Global Economic Highlights on May 9th

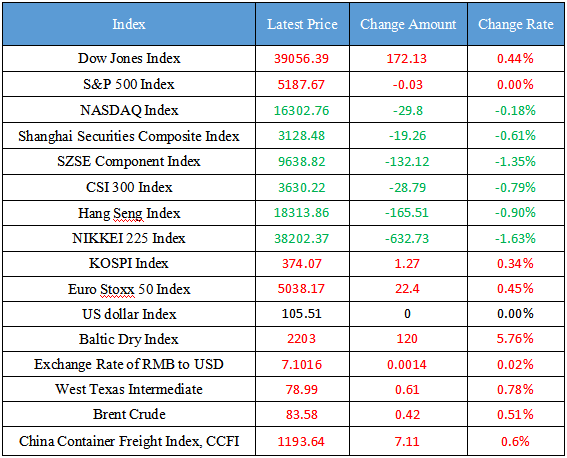

Latest Global Major Index

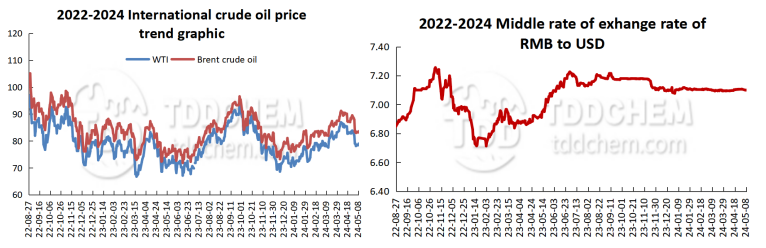

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The 2024 legislative work plan of the Standing Committee of the National People's Congress was announced

2. The first 10,000-ton sea vessel sailed directly to Chongqing, and the transportation time was shortened by 20 days

3. The profit of key domestic real estate enterprises fell by about 50% in the first quarter, and the pressure on the industry's annual performance still exists

4. Ministry of Industry and Information Technology: Encourage enterprises to adjust the energy consumption structure and use clean energy such as photovoltaic

5. COSCO Shipping Development: It is expected that the container market will enter a stable recovery channel in 2024 The overall situation is better than last year

International News

1. German industry will not contribute to economic growth in the coming months

2. By 2032, the U.S. chip manufacturing capacity may triple

3. Argentina's 10,000 peso banknotes are in circulation, and the inflation rate in Argentina may reach 203.8% this year

4. ING International: The Riksbank has taken action in response to the economic crisis, and further interest rate cuts may be inevitable

5. Institutions: UK Treasury yields held steady ahead of the central bank's interest rate decision

Domestic News

1. The 2024 legislative work plan of the Standing Committee of the National People's Congress was announced

The Standing Committee of the National People's Congress announced its 2024 legislative work plan, which showed that the legal bills that will continue to be considered include the Financial Stability Law (June), the Mineral Resources Law (Amendment) (June), and the Value-Added Tax Law (December); The bills reviewed for the first time included the Enterprise Bankruptcy Law (revision) and the Anti-Unfair Competition Law (revision); Among the preparatory review projects, comprehensive laws on finance, including the financial regulatory system, as well as legislative projects in areas such as the fiscal and taxation system, network governance, and the healthy development of artificial intelligence, are to be studied and drafted by relevant parties, and deliberations are arranged as appropriate. (Chinese National Network)

2. The first 10,000-ton sea vessel sailed directly to Chongqing, and the transportation time was shortened by 20 days

On May 8, the "Chuangxin 5" cargo ship carrying 5,400 tons of soybeans successfully entered the jurisdiction of Chongqing, creating a precedent for the first river-sea direct ship from the coast to Chongqing. It is understood that the "Innovation 5" is an LNG dual-fuel powered river-sea direct ship, which has the four characteristics of river--suitability, sea-suitability, green and economy. The ship has a total length of 130 meters, a width of 16.20 meters, a depth of 8.50 meters, a design draft of 6.1 meters, and a cargo capacity of 9,832 tons. This voyage carries 5,400 tons of imported soybeans, departing from Ningbo Zhoushan Port on April 24, and will sail directly to Chongqing Wanzhou Xintian Port and Luohuang Port, which has changed the previous mode of transshipment by river ship in the middle and lower reaches of the Yangtze River, and is expected to shorten the transportation time by about 20 days, save transit fees and reduce the cargo damage rate.

3. The profit of key domestic real estate enterprises fell by about 50% in the first quarter, and the pressure on the industry's annual performance still exists

According to a report released by CICC, the overall net profit of 103 A-share real estate companies at the mainland fell by 95% year-on-year in the first quarter, and the combined profit of Chinese state-owned enterprises fell by 68% year-on-year to RMB2.6 billion, while mixed-ownership enterprises and private enterprises lost RMB600 million and RMB1.2 billion respectively, both down by more than 100% year-on-year. Considering that the fundamentals of the industry are still weak, CICC believes that key real estate companies will take the turnover of their main business and the performance of operating cash flow as an important reference for their expansion speed, and at the same time pay more attention to the margin of safety of decentralization on the land acquisition side. With the pressure on the industry's full-year performance still remaining, the bank believes that high-quality state-owned enterprises are expected to show greater resilience on the profit side with a more stable scale of contract liabilities and more controllable profit margins.

4. Ministry of Industry and Information Technology: Encourage enterprises to adjust the energy consumption structure and use clean energy such as photovoltaic

The Ministry of Industry and Information Technology (MIIT) publicly solicits opinions on the standardization conditions and announcement management measures for the lithium battery industry (draft for comments). It mentioned that enterprises should formulate product unit consumption indicators and energy consumption accounts, and shall not use backward energy-using equipment and production processes that have been eliminated by the state and seriously pollute the environment. Encourage enterprises to adjust the structure of energy consumption, use clean energy such as photovoltaics, build and apply industrial green microgrids, carry out research on the application of energy-saving technologies, formulate energy-saving rules and regulations, develop commonalities and key technologies on energy-saving, and promote energy-saving technology innovation and achievement transformation.

5. COSCO Shipping Development: It is expected that the container market will enter a stable recovery channel in 2024 The overall situation is better than last year

COSCO SHIPPING Development held the 2023 annual and the first quarter of 2024 performance briefing, and the company's executives introduced that since the fourth quarter of 2023, the shipping industry has recovered rapidly due to the impact of the Red Sea situation, which has pushed up the demand for containers to a certain extent, and continued to 2024. In the future, with the demand for new capacity container and a large number of old container renewal, and the adjustment of the national industrial structure and the expansion of container application scenarios, it will provide a stronger support foundation for the container market and give rise to more diversified demand. It is expected that the container market has entered a stable recovery channel in 2024, and the overall situation was better than that in 2023. At present, the overall production and operation of the company's container factories are normal and orderly, and the dry container with orders in hand have been scheduled to produce to about August, and the reefer container have been scheduled to about July.

International News

1. German industry will not contribute to economic growth in the coming months

Commerzbank economist Ralph Solveen said that German industry production is likely to remain weak in the coming months and new orders remain subdued before a modest recovery in the second half of 2024. He said in a note that the 0.4% drop in industrial output in March was due to a decline in manufacturing output (excluding the energy and construction sectors). In fact, construction output grew unexpectedly, perhaps due to relatively mild weather, although this growth is unlikely to continue given the small backlog reported by companies. The setback in the construction and manufacturing sectors could slow economic growth in the coming months and hinder the expansion of the German economy in the second quarter. However, Solveen added that a modest rebound could be seen after the summer as some sentiment indicators, such as business expectations for IFOs, have picked up recently.

2. By 2032, the U.S. chip manufacturing capacity may triple

According to a forecast by the U.S. Semiconductor Industry Association, U.S. chip production will explode in the next few years, helping to ease dependence on East Asia. The study found that semiconductor manufacturing capacity in the U.S. will triple by 2032. This would raise the U.S. share of the industry to 14% from the current 10%, and at the same time the growth would reverse the downward trend in domestic chip production.

3. Argentina's 10,000 peso banknotes are in circulation, and the inflation rate in Argentina may reach 203.8% this year

On the 7th local time, the Central Bank of Argentina announced that a banknote of 10,000 pesos, equivalent to about 11 US dollars, began to circulate, which is the largest denomination banknote in circulation in Argentina at present. Argentina's central bank said that the circulation of 10,000 peso banknotes will facilitate cash transactions and further reduce the cost of banknote circulation. In addition, the 20,000-peso banknote is expected to enter circulation in the fourth quarter of this year. The data showed that Argentina's inflation rate was 11% in March, with cumulative inflation over the past 12 months.

4. ING International: The Riksbank has taken action in response to the economic crisis, and further interest rate cuts may be inevitable

ING's James Smith and Francesco Pesole said the Riksbank was acting cautiously on fears of a weaker Swedish currency, but further rate cuts later this year seemed inevitable as the economy came under more pressure. "The fact that the Riksbank chose to act today, and crucially ahead of the ECB, speaks for itself." ING said the move showed that domestic economic concerns were starting to dominate the debate within the committee as the Swedish economy shrank for four consecutive quarters and the job market cooled rapidly. While the SEK's woes are not over, the Riksbank will be satisfied with the market outcome of its interest rate decision if EUR/SEK does not move significantly higher before the end of today, ING said. "However, downside risks to the SEK remain fairly clear."

5. Institutions: UK Treasury yields held steady ahead of the central bank's interest rate decision

UK treasury yields held steady as investors traded cautiously ahead of the Bank of England's monetary policy announcement on Thursday. Salomon Fiedler, an economist at Berenberg Bank, said in a note that the Bank of England is expected to keep interest rates unchanged at 5.25% and provide guidance on when rate cuts may begin. "While we think the BOE is likely to wait until its 1 August meeting to cut rates by 25bp for the first time, risks are already leaning towards an earlier move on 20 June."

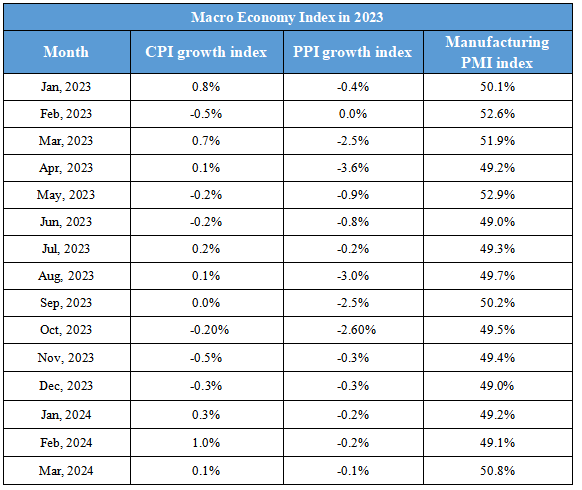

Domestic Macro Economy Index