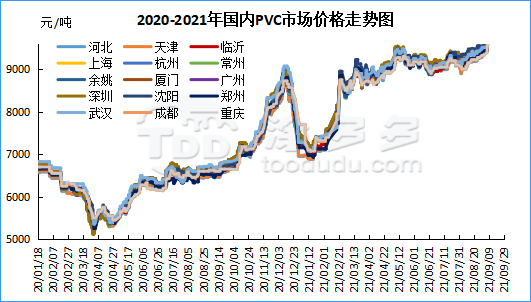

PVC monthly report: September single-month increase of up to 2730-3185 yuan / ton

Domestic PVC market overview

This month, the domestic PVC market prices rose wildly, a huge increase in a single month, relative to the beginning of the month prices rose 2730-3185 yuan / ton, an increase of 28.9%-33.44%. The crazy rise in spot prices is mainly due to several factors.

1.the Inner Mongolia region, Ningxia region, Shaanxi region still have power restrictions, where the Inner Mongolia region is relatively small, the impact on the region's calcium carbide and PVC is not significant, and with the end of the autumn maintenance PVC plant load has been enhanced, but Shaanxi region, North Yuan in the energy consumption file, PVC plant load start-up fell to 3 percent, resulting in a shortage of market once North Yuan brand PVC. ningxia region power restrictions mainly involving calcium carbide, Ningxia calcium carbide enterprises to export calcium carbide, calcium carbide is a high energy-consuming industry, a single ton of calcium carbide power consumption in 4200-4400 degrees of electricity, because calcium carbide enterprises and ferrosilicon enterprises basically belong to the key enterprises of the double control, in the second half of the regional energy consumption documents, calcium carbide enterprises, the device load is constantly controlled, calcium carbide prices soared, strong support for PVC.

2.in the market storm rapidly changing today, some of the self media over-interpretation of some policy documents, and even sniff the wind grass, resulting in PVC single product fluctuations from the early 50-100 yuan / ton, to the current single day up as much as 500-700 yuan / ton. Spot prices rose wildly for a continuous period of time, macro sentiment was constantly reinforcing the bias, because whether the spot market or futures market single-day fluctuations are above 400-500. Surely there is a crazy rise in futures and spot prices have unreasonable, but the overall macro sentiment in the case of no retracement of the low, constantly being reinforced, and the spot market even panic rush phenomenon.

3.For the regional energy consumption double control, its PVC mainstream consumption areas of East China and South China also have power restrictions, but PVC downstream products enterprises are more complex difficult to count, because the Guangdong region and the demand side of Jiangsu area power restrictions, but the impact on the plate is very lagging, in contrast to the strong supply and weak demand, the accumulation of social inventory in the short term and can not affect the strong trend of the plate. The negative feedback of demand was slow to cause a short. Therefore, it caused a crazy rise in PVC spot prices in September. Valuation comparison, the end of the month compared to the beginning of the spot price: North China rose 2760-2810 yuan / ton, East China rose 2770-2985 yuan / ton, South China rose 2730-2795 yuan / ton, Northeast China rose 3185 yuan / ton, Central China rose 2820-2960 yuan / ton, Southwest China rose 2945 yuan / ton.

Post Market Forecast

Plastic Doduo forecast: futures: PVC01 contract intraday continues to maintain a sharp rise, intraday position reduction upward, ahead of us that reminded, the National Day Festival before the funds left the field in advance to hedge, can not be judged as the trend of the plate 01 contract weakening, today the futures price again broke through the previous high constantly upward, the highest point to 12210, position reduction of 22007 hands, empty flat more for short single stop loss, the plate did not as the Mid-Autumn Festival before the The hedge fell, the National Day before the plate even maintained a relatively large rise, in addition to the end of the coking coal up, the market macro-strong sentiment continued, the Mandarin commodity index to challenge the 220 mark, up to 220.40. And from the PVC01 contract position, the high level of continuous position reduction currently 420,000 hands has been considered low, after the holiday funds return and see how the interpretation.

On the spot: the current disturbance of power restrictions in terms of calcium carbide continues, calcium carbide prices remain high, receiving prices continue to rise, PVC single product cost support is strong. And from the production side 2021 September PVC production 1,592,100 tons, 14.38% less than in August. The supply is significantly reduced, relatively superimposed on the opening of exports, the volume of export orders stable, the domestic market can be circulated PVC spot volume reduced. Supply is expected to be tight or long-term continuation of the state, and the current macro sentiment continues to be positive, the bottoming out of the rebound in coal has also driven the continued rise in the bulk of the goods. Downstream demand, although in the higher PVC spot price suppression, downstream enterprises during the National Day part of the holiday, the overall industry start or further reduced, but the high price suppression of domestic demand or lower than the upstream supply reduction, and as we mentioned earlier, the downstream products companies are also raising the cost of selling prices. Comprehensive view of the last working day before the National Day futures plate did not, as expected by the industry, a sharp pullback, but continue to pull up break through the previous high, driving the spot market to further seal the plate, although the National Day holiday also exists more uncertainty, but the current short-term view of spot prices will still run at high levels, strong ideas to treat.