May 22nd, Global Economic Trends and Domestic Policy Updates

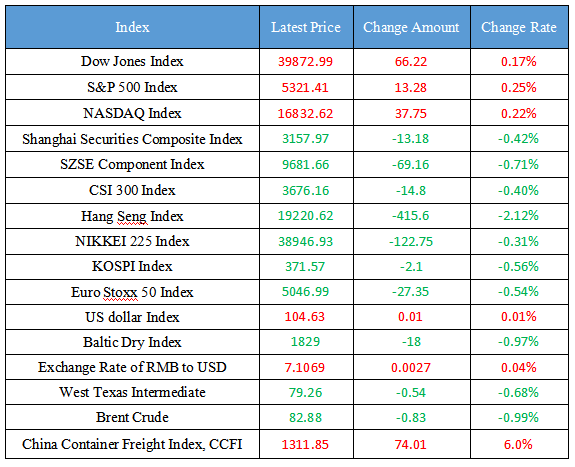

Latest Global Major Index

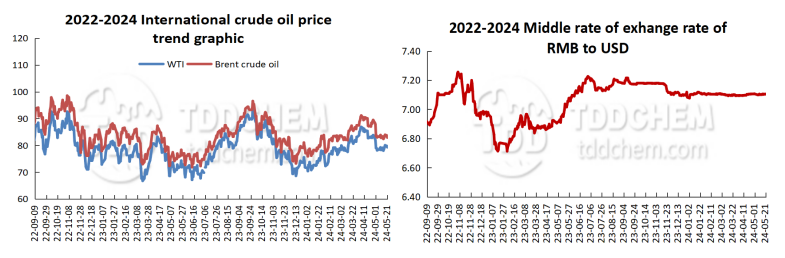

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. National Development and Reform Commission: The profits of industrial enterprises have increased for three consecutive quarters, providing strong support for enterprises to expand reproduction

2. Xinjiang: Accelerate the construction of clean energy bases such as wind power and photovoltaic, and vigorously build a new power system

3. Xinjiang's oil and gas production equivalent has ranked first in the country for three consecutive years

4. Shanghai Futures Exchange: Adjust the margin ratio and price limit of gold and other futures trading

5. Lei Haichao, Secretary of the Party Leadership Group of the National Health Commission, went to the State Administration of Traditional Chinese Medicine for research and discussion

International News

1. The premium of the near-month and far-month contracts of Brent oil narrowed, and the concern of tight supply eased

2. Canada's CPI fell to a three-year low, increasing the probability of interest rate cuts

3. ING Bank: The dollar is stable in the short term, but it may rise with yields

4. India's largest oil producer beat quarterly profits over expectations

5. Shipping prices continue to rise and are expected to cool down in the second half of the year

Domestic News

1. National Development and Reform Commission: The profits of industrial enterprises have increased for three consecutive quarters, providing strong support for enterprises to expand reproduction

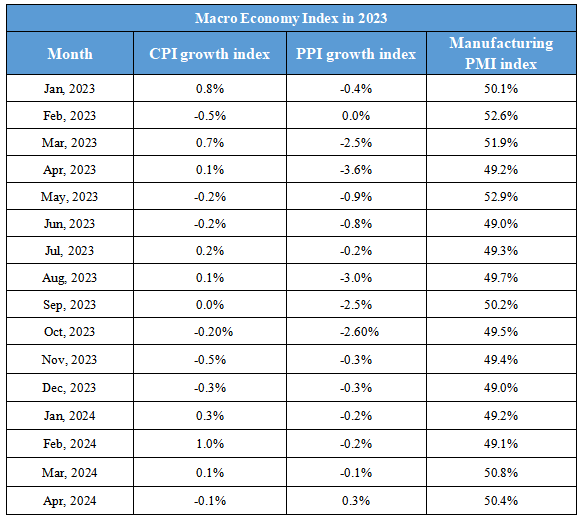

Li Chao, spokesman of the National Development and Reform Commission, said in response to reporters' questions that in March ~ April this year, the manufacturing PMI continued to be in the expansion range of more than 50%, reflecting the steady growth of industrial production and the gradual improvement of enterprise efficiency under the condition that macroeconomic policies continue to be effective. At present, favorable conditions are accumulating to promote the sustainable recovery and development of the manufacturing industry. For example, in the first quarter, the profits of industrial enterprises above designated size increased by 4.3% year-on-year, growing for three consecutive quarters, and the profit growth provided strong support for enterprises to expand reproduction. In the next step, the National Development and Reform Commission will implement ultra-long-term special treasury bonds to support the implementation of major national strategies and security capacity building in key areas, and accelerate the issuance of investment in the central budget and the issuance and use of local government special bonds.

2. Xinjiang: Accelerate the construction of clean energy bases such as wind power and photovoltaic, and vigorously build a new power system

On May 21, Erken Tuniyaz, deputy secretary of the Party Committee of Xinjiang Uygur Autonomous Region and chairman of the autonomous region, said at the press conference that in promoting the construction of a modern industrial system, the next step is mainly the following considerations: First, consolidate and upgrade advantageous industries, and do a good job in oil, gas and coal. Second, cultivate and expand emerging industries and open up a new track of clean energy. Xinjiang will accelerate the construction of clean energy bases such as wind power and photovoltaics, continue to promote the large-scale and intensive development of new materials such as silicon and aluminum, vigorously build a new power system, and realize the coordinated development of photovoltaic "blue", desert "yellow" and ecological "green". Third, transform and upgrade traditional industries and stimulate new green and low-carbon kinetic energy. Xinjiang will accelerate digital and intelligent transformation, vigorously support enterprises to introduce new technologies and new models, promote equipment renewal and process upgrading, and continuously improve the "gold content", "green content" and "intelligence content" of the manufacturing industry. (China.com)

3. Xinjiang's oil and gas production equivalent has ranked first in the country for three consecutive years

On the morning of May 21, the Information Office of the State Council held a series of press conferences on the theme of "Promoting High-quality Development", and Erken Tuniyaz, deputy secretary of the Party Committee of Xinjiang Uygur Autonomous Region and chairman of the autonomous region, said that in 2023, Xinjiang's oil and gas production equivalent reached 66.06 million tons, ranking first in the country for three consecutive years; The new raw coal output was 46 million tons, ranking second in the country. The installed capacity of new energy such as wind power and photovoltaic exceeded 70 million kilowatts, accounting for nearly half of the total installed capacity. 120 million tons of "Xinjiang coal export" and 126.3 billion kilowatt hours of "Xinjiang electricity delivery" have lit up thousands of lights and warmed thousands of households. (CCTV News)

4. Shanghai Gold Exchange: Adjust the margin ratio and price limit of some contracts

After research, it was decided that from the closing settlement on May 23, 2024 (Thursday), the trading margin ratio and price limit will be adjusted as follows: The price limit of gold and silver futures contracts will be adjusted to 10%, the hedging transaction margin ratio will be adjusted to 11%, and the speculative trading margin ratio will be adjusted to 12%. In case of the provisions of Article 12 of the Measures for the Administration of Risk Control of the Shanghai Futures Exchange, the trading margin ratio and the price limit shall be adjusted on the basis of the above-mentioned trading margin ratio. (Shanghai Futures Exchange)

5. Lei Haichao, Secretary of the Party Leadership Group of the National Health Commission, went to the State Administration of Traditional Chinese Medicine for research and discussion

Lei Haichao, Secretary of the Party Leadership Group of the National Health Commission, went to the State Administration of Traditional Chinese Medicine for research and discussion. Lei Haichao successively went to the Science and Technology Department, the Department of Medical Administration, and the Department of Minority Medicine of the State Administration of Traditional Chinese Medicine to learn about the situation, and listened to the work report of the State Administration of Traditional Chinese Medicine. He stressed that it is necessary to further improve the political position, adhere to the equal emphasis on traditional Chinese medicine and Western medicine, from the height of enhancing the "four self-confidence", in-depth planning of the inheritance and innovation of traditional Chinese medicine, promote the implementation of the "Shennong Taste Herbs in the New Era" project, enrich the treatment methods of traditional Chinese medicine, and develop more authentic medicinal resources. It is necessary to vigorously promote the culture of traditional Chinese medicine and continue to strengthen the construction of work style and clean government.

International News

1. The premium of the near-month and far-month contracts of Brent oil narrowed, and the concern of tight supply eased

On Tuesday, the premium of the front-month Brent contract to the six-month contract narrowed to $2.15 a barrel, the lowest since early February. This premium has been more than halved from the 2024 high of $5.76 on April 5. This is another indication that concerns about tight supply for spot delivery are easing. Global spot crude markets are weakening, reflecting weaker consumer and industrial demand, as well as increased supply from non-OPEC producers, traders and analysts said this week. In another sign, on Tuesday, the spread between the front-month and next-month contracts for Brent crude narrowed to 10 cents, the lowest since January.

2. Canada's CPI fell to a three-year low, increasing the probability of interest rate cuts

Data released by Statistics Canada on Tuesday showed that inflation in Canada fell to a three-year low of 2.7% in April, in line with expectations, and core measures continued to decline, which could increase the likelihood of a rate cut in June. The current annual rate of inflation is closer to the Bank of Canada's 2% target compared to April, when BoC Governor McLeum said the committee wanted to keep inflation cool before cutting interest rates. Inflation of 2.7% was slightly lower than the Bank of Canada's forecast. The Bank of Canada forecasts that inflation will remain around 3% in the first half of 2024, falling to 2.2% by the end of this year and 2% by 2025. Statistics Canada said the acceleration in gasoline prices in April added to upward pressure on inflation, as the higher cost of switching to summer fuel blends, higher oil prices due to supply issues and an increase in the federal carbon tax all contributed to the price increases.

3. ING Bank: The dollar is stable in the short term, but it may rise with yields

ING: The dollar looks set to remain stable in the short term, but it seems that the dollar is at risk of following the rise in US Treasury yields. Despite some encouraging news on the US data front, our rates team remains pricing in upside risks to US Treasury yields in the near term, and we doubt that the USD will weaken further before the end of May. Market expectations for a full rate cut by the Fed by the end of the year have been modestly reduced to 42bps, but overnight index swap pricing is unlikely to see the next significant move ahead of the US core personal consumption expenditures data on 31 May.

4. India's largest oil producer beat quarterly profits over expectations

India's state-owned oil and gas company reported better-than-expected quarterly profits, as lower operating costs and higher oil production helped offset lower gas prices and production. The company's net profit jumped to Rs 9,869 crore ($1.2 billion) in the three months ended March 31 from Rs 5.3 billion a year earlier, the filing showed. While the analyst poll estimated the company's average net profit at Rs 8,764 crore. Global oil exploration companies benefited from higher oil prices last quarter, but the Indian government limited their profits by imposing a windfall tax. Indian Oil & Natural Gas Corp, which accounts for 67 percent of India's oil production and 53 percent of its natural gas production, is investing billions of dollars in deepwater and ultra-deepwater exploration to help India reduce its heavy dependence on overseas supplies.

5. Shipping prices continue to rise and are expected to cool down in the second half of the year

At the end of 2023, affected by the Red Sea crisis, international shipping prices have been rising, especially for European and American routes, which have doubled in just one month. May is the traditional off-season of the international shipping market, but this year the situation is different, since the end of April, Europe, the Americas route freight rate increase is generally in double digits, some routes freight rates soared nearly 50%, "one container is hard to find" situation appears again. Industry people believe that the tide of shipping price increases is driven by various factors such as the Red Sea situation, foreign trade enterprises "rushing to export", and shipowners raising prices, and it is expected that freight rates will still fluctuate at a high level in the short term, but will not continue to grow significantly. The rate increase will not last long, and it is expected to ease within three months. (Xinhua News Agency)

Domestic Macro Economy Index