Global Macro Overview on May 28th

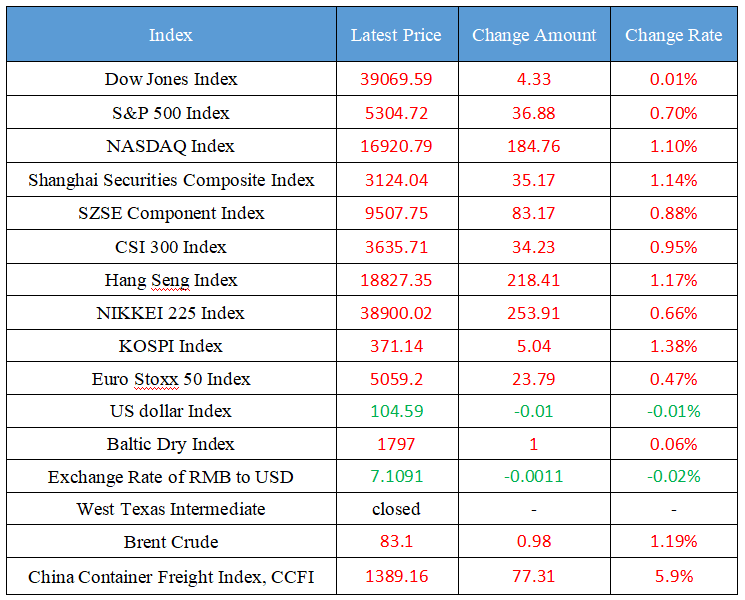

Latest Global Major Index

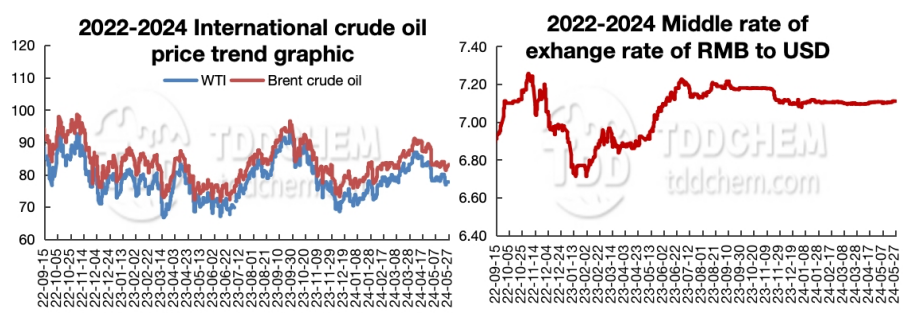

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Taiwan Affairs Office of the State Council: The World Health Assembly's rejection of the Taiwan-related proposal once again shows that the international community's adherence to the one-China principle is unshakable

2. Dawn shares: a wholly-owned subsidiary plans to invest 450 million yuan to build a new material expansion project (phase II)

3. Industry experts: Shanghai's new real estate policy is rich in content and innovative, which will enhance market confidence

4. Sungrow: The company is implementing the construction of the second phase of the hydrogen energy automation and intelligent manufacturing plant

5. The spokesperson of the Ministry of Foreign Affairs issued a statement on the rejection of the Taiwan-related proposal at the 77th World Health Assembly

International News

1. Above-average monsoon rainfall is expected in India, boosting agricultural production and economic growth

2. European stocks maintain stability, the United Kingdom and the United States have a break in the market, and the focus shifts to the macroeconomy and the European Central Bank's policy moves

3. The market is ready for the European Central Bank's decision to cut interest rates in June, and the future path is full of uncertainties

4. The Bank of Israel keeps interest rates unchanged and expectations for further interest rate cuts are lower

5. OPEC: Global oil demand will continue to grow strongly in the next two years

Domestic News

1. Taiwan Affairs Office of the State Council: The World Health Assembly's rejection of the Taiwan-related proposal once again shows that the international community's adherence to the one-China principle is unshakable

On May 27, Chen Binhua, spokesman for the Taiwan Affairs Office of the State Council, answered a reporter's question. Chen Binhua said that there is only one China in the world, and Taiwan is a part of China. The decision of the 77th World Health Assembly not to include Taiwan-related motions in the agenda of the World Health Assembly once again shows that the pattern of the international community's adherence to the one-China principle is unshakable, and it also proves once again that the DPP authorities' attempt to participate in the WHA without recognizing the "92 Consensus" embodying the one-China principle and without going through cross-strait consultations will lead to the support of external forces. Taiwan compatriots are our relatives, and we have always kept the health and well-being of Taiwan compatriots at heart, and will continue to effectively protect the health rights of Taiwan compatriots by arranging for medical and technical experts from Taiwan, China, to participate in WHO technical activities, and promptly informing the Taiwan region of public health emergencies notified by the WHO through relevant channels. (CCTV News)

2. Dawn shares: a wholly-owned subsidiary plans to invest 450 million yuan to build a new material expansion project (phase II)

Dawn announced that in order to further expand production capacity, meet customer market demand, increase market share, enhance market competitiveness, and improve the company's profitability, the company's wholly-owned subsidiary, Dawn Degradation, plans to invest 450 million yuan to build a "new material expansion project (phase II)". The construction content of the project is a 100,000-ton TPU and 60,000-ton polyol construction project, with a construction period of 4 years.

3. Industry experts: Shanghai's new real estate policy is rich in content and innovative, which will enhance market confidence

For the new real estate policy issued by Shanghai, a number of industry experts believe that this move will play a positive role and effect, better guide market expectations, enhance market confidence, and will further promote the steady and healthy development of Shanghai's real estate market. The policy coordinates the market and security, stock and increment, and better meets the needs of residents for rigid housing and diversified improved housing while improving the quality of housing and promoting the balance between jobs and housing. Yan Yuejin, research director of Shanghai E-House Real Estate Research Institute, believes that Shanghai's adjustment and optimization of the housing purchase restriction policy involves rich content, covering foreign household registration, talents, singles, divorced, enterprises, multi-child families, gifts and other levels, so as to better implement the service and housing orientation.

4. Sungrow: The company is implementing the construction of the second phase of the hydrogen energy automation and intelligent manufacturing plant

Sungrow said at the performance briefing that as the earliest new energy enterprise in the field of hydrogen energy in China, the company is committed to providing "efficient, intelligent and safe" green electricity hydrogen production systems and solutions, with the R&D, manufacturing and delivery capabilities of IGBT hydrogen production power supply, ALK and PEM electrolyzers, gas-liquid separation and purification equipment, smart hydrogen energy management system and other integrated system equipment, and has developed off-grid, grid-connected and microgrid multi-mode hydrogen production system solutions. At present, the global hydrogen energy industry is accelerating, and the company is implementing the construction of the second phase of the hydrogen energy automation and intelligent manufacturing plant, and the production capacity will be increased to 3GW in 2024. In the future, Sunshine Hydrogen Energy will continue to increase R&D investment, continue to make breakthroughs in product performance, single-tank output, and system efficiency, and accelerate cooperation in transnational projects in the Middle East, Australia, and Europe.

5. The spokesperson of the Ministry of Foreign Affairs issued a statement on the rejection of the Taiwan-related proposal at the 77th World Health Assembly

On May 27, the General Committee and Plenary of the 77th World Health Assembly respectively decided to explicitly reject the proposal put forward by individual countries to "invite Taiwan to participate in the World Health Assembly as an observer" to be included in the agenda of the Assembly. This is the eighth consecutive year that the World Health Assembly has rejected the so-called Taiwan-related proposal. China's position on Taiwan-related issues at the World Health Assembly has been widely understood and supported by the international community, and more than 100 countries have clearly supported China's position through a special letter to the WHO Director-General. This fully shows that the one-China principle is the aspiration of the international community and the trend of the times, and brooks no challenge. We once again tell the DPP authorities that the basic pattern of the international community's adherence to the one-China principle is unshakable and the general trend of China's reunification is irreversible. "Taiwan independence" runs counter to the interests of Taiwan compatriots, and there is absolutely no way out for "relying on foreign countries to seek independence." China also urges certain countries to stop distorting and challenging UN General Assembly Resolution 2758, stop hollowing out the one-China principle, stop politicizing health issues, stop interfering in China's internal affairs under the pretext of the Taiwan issue, and "using Taiwan to contain China" is doomed to failure. (Ministry of Foreign Affairs)

International News

1. Above-average monsoon rainfall is expected in India, boosting agricultural production and economic growth

This year's monsoon rains in India are likely to be above average. The monsoon is vital to India's nearly $3.5 trillion economy, providing nearly 70 percent of the rainwater needed to irrigate crops, replenish reservoirs and aquifers. Nearly half of India's farmland is unirrigated and relies entirely on rains from June to September to grow crops such as rice, corn, cotton, soybeans and sugar cane. Abundant rainfall is likely to boost agricultural production and broader economic growth, helping to reduce food price inflation. Below-average rainfall in 2023 has affected food production as reservoir levels have dried up. The government's response was to restrict the export of sugar, rice, onions, and wheat. The resumption of exports depends on how quickly production recovers in 2024, which is not possible without good monsoon rains. India is the world's second-largest producer of wheat, rice and sugar, and the largest importer of palm, soybean and sunflower oils.

2. European stocks maintain stability, the United Kingdom and the United States have a break in the market, and the focus shifts to the macroeconomy and the European Central Bank's policy moves

European equities were largely flat during the light trading day as UK and US markets were closed for holidays. The previous better-than-feared European earnings season provided support for a historic rally in equities, but investors' focus may now turn to the still-uncertain macroeconomic situation. Ulrich Urban, Head of Multi-Asset Strategy and Research at Berenberger, said: "Despite the relatively low positioning of international investors in Europe, we remain bullish on European equities given the country's recent unexpectedly positive economic performance. At the same time, investors are paying close attention to the comments of ECB officials, who are assessing the outlook for monetary policy. Today, ECB Governing Council member Villeroy said that the ECB should not rule out a second rate cut in July.

3. The market is ready for the European Central Bank's decision to cut interest rates in June, and the future path is full of uncertainties

Over the past few weeks, the ECB has made it clear that it will cut interest rates in June. The ECB's decision at next week's policy meeting is almost a foregone conclusion, and markets are now well prepared. But the key question now is, what happens next? In other words, the "easy" part is over. Now, the real challenge for the ECB begins. We think the ECB will continue to monitor payroll data to try to better understand the outlook. After June, there will be four more policy meetings this year. But as things stand, traders expect another 25 basis points of rate cuts by the ECB after next week. The ECB has already signaled that they are not keen on consecutive rate hikes. Therefore, July can be safely excluded. This makes it possible to follow up on the June initiative in September, October or December. With at least four months left on the market at the earliest, pricing expectations still have a lot of room to change.

4. The Bank of Israel keeps interest rates unchanged and expectations for further interest rate cuts are lower

The Bank of Israel left interest rates unchanged at today's meeting, Citigroup no longer expects Israel to resume cutting interest rates this year, and traders have lifted bets on the imminent introduction of further easing. Israeli policymakers had earlier hinted at three more rate cuts in 2024, but after the rate cuts at the start of the year, they increasingly took a more neutral approach. The change in tactics largely reflects the economic spillover effects of the war on Hamas, which has dragged on for more than seven months. Roneen Menachem, chief market economist at Mizrahi Tefahot Bank, said: "There are more concerns that interest rate differentials between Israel and the US could lead to a further depreciation of the already volatile shekel and increase inflationary pressures. ”

5. OPEC: Global oil demand will continue to grow strongly in the next two years

At the extraordinary meeting of the 141st meeting of the Council of the OPEC Economic Commission (ECB), the OPEC secretary general said that the world economy has shown relative resilience, with oil demand expected to grow by 2.2 million barrels per day by 2024, and total global demand is expected to average 104.5 million barrels per day. Global oil demand growth is forecast to grow further strongly by 1.8 million b/d by 2025, with total global demand averaging 106.3 million b/d. The special session was followed by a closed-door meeting at the end of the week, focusing on the global oil market, its state and near-term prospects.

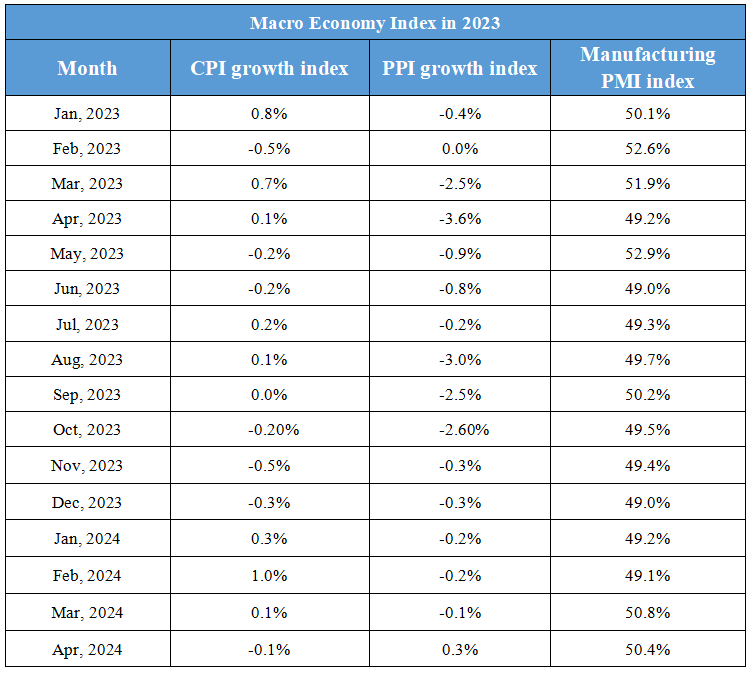

Domestic Macro Economy Index