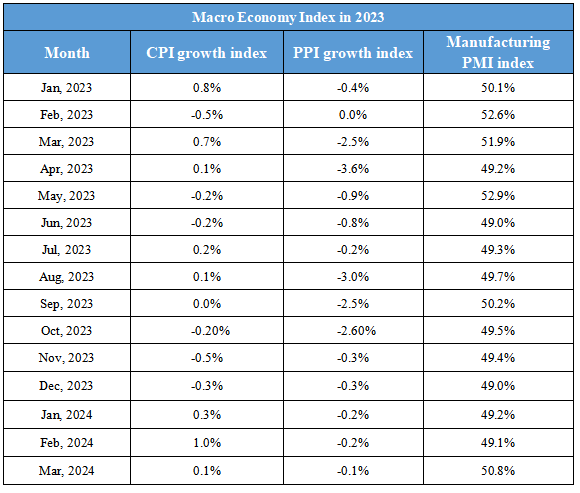

May 9th Macroeconomic Index: China's Commodity Price Index Rises 3% MoM, Offshore Wind Power Development Shows Inflection Point

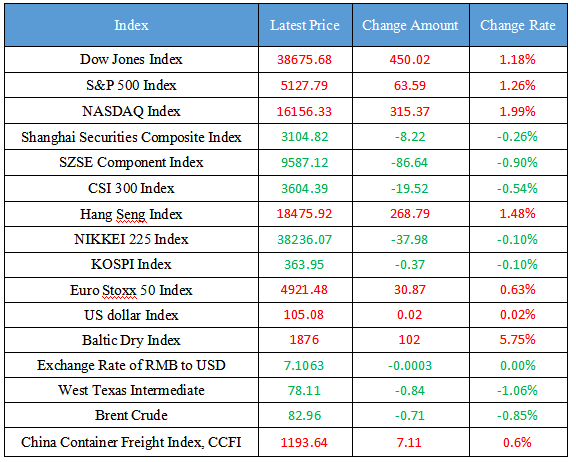

Latest Global Major Index

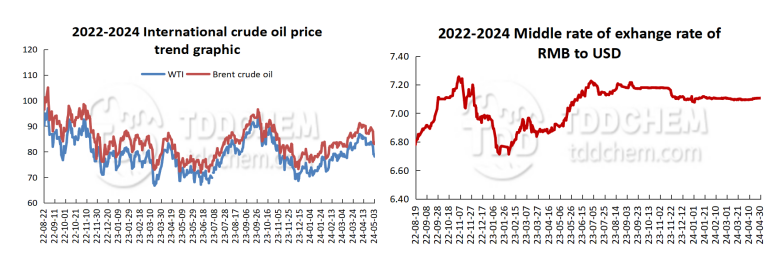

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. China Securities Construction Investment: The growth of the pharmaceutical industry is under short-term pressure. It is expected that it will gradually stabilize and rebound in the second quarter

2. The development of domestic offshore wind power is expected to show an inflection point, and the prosperity will rise

3. Month-on-month increase is 3% with increasing rate, and China's commodity price index in April was released

4. In the second quarter, the market may be catalyzed by positive policy expectations

5. China Securities Construction Investment: resources supply is tight, and antimony prices are trending up

International News

1. The shrinkage of the balance sheet slowed down as scheduled, and the Fed still needs to wait for interest rate cuts

2. Russia and Iran formulate a new settlement plan between the two countries

3. U.S. and Israeli officials said it would take another week to finalize the Gaza ceasefire agreement

4. The U.S. government is likely to raise taxes to offset the widening deficit

5. The UAE's Sharjah Petroleum Commission announced the discovery of new gas reserves

Domestic News

1. China Securities Construction Investment: The growth of the pharmaceutical industry is under short-term pressure. It is expected that it will gradually stabilize and rebound in the second quarter

The research report of China Securities Construction Investment pointed out that in the second half of 2023 and the first quarter of 2024, the growth rate of the pharmaceutical industry was under pressure as a whole. However, there are also structural highlights such as the improvement in the profitability of APIs in the first quarter of 2024 and the exceeding expectations under the high base of OTC of some traditional Chinese medicines. Starting from the second quarter of 2024, some high-base factors will gradually weaken, and enterprises will gradually adapt to the operation under the new normal of compliance, and the overall growth rate is expected to gradually stabilize. Looking forward to the second half of the year, considering the low base of hospital sales in the same period last year, the overall growth rate will be better than that of the first half of the year.

2 The development of domestic offshore wind power is expected to show an inflection point, and the prosperity will rise

The CITIC Securities research report pointed out that the development of domestic offshore wind power is expected to show an inflection point and the prosperity will rise. It is mainly manifested in several aspects: first, on the basis of project approval, the bidding scale of domestic offshore wind power projects has gradually increased; second, the construction of offshore wind power projects has been gradually started, and the project delivery volume has continued to increase; third, the orders and performance of major equipment manufacturing enterprises have achieved rapid growth. At present, from the perspective of bidding, the domestic offshore wind power bidding scale of 1.85GW in April 2024 is better than the 1.1GW in the entire Q1, which has shown an obvious marginal improvement trend, and the start of project construction and the improvement of enterprise orders are also expected to be gradually confirmed with the lifting of restrictions and the advancement of bidding. It is recommended to pay attention to the links with product advantages, capacity layout and value increment in the offshore wind power industry chain, such as submarine cables, pile foundations, supporting equipment and other links.

3. Month-on-month increase is 3% with increasing rate, and China's commodity price index in April was released

The China Federation of Logistics and Purchasing announced China's commodity price index for April on the 5th. Judging from the operation of the index, the index rose for two consecutive months in April, and the increase expanded. China's commodity price index was 115.4 points in April, up 3% month-on-month and 2.4 percentage points faster than the previous month. In terms of industries, the price index of non-ferrous metals and chemicals continued to rise month-on-month, especially the price index of non-ferrous metals rose sharply by 6.6% month-on-month. According to the analysis, the non-ferrous metal price index rose sharply in April, mainly due to the recovery of the global manufacturing industry and the tight supply of raw materials such as copper ore.

4. In the second quarter, the market may be catalyzed by positive policy expectations

Zhongtai Securities Research Report pointed out that in the second quarter, the market may be catalyzed by positive policy expectations. In terms of investment direction: 1) real estate repair is expected to increase, real estate post-cycle consumption and durable goods consumption strongly related to the economy may appear repair situation; 2) strengthen patient capital, give full play to the investment support of private equity funds in scientific and technological innovation, and some enterprises with strong competitive advantages in science and technology innovation attributes or lead the growth style of the dominant market; 3) focus on new quality productive forces, build a modern industrial system, pay attention to the leading central enterprises of each basic general industrial chain leaders in the supply chain security orientation, and the investment opportunities brought by the increase in demand for upstream capital goods。

5. China Securities Construction Investment: Resources supply is tight, and antimony prices are trending up

The research report pointed out that the price of antimony ingot rose by 4.1% and the price of antimony oxide rose by 4.6% this week. On the supply side, according to Fastmarkets, Russia's polar gold (Polyus) has not yet opened the 2024 tender, and "even if domestic smelters can obtain raw materials from polar gold, the volume will be significantly lower than last year, because polar gold sold 2 years of inventory in 2023", coupled with the unstable situation in Myanmar affecting the production and export of antimony ore, the shortage of domestic antimony ore raw materials has intensified recently. On the demand side, the demand for photovoltaic glass continues to increase, and the demand for flame retardants is expected to rise in the context of the recovery of the electronic cycle. Supply is tight, demand is growing, inventories continue to deplete, and the antimony price center is expected to continue to rise.

International News

1. The shrinkage of the balance sheet slowed down as scheduled, and the Fed still needs to wait for interest rate cuts

At the Fed's May 2024 meeting, the Fed kept the target range for the federal funds rate at 5.25%-5.5%. The statement of this meeting has changed significantly, announcing that it will start slowing down the shrinkage of the balance sheet in June. Powell's speech was generally neutral and dovish, noting that the Fed's next move is unlikely to be a rate hike. CITIC Securities believes that before the U.S. unemployment rate rises above 4%, the Fed's policy focus is still on inflation, and it is expected that there is still the possibility of interest rate cuts within the year. In the short term, it is expected that the U.S. dollar index and U.S. Treasury interest rates will remain fluctuate, and U.S. stocks may continue to fluctuate and run weakly.

2. Russia and Iran formulate a new settlement plan between the two countries

According to Russia's "Izvestia" newspaper on May 2, Rahimi Mohsin, commercial counselor of the Iranian Embassy in Russia, said that “Iran and Russia are working on a new plan for settlement between the two countries. The two countries are looking at the use of digital financial assets and central bank digital currencies, which could simplify trade between countries and potentially mitigate the impact of sanctions”. He also said that there were still some difficulties and that there was a need to create infrastructure and legislate for new means of payment. However, Iran intends to work with Russia to make such a solution work.

3. U.S. and Israeli officials said it would take another week to finalize the Gaza ceasefire agreement

According to a CNN report on the 4th local time, negotiators from the United States and Israel held a meeting in Cairo, Egypt on the same day to discuss the Gaza ceasefire agreement, including the release of detainees. U.S. and Israeli officials say even if Hamas accepts the latest ceasefire proposal, it could take a week for the two sides to continue negotiations on the details of the agreement before finalizing it.

4. The U.S. government is likely to raise taxes to offset the widening deficit

At Berkshire Hathaway's annual shareholder conference in Omaha on Saturday, Buffett said the U.S. government is expected to raise taxes to address the widening fiscal deficit rather than reduce spending. "They might decide one day that they don't want the deficit to be so big because it has some serious consequences," Buffett said. They may not want to spend less, and they may decide to get a larger percentage of the assets we have, which we will pay for. "In its latest long-term budget projections, the Congressional Budget Office (CBO) estimates that the federal deficit to GDP ratio will rise to 8.5% in fiscal year 2054, up from 5.5% in fiscal year 2024. If the tax cuts introduced in 2017 continue next year, the US budget deficit will worsen even further.

5. The UAE's Sharjah Petroleum Commission announced the discovery of new gas reserves

The UAE's Sharjah Petroleum Commission announced on May 4 local time that new natural gas reserves have been discovered in the Al Hadiba oil field in Sharjah. Sharjah National Oil Company discovered the new gas field after drilling a well in the past few months, which will be tested in the coming days to confirm its potential gas reserves.

Domestic Macro Economy Index