May 30th Macroeconomic Index: China Cuts Mortgage Rates, Energy Conservation Law to Be Revised

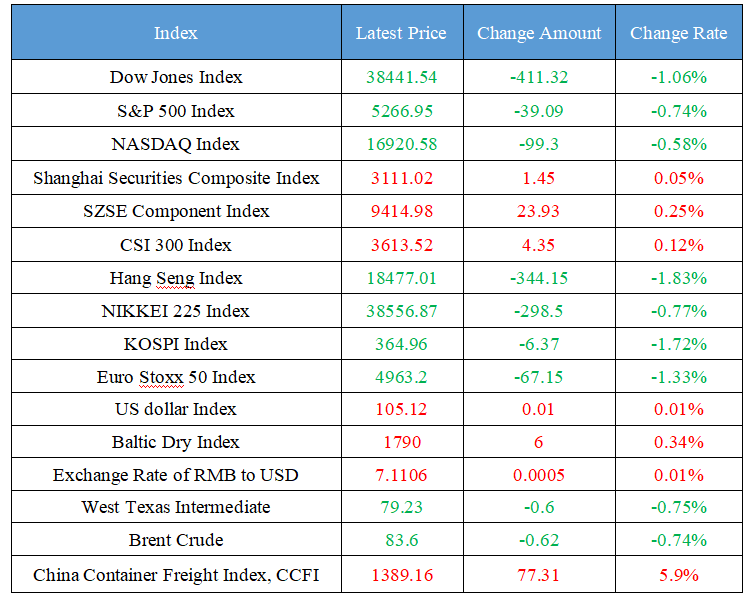

Latest Global Major Index

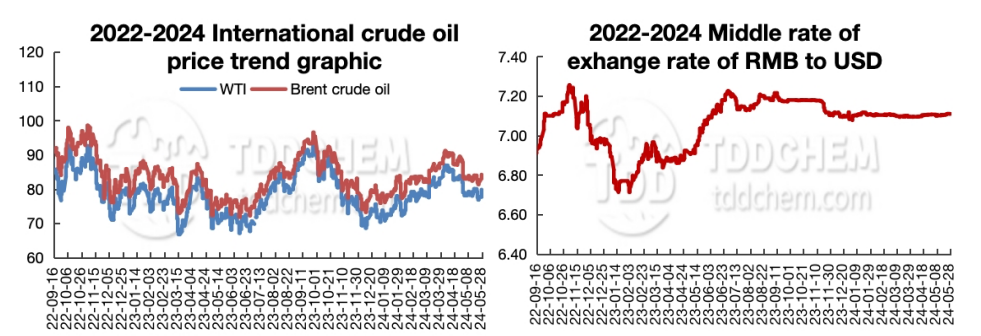

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The State Council: Promote the revision of the Energy Conservation Law and accelerate the formulation and revision of mandatory energy-saving standards

2. More than 20 provinces in China have cancelled the lower limit of mortgage interest rates, and mortgage interest rates in many places have reached new lows

3. Microconductive nano: It is planned to issue convertible bonds to raise no more than 1.17 billion yuan for semiconductor thin film deposition equipment and intelligent factory construction projects

4. The State Council: Make strict policy requirements for the petrochemical industry

5. The State Council: Gradually remove restrictions on the purchase of new energy vehicles in various places

International News

1. Bonus points for interest rate cut expectations The euro area has better reasons for implementing long-term treasury bonds than the United States

2. German inflation is rising again, highlighting the challenges facing the ECB

3. Federal Reserve Bank of Dallas: The consolidation of the U.S. energy industry will continue until 2024

4. OPEC+ will continue to implement the production reduction policy, and it is necessary to pay attention to the changes in Venezuela's production

5. ConocoPhillips acquired Marathon Oil for $22.5 billion to expand its oil and gas footprint

Domestic News

1. The State Council: Promote the revision of the Energy Conservation Law and accelerate the formulation and revision of mandatory energy-saving standards

On May 29, the State Council issued the "2024-2025 Energy Conservation and Carbon Reduction Action Plan". It mentions the need to improve institutional standards. Promote the revision of the Energy Conservation Law, timely improve the energy-saving review measures for fixed asset investment projects, energy-saving management measures for key energy-using units, energy-saving supervision measures and other systems, strengthen incentives and constraints, and implement the whole chain management of energy consumption. Improve the legal system of the national carbon market. Combined with the promotion of large-scale equipment renewal and consumer goods trade-in, benchmarking domestic and international advanced levels, accelerating the formulation and revision of mandatory energy-saving standards, and expanding the coverage of standards. According to the top 5%, 20% and 80% of the energy efficiency of relevant industries and products and equipment, the energy-saving standard level 1, level 2, level 3 (or level 5) indicators are set.

2. More than 20 provinces in China have cancelled the lower limit of mortgage interest rates, and mortgage interest rates in many places have reached new lows

A new round of housing credit policies is being stepped up. Zhongxin Finance combined with institutional data combing and found that up to now, more than 20 provinces have clearly canceled the lower limit of mortgage interest rates and lowered the lower limit of the down payment ratio. According to agency data, some banks in some cities have implemented the first home loan interest rate of about 3.1%, which has fallen to the lowest in history; In terms of down payment, the current mainstream trend is to reduce the down payment ratio for first and second homes to 15% and 25% respectively. (Chinanews.com)

3. Microconductive nano: It is planned to issue convertible bonds to raise no more than 1.17 billion yuan for semiconductor thin film deposition equipment and intelligent factory construction projects

Microconductive Nano announced that the total amount of funds raised by the company to issue convertible corporate bonds to unspecified objects does not exceed 1.17 billion yuan. After deducting the issuance expenses, it will be fully invested in the construction project of the intelligent factory of semiconductor thin film deposition equipment, the expansion project of the R&D laboratory and the replenishment of working capital. The intelligent factory construction project of semiconductor thin film deposition equipment mainly produces iTomic series and iTronix series products in the semiconductor field, which involve two types of equipment: atomic layer deposition and chemical vapor deposition.

4. The State Council: Make strict policy requirements for the petrochemical industry

The State Council issued the Action Plan for Energy Conservation and Carbon Reduction from 2024 to 2025. It is mentioned that the new production capacity of oil refining, calcium carbide, ammonium phosphate, yellow phosphorus and other industries will be strictly controlled, new production capacity of polyvinyl chloride and vinyl chloride using mercury will be prohibited, and the scale of new delayed coking production will be strictly controlled. New construction, renovation and expansion of petrochemical projects must meet the energy efficiency benchmark level and environmental performance level A, and the capacity used for replacement must be shut down and the main production facilities must be dismantled in a timely manner as required. Completely eliminate atmospheric and vacuum devices of 2 million tons/year and below. By the end of 2025, the country's crude oil processing capacity will be controlled within 1 billion tons.

5. The State Council: Gradually remove restrictions on the purchase of new energy vehicles in various places

The State Council issued the Action Plan for Energy Conservation and Carbon Reduction from 2024 to 2025. It is mentioned that the low-carbon transformation of transportation equipment will be promoted. Accelerate the elimination of old motor vehicles, and improve the access standards for energy consumption limits of commercial vehicles. Gradually lift restrictions on the purchase of new energy vehicles in various places. Implement support policies such as facilitating the passage of new energy vehicles. Promote the electrification of vehicles in the public sector, orderly promote new energy medium and heavy-duty trucks, and develop zero-emission freight fleets. Promote the scrapping and renewal of old transport ships, and promote the pilot project of electrification of coastal inland waterway ships. By the end of 2025, the CO2 emission intensity of the transport sector will be reduced by 5% compared to 2020.

International News

1. Bonus points for interest rate cut expectations The euro area has better reasons for implementing long-term treasury bonds than the United States

Anne, managing director of the investment solutions division of MFS Investment Management, said in a note that the eurozone has a stronger case for long-term government bonds than in the United States. That's because the ECB is more likely to cut interest rates than the Fed, he said. In the case of the US, there is some uncertainty about the Fed's policy outlook and the pace of the disinflationary process in the short term, which has reduced short-term investor interest in fixed income products. From a monetary policy perspective, the macro environment is more favourable for European fixed income.

2. German inflation is rising again, highlighting the challenges facing the ECB

The data showed that inflation in Germany accelerated for the second month in a row, underscoring the difficulty of the ECB's task of achieving its 2% target as it prepares to cut interest rates next week. Much of this increase has been driven by the base effect of introducing cheap public transport tickets. Twelve months ago, this move drove down ticket prices. However, this week's data is unlikely to prevent ECB policymakers from cutting rates on 6 June, which would be the first rate cut since the ECB embarked on an unprecedented back-to-back rate hike to curb rising prices. At the beginning of the year, wage growth in Germany was particularly strong. Compared to the same period last year, negotiated wages rose by 6.2 percent, compared to a 4.7 percent increase in the eurozone as a whole.

3. Federal Reserve Bank of Dallas: The consolidation of the U.S. energy industry will continue until 2024

The wave of consolidation in the U.S. energy sector sparked $250 billion worth of deals in 2023, and the wave has continued into this year as companies look for opportunities to deploy cash reserves and increase them, according to the data. A survey of energy industry executives conducted by the Federal Reserve Bank of Dallas in December showed that most expect more oil company deals worth $50 billion or more over the next two years. In 2023, about 39 private companies were acquired by public companies, according to Enverus. Here's a list of deals in the U.S. oil and gas industry so far this year.

4. OPEC+ will continue to implement the production reduction policy, and it is necessary to pay attention to the changes in Venezuela's production

The OPEC+ meeting will be held on Sunday, and the group is expected to continue its current production cuts policy as concerns remain about economic conditions, interest rates, inflation, demand and growing geopolitical risks, Venezuelan research firm Orinoco Research said. While Venezuela has seen a slight increase in oil production, it is uncertain whether it will be one of the countries to reduce production in the medium term, as it has previously been excluded due to its long-term decline in oil production. However, with sanctions still in place on Iranian oil and different African oil-producing and exporting countries experiencing problems in production, if Venezuela's production continues to grow, it could play a more significant role in the global oil market and OPEC in the long run, especially in the Americas and European markets. At the same time, other countries in South America and Africa, such as Guyana and Namibia, are also on the rise.

5. ConocoPhillips acquired Marathon Oil for $22.5 billion to expand its oil and gas footprint

ConocoPhillips reportedly agreed to buy Marathon Oil in an all-stock deal for $22.5 billion, expanding the massive buying spree in the U.S. oil and gas industry. The move expands ConocoPhillips' footprint in domestic shale fields from Texas to North Dakota and brings the company's reserves as far as Equatorial Guinea. With producers betting that oil and gas demand will remain strong in the coming years, they are seeking new drilling sites, and there has been another wave of big deals recently. In recent years, ConocoPhillips has expanded its presence in the Permian Basin with the acquisition of Concho Resources Inc. for $13 billion and Shell's assets in the region for $9.5 billion.

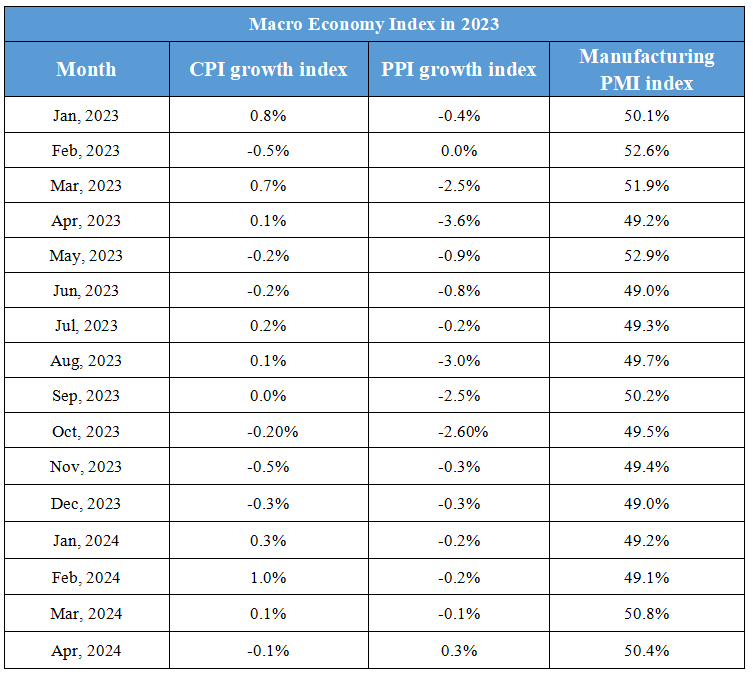

Domestic Macro Economy Index