2020 Polypropylene PP Industry Annual Report

Statement

The report analyzes the current state of polypropylene development and predicts the long-term and short-term development trends of the polyvinyl chloride industry, with data from the National Bureau of Statistics, the National Information Center, and the General Administration of Customs. The following is a map of the original production of Plastopolymer.

1.2020 China polypropylene PP market overview

The domestic PP market fluctuations intensified in 2020, as seen in the trend chart, market prices went through three stages, falling first and then sharply adjusted upward, and after a significant downward move to the median flat, began a long period of narrow fluctuations, followed by a rise and then a fall in the fourth quarter.

The first quarter: In January, the domestic PP market continued to show a downward trend, during the Spring Festival holiday, after the end of the stocking, downstream enterprises on holiday and shutdown, logistics and transportation, business and petrochemical plant inventory increased greatly, the market stagnation, the transaction center fell slightly 300-700 yuan / ton. February domestic PP market prices also showed a decline, the sudden outbreak of the epidemic affects the downstream start, before the epidemic did not appear inflection point In February, the domestic PP market prices also showed a decline, the sudden outbreak of the epidemic affected downstream start-ups, before the epidemic did not appear inflection point, the downstream enterprises in various regions to resume work is not enough, the poor digestion of petrochemical stocks, prices downward. In March, the overall market trend has not changed, still mainly downward, from the comparison of regional estimates, there are still 300-500 yuan / ton of decline. The two oil inventories once reached a historical high, so the field merchants and petrochemical plants have lowered the offer in order to facilitate the delivery.

Second quarter: In April, the domestic PP market prices in the surge and plunge, the overall out of the roller coaster-like market. Enterprises in various regions have resumed work and production with the support of national as well as regional policies, and demand for PP has rebounded. Petrochemical ex-factory prices are constantly being raised. The price of the domestic PP market in May was shaking upwards. In June, the domestic PP market is dominated by a high level of vibration, the overall market trading atmosphere was a stalemate confrontation pattern, the price of narrow oscillation. The mainstream of the market drawing more concentrated in 7700-7900 yuan / ton or so finishing.

The third quarter: in July the domestic PP market prices continue to high oscillation finishing, price adjustments in the range of 50-200 yuan / ton, but the downstream resistance to high gradually increased, the transaction is blocked, the downstream just need to fill positions at low levels, terminal trading in general. August market trading is flat, wait and see obvious. September domestic PP market prices after the high oscillation finishing, by the futures continue to move higher, petrochemicals to inventory good The price of petrochemicals followed the rise, the center of gravity in the field quickly moved up, but with the higher prices of downstream profits compressed serious, resistance to high prices is obvious. The mainstream of the market drawing more concentrated in the 7980-8200 yuan / ton or so.

Fourth quarter: In October, the domestic PP market prices were high. In November, the overall price center of gravity of the domestic PP market moved up significantly, the field inquiry atmosphere is active, the downstream demand is very strong, with the release of macro positive, coupled with the futures soaring drive, the market again set sail, prices soared. The domestic PP market price was in a downward shaking trend. Spot high shipments are blocked, the impact of petrochemical enterprise price cuts one after another, merchants actively yield shipments, but the downstream new orders gradually reduced, and North China, East China and other places have been rumored to limit production, power restrictions and other negative news to suppress the field wait-and-see atmosphere, the industry is cautiously bearish, low prices frequently, the field supply-demand imbalance pressure gradually highlighted, the second half of the overall market decline slightly accelerated, merchants actively yield shipments, the downstream due to Demand continues to be sluggish, the terminal trading is light. The mainstream of the market drawing more concentrated in 7950-8250 yuan / ton or so.

2.2020 Domestic polypropylene PP market prices

3.2020 China polypropylene PP production capacity analysis

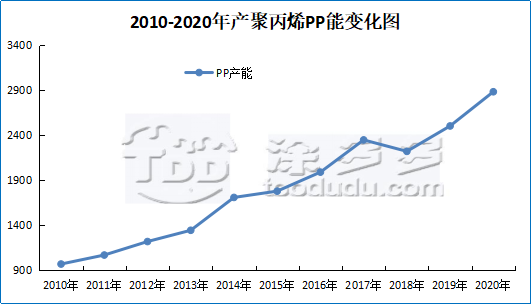

In the past five years, China's polypropylene production capacity has been increasing year by year, with an average growth rate of 9.30%. 2020 is a big year for production, which in turn will accelerate capacity growth; as of December 2020, domestic polypropylene production capacity has reached 28.82 million tons/year, an increase of 3.8 million tons/year, or 15.19%, compared to 2019. The more certain new capacity growth in 2021 is expected to be at 4.5 million tons/year.

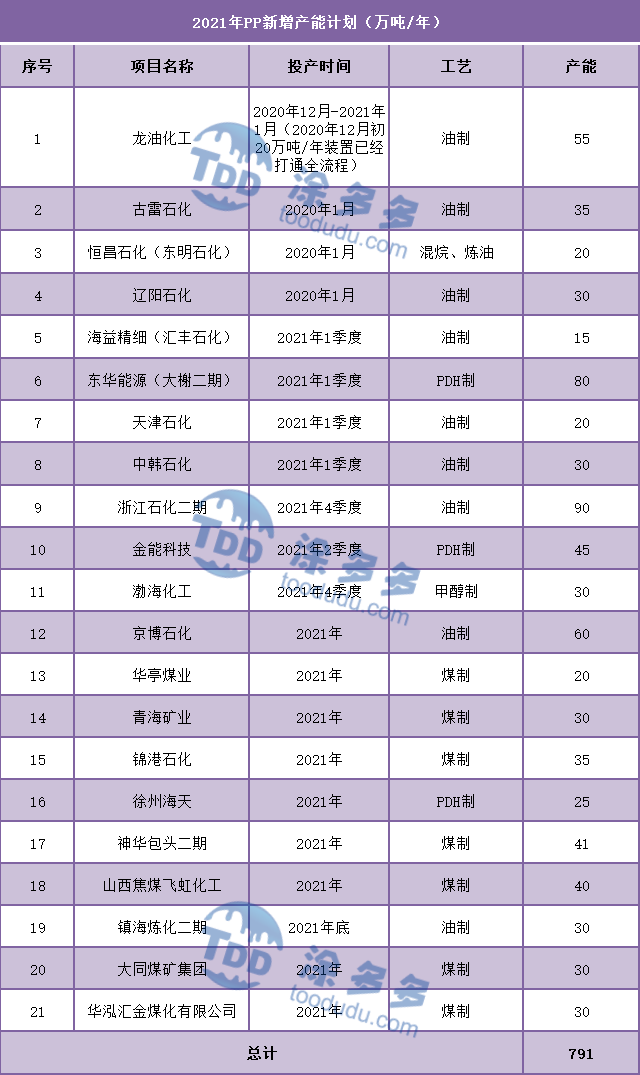

4.2021 China Polypropylene PP new capacity plan

5.2020 Polypropylene PP Production Analysis

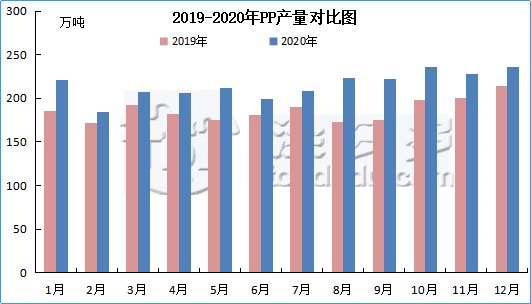

China's annual PP production in 2020 accumulated 25.8159 million tons, compared with last year's 22.3999 million tons up 3.416 million tons, or 15.25%.

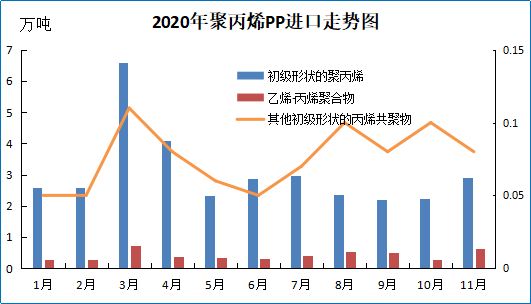

6.2020 Polypropylene PP import analysis

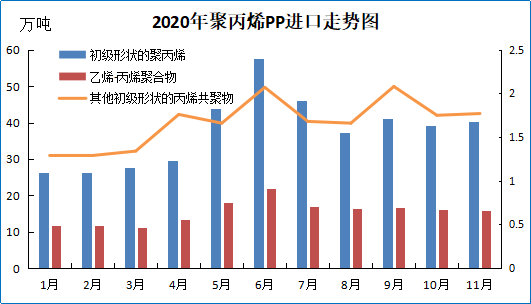

From January to November 2020, the cumulative import of polypropylene in primary shape was 4,145,600 tons, the cumulative import of ethylene-propylene polymers was 1,696,600 tons, and the cumulative import of other copolymers of propylene in primary shape was 183,500 tons.

7.2020 Polypropylene PP export analysis

From January to November 2020, the cumulative exports of polypropylene in primary shapes amounted to 296,400 tons, the cumulative exports of ethylene-propylene polymers amounted to 43,100 tons, and the cumulative exports of propylene copolymers in other primary shapes amounted to 0.75 million tons.

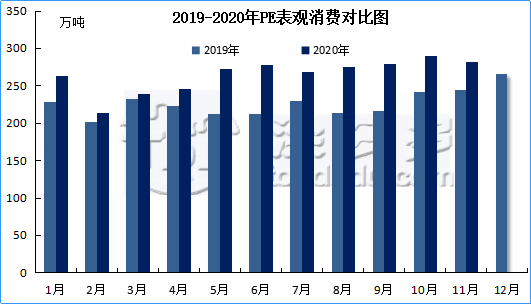

8.2020 Apparent consumption analysis of polypropylene PP

The cumulative apparent consumption from January to November 2020 is at 29,088,700 tons, up 18.43% from 24,562,600 tons last year.