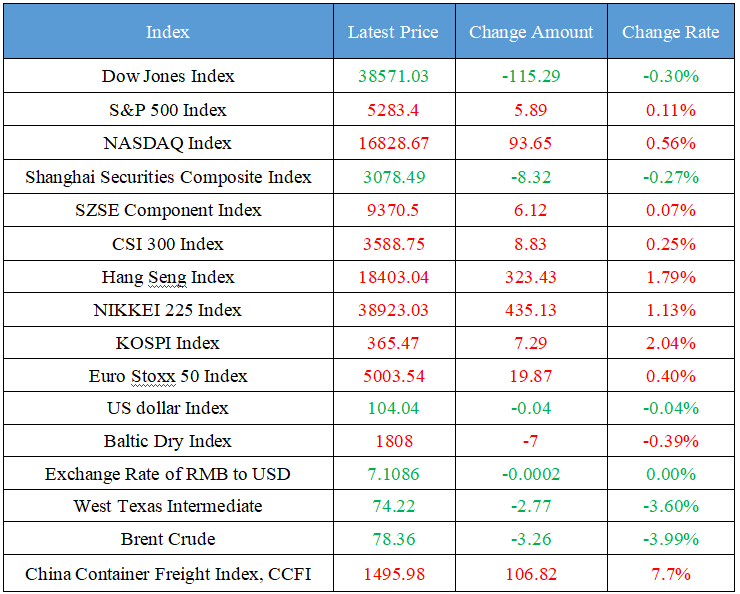

Latest Global Major Index

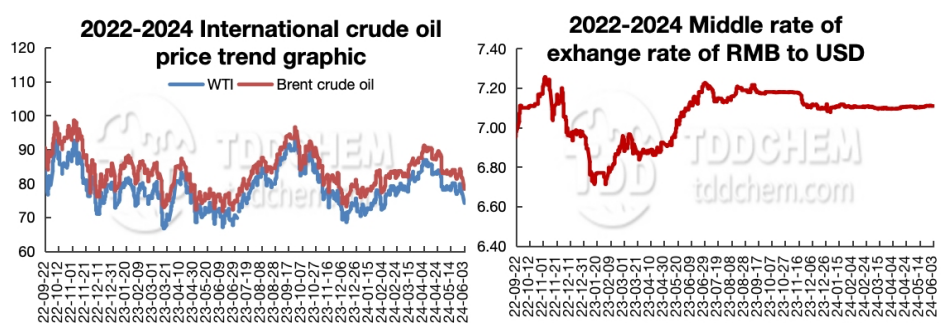

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The central + local governments have a total of nearly 12 billion yuan in trade-in subsidies, and independent new energy vehicles are expected to benefit the most

2. Wondershare Technology and Zhongke Hongqi signed a framework agreement to fully cooperate in the field of information and innovation

3. The latest internal documents of the Beijing Stock Exchange: There are four major problems in the recent on-site supervision projects

4. The activity of the Shenzhen market increased significantly In May due to the superposition effect of property market policies

5. Shanghai State Investment Corporation and Science and Technology Venture Capital Group implemented joint reorganization

International News

1. New orders in the U.S. manufacturing industry resumed growth in May, and cost inflation continued to increase

2. SD Guthrie: The average price of crude palm oil this year will be higher than 4,000 ringgit

3. Russia has found a new place for oil transshipment in the Mediterranean

4. Norway gas supply was unexpectedly interrupted, and European natural gas prices soared to the highest level this year

5. Mongolia and Belarus have signed a number of agreements to expand bilateral relations in various fields

Domestic News

1. The central + local governments have a total of nearly 12 billion yuan in trade-in subsidies, and independent new energy vehicles are expected to benefit the most

According to the notice of the Ministry of Finance on issuing the budget of the central government for the 2024 car trade-in subsidy released on the website of the Ministry of Finance, the Ministry of Finance recently issued 6.44 billion yuan of financial interest discounts and awards and subsidies in 2024 for the pre-allocation of central financial subsidy funds for car trade-in in 2024. According to the "Notice", a total of 2.67 billion yuan will be allocated in the eastern region, 1.97 billion yuan will be allocated in the central region, and 1.79 billion yuan will be allocated in the western region. In addition, the "Notice" also shows that in this round of car trade-in subsidies, the local government will provide a total of nearly 4.758 billion yuan, and local and central government will allocate 11.198 billion yuan in total. According to Huatai Securities estimates, during the implementation of the national three emission standards from 2008 to 2011, the sales of passenger cars of various car companies, SAIC Volkswagen, FAW-Volkswagen, Guangqi Honda and other joint venture brands accounted for a relatively large sales, and this round of trade-in policy may further promote independent brands to seize the share of joint ventures.

2. Wondershare Technology and Zhongke Hongqi signed a framework agreement to fully cooperate in the field of information and innovation

Wondershare Technology and Zhongke Hongqi (Beijing) Information Technology Co., Ltd. signed a strategic cooperation framework agreement, the two sides will carry out comprehensive cooperation in the field of information and innovation, through joint development of integrated solutions and other measures, to help various industries reduce costs and increase efficiency, and promote the accelerated development of the information and innovation ecosystem. It is reported that Zhongke Hongqi is a high-tech enterprise integrating R&D, incubation and industrialization of core technologies of national independent and controllable network security and informatization, and has established a good sales channel and service network across the country, with customers widely distributed in various industries such as government, postal services, education, telecommunications, and finance. Among them, Hongqi operating system has been at the forefront of China's independent operating system market for many years, and is one of the most influential operating system brands in China.

3. The latest internal documents of the Beijing Stock Exchange: There are four major problems in the recent on-site supervision projects

It is reported that the Beijing Stock Exchange recently issued the "Issuance and Listing Review Dynamics 2024 Issue 1 (Total Issue 9)". In the Q&A part of the "Review Dynamics", the Beijing Stock Exchange said that for the projects that have recently launched on-site supervision, the sponsor institutions mainly have four major problems: insufficient verification of capital flow, insufficient verification of income authenticity, no evidence support for the verification conclusion of marketing fees, and untimely reporting of the sharp decline in performance after the period. Specifically, the first is that the verification of capital flow is insufficient. These include inconsistencies in the verification conclusions; Insufficient verification of the actual controller's relatives disbursing expenses on behalf of the issuer and having large capital transactions with the issuer's related parties; Insufficient verification of whether related parties are disbursing costs and expenses on behalf of the issuer. Second, the verification of the authenticity of income is insufficient. Third, there is no evidence to support the conclusion of the verification of marketing expenses. Fourth, the report on the sharp decline in performance after the period was not timely. Fifth, other circumstances.

4. The activity of the Shenzhen market increased significantly In May due to the superposition effect of property market policies

According to the latest data released by the Shenzhen Real Estate Agents Association, a total of 2,375 new houses were traded in the city in May, down 16.0% month-on-month and 29.9% year-on-year, of which 2,009 new homes were sold, down 14.7% month-on-month and 27.9% year-on-year. The Shenzhen Real Estate Agents Association believes that with the launch of the new property market policies in Shenzhen on May 6 and May 28, the activity of the new housing market has increased significantly. However, in view of the statistics of new home transaction data, buyers need to complete the mortgage process, including the down payment, before the online registration will be carried out. Therefore, the specific effect of the May policy has not yet been fully realized in the transaction data of that month, and it is expected that the new home transaction data in June will improve as the process progresses. (Securities Times)

5. Shanghai State Investment Corporation and Science and Technology Venture Capital Group implemented joint reorganization

Shanghai Science and Technology Venture Capital (Group) Co., Ltd. announced that the company recently received the "Notice of the Municipal State-owned Assets Supervision and Administration Commission on the Implementation of Joint Restructuring between Shanghai State-owned Assets Investment Corporation and Shanghai Kechuang Group" issued by the Shanghai State-owned Assets Supervision and Administration Commission. According to the notice, with the consent of the Shanghai Municipal Party Committee and the Municipal Government, it was decided to transfer 100% of the equity of Shanghai Kechuang Group held by the Shanghai State-owned Assets Supervision and Administration Commission to Shanghai State-owned Capital Investment Co., Ltd. free of charge, and the base date of the transfer is December 31, 2023. After this change, Shanghai Kechuang Group is directly held by Shanghai SDIC with 100% equity, and the controlling shareholder is changed to Shanghai SDIC, and the actual controller is still Shanghai State-owned Assets Supervision and Administration Commission.

International News

1. New orders in the U.S. manufacturing industry resumed growth in May, and cost inflation continued to increase

Andrew Harker, director of economics at S&P Global Market Intelligence, said it was encouraging that new orders returned to growth in May. Although the increase is modest, the increase in new orders bodes well production in the coming months. In fact, manufacturers cite confidence in the future as a factor contributing to employment, purchasing activity, and increased inventories of finished goods. However, cost pressures continue to mount, and inflation in this area is the strongest in more than a year. Although the pace of output price increases slowed in May, this situation will be unsustainable if the cost burden increases further in the coming months.

2. SD Guthrie: The average price of crude palm oil this year will be higher than 4,000 ringgit

According to foreign media reports, Mohd Haris Mohd Arshad, chief operating officer of SD Guthrie, formerly known as Sime Darby Plantation Company, said that the company expects crude palm oil prices to remain quite supportive, with an average price of more than 4,000 ringgit per ton this year. He said this was mainly due to limited supply due to the weather. Given that palm oil is the cheapest relative to other vegetable oils, we expect Indonesian production to remain an issue. "In light of this, we expect prices to remain well supported." Talking about the impact of La Niña and El Niño weather phenomena on crops, he said that El Niño does not have much of an impact on Malaysia substantially, but it certainly has an impact on Indonesia. In addition, in response to a question about the dependence of migrant workers, he said that before the pandemic, the company, like other companies, had a recognized ratio of 20:80 between local and foreign. "Now we have 30 percent local companies and 70 percent foreign workers."

3. Russia has found a new place for oil transshipment in the Mediterranean

Under pressure from the Greek Navy, Russian oil traders have found a new transshipment location for crude oil in the Mediterranean, which shows how difficult it is to combat Russian oil sales. Ship tracking data collected by the agency shows that tankers are transferring Russian Urals crude from the small tanker Serendi to a large tanker Rolin near the city of Nador at the eastern end of Morocco on the Mediterranean coast. This is the first time that a Russian crude trader has made a ship-to-ship transfer of oil at this location.

4. Norway gas supply was unexpectedly interrupted, and European natural gas prices soared to the highest level this year

European gas prices surged to their highest point this year after Norway's gas supplies fell sharply, highlighting the risk of over-reliance on a major supplier. On Monday, the price of Dutch benchmark natural gas futures surged more than 11%, the biggest increase this year. It is not yet known how long the unexpected shutdown of the large gas processing plant in Nyhamna, Norway, will last. At the same time, Norwegian gas flows to the UK's Issington terminal, which is the UK's inlet for a third of the UK's total supply, plummeted to zero. The outage shows that Norway plays a pivotal role in European gas supply, and that even after the energy crisis, the market remains very sensitive to supply issues.

5. Mongolia and Belarus have signed a number of agreements to expand bilateral relations in various fields

According to the Mongolian Presidential Office, on June 3, Mongolian President Khurilsukh signed a cooperation agreement on friendly relations and cooperation between Mongolia and Belarus with visiting Belarusian President Lukashenko at the State Palace. This marks a new stage in the relations and cooperation between the two countries, and the two sides will expand their relations in the political, economic, social, and cultural fields. (CCTV News)

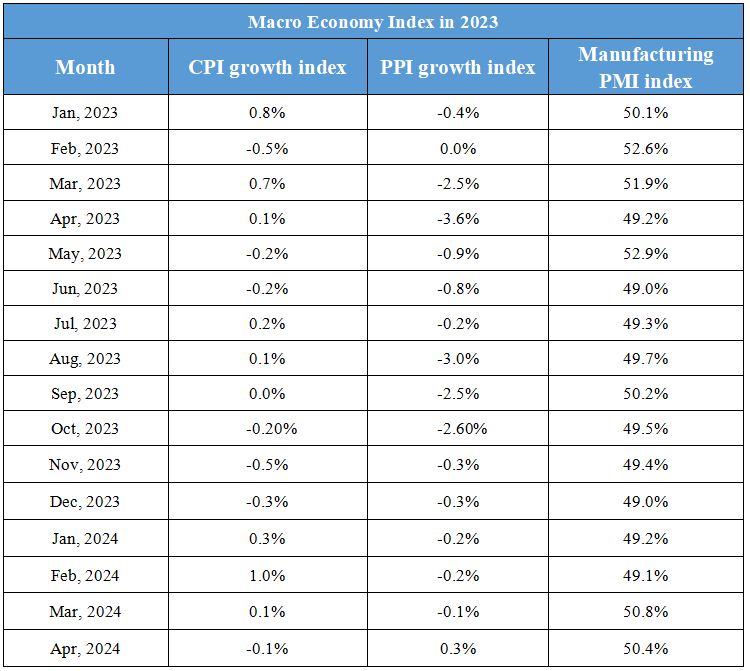

Domestic Macro Economy Index