April 30th Macroeconomic Index: Shanghai's Container Exports Surge 35.4%, ECB Cautious on July Rate Cut

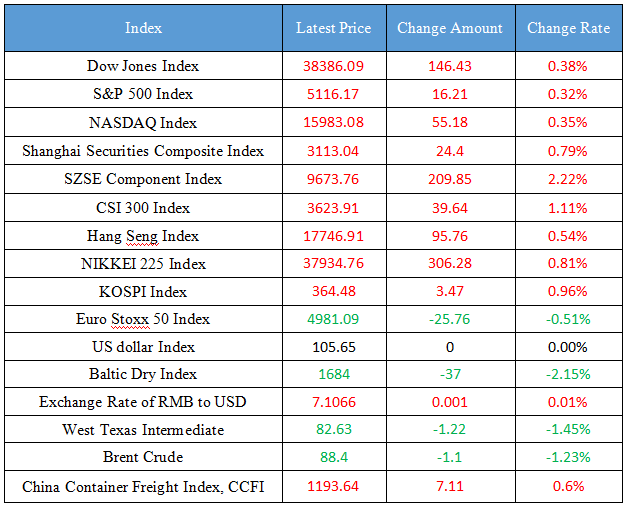

Latest Global Major Index

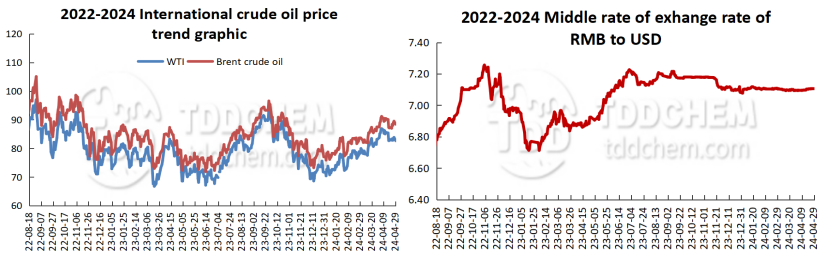

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. In the first quarter of this year, Shanghai's container exports exceeded 1.2 billion yuan, an increase of 35.4% year-on-year

2. National Energy Administration: Pay close attention to the energy supply situation in the peak summer of this year and take multiple measures to ensure livelihood energy using

3. The State Administration of Financial Supervision and Administration issued the "Guiding Opinions on Promoting the Standardized and Healthy Development of Financial Companies of Enterprise Groups and Improving the Quality and Efficiency of Supervision"

4. The scope of the pilot project of special re-lending for inclusive pension has been expanded to the whole country

International News

1. ECB Governing Council Member Wensch: The interest rate cut in July should be carefully considered

2. Capital Economics: Despite signs of improvement, the Eurozone economy remains weak

3. Saudi Arabia may raise the prices of most crude oil varieties sold to Asia in June

4. The Japanese authorities have chosen to keep the decision whether to intervene in the foreign exchange market a secret for the time being

Domestic News

1. In the first quarter of this year, Shanghai's container exports exceeded 1.2 billion yuan, an increase of 35.4% year-on-year

According to the statistics released by Shanghai Customs on April 29, in the first quarter of this year, Shanghai's export container value totaled 1.261 billion yuan, a year-on-year increase of 35.4%. Since the beginning of this year, the demand for international container market has rebounded, and Shanghai's container export orders have ushered in a "good start".

2. National Energy Administration: Pay close attention to the energy supply situation in the peak summer of this year and take multiple measures to ensure livelihood energy using

According to the website of the National Energy Administration, on April 26, the National Energy Administration held the first regular meeting of energy supervision in Beijing in 2024. Pay close attention to the energy supply situation in this year's peak summer, play a front-line regulatory role, and take multiple measures to ensure people's livelihood and energy using. Accelerate the construction of a unified national electricity market system, continue to carry out special rectification of improper intervention in the market, and create a good market environment for the development of new energy. Focus on the main responsibilities and main business and natural monopoly links, strengthen administrative law enforcement, and achieve "long teeth and thorns", forming a closed loop of supervision.

3. The State Administration of Financial Supervision and Administration issued the "Guiding Opinions on Promoting the Standardized and Healthy Development of Financial Companies of Enterprise Groups and Improving the Quality and Efficiency of Supervision"

Cinda Securities Research Report pointed out that the downstream manufacturing industry is expected to continue to perform strongly, and the middle and upper reaches of the margin will improve. (1) Downstream manufacturing profits are expected to continue to perform strongly in the context of policy support and better exports. (2) Commodity prices strengthened as a whole in April, and the prices of cement and rebar, including domestic pricing, also showed signs of stabilizing and rebounding, and the profit proportion of the middle and upstream industries may improve marginally. (3) In the environment of sluggish domestic demand, the increase in the price of upstream raw materials may squeeze the profits of the downstream consumer goods industry, and it may be necessary to be wary of the decline in the profitability of downstream consumer goods.

4. The scope of the pilot project of special re-lending for inclusive pension has been expanded to the whole country

A few days ago, the central bank, the National Development and Reform Commission, the Ministry of Industry and Information Technology, and the Ministry of Civil Affairs jointly issued the "Notice on Matters Concerning the Continuation of the Implementation of Special Re-lending for Inclusive Pension", expanding the pilot scope of special re-lending for inclusive pension to the whole country, and expanding the scope of support to support financial institutions to provide preferential loans, reduce financing costs, and promote the increase in the supply of inclusive pension services. It will be implemented until the end of 2024. According to the "Notice", the scope of special re-lending support for inclusive pension has been expanded to the operation of public welfare and inclusive pension institutions, the construction of home community pension system, and the manufacture of elderly products included in the catalogue.

International News

1. ECB Governing Council Member Wensch: The interest rate cut in July should be carefully considered

ECB Governing Council member Wensch said in an interview that the ECB should be cautious about the signal it will send to investors for the second consecutive rate cut in July. "Another rate cut in July will be interpreted by the market as a rate cut at every meeting," Wensch said. This may lead to a repricing that goes too far. "The ECB is preparing to cut interest rates for the first time at its June meeting, but policymakers are still discussing the next steps. Most are urging to remain open and make data-driven decisions, while more stubborn-than-expected inflation and volatile geopolitics in the US have created uncertainty. "For me, July (rate cut) is not a foregone conclusion. I believe that we will have at least two rate cuts in 2024 barring bad news, (but) that doesn't mean we're going to cut rates in July, we need to be cautious." ”。

2. Capital Economics: Despite signs of improvement, the Eurozone economy remains weak

Franziska Palmas, European economist at Capital Economics, said that the weakening of business confidence in the eurozone will allow the ECB to make a series of interest rate cuts starting in June. The European Commission's monthly survey released on Monday showed that overall economic sentiment unexpectedly fell this month due to a drop in confidence in industry and services, while consumer confidence barely improved. This is a reminder that despite some recent signs of improvement, the eurozone's economy remains weak, "so a rate cut in June still seems a certainty, and there is a strong chance of further rate cuts thereafter," Palmas said. ”

3. Saudi Arabia may raise the prices of most crude oil varieties sold to Asia in June

Saudi Arabia is likely to raise the prices of most crude grades sold to Asia in June to their highest level in five months, according to sources on Monday. The official selling price (OSP) of flagship Arabian light crude oil is likely to rise 70-90 cents to nearly $3 per barrel from the Oman-Dubai average price in June, which would be the highest level since January. Supported by tight supply and strong fuel oil margins, the OSP of medium and heavy oils is expected to be in line with light oils. Changes in feedstocks at the ADNOC refinery led to a record 1.65 million b/d of Murban crude exports in April, with strong supply and weak naphtha margins expected to limit ultralight crude prices to 30-50 cents in June, lagging gains in other grades, Kpler data showed.

4. The Japanese authorities have chosen to keep the decision whether to intervene in the foreign exchange market a secret for the time being

On Monday, Japan's top monetary official chose not to let market participants know whether the Japanese government had intervened in the currency market after the dollar fell sharply 2% against the yen. Japan's Vice Minister of Finance Mato Kanda said: "There is no comment at this time." The reluctance of the Japanese authorities to comment on exchange rate movements may raise doubts among market participants about the position of the Japanese Ministry of Finance on intervening in the foreign exchange market. This is in the interest of the Ministry of Finance: not intervening in the market also keeps traders alert to possible actions. Another explanation is that the sharp fluctuations in the yen exchange rate in October 2023 were largely algorithmic trading at a time of market nervousness and illiquidity. At the time, Japanese officials also declined to comment on whether to intervene in the market, suggesting that maintaining uncertainty was part of their FX strategy. The Japanese government will release data on foreign exchange intervention at 18:00 Beijing time on Tuesday. Monthly announcements typically do not include data for the last few business days of the month. As a result, in the case of Japan's intervention in the market on Monday, official data will not be released until the end of May.

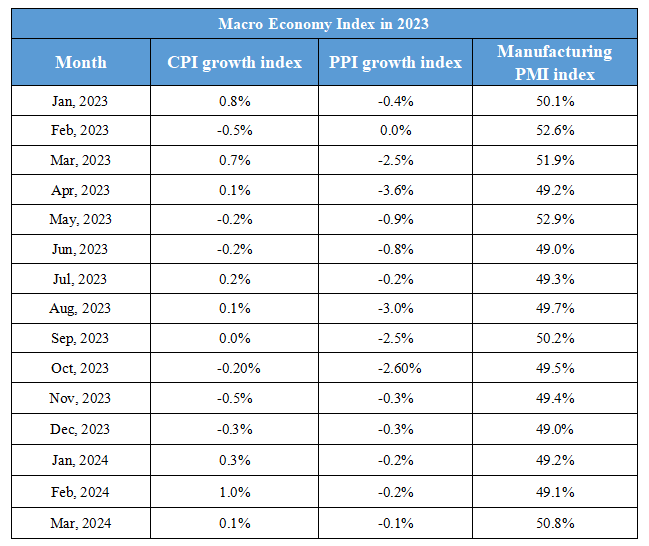

Domestic Macro Economy Index