May 14th Macroeconomic Index: Chinese Companies Secure Exploration Licenses in Iraq, Positive Factors Accumulate for China's Asset Recovery

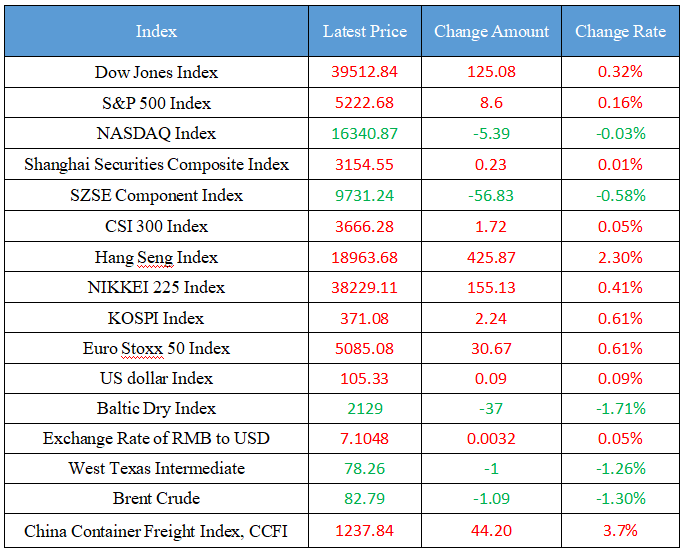

Latest Global Major Index

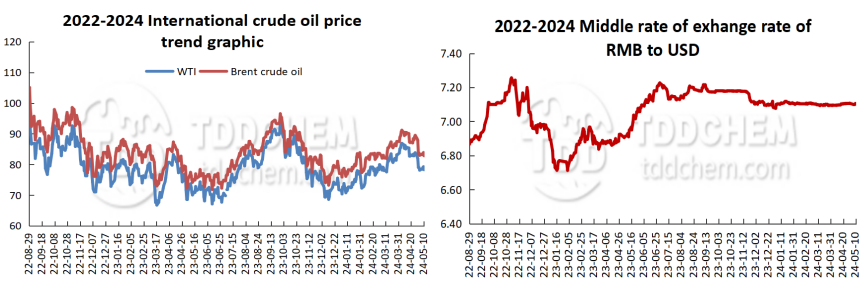

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Chinese companies have obtained exploration licenses for five oil and gas fields in Iraq

2. CITIC Securities: Many positive factors are accumulating, and all kinds of funds are rushing to promote the comprehensive recovery of China's assets in the near future

3. This year, the rail-sea intermodal trains of the western land-sea corridor have transported more than 300,000 TEUs

4. Guosheng Securities: It is expected that in 2024, supporting policies to support the development of low altitude space economy will be introduced in various places

5. National Development and Reform Commission: Form a reserve for energy-saving and carbon-reduction transformation and energy-using equipment renewal projects

International News

1. Iraq's oil minister "changed his tune": extending the oil production cut is OPEC's decision

2. Zhongman Petroleum: Successfully won the bid to obtain the development rights of two oil and gas blocks in Iraq

3. OPEC representative: Iraq's remarks about cutting production look like "consistent pre-meeting behavior"

4. U.S. inflation is expected to slow down for the first time in half a year, but the Fed's bigger concerns are still to come

5. Bank of America Merrill Lynch: Canada's wage situation suggests that a rate cut in June is still possible

Domestic News

1. Chinese companies have obtained exploration licenses for five oil and gas fields in Iraq

On May 11, local time, in a round of oil and gas exploration license bidding held by the Iraqi Ministry of Oil, Chinese companies won the bid to explore five oil and gas fields in Iraq. ZPEC won the bid for the northern extension of the eastern Baghdad oil field and the midstream Euphrates oil field spanning the southern provinces of Najaf and Karbala. China United Energy Group Co., Ltd. won the bid for the Al-Faw oilfield in the south of Basra, Zhenhua won the bid for the Qurnain oilfield in the border area between Iraq and Saudi Arabia, and Intercontinental Oil and Gas won the bid for the Zurbatiya oilfield in the Wasit region of Iraq.

2. CITIC Securities: Many positive factors are accumulating, and all kinds of funds are rushing to promote the comprehensive recovery of China's assets in the near future

CITIC Securities issued a document saying that the macro policy environment continues to improve, many positive factors are accumulating, all kinds of funds rush to promote the comprehensive repair of China's assets in the near future, optimism is budding, and the market has returned to normal, it is recommended to make less game, and focus on the three main lines of excellent performance growth, low-volatility dividends and active themes. Judging from the recent intensive positive factors, first, the tone of real estate policy has changed significantly, and the dilemma of the industrial chain is expected to be reversed; Second, the market has entered a performance vacuum period in the short term, and the performance in the first quarter is expected to be the low point of the whole year; Third, some industry policies have begun to focus on controlling production and ensuring prices, improving the competitive landscape and corporate profitability; Fourth, the logic of overseas business has been widely recognized by the market, opening the growth and valuation ceiling of traditional industries.

3. This year, the rail-sea intermodal trains of the western land-sea corridor have transported more than 300,000 TEUs

The reporter learned from China Railway Nanning Bureau Group Co., Ltd. that as of the 12th, the container cargo transported by rail-sea intermodal trains in the new western land-sea corridor this year has exceeded 300,000 TEUs, reaching 303,000 TEUs. "This year, the export goods transported by the rail-sea intermodal trains of the new western land-sea corridor are mainly auto parts, motorcycle parts, and generator parts, and the imported goods transported are mainly shortening from Indonesia and pulp from Vietnam, with 1,143 kinds of goods transported." Huang Jiangnan, director of Qinzhou Port East Station of Guangxi Coastal Railway Co., Ltd., said. (Xinhua News Agency)

4. Guosheng Securities: It is expected that in 2024, supporting policies to support the development of low altitude space economy will be introduced in various places

Guosheng Securities' latest research report pointed out that in March 2024, the low-altitude space economy was officially written into the 2024 government work report. In 2024, 18 provinces/municipalities/autonomous regions wrote the low-altitude space economy into the government work report, and it is expected that in 2024, supporting policies to support the development of the low-altitude space economy are expected to be introduced, and the development of the industry is expected to accelerate. In 2023, the scale of China's low-altitude space economy reached 505.95 billion yuan, and by 2026, the scale of low-altitude space economy is expected to reach 1,064.46 billion yuan. Among them, the market size of the eVTOL track is expected to reach 9.5 billion yuan in 2026, which is expected to expand the application scenarios of low-altitude space economy.

5. National Development and Reform Commission: Form a reserve for energy-saving and carbon-reduction transformation and energy-using equipment renewal projects

The General Office of the National Development and Reform Commission issued a notice on in-depth energy efficiency diagnosis of key energy-using units. Form a reserve for energy-saving and carbon-reduction transformation and energy-using equipment renewal projects. According to the energy-saving management files of key energy-using units, combined with the energy efficiency level of key areas and industries, and major energy-using equipment, establish and update the list of energy-saving and carbon-reduction transformation and energy-using equipment renewal projects on a rolling basis, form a transformation plan, and clarify the transformation time limit.

International News

1. Iraq's oil minister "changed his tune": extending the oil production cut is OPEC's decision

Iraq's oil minister said on Sunday that extending the production cuts was a matter for OPEC and that the country would stick to any decision made by it. "The extension of the voluntary production cuts depends on the agreement among OPEC countries," he said. Iraq is part of OPEC, and it is necessary for us to comply with and agree to any decision issued by the organization. Iraq's oil minister hinted on Saturday that Iraq would not agree to extend the production cuts. Oil ministers will meet in Vienna on June 1, and it is widely believed that they will extend the current restrictions into the second half of the year. Iraq, OPEC's second-largest oil producer, has failed to fully implement its existing production cuts, which has caused unease within the group.

2. Zhongman Petroleum: Successfully won the bid to obtain the development rights of two oil and gas blocks in Iraq

Zhongman Petroleum announced that the company participated in the fifth (+) round and the sixth round of oil and gas block bidding of the Ministry of Petroleum of Iraq, and successfully won the bid to obtain the development rights of the East Baghdad Field Northern Extension block and the Middle Euphrates block in Iraq. The EBN block is located in the provinces of Baghdad and Salah al-Din in central Iraq, with an area of 231 square kilometers. The MF block is located in the provinces of Najaf and Karbala in central Iraq, with an area of 1,073 square kilometers.

3. OPEC representative: Iraq's remarks about cutting production look like "consistent pre-meeting behavior"

Iraq's oil minister has said it will not agree to any new production cuts at the next OPEC+ meeting, which could set the stage for difficult negotiations in early June. OPEC+ ministers will meet in Vienna on June 1 and are widely expected to extend the current production cuts into the second half of the year. Iraq, OPEC's second-largest oil producer, has caused unease in the organization by failing to fully implement existing production cuts. It was unclear whether Iraq's oil chief would maintain his position at the meeting, which one OPEC representative said looked like a consistent pre-meeting behavior. Iraq's deputy oil minister made more conciliatory remarks, saying that Iraq was "committed to voluntarily reducing production within the deadline set by OPEC+."

4. U.S. inflation is expected to slow down for the first time in half a year, but the Fed's bigger concerns are still to come

Underlying inflation in the US is likely to slow for the first time in six months in April, and price pressures are expected to start easing again after a series of unexpected rises. Core CPI is expected to rise 0.3% month-on-month, compared to 0.4% in the previous three months and 3.6% year-on-year, and while the increase would be the smallest in three years, it would still be too fast to reassure the Fed. Headline CPI could rise 0.4% month-on-month for the third straight month as gasoline prices hit six-month highs. While core goods prices are largely falling, the cost of basic services remains high, which explains why inflation was stubborn in the first quarter. Analysts such as Anna Wong said, "The core CPI report for April may look encouraging, slowing down from March – but the April PCE data is still likely to be strong, which is a bigger concern for the Fed." ”

5. Bank of America Merrill Lynch: Canada's wage situation suggests that a rate cut in June is still possible

Bank of America Merrill Lynch believes that the slowdown in Canada's wage growth in April makes a possible rate cut in June, even with a strong labor force report. Job positions unexpectedly increased by 90,400 and the unemployment rate held steady at 6.1%, compared to Bank of America Merrill Lynch's forecast of 6.2%. The growth was driven mainly by part-time employment and the service sector. The agency noted that the slowdown in hourly earnings growth, as well as the fact that core inflation continues to fall, make a rate cut in July more likely and leave the door open for the first rate cut in June. If the April CPI core inflation rate released on May 21 performs well, it is likely to clear the way for a rate cut in June.

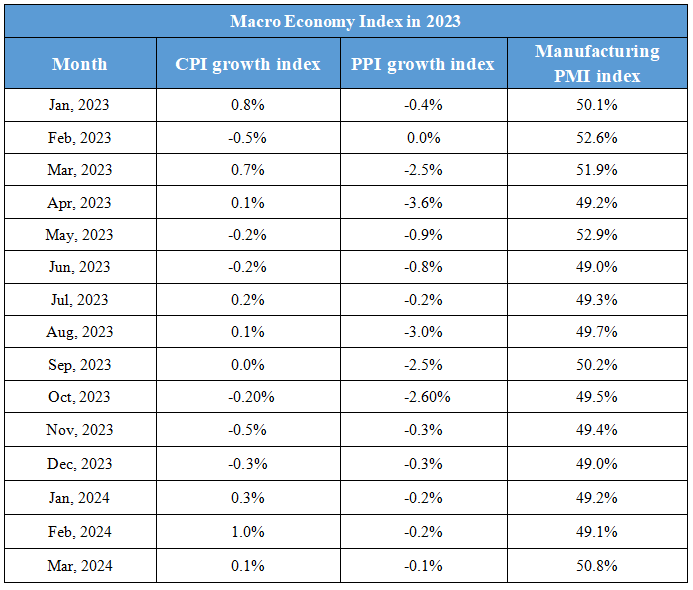

Domestic Macro Economy Index