May 11th Macroeconomic Index: China's Coal Role Unchanged, Postal Industry Revenue Up 13.2%, Biden to Announce New Tariffs on Chinese EVs

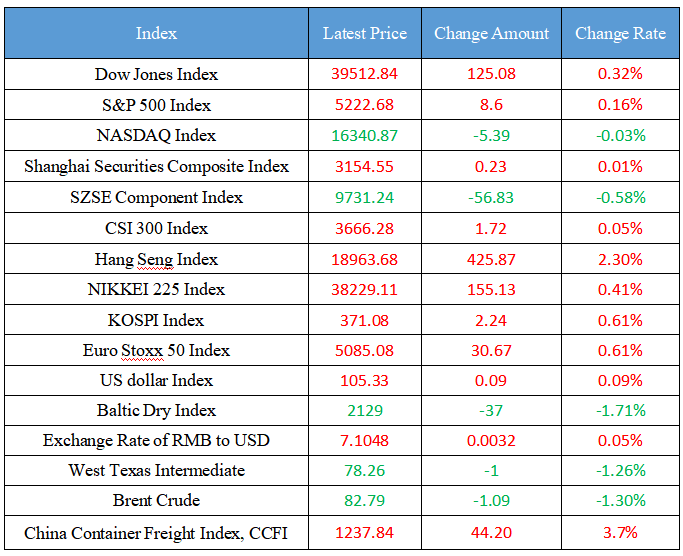

Latest Global Major Index

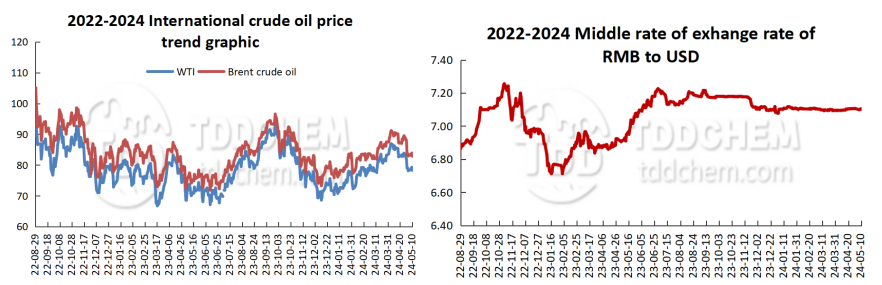

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. China Coal Transportation and Distribution Association: Coal will be difficult to change its role as a backstop for energy in China for a long time in the future

2. State Post Bureau: In 2023, the business income of the postal industry reached 1,529.3 billion yuan, a year-on-year increase of 13.2%

3. The research team of the National Development and Reform Commission went to Tongshi Optoelectronics to inspect the development of the Low Altitude Space Economy

4. National Data Administration: Promote the green and low-carbon development of the digital industry, and empower the green development of traditional industries with digital technology

5. 3700 has become a very important game gate for steel prices, and we will focus on the change in inventory next week

International News

1. OCBC Bank of Singapore: The Bank of England is still expected to cut interest rates in August, but there is a risk of advance

2. The port of Salalah offer alternative shipping routes to avoid the South Red Sea, what changes will happen to the transit time and cost?

3. Biden was revealed to have announced new tariffs on China's electric vehicles as soon as next week; China: The US is making worse mistakes

4. Affected by the optimism of interest rate cuts, gold prices rose to a three-week high

5. India's foreign exchange reserves rose for the first time in four weeks

Domestic News

1. China Coal Transportation and Distribution Association: Coal will be difficult to change its role as a backstop for energy in China for a long time in the future

On May 9, 2024, the 5th General Meeting of China Coal Transportation and Distribution Association and the 1st Plenary Meeting of the 5th Council were held in Beijing. Li Yanjiang, Secretary of the Party Committee of the China Coal Industry Association, pointed out that due to multiple factors such as climate change, geopolitics, the international coal, oil, natural gas and other energy markets fluctuations, and the policies of major energy exporting countries have been frequently adjusted, which has exacerbated the volatility of the international energy market. China's resource endowment characteristics of "rich in coal, poor in oil and gas" determine that it is difficult to change the status and role of coal as China's backstop energy for a long time in the future. As the main energy source in China, coal is related to the national economy, people's livelihood and the overall situation of economic and social development. The coal industry must enhance its sense of urgency and hardship, adhere to bottom-line thinking and limit thinking, and ensure the safety of coal supply. Coal is located at the forefront of the industrial chain and supply chain of coal power, coal coking steel, coal building materials, coal chemical industry, etc., and the establishment of long-term strategic cooperation and guarantee mechanism between all links of the coal industry chain and supply chain to prevent large market fluctuations and prevent business risks is the direction of coal supply-side structural reform and coal market-oriented reform, and is also the inevitable choice for the coordinated development of coal upstream and downstream industries.

2 State Post Bureau: In 2023, the business income of the postal industry reached 1,529.3 billion yuan, a year-on-year increase of 13.2%

The State Post Bureau released the 2023 Statistical Communiqué on the Development of the Postal Industry, and the volume of postal delivery business in 2023 reached 162.48 billion pieces, a year-on-year increase of 16.8%. Among them, the express delivery business volume completed 132.07 billion pieces, a year-on-year increase of 19.4%. In 2023, the business income of the postal industry (excluding the direct operating income of the Postal Savings Bank) reached 1,529.30 billion yuan, a year-on-year increase of 13.2%. Among them, the revenue of express delivery business reached 1,207.40 billion yuan, a year-on-year increase of 14.3%. The revenue of express delivery business accounted for 79.0% of the total revenue of the industry, an increase of 0.8 percentage points over the previous year.

3. The research team of the National Development and Reform Commission went to Tongshi Optoelectronics to inspect the development of the Low Altitude Space Economy

The research team of the National Development and Reform Commission, composed of the Academic Committee of the National Development and Reform Commission, the Macroeconomic Research Institute and Zhonghongwang, went to Changchun Tongshi Optoelectronics Technology Co., Ltd. to inspect the development of the low altitude space economy. Since the beginning of this year, the low altitude space economy has attracted much attention from the market, and governments at all levels have taken the low altitude space economy as a key layout of the new industrial track that needs to be vigorously supported for development. As an important product sequence of Tongshi Optoelectronics, aviation airborne photoelectric pods have become an extremely important part of the low-altitude economic industry chain. The research team of the National Development and Reform Commission went to Tongshi Optoelectronics to inspect the development of the low altitude space economy, aiming to find out the current situation of the industry and listen to the opinions and suggestions of enterprises on the development of low altitude space economy. Tongshi Optoelectronics also actively provides suggestions for the top-level design and industrial layout of the low altitude space economy of the country.

4. National Data Administration: Promote the green and low-carbon development of the digital industry, and empower the green development of traditional industries with digital technology

The State Council Information Office held a press conference on the 7th Digital China Construction Summit. Liu Liehong, a member of the Party Leadership Group of the National Development and Reform Commission and Director of the National Data Bureau, said that we will fully empower transformation and development. We will continue to promote the digital transformation and intelligent upgrading of the manufacturing industry, and create a digital transformation ecosystem of the industry that connects supply and demand, collaborates the whole chain, and value driven. Promote the green and low-carbon development of digital industries, empower the green development of traditional industries with digital technology, and actively build a green, low-carbon and circular economic system. Build a high-quality digital society and promote the construction of smart cities and digital villages. Thoroughly implement the "Data Element ×" action plan, and encourage multiple entities to actively participate in the development and utilization of data elements. (China.com)

5. 3700 has become a very important game gate for steel prices, and we will focus on the change in inventory next week

Judging from the current market operation, various factors are intricately intertwined and complex. This week's change in steel prices first stronger and then weaker also reflects the shift in capital sentiment. From the linkage of macro and large types of assets, the black decline momentum is insufficient. Steel focuses on adjusting the fundamental contradictions, focusing on the change in inventory next week, if the pressure on both ends of supply and demand is large, the market still has downward pressure. From the market point of view, this week's market prices rose first and then fell, and the fluctuation space was significantly larger than last week, with a difference of more than 130 points. At present, the price has basically returned to the pivotal position in the week before the "May Day" holiday, which is more critical. (Lange Steel)

International News

1. OCBC Bank of Singapore: The Bank of England is still expected to cut interest rates in August, but there is a risk of advance

The Bank of England (BoE) has been as widely expected this week, keeping interest rates unchanged at 5.25%. The vote was 7 to 2, which is also the consensus expectation we indicated. Short-term treasury yields fell in response. The view of the two members who voted in favour of a 25bp cut was that Bank Rates now need to be less restrictive to allow for a smooth and gradual transition in policy stance, taking into account the lag in transmission. We agree that this could be applied to other economies as well. The swap contracts are pricing in a total of 61 basis points of rate cuts by the Bank of England this year, compared to 57 basis points the day before. The market is still divided between June (which is expected to be 57% likely) and August for a rate cut. Our long-term view has been for a rate cut in August, but the expected rate cut could be sooner. Between now and the June MPC meeting, there is a wealth of data to digest, including two CPI reports.

2. The port of Salalah offer alternative shipping routes to avoid the South Red Sea, what changes will happen to the transit time and cost?

According to foreign media reports, Oman's Salalah port has launched a multimodal transport service connecting the Saudi port of Jeddah as an alternative to diverting the Cape of Good Hope. In Salalah Port, there is a cross-border overland truck route that connects to Jeddah. The overland route takes about 4-5 days and is then connected to Europe or the east coast of the United States via the Suez Canal by container ship, reducing the total transit time of the current route. The port said the new multimodal service is expected to reduce transit times by 20%-40% compared to traditional east-west trade routes, achieving cost savings of 10%-20% compared to air-only solutions. The port has recently partnered with Maersk, Oman Airports and Transom to launch several sea and air solutions through the port, which are currently gaining momentum for stable operation.

3. Biden was revealed to have announced new tariffs on China's electric vehicles as soon as next week; China: The US is making worse mistakes

Reuters quoted two people familiar with the matter on May 9 local time as saying that U.S. President Joe Biden will announce new tariffs on China's strategic sectors, including electric vehicles, as soon as next week. Specific areas will also include semiconductors and solar equipment, one of the people said. At the regular press conference of the Chinese Foreign Ministry held on May 10, Foreign Ministry spokesman Lin Jian said in response to a question from a foreign media reporter about "what is the response of the Ministry of Foreign Affairs to this?" The "Section 301 tariffs" imposed by the previous US administration on China seriously interfered with the normal economic and trade exchanges between China and the United States, and the WTO ruled that it violated WTO rules. Instead of correcting its erroneous practices, the US side continues to politicize economic and trade issues and uses the so-called "Section 301 tariff" review procedure to further increase tariffs, which is a worsen mistake. We urge the US side to earnestly abide by WTO rules and cancel all additional tariffs imposed on China, let alone increase tariffs. China will take all necessary measures to defend its rights and interests. (Huanqiu.com)

4. Affected by the optimism of interest rate cuts, gold prices rose to a three-week high

Gold prices rose to their highest level in more than three weeks, driven by US data that supported the case for the Federal Reserve to start easing monetary policy this year. Initial jobless claims released on Thursday rose to their highest level since August last year, further suggesting that the U.S. labor market is cooling. The Federal Reserve has said that it’s crucial to bring inflation under control before implementing interest rate cuts. Gold is up nearly 15% year-to-date, with record gains, supported by central bank buying and heightened geopolitical risks in the Middle East, reinforcing gold's appeal as a safe-haven asset. In addition, increased demand from Chinese investors also supported gold prices. ANZ said in a report that strong demand from China means that gold prices will continue to rise, with gold expected to climb to around $2,500 an ounce by the end of the year.

5. India's foreign exchange reserves rose for the first time in four weeks

India's foreign exchange reserves rose for the first time in four weeks amid the possibility of monetary authorities buying dollars. India's foreign exchange reserves increased by $3.7 billion to $641.59 billion as of May 3, data released by the Reserve Bank of India (RBI) on Friday showed. In early April, the total of this batch of assets reached a record $649 billion, but then fell for three consecutive weeks. Monetary intervention is the RBI's preferred tool to curb rupee volatility. Asian currencies, including the Japanese yen, South Korean won and Indian rupee, came under pressure against the USD as US officials appeared likely to keep borrowing costs high.

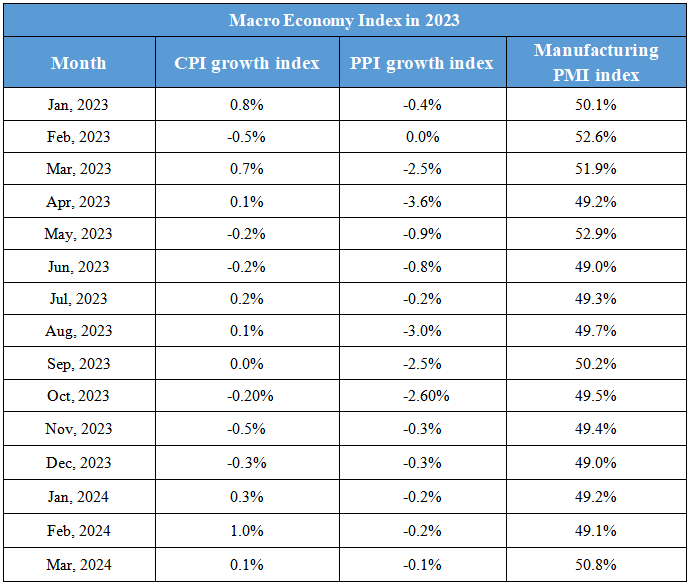

Domestic Macro Economy Index