Titanium ore market summary in the first quarter of 2022

May 29, 2024, 11:58 AM

TDD-global

6536

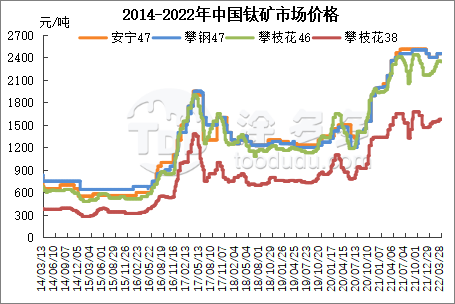

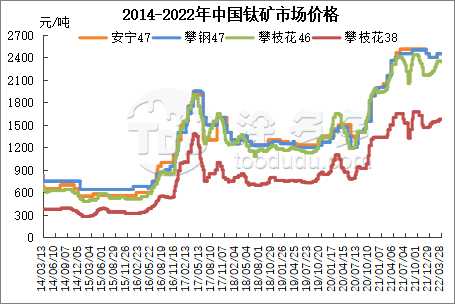

In the first quarter of 2022, the overall price of titanium ore showed a rising trend, since the end of 2021, the titanium market appeared a turning point, the overall market ushered in an improvement.

Market description for the first quarter of 2022

In the first quarter of 2022, since the end of 2021, the titanium market increased by 100-200 yuan / ton by about 8%. The imported titanium market continues the rising trend in 2021. The international titanium raw material market is still tight, and the market price is high.

1. titanium ore market price analysis

01. Domestic titanium ore price analysis

In the first quarter of 2022, the overall Chinese titanium market price showed an upward trend, take Panxi titanium price as an example, in January, middle school ore price rose from 1450-1500 yuan / ton to 1500-1550 yuan / ton, 10 mine price rose from 2130-2200 yuan / ton to 2300-2380 yuan / ton, 20 mining prices from 2400-2500 yuan / ton to 2450-2550 yuan / ton.

From January to February, the price of small and medium-sized titanium ore continued to rise, and in the middle to late March, the transaction price of small and medium-sized titanium ore slightly weakened, and individual transaction prices fell by 20-30 yuan / ton.The main reasons for the price increase are: 1. Since the end of 2021, the demand, 2. In February, the supply of some mining enterprises decreased the maintenance price of small and medium-sized mines, and the market price increases.

In late March, the number of titanium ore manufacturers gradually decreased, due to the influence of public health time, the domestic market and high cost, some miners panic, but the ore supply is still tight, and the market is stable and more, and the price is large, the titanium ore market is stable operation.

02. Market analysis of imported titanium ore

The price of imported titanium ore rose in the first quarter, increasing by 5% -10% at the end of the quarter, limited due to policy reasons, the market price, the high price in the first quarter is high demand, the domestic downstream market demand again, international titanium dioxide enterprises resume production, imported titanium ore supply is further tight, the market price also increased.

Import titanium market domestic transportation is limited, by the recent outbreak to spread sharply, port control controls, Qinzhou plant affected titanium production, port domestic transport restrictions, the goods basically stagnation, still in the current market form, titanium ore transport in the short term is still larger, supply is still tight, market prices remain high.

2. Import and export data

2. Import and export data

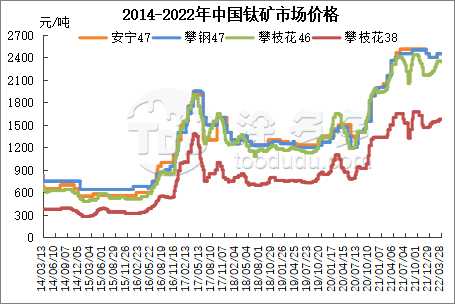

01. Market analysis of imported titanium ore

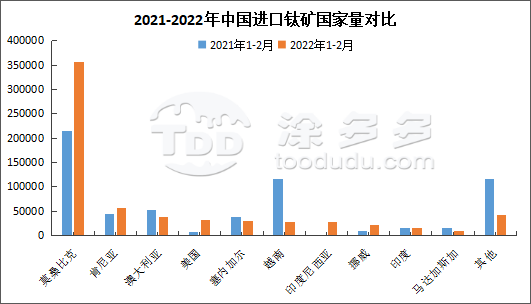

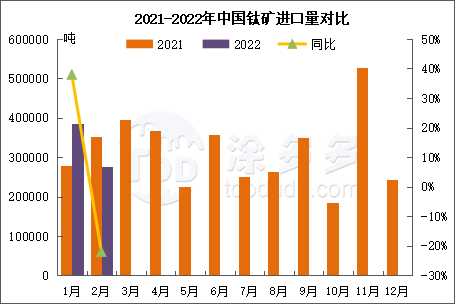

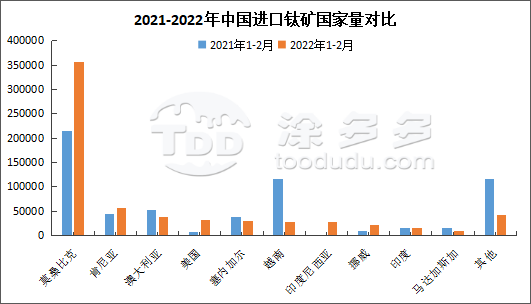

According to customs data, from January to February 2022, China's cumulative import of titanium ore was about 65.93 (including medium ore) 10,000 tons, up 4.47% year on year, and the import volume increased by about 28,200 tons.Affected by foreign weather and mining resources in some countries, the amount of titanium imported ore from some countries declined significantly. From January to February, the overall import volume increased slightly, and it is expected that the total amount of imported ore in the first quarter will be about 900,000 tons.

According to customs data, from January to February 2022, China's cumulative import of titanium ore was about 65.93 (including medium ore) 10,000 tons, up 4.47% year on year, and the import volume increased by about 28,200 tons.Affected by foreign weather and mining resources in some countries, the amount of titanium imported ore from some countries declined significantly. From January to February, the overall import volume increased slightly, and it is expected that the total amount of imported ore in the first quarter will be about 900,000 tons.

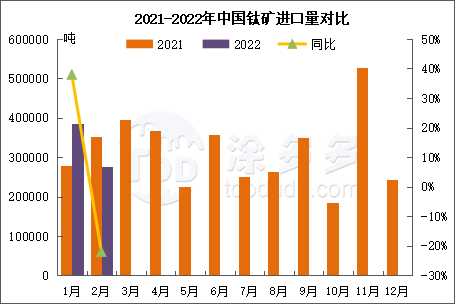

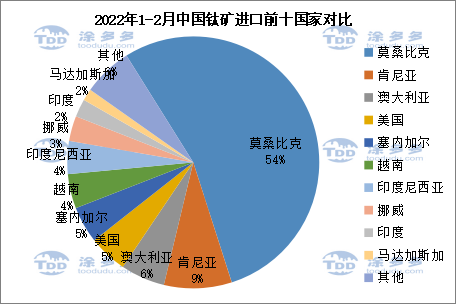

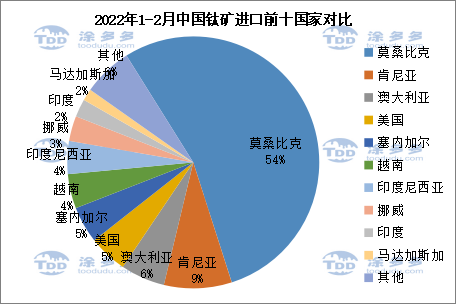

The top three countries from January-February were Mozambique, Kenya and Australia, accounting for 54%, 9% and 6% of the total imports respectively.

The top three countries from January-February were Mozambique, Kenya and Australia, accounting for 54%, 9% and 6% of the total imports respectively.

This year, the overall titanium import market is improving, and Eloka and Rio Tinto titanium raw materials are tight. This year, Australia has reduced exports to China. Vietnam has decreased due to export restrictions, and the import of gross ore has increased from January to February.

This year, the overall titanium import market is improving, and Eloka and Rio Tinto titanium raw materials are tight. This year, Australia has reduced exports to China. Vietnam has decreased due to export restrictions, and the import of gross ore has increased from January to February.

3. Downstream market data

3. Downstream market data

01, Titanium dioxide, titanium sponge production

According to tuduoduo data: from January to February 2022, titanium dioxide production in 680,000 tons, compared with 631,100 tons in the same period last year, the output increased by about 28,100 tons, an increase of 4.47%.From January to February 2022, the production of titanium sponge was 21,400 tons, 23,500 tons compared with the same period last year, and the production decreased by 2,100 tons, or 8.74%.The reduction of titanium sponge production is mainly due to the continuous high price of raw material magnesium ingot, most half-process enterprises have not started, and the market construction is insufficient.

In 2022, the new production capacity of titanium dioxide market will be about 1.1 million tons, and that of titanium sponge will be about 100,000 tons. With the gradual release of downstream market production capacity, the demand for raw material titanium market will be further increased.

4. afternoon forecast

Titanium ore market forecast

The downstream titanium dioxide market affected by cost pressure and public health, some enterprises fell, domestic titanium market is weak, the price is slightly lower, and the market is coming off-season, titanium prices are expected to continue from April to May, some market prices fall slightly; but the raw material mining is still insufficient, the price remains high, and the domestic titanium resources are still relatively tight, in the later stage with the domestic transportation gradually improved.

The price of imported titanium ore rose in the first quarter, increasing by 5% -10% at the end of the quarter, limited due to policy reasons, the market price, the high price in the first quarter is high demand, the domestic downstream market demand again, international titanium dioxide enterprises resume production, imported titanium ore supply is further tight, the market price also increased.

Import titanium market domestic transportation is limited, by the recent outbreak to spread sharply, port control controls, Qinzhou plant affected titanium production, port domestic transport restrictions, the goods basically stagnation, still in the current market form, titanium ore transport in the short term is still larger, supply is still tight, market prices remain high.

01. Market analysis of imported titanium ore

Titanium ore imports from 2021-2022

Unit: ton

01, Titanium dioxide, titanium sponge production

According to tuduoduo data: from January to February 2022, titanium dioxide production in 680,000 tons, compared with 631,100 tons in the same period last year, the output increased by about 28,100 tons, an increase of 4.47%.From January to February 2022, the production of titanium sponge was 21,400 tons, 23,500 tons compared with the same period last year, and the production decreased by 2,100 tons, or 8.74%.The reduction of titanium sponge production is mainly due to the continuous high price of raw material magnesium ingot, most half-process enterprises have not started, and the market construction is insufficient.

In 2022, the new production capacity of titanium dioxide market will be about 1.1 million tons, and that of titanium sponge will be about 100,000 tons. With the gradual release of downstream market production capacity, the demand for raw material titanium market will be further increased.

4. afternoon forecast

Titanium ore market forecast

The downstream titanium dioxide market affected by cost pressure and public health, some enterprises fell, domestic titanium market is weak, the price is slightly lower, and the market is coming off-season, titanium prices are expected to continue from April to May, some market prices fall slightly; but the raw material mining is still insufficient, the price remains high, and the domestic titanium resources are still relatively tight, in the later stage with the domestic transportation gradually improved.

August 21, 2024, 2:42 PM

August 21, 2024, 2:28 PM

August 21, 2024, 2:20 PM

August 21, 2024, 3:01 PM