May 23rd Macroeconomic Index: China's Domestic News Highlight Economic Growth, US Announces New Tariffs on China

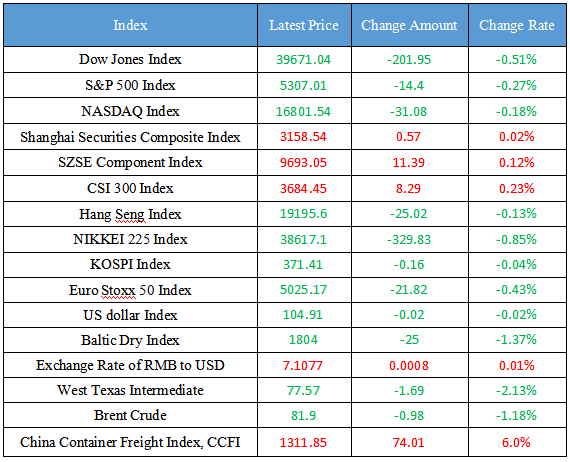

Latest Global Major Index

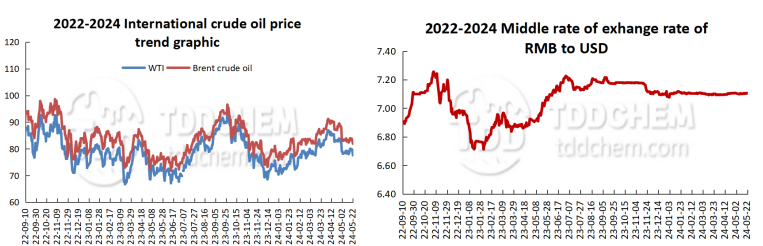

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. National Development and Reform Commission: Vigorously cultivate cruise operators with market competitiveness

2. Heilongjiang has exceeded 10 billion kilowatt-hours of new energy power transmission this year

3. COSCO SHIPPING Group signed a strategic cooperation framework agreement with Xiamen Municipal Government

4. The container throughput of Shanghai Port has ranked first in the world for 14 consecutive years

5. Guosheng Securities: The supporting regulations for the low-altitude space economy have been gradually improved, and the commercialization of the industry is expected to accelerate

International News

1. The United States announced a new round of tariff rules on China, and electric vehicles and other products would be implemented from August.

2. U.S. natural gas continues to pull back

3. Oil prices fell due to the weak market and the decline in hopes of interest rate cuts

4. The weather outlook supports demand, and European natural gas prices have risen

5. UK CPI data was strong in April , and traders postpone interest rate cut forecasts

Domestic News

1. National Development and Reform Commission: Vigorously cultivate cruise operators with market competitiveness

Huo Fupeng, head of the Industrial Development Department of the National Development and Reform Commission, said at the regular policy briefing of the State Council on May 22 that in the next step, the National Development and Reform Commission will work with relevant departments in cruise operation and management, equipment manufacturing, supporting construction, tourism consumption and other aspects of the work together. From both ends of the supply and demand of the cruise tourism market, we will make concerted efforts to improve the policy system, optimize the institutional environment, and systematically promote the high-quality development of the cruise industry throughout the industry chain. In terms of operation and management, we will build a first-class service system. Benchmark against the world's first-class cruise operating companies, and vigorously cultivate cruise operating enterprises with market competitiveness. Strengthen the construction of professional operation capabilities such as route planning, ship management, brand building, and risk prevention and control. Accelerate the training of cruise operation talents, continuously improve the service guarantee system, and promote international operation cooperation in an orderly manner. (Securities Times).

2. Heilongjiang has exceeded 10 billion kilowatt-hours of new energy power transmission this year

On May 22, the reporter learned from the State Grid Heilongjiang Electric Power Co., Ltd. today that since 2024, Heilongjiang Province has achieved a total of 16.491 billion kilowatt-hours of external power transmission transactions, an increase of 46.43% over the same period last year, a record high, of which 10.33 billion kilowatt-hours of new energy external power transmission transactions, an increase of 121.2% over the same period last year. A few days ago, in the May transaction of the Northeast Power Grid to Zhejiang organized by the Beijing Electric Power Trading Center, Heilongjiang Province traded 36.98 million kilowatt hours of electricity, all of which were new energy power generation. (Xinhua News Agency)

3. COSCO SHIPPING Group signed a strategic cooperation framework agreement with Xiamen Municipal Government

COSCO SHIPPING Group and Xiamen Municipal Government officially signed a strategic cooperation framework agreement, opening a new milestone of comprehensive cooperation. Zhu Bixin, general manager of COSCO SHIPPING Group, said that Xiamen is an important node city in the "Belt and Road" initiative, an international comprehensive transportation hub city determined by the state, and a bridgehead to serve cross-strait economic and trade exchanges and development integration. Xiamen's comparative advantages are highly consistent with the development direction of COSCO SHIPPING Group, and the two sides have a good foundation for cooperation and complementary significance.

4. The container throughput of Shanghai Port has ranked first in the world for 14 consecutive years

On May 22, Wei Lu, chief economist of the Shanghai Municipal Development and Reform Commission, introduced in the "High-quality Development Research Tour" Shanghai theme interview briefing that in recent years, Shanghai has strengthened the resource allocation function of shipping hubs, accelerated the digital, intelligent and green transformation of shipping, and ranked third in the world in the Xinhua Baltic Shipping Center Index for four consecutive years. In 2023, the container throughput of Shanghai Port reached 49.158 million TEUs, ranking first in the world for 14 consecutive years, and Yangshan Phase IV automated terminal has become the world's largest automated terminal. The world's top 10 liner companies, 5 of the world's top 10 ship management agencies, and 10 members of the International Association of Classification Societies have all set up regional headquarters or branches in Shanghai, and the total business volume of ship insurance and cargo insurance accounts for nearly 1/4 of the country, ranking first in the country.

5. Guosheng Securities: The supporting regulations for the low-altitude space economy have been gradually improved, and the commercialization of the industry is expected to accelerate

As an important component of new productive forces, the low-altitude space economy has strong national and local policy support, supporting regulations have been gradually improved, and the commercialization of the industry is expected to accelerate. It is recommended to pay attention to the potential benefits of the industrial chain: complete aircraft, air traffic control, power, parts, aviation materials, radar systems, design, operation and testing, etc.

International News

1. The United States announced a new round of tariff rules on China, and electric vehicles and other products would be implemented from August.

In the early morning of May 22, Eastern time (evening of May 22, Beijing time), the Office of the United States Trade Representative (USTR) announced the draft details of a new round of 301 tariffs on China, further refining the previously announced product categories to be subject to tariffs to specific product names and customs numbers, among them, tariffs on steel and aluminum, electric vehicles and lithium batteries for electric vehicles will take effect on August 1. (Caixin)

2. U.S. natural gas continues to pull back

U. S. natural gas futures prices fell for the second day in a row, continuing to retreat from a four-month high set on Monday. Eli Rubin, an analyst at EBW Analytics, said in a note: "Profit-taking, technical consolidation, and the short-covering pause that occurred over the Memorial Day weekend all constitute bearish concerns for the next 7-10 days." As for the weather, he added: "Widespread high temperatures in the Midwest and the Mid-Atlantic are likely to support electric burning in the middle of the week, while high temperatures in Texas will return over the weekend."

3. Oil prices fell due to the weak market and the decline in hopes of interest rate cuts

Oil prices fell on the back of market weakness, declining Fed rate cut hopes and easing geopolitical tensions. Profit margins at U.S. refineries have fallen sharply and the country's gasoline demand is at its lowest level since 2020, ANZ analysts said in a note. The latest U.S. crude oil inventory data surprised the market by adding 2.5 million barrels in the week ended May 17. At the same time, cautious rhetoric from Fed officials has also dampened hopes of rate cuts, raising fears that higher interest rates for longer periods of time will weigh on demand.

4. The weather outlook supports demand, and European natural gas prices have risen

European gas prices rose for the seventh transaction days, and the needs were supported by forecasts of warmer weather despite the end of major maintenance work in Norway, the largest gas supplier. Benchmark futures rose as much as 2.7% after closing the day at their highest level in more than a month. The recovery in cooling demand in Europe has supported prices, with Germany and Northern Europe expected to experience unusually high temperatures next week. In addition, traders are also wary of potential supply disruptions as geopolitical tensions rise. According to S&P Global Commodity Insights, industrial demand growth in six major European countries – Germany, Italy, the Netherlands, the United Kingdom, France and Spain – is also continuing to rise.

5. UK CPI data was strong in April , and traders postpone interest rate cut forecasts

Traders have cut bets on the Bank of England to cut interest rates in June after the release of the UK CPI data, and are now expecting only 38 basis points of rate cuts by the Bank of England in 2024, and traders are no longer fully pricing in two rate cuts by the Bank of England this year. Meanwhile, overnight index swaps (OIS) showed that the odds of a BoE rate cut in June fell to around 18% from 50% on Tuesday due to strong UK CPI data, with traders fully pricing in the timing of the BoE's first rate cut until November.

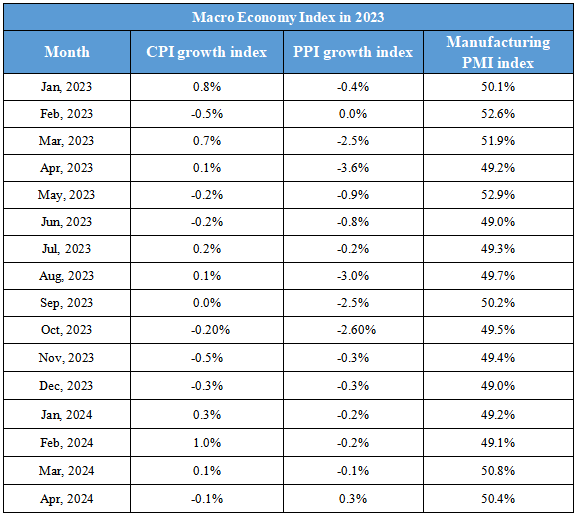

Domestic Macro Economy Index