May 24th Macroeconomic Index: China's Foreign Non-Financial Direct Investment Surges 18.7%, Memory Chip Prices Rise 50%

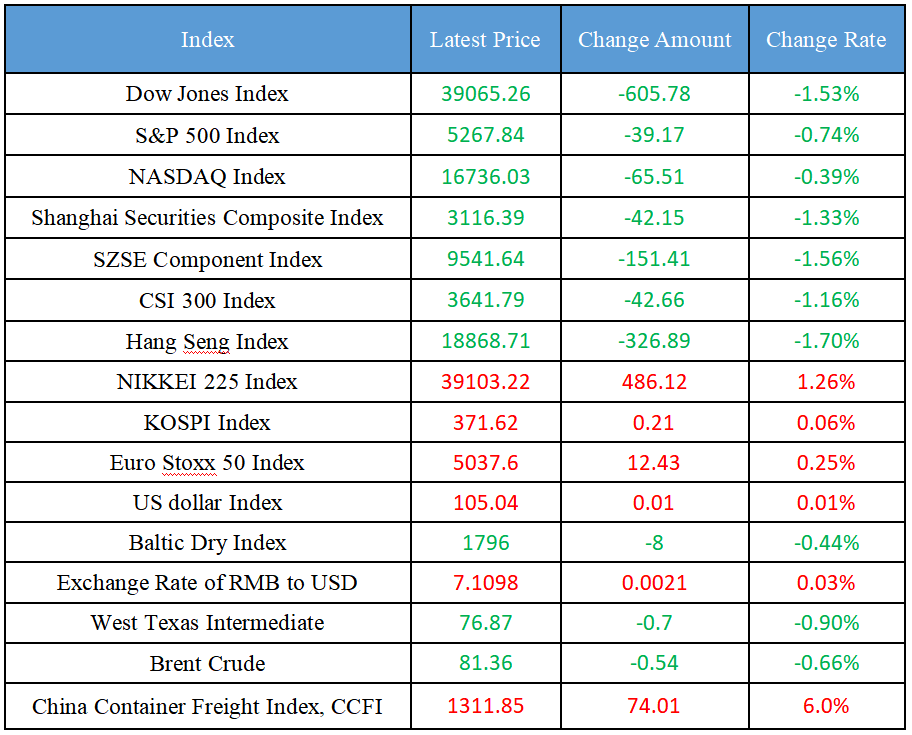

Latest Global Major Index

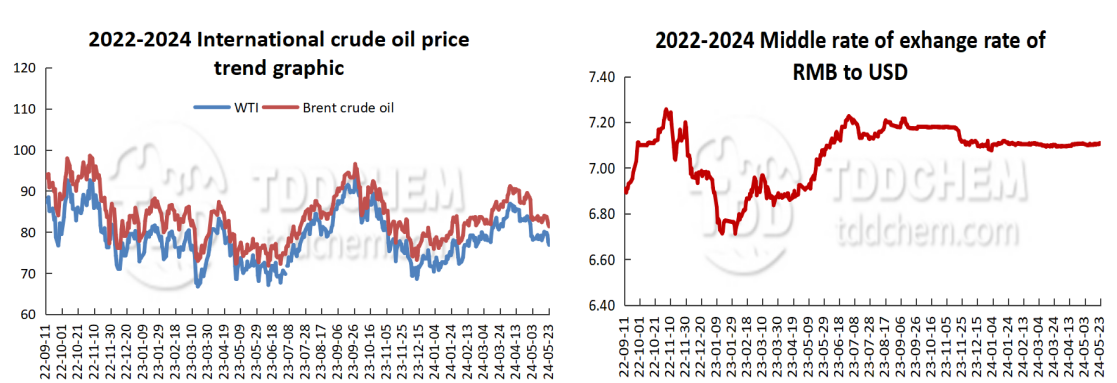

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Accelerate the pace of industrialization, cultivate more improved varieties and seeds, and ensure national food security from the source

2. The price of memory chips has risen by 50%, and it may continue to rise

3. National Health Commission: Intensify reforms in key areas and key links of medical reform

4. Ministry of Commerce: From January to April, China's foreign non-financial direct investment was 343.47 billion yuan, a year-on-year increase of 18.7%

5. From January to April, the export of new containers in Fujian Province soared nearly 8 times

International News

1. Global business has generally improved, providing room for central banks to postpone interest rate cuts

2. After the announcement of the general election in the United Kingdom, the implied volatility of the pound rose but was still not close to the peak

3. In May, the amount of diesel exported by India oil tankers decreased

4. The UK seeks comments on the expansion of the carbon emissions trading scheme

5. Affected by the hawkish outlook of the Federal Reserve, oil prices fell for the fourth consecutive trading day

Domestic News

1. Accelerate the pace of industrialization, cultivate more improved varieties and seeds, and ensure national food security from the source

Li Qiang, member of the Standing Committee of the Political Bureau of the CPC Central Committee and Premier of the State Council, conducted research in Henan from May 22 to 23. He stressed that it was necessary to promote the construction of innovation platforms in the field of seed industry, strengthen the frontier research of key varieties, accelerate the pace of industrialization, cultivate more improved varieties and seeds, and ensure national food security from the source. The development of modern agriculture was increasingly dependent on science and technology and talent, and it was necessary to increase incentives and support for agricultural scientific research personnel, encourage more young students to study agriculture, and attract more outstanding talents to devote themselves to agriculture. Li Qiang pointed out that the food industry was the oldest industry with great development potential. It was necessary to play the role of a leading enterprise, drive the linkage and integrated development of the whole industrial chain, improve quality, start the brand, and make the specialty food industry better and stronger. It was necessary to innovate agricultural management methods, cultivate and expand new agricultural business entities, drive farmers to increase their incomes and become rich, improve the quality and efficiency of agricultural development, and provide support for promoting the comprehensive revitalization of rural areas. (CCTV).

2. The price of memory chips has risen by 50%, and it may continue to rise

Memory chips are the most important segment of the semiconductor market, which is mainly divided into flash memory and memory. Data shows that since the beginning of this year, the price of memory chips has increased by about 50% compared with the same period last year. The person in charge of a storage company said that from the end of 2023, the semiconductor storage industry will gradually enter an upward cycle, and this year it has received many notices from upstream memory chip factories to increase the contract price. According to reports, the price of memory chips may continue to rise, and it is expected that the contract price of new DRAM memory products will rise by 13% to 18% in the second quarter of this year. (CCTV Finance)

3. National Health Commission: Intensify reforms in key areas and key links of medical reform

Xue Haining, Deputy Director of the Department of Physical Reform of the National Health Commission, said that the next step is to strengthen the confidence and courage of reform, consolidate and strengthen the measures that have been proven effective in practice, and increase reform efforts in key areas and key links. Among them, it is necessary to focus on the pilot cities for medical service price reform, pilot provinces and demonstration cities for public hospital reform and high-quality development, continue to deepen the reform of medical service prices, straighten out the price comparison relationship of medical services, and optimize the income structure of hospitals. It is necessary to accelerate the promotion of centralized procurement of pharmaceutical consumables to speed up and expand the scope, and form a national and provincial linkage procurement pattern. (CCTV News)

4. Ministry of Commerce: From January to April, China's foreign non-financial direct investment was 343.47 billion yuan, a year-on-year increase of 18.7%

He Yadong, spokesman of the Ministry of Commerce, said at the press conference that from January to April 2024, China's foreign non-financial direct investment was 343.47 billion yuan, a year-on-year increase of 18.7%. Among them, the non-financial direct investment of Chinese enterprises in the "Belt and Road" countries was 77.77 billion yuan, a year-on-year increase of 20.4%. From January to April 2024, the turnover of foreign contracted projects was 313.42 billion yuan, a year-on-year increase of 8.8%; The newly signed contract value was 444.39 billion yuan, a year-on-year increase of 9.3%. Among them, the turnover of Chinese enterprises in the "Belt and Road" national contracted projects was 252.56 billion yuan, a year-on-year increase of 9.1%; The newly signed contract value was 386.29 billion yuan, a year-on-year increase of 17.7%.

5. From January to April, the export of new containers in Fujian Province soared nearly 8 times

On the 22nd, under the supervision of Xiamen Customs, a batch of a total of 300 newly made containers was successfully exported overseas, which is the 49th batch of new containers exported by Xiamen Taiping Container Manufacturing Co., Ltd. this year. According to Xiamen Customs, containers are the main loading tools for ocean transportation, and more than 90% of the world's containers are produced in China. Affected by the international situation, the international shipping cycle has been lengthened, and the volume of container exports has "blowout". According to the statistics of Xiamen Customs, from January to April this year, Fujian Province exported a total of 526 million yuan of new containers, a year-on-year increase of 7.86 times. (Fujian Daily)

International News

1. Global business has generally improved, providing room for central banks to postpone interest rate cuts

Survey data released on Thursday showed that global business performance generally improved this month, with economic activity picking up in parts of Asia and Europe, providing room for central banks to potentially delay interest rate cuts. In the wake of the pandemic, many central banks raised interest rates to combat rampant inflation, but the conversation now turned to how quickly rates will fall and by how much. A survey of economists conducted by the agency in April showed that the global economy is likely to remain strong for the rest of the year and into 2025, beating previous expectations of a slowdown. Economists say stronger than expected economic growth is more likely than weak.

2. After the announcement of the general election in the United Kingdom, the implied volatility of the pound rose but was still not close to the peak

ING strategists said in a note that the implied volatility of the pound rose after the UK's surprise announcement that a general election would be held on July 4. GBP-USD two-month implied volatility jumped around 20bps following the announcement, but remained far from its April peak of 7.30. With the opposition Labour Party, which is expected to win, making policy commitments ahead of the election, some "noise" around the pound is likely to emerge ahead of the vote. The most impactful news was probably about Scotland's plans to hold a new referendum, but they said it seemed unlikely. GBPUSD two-month volatility is now at 6.08, up from 5.6050 in early Wednesday trading, according to Refinitiv data.

3. In May, the amount of diesel exported by India oil tankers decreased

Indian refiners used crude tankers to ship less refined products such as diesel to major European markets in May, up from near a two-year high last month, trade sources and analysts said. This is because the growing inventory in the Antwerp-Rotterdam-Amsterdam area, as well as the unstable east-west diesel price spread, weakens the case for sellers to ship large quantities of industrial fuel to the West. While the increase in India's exports to Europe in April provided a floor for Asia's profit margins, a reduction in such exports in May could force Indian refiners to shift diesel sales back to Asia, exacerbating the region's oversupply, analysts and traders said.

4. The UK seeks comments on the expansion of the carbon emissions trading scheme

The UK Emissions Trading Scheme Authority said it had launched two consultations on how to expand the ETS to cover the waste treatment sector and how to integrate greenhouse gas removal technologies, such as direct air carbon capture, into the system. The first consultation seeks comments on how to include the waste incineration and waste-to-energy sectors in the scheme from 2026 and is valid until 18 July. In addition, the agency is also seeking comments on how to incorporate technologies to remove greenhouse gases from the atmosphere, such as direct air carbon capture, into the plan, which will close on August 15. The authorities said they intended to seek more advice, including how to extend the ETS to the domestic maritime sector from 2026 onwards, and would launch it in due course.

5. Affected by the hawkish outlook of the Federal Reserve, oil prices fell for the fourth consecutive trading day

Oil prices extended losses today after crude oil prices closed at their lowest level in three months on Wednesday amid signs that the Federal Reserve may keep interest rates higher for longer, which could weigh on energy demand. Some institutional analysts said that oil is generally in a bearish trend, and the biggest focus is still on whether the OPEC+ meeting will extend voluntary production cuts.

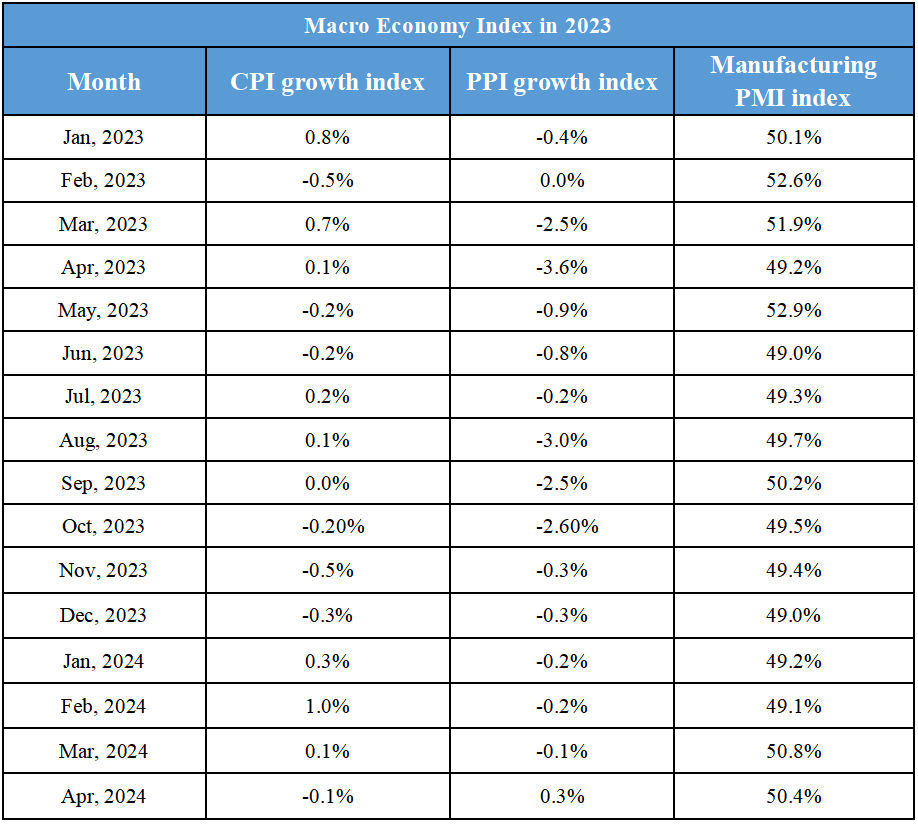

Domestic Macro Economy Index